- EUR/USD fails to reclaim 1.0900 once more as markets pivot to face CB risks.

- Euro area Consumer Confidence for January will give a preview of data tone on Tuesday.

- European PMIs due Wednesday, ECB rate call on Thursday.

The EUR/USD waffled on Monday, drifting down into the 1.0880 region as markets pivot ahead of a slew of central bank rate calls this week, with the European Central Bank (ECB) in particular focus for their monetary policy statement slated for Thursday.

Tuesday will kick off the Euro’s data exposure this week with the ECB’s Bank Lending Survey, which serves as a temperature gauge for bank lending throughout the broader financial Eurosystem, and helps to inform the ECB of the evolution of financial conditions. Tuesday also sees the European Consumer Confidence index survey for January, which is forecast to tick up slightly from -15.0 to -14.3.

Wednesday sees a gamut of European Purchasing Managers’ Indexes (PMI), and markets are expecting the pan-European Composite PMI for January to improve slightly from 47.6 to 48.0. European PMIs have consistently printed in contraction territory for six consecutive months, and another print in sub-50.0 territory in January will make for a straight seventh.

ECB policymakers have put significant effort into delivering soothing talking points to markets in an attempt to walk back investor expectations of rate cuts from the ECB, with ECB President Christine Lagarde highlighting last week that overheated market hopes for rate cuts run the risk of making the ECB’s job even harder than it needs to be as market-reactionary rate tantrums weigh on valuations and distort market stability with continuous sentiment swoons.

The ECB doesn’t see rate cuts until the summer months at the earliest, and money markets appear set to meet the central bank on something that is approaching middle ground.

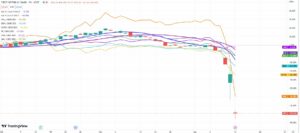

EUR/USD Technical Outlook

The EUR/USD continues to trade into the south end of the 200-hour Simple Moving Average (SMA), slumping below the 1.0900 handle after a brief test above the barrier early Monday.

Intraday action has been capped under the 1.0900 level since tumbling from the 1.1000 major handle last week, dipping into 1.0850 but bid well enough to prevent further declines.

Daily candlesticks have the EUR/USD trading into a tight consolidation range between the 50-day and 200-day SMAs at 1.0925 and 1.0850 respectively. Despite bids getting caught up in a near-term congestion pattern, the EUR/USD is notably bullish in the medium-term, with a pattern of higher lows remaining intact and December’s swing high into 1.1140 keeping the major pair on the high end.

EUR/USD Hourly Chart

EUR/USD Daily Chart

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.fxstreet.com/news/eur-usd-drifts-lower-as-markets-gear-up-for-central-bank-rate-call-week-202401222326

- :has

- :is

- $UP

- 1

- a

- above

- Action

- After

- ahead

- also

- an

- and

- Another

- appear

- approaching

- ARE

- AREA

- AS

- At

- attempt

- average

- back

- Bank

- Bank Rate

- barrier

- BE

- been

- below

- between

- bid

- broader

- Bullish

- but

- call

- Calls

- caught

- CB

- central

- Central Bank

- Christine

- conditions

- confidence

- Confidence Index

- congestion

- consecutive

- consistently

- consolidation

- consumer

- continues

- continuous

- contraction

- cuts

- daily

- data

- Declines

- delivering

- Despite

- Doesn’t

- down

- due

- earliest

- Early

- ECB

- effort

- end

- enough

- EUR/USD

- European

- European Central Bank

- European PMIs

- Even

- evolution

- expectations

- expecting

- Exposure

- Face

- fails

- financial

- Focus

- For

- from

- further

- gauge

- Gear

- getting

- Give

- Ground

- handle

- harder

- Have

- helps

- High

- higher

- highlighting

- hopes

- HTTPS

- improve

- in

- index

- indexes

- inform

- into

- investor

- IT

- January

- Job

- keeping

- kick

- Last

- lending

- Level

- lower

- Lows

- major

- make

- Making

- Market

- Markets

- Meet

- Middle

- Monday

- money

- months

- more

- moving

- moving average

- needs

- notably

- of

- off

- on

- once

- pair

- particular

- Pattern

- Pivot

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- points

- policymakers

- president

- prevent

- Preview

- purchasing

- put

- range

- Rate

- region

- remaining

- respectively

- Risk

- risks

- Run

- see

- sees

- sentiment

- serves

- set

- significant

- Simple

- since

- SIX

- SMA

- SMAs

- something

- South

- Stability

- Statement

- straight

- summer

- Survey

- Swing

- talking

- Technical

- territory

- test

- than

- that

- The

- their

- this

- this week

- throughout

- thursday

- tick

- to

- TONE

- trade

- Trading

- Tuesday

- under

- until

- Valuations

- walk

- Wednesday

- week

- weigh

- WELL

- which

- will

- with

- zephyrnet