- Evergrande had previously defaulted on bond payments of about $47.5 million due at the end of September

- Although DMSA claims that Evergrande didn’t pay its interest payments, a Clearstream spokesperson told Bloomberg it received overdue interest payments on three US dollar bonds issued by the Chinese developer

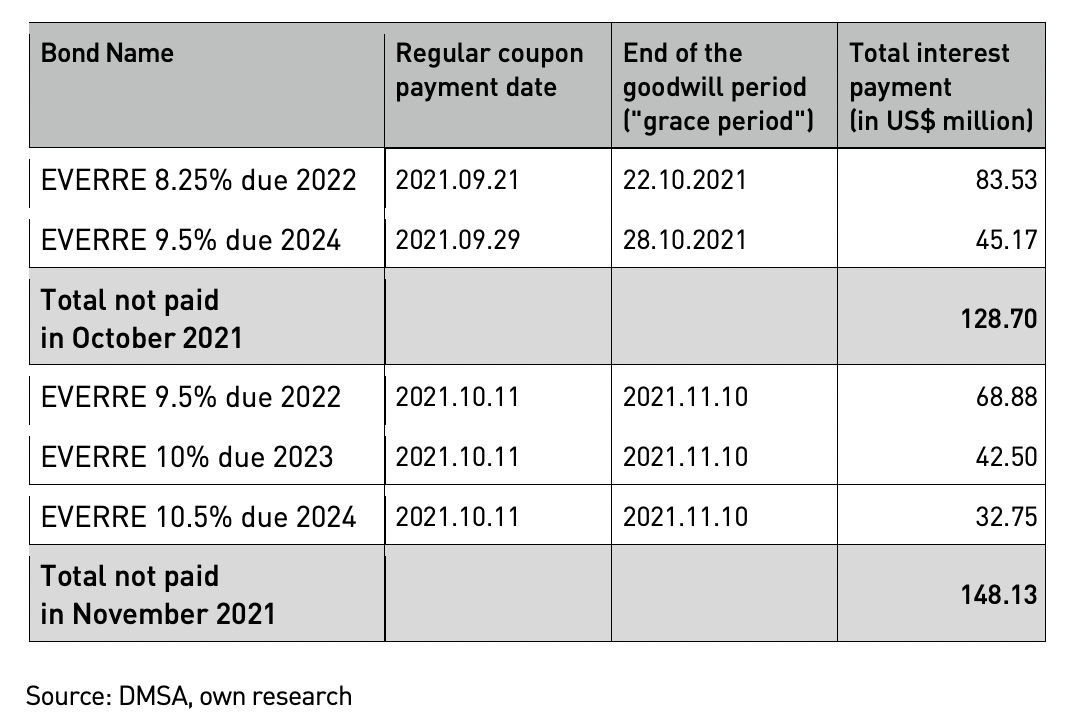

China Evergrande Group has officially defaulted on $148.13 million in interest payments. The Deutsche Marktscreening Agentur (DMSA), which invested in Evergrande’s bonds, is now preparing bankruptcy proceedings against the company.

The Chinese real estate developer has defaulted again on interest payments to international investors, a letter by DMSA stated. DMSA is an independent data service that evaluates market-relevant information on companies to help investors, according to its website.

DMSA has not received any interest payments from Evergrande, it said. Overall, Evergrande would have to pay $148.13 million in interest on its three bonds that were due today, DMSA said. “But so far we have not received any interest on our bonds,” DMSA Senior Analyst Marco Metzler said in the letter. “With banks in Hong Kong closing today, it’s certain that these bonds have defaulted,” Metzler added.

Although DMSA claims that Evergrande didn’t pay its interest payments, a Clearstream spokesperson told Bloomberg it received overdue interest payments on three US dollar bonds issued by the Chinese developer. Clearstream is an international central securities depository that provides post-trade infrastructure and securities services for customers across 110 countries, it said.

Bloomberg also reported Wednesday that two investors holding two of the bonds confirmed that they received the payments, but didn’t disclose their identity because they weren’t authorized to speak publicly.

As DMSA prepares to file for bankruptcy proceedings against the Chinese company, it’s calling on other bond investors to join in as well.

“But while the international financial market has so far met the financial turmoil surrounding the teetering giant Evergrande with a remarkable basic confidence — one can also say: with remarkable naivety — the US central bank Fed confirmed our view yesterday,” Metzler said. “In its latest stability report, it explicitly pointed out the dangers that a collapse of Evergrande could have for the global financial system,” he added.

Evergrande is the second-largest real estate developer in the country and has made headlines for its faulty practices including defaulting on bond payments of about $47.5 million due at the end of September. In October, the company’s shares were halted in Hong Kong trading at one point, due to a sale of a majority stake in its business for more than $5 billion.

Separately, Chinese authorities had asked local governments to prepare for the debt-inundated real estate company’s potential downfall, Blockworks previously reported in late September.

In October, the company sold a $5.1 billion interest in its Evergrande Property Services Group to the 13th largest property developer in China in an effort to manage its debt.

This story was updated on November 10, 2021, at 4:27 pm ET.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.

Source: https://blockworks.co/evergrande-defaults-on-148-13m-bankruptcy-proceedings-begin/

- analyst

- asset

- avatar

- Bank

- Bankruptcy

- Banks

- Billion

- Bloomberg

- Bonds

- business

- Central Bank

- China

- chinese

- claims

- Companies

- company

- confidence

- countries

- crypto

- Crypto News

- Customers

- data

- Debt

- Developer

- digital

- Digital Asset

- Dollar

- energy

- estate

- Fed

- financial

- Free

- funds

- Global

- Governments

- Group

- Headlines

- Hong Kong

- HTTPS

- Identity

- Including

- information

- Infrastructure

- insights

- interest

- International

- Investors

- IT

- join

- journalism

- latest

- local

- Majority

- Market

- Markets

- Media

- million

- news

- North

- north carolina

- Other

- Pay

- payments

- property

- real estate

- report

- reporter

- Securities

- Services

- Shares

- So

- spokesperson

- Stability

- system

- top

- Trading

- university

- us

- US Dollar

- View

- Website