Ethereum has reduced its total supply at the rate of 1% in the past week, making it the first crypto of note to have ever done so.

23,000 eth have been taken out of circulation in the past week, about 1/5th of the total amount since ethereum turned deflationary in January.

112,000 eth have been removed from the supply in total, worth $200 million. About half of it, ◊44,000, has been taken out this month.

Network fees have increased in light of ethereum’s price rise, doubling since the beginning of the year.

It costs now about $15 for a Uniswap transaction and just $2 for a normal transaction, a circa 3x increase from the September low during the long sideway.

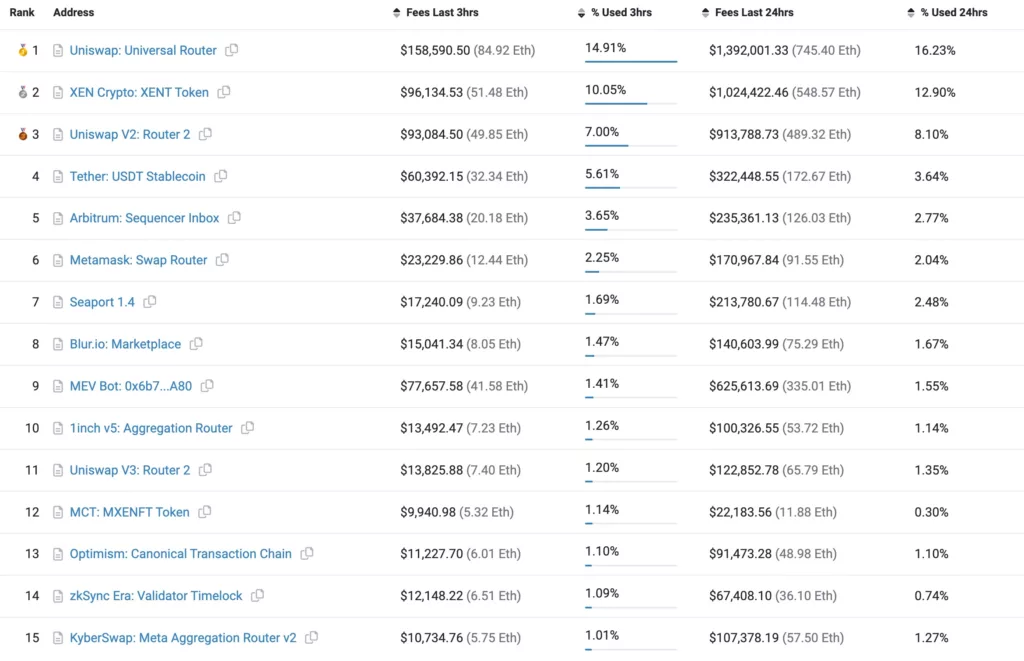

One of the top gas burners right now, and has been for some time, is XEN which has contributed to the supply reduction by $1 million in the past 24 hours.

Their whitepaper basically says this is BTC but without Proof of Work mining, you instead have algo minting with it becoming more difficult to get more XEN the more proof of participation there is.

So this goes back to pure tokenomics with the paper itself claiming there is no more to it. Certainly not any blockchain related innovation as it is an ERC20 token running on eth.

Arbitrum has contributed to the supply reduction by quarter of a million in the past 24 hours, making it the biggest sustained new entrant with Optimism and zkSync at $90,000 and $70,000.

This is now the new ranking board, at least for eth. We have MEV bot at above half a million dollars, eating everybody’s sandwiches and Kyber is apparently not dead, they at 100k for the past 24 hours, making it the top 15 dapp in eth.

Then there’s Seaport, which has a Github and describes itself as “a new marketplace protocol for safely and efficiently buying and selling NFTs.”

Why they swimming in the ocean when it’s not quite summer yet, is anyone’s guess but if ethereum keeps reducing its supply at the current rate, some 1.2 million eth will be taken out of circulation. That’s worth $2.2 billion.

Since January it has been operating at the rate of 0.1%, though accelerating significantly this month to 0.45%.

Even at the lower end however, about $1 billion will be taken out of circulation by the end of the year, and that’s including the reward stakers receive to secure the network.

This is going slower than the reduction in the dollar’s supply at about 5% a year, but then eth hopefully will be sustainable.

Unlike the USD, which depends on whatever the banking executives feel like its supply should be, eth’s supply is set by the market now for the first time in crypto and maybe in the history of money.

That’s because a certain portion of the transaction fee is burned by sending it to the network address, 0x00000, which has no private key and so no one can spend it.

The more the network is used, the more the supply falls and vice versa, while on the other hand a somewhat constant 0.5% a year is added through staking rewards, that’s about 2,000 eth a day.

