FCAC Survey Results: Understanding the Canadian Consumer’s Perspective on Open Banking

FCAC | Jun 5, 2023

Image: FCAC commissioned survey chart

FCAC contracted the services of Advanis to conduct POR, between May 16 and June 28, 2022, into Canadians' awareness and understanding of open banking and financial technology or fintech services.

The goal of this research was to help FCAC better understand the knowledge, perceptions, habits, concerns, and consumer protection expectations of Canadian consumers with respect to open banking and related fintech services.

- Low Awareness and Understanding of Open Banking:

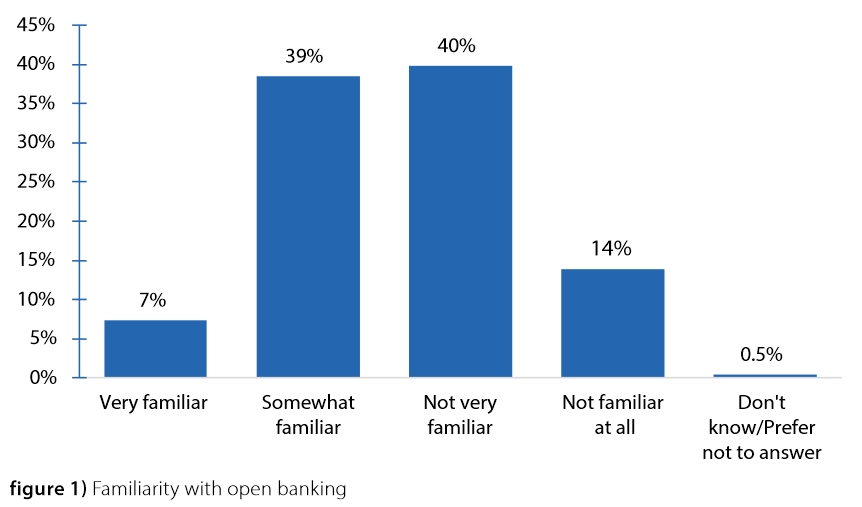

- The research reveals that only 9% of Canadians have heard of open banking, with a mere 7% of these respondents being "very" familiar with it. This indicates a significant knowledge gap among consumers, highlighting the need for comprehensive educational initiatives to increase awareness and understanding of open banking.

- Consumer Protection is Crucial:

- The study indicates that the consumer protection measures incorporated into an open banking framework will significantly impact participation. The most popular protection, selected by 70% of respondents, was "full protection from any losses" if something were to go wrong.

- Other valued protections included the ability to revoke consent at any time and requirements for reporting data breaches.

See: Visa Survey: Insights into Consumer Preferences for Open Banking

- Limited Interest in Participation:

- Despite the potential benefits of open banking, consumer interest in using open banking is low. After hearing a definition of open banking, over half (52%) of Canadians said they would not participate in an open banking system. approximately one-third (29%) said "maybe" while only 15% said they would participate.

- Canadians also value strong governance and regulatory oversight:

- 53% of respondents selected "making sure someone oversees the open banking system to keep consumers protected," and

- 54% wanted to be sure that banks can't pressure them to share their financial data.

- If something were to go wrong, 62% want a clear and easy process to follow to make things right.

- Many Canadians need to know more about open banking before they decide whether to use it.

More information --> here

Download the 22 page PDF survey results report --> here

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://ncfacanada.org/fcac-survey-results-understanding-the-canadian-consumers-perspective-on-open-banking/

- :is

- :not

- 15%

- 16

- 2018

- 2022

- 22

- 28

- 32

- 40

- 500

- a

- About

- affiliates

- After

- also

- alternative

- alternative finance

- among

- an

- and

- any

- approximately

- ARE

- Assets

- Association

- At

- awareness

- Banking

- banking system

- Banks

- BE

- become

- before

- being

- benefits

- Better

- between

- blockchain

- breaches

- by

- cache

- CAN

- Canada

- Canadian

- Canadians

- clear

- closely

- community

- comprehensive

- Concerns

- Conduct

- consent

- consumer

- Consumer Protection

- Consumers

- create

- Crowdfunding

- crucial

- cryptocurrency

- data

- Data Breaches

- decentralized

- decide

- definition

- digital

- Digital Assets

- distributed

- easy

- ecosystem

- Education

- educational

- engaged

- entry

- Ether (ETH)

- expectations

- familiar

- finance

- financial

- financial data

- financial innovation

- financial technology

- fintech

- follow

- For

- Framework

- from

- full

- funding

- funding opportunities

- gap

- get

- Global

- Go

- goal

- governance

- Government

- Half

- Have

- heard

- hearing

- help

- helps

- highlighting

- HTML

- HTTPS

- if

- Impact

- in

- included

- Incorporated

- Increase

- indicates

- industry

- information

- initiatives

- Innovation

- innovative

- insights

- Insurtech

- Intelligence

- interest

- into

- investment

- IT

- Jan

- jpg

- june

- Keep

- Know

- knowledge

- launch

- losses

- Low

- make

- Making

- Market

- max-width

- May..

- maybe

- measures

- member

- Members

- mere

- more

- most

- Most Popular

- National

- Need

- networking

- of

- on

- One-third

- only

- open

- open banking

- opportunities

- or

- page

- participate

- participation

- partners

- payments

- peer to peer

- perks

- perspective

- plato

- Plato Data Intelligence

- PlatoData

- please

- Popular

- POR

- potential

- preferences

- pressure

- process

- projects

- protected

- protection

- provides

- Regtech

- regulatory

- related

- report

- Reporting

- Requirements

- research

- respect

- respondents

- Results

- Reveals

- right

- s

- Said

- Sectors

- selected

- Services

- Share

- significant

- significantly

- Someone

- something

- stakeholders

- Stewardship

- strong

- Study

- Survey

- system

- Technology

- that

- The

- their

- Them

- These

- they

- things

- this

- this year

- thousands

- Title

- to

- today

- Tokens

- understand

- understanding

- use

- using

- valued

- very

- vibrant

- visa

- Visit

- want

- wanted

- was

- were

- whether

- while

- will

- with

- works

- would

- Wrong

- year

- you

- zephyrnet