The Federal Deposits Insurance Corporation (FDIC) has reportedly given JP Morgan and the Pittsburgh based PNC Financial Services until Sunday to submit takeover bids on First Republic.

Neither of the three has confirmed as such, but media reports based on unnamed sources have moved from FDIC is taking over First Republic on Friday to now who they’re selling it to.

As the largest bank in US, JP Morgan would need an exemption to buy the troubled bank, but they have a fairly direct interest as they were the biggest contributor to a $30 billion deposits in First Republic by large banks last month to re-assure the market.

That $30 billion is uninsured, so just how FDIC will address it remains to be seen, with the big banks expecting to recover some, but not all, of the $30 billion.

PNC on the other hand is a somewhat new entrant to this collapsing banks saga. They have about $325 billion in assets under management, making it just slightly bigger than First Republic in better times.

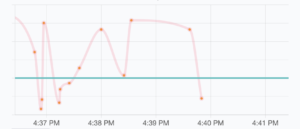

Deposits at First Republic peaked at around $212 billion last year, but declined since and more than halved during a two weeks long bank-run last month that led to $100 billion being withdrawn.

To manage, the bank borrowed $100 billion from Fed, the Federal Home Loan Bank and JP Morgan, with one big question now being what happens to this $100 billion they borrowed if they go into receivership.

Just how much they borrowed from Fed exactly is not clear, but a default by First Republic on those borrowed loans would basically amount to the taxpayer picking up the tab.

Not least because in the recent disposal of assets belonging to the Silicon Valley Bank or Signature, FDIC seems to have sold them for cheap, on very generous terms, and without impugning any obligations, in addition to politicizing the process.

They are refusing for example to sell Signature’s crypto tech aspects related to 24/7 USD processing for stablecoins, which probably breaches all sorts of obligations to both creditors and shareholders of the bank.

In addition, despite the immense power FDIC is yielding, the agency remains very non transparent, starting with its chair Martin J. Gruenberg.

Gruenberg has been on the FDIC board since 2005, 18 years, and its chair since 2012. One of the consequences of this unusually long tenure is that we don’t easily have access to his financial disclosure which by law is meant to be public.

Public nowadays means going to a link and seeing it, but in 2005 it was still a paper system, and so you have to request access with all the time delays.

Jamie Dimon as it happens has also been CEO of JP Morgan since 2005. Dimon does not hide his disdain for crypto. That Gruenberg showed some too in regards to Signature may well raise the question of just how independent is FDIC really and just how much is it influenced by Dimon and other banks.

These banks refused a private market purchase of First Republic, preferring instead to buy bits and pieces, without the obligations, from FDIC. They called that “cleaner,” but that only means the cleaner here is the public.

So we’ll soon see a fourth bank chopped up behind closed doors with almost no information at all provided to the public, while shareholders lose more than $100 billion in just six weeks from the banking sector.

The best part is those shareholders will have no say on anything, despite losing tons of money, and just how much the trustee will act in their interest, rather than that of other banks, is clearly up for questioning as Signature shows.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Source: https://www.trustnodes.com/2023/04/29/fdic-gives-sunday-deadline-for-first-republic-bids

- :has

- :is

- :not

- $UP

- 2012

- a

- About

- access

- Act

- addition

- address

- agency

- All

- also

- amount

- an

- and

- any

- ARE

- around

- AS

- aspects

- Assets

- At

- Bank

- Banking

- banking sector

- Banks

- based

- Basically

- BE

- because

- been

- behind

- being

- BEST

- Better

- Big

- bigger

- Biggest

- Billion

- board

- borrowed

- both

- breaches

- but

- buy

- by

- called

- ceo

- Chair

- cheap

- clear

- clearly

- closed

- CONFIRMED

- Consequences

- contributor

- CORPORATION

- creditors

- crypto

- Default

- delays

- deposits

- Despite

- Dimon

- direct

- disclosure

- does

- Dont

- doors

- during

- easily

- exactly

- example

- expecting

- fairly

- fdic

- Fed

- Federal

- financial

- financial services

- First

- For

- Fourth

- Friday

- from

- generous

- given

- gives

- Go

- going

- halved

- hand

- happens

- Have

- here

- Hide

- his

- Home

- How

- HTTPS

- if

- immense

- in

- independent

- influenced

- information

- instead

- insurance

- interest

- into

- IT

- ITS

- jp morgan

- just

- large

- largest

- Last

- Last Year

- Law

- Led

- LINK

- loan

- Loans

- Long

- lose

- losing

- Making

- manage

- management

- Market

- Martin

- May..

- means

- Media

- money

- Month

- more

- Morgan

- much

- Need

- New

- no

- now

- obligations

- of

- on

- ONE

- only

- or

- Other

- over

- Paper

- part

- pieces

- pittsburgh

- plato

- Plato Data Intelligence

- PlatoData

- PNC

- power

- private

- probably

- process

- processing

- provided

- public

- purchase

- question

- raise

- rather

- really

- recent

- Recover

- refusing

- regards

- related

- remains

- Reports

- Republic

- request

- saga

- sector

- see

- seeing

- seems

- seen

- sell

- Selling

- Services

- Shareholders

- Shows

- Silicon

- Silicon Valley

- silicon valley bank

- since

- SIX

- So

- sold

- some

- somewhat

- Soon

- Sources

- Stablecoins

- Starting

- Still

- submit

- such

- system

- takeover

- taking

- Taxpayer

- tech

- than

- that

- The

- their

- Them

- they

- this

- those

- three

- time

- times

- to

- tons

- too

- transparent

- Trustee

- Trustnodes

- two

- under

- UNNAMED

- us

- USD

- Valley

- very

- was

- we

- webp

- Weeks

- WELL

- were

- What

- which

- while

- WHO

- will

- with

- without

- would

- year

- years

- yielding

- you

- zephyrnet