- The ECB concluded a prolonged sequence of 10 consecutive rate hikes.

- The Eurozone economy is showing a significant slowdown.

- Investors increased their expectations for ECB rate cuts.

The EUR/USD price analysis points south as the ECB held steady on interest rates. It concluded a prolonged sequence of 10 consecutive rate hikes. However, the ECB firmly stated that the growing talk of rate cuts in the market was premature.

-Are you interested in learning about the forex signals telegram group? Click here for details-

In its efforts to curb rapid price increases, the ECB has raised rates by 4.5 percentage points since July 2022. However, the bank pledged a pause last month as the exceptionally high borrowing costs began affecting the economy. With price pressures diminishing, inflation dropping by more than half within a year, and the economy showing a significant slowdown, a recession is possible. This scenario makes additional rate hikes unlikely.

ECB President Christine Lagarde, repeating the guidance from six weeks ago, hinted at a steady policy in the near future. However, she offered little additional direction. She even left the door slightly ajar for the potential of future rate hikes, though as a distant possibility.

Lagarde argued that the Eurozone economy appeared weak, possibly even weaker than predicted last month. However, she emphasized that price pressures remained robust. Moreover, they could intensify if the conflict in the Middle East led to increased energy costs.

Despite her efforts to resist expectations of rate cuts, she couldn’t sway market sentiment.

Investors remained unconvinced and increased their expectations for rate cuts, characterizing the guidance as “dovish.” Currently, markets indicate a significant likelihood of the ECB initiating interest rate cuts in April.

EUR/USD key events today

Investors are awaiting core inflation data with two major components,

- The core PCE price index (MoM)

- The core PCE price index (YoY)

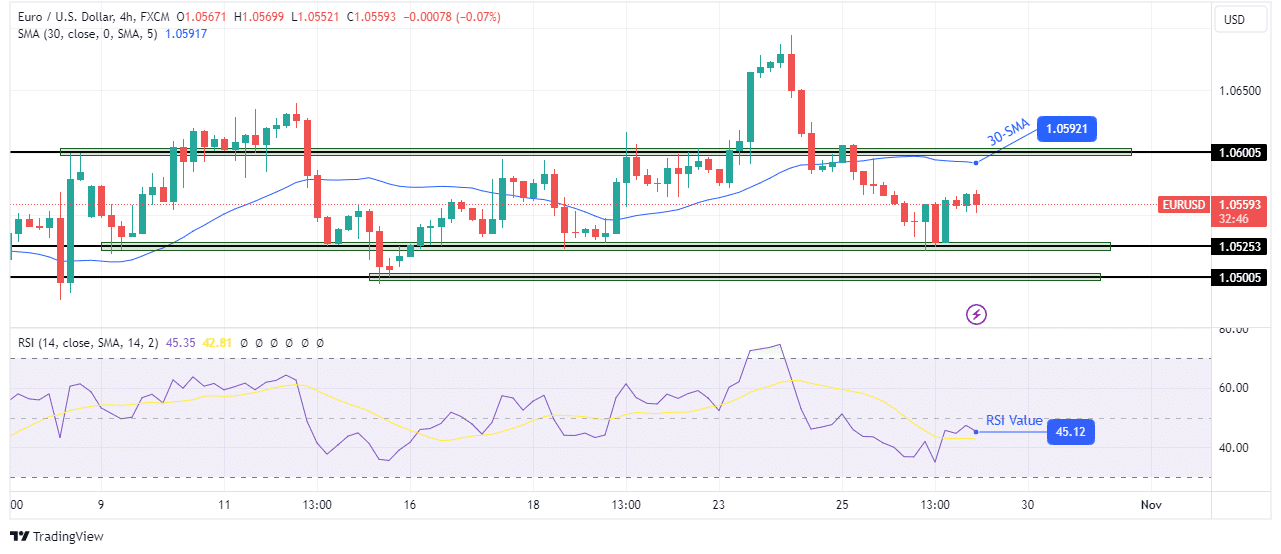

EUR/USD technical price analysis: 1.0525 support holds firm for now.

The EUR/USD price is bearish on the charts as the price has fallen below 30-SMA. It has paused at the 1.0525 support level, where bulls are trying a rebound. However, with the price below the SMA and the RSI under 50, it will be hard for bulls to maintain the recovery.

-Are you interested in learning about forex indicators? Click here for details-

The highest price before bears return is the 30-SMA and the 1.0600 resistance level. A break above this zone would confirm a bullish takeover. However, given the bearish bias, the price will likely bounce lower to retest the 1.0525 and the 1.0500 support levels.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/eur-usd-price-analysis-ecb-keeps-interest-rates-unaltered/

- :has

- :is

- :where

- 1

- 10

- 2022

- 50

- a

- About

- above

- Accounts

- Additional

- affecting

- ago

- analysis

- and

- appeared

- April

- ARE

- argued

- AS

- At

- awaiting

- Bank

- BE

- bearish

- Bears

- before

- began

- below

- bias

- Borrowing

- Bounce

- Break

- Bullish

- Bulls

- by

- CAN

- CFDs

- Charts

- Christine

- CHRISTINE LAGARDE

- click

- components

- concluded

- Confirm

- conflict

- consecutive

- Consider

- Core

- core inflation

- Costs

- could

- Currently

- cuts

- data

- diminishing

- direction

- Distant

- Door

- Dropping

- East

- ECB

- economy

- efforts

- emphasized

- energy

- EUR/USD

- Eurozone

- Even

- events

- exceptionally

- expectations

- Fallen

- Firm

- firmly

- For

- forex

- from

- future

- given

- Growing

- guidance

- Half

- Hard

- Held

- her

- here

- High

- highest

- Hikes

- hinted

- holds

- However

- HTTPS

- if

- in

- increased

- Increases

- index

- indicate

- inflation

- initiating

- interest

- INTEREST RATE

- Interest Rates

- interested

- Invest

- investor

- IT

- ITS

- July

- Key

- Lagarde

- Last

- learning

- Led

- left

- Level

- levels

- likelihood

- likely

- little

- lose

- losing

- lower

- maintain

- major

- MAKES

- Market

- market sentiment

- Markets

- max-width

- Middle

- Middle East

- mom

- money

- Month

- more

- Moreover

- Near

- now

- of

- offered

- on

- pause

- paused

- pce

- percentage

- plato

- Plato Data Intelligence

- PlatoData

- points

- policy

- possibility

- possible

- possibly

- potential

- predicted

- Premature

- president

- price

- Price Analysis

- provider

- raised

- rapid

- Rate

- rate hikes

- Rates

- rebound

- recession

- recovery

- remained

- Resistance

- retail

- return

- Risk

- robust

- rsi

- scenario

- sentiment

- Sequence

- she

- should

- showing

- signals

- significant

- since

- SIX

- Slowdown

- SMA

- South

- stated

- steady

- support

- support level

- support levels

- Take

- takeover

- Talk

- Technical

- Telegram

- than

- that

- The

- their

- they

- this

- though?

- to

- trade

- Trading

- trying

- two

- unaltered

- under

- unlikely

- was

- Weeks

- when

- whether

- will

- with

- within

- would

- year

- you

- Your

- zephyrnet