This creates a fairly direct relationship between the velocity of money and the supply of money, and in theory that means the value of eth past the current adoption stage should grow or fall depending on whether the global economy grows or otherwise.

While in USD and all other fiat money, a slowdown in the economy can be met with the banking executives who make the majority of the board of Federal Reserve Banks deciding to print, in eth the algo decides based on the fairly direct input of the market.

So if we imagine this at the scale of an economy, a slowdown will lead to an increase in the money supply proportionate to that slowdown, devaluing holdings therefore and spurring spending.

An acceleration on the other hand will decrease supply, making holding more valuable and so potentially taming the bull to not become a bubble.

As with most bots, the internal eth ‘bot’ at this stage is probably crude too because it is obviously not directly operating at the scale of an actual economy, though eth is now the size of Greece. Just not for buying tomatoes, unless they in jpegs.

In addition eth is still at the adoption stage where its relationship with global growth is ancillary, but nonetheless this is the first large scale experiment in automating the Federal Reserves.

In replacing the banking executives with algorithmic parameters, which as science develops will probably need to be fine tuned, but at this adoption stage can be simple parameters.

Far into the future, the entire market input, including the prices of tomatoes, can potentially feed into that velocity and supply algo, with money so to become scientific and academic.

No longer political. So making eth distinct from all cryptos at this point, and from bitcoin, because it does not have a fixed supply or a fixed inflationary supply, but a velocity of money supply for up to about 0.5% of its total supply, afterwhich it is deflationary though again at the rate of the velocity of money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Source: https://www.trustnodes.com/2023/04/24/ethereums-supply-falls-at-a-rate-of-1

- :has

- :is

- :not

- :where

- $1 billion

- $1 million

- $UP

- 000

- 1

- 100k

- a

- About

- above

- academic

- accelerating

- acceleration

- added

- addition

- address

- Adoption

- ALGO

- algorithmic

- All

- amount

- an

- and

- any

- April

- AS

- At

- automating

- back

- Banking

- Banks

- based

- Basically

- BE

- because

- become

- becoming

- been

- Beginning

- between

- Biggest

- Billion

- Bitcoin

- blockchain

- board

- Bot

- bots

- BTC

- bubble

- bull

- burned

- but

- Buying

- by

- CAN

- certain

- certainly

- Circulation

- claiming

- constant

- contributed

- Costs

- creates

- crude

- crypto

- cryptos

- Current

- dapp

- DApps

- day

- dead

- Deciding

- decrease

- deflationary

- Depending

- depends

- develops

- difficult

- direct

- directly

- distinct

- dollars

- doubling

- during

- economy

- efficiently

- Entire

- ERC20

- ERC20 token

- ETH

- ETH dapps

- ethereum

- Ethereum's

- EVER

- executives

- experiment

- fairly

- Fall

- Falls

- Federal

- federal reserve

- fee

- Fees

- Fiat

- Fiat Money

- fine

- First

- first time

- fixed

- For

- from

- future

- GAS

- get

- GitHub

- Global

- Global economy

- Goes

- going

- Greece

- Grow

- Grows

- Growth

- Half

- hand

- Have

- High

- history

- holding

- Holdings

- Hopefully

- HOURS

- However

- HTTPS

- imagine

- in

- Including

- Increase

- increased

- Inflationary

- Innovation

- input

- instead

- internal

- into

- IT

- ITS

- itself

- January

- JPEGs

- just

- Key

- kyber

- large

- lead

- light

- like

- Long

- longer

- Low

- Majority

- make

- Making

- Market

- marketplace

- max-width

- means

- MEV

- MEV Bot

- million

- million dollars

- Mining

- minting

- money

- money supply

- Month

- more

- most

- Need

- network

- New

- NFTs

- normal

- now

- ocean

- of

- on

- ONE

- operating

- Optimism

- or

- Other

- otherwise

- Paper

- parameters

- participation

- past

- plato

- Plato Data Intelligence

- PlatoData

- Point

- political

- potentially

- price

- price rise

- Prices

- private

- Private Key

- probably

- proof

- proportionate

- protocol

- Quarter

- Ranking

- Rate

- receive

- Reduced

- reducing

- related

- relationship

- Removed

- Reserve

- reserves

- Reward

- Rewards

- Rise

- running

- safely

- says

- Scale

- Science

- Seaport

- secure

- Selling

- sending

- September

- set

- should

- significantly

- Simple

- since

- Size

- Slowdown

- So

- some

- somewhat

- spend

- Spending

- Stage

- stakers

- Staking

- Staking Rewards

- Still

- summer

- supply

- sustainable

- swimming

- than

- that

- The

- The Future

- There.

- therefore

- they

- this

- Through

- time

- to

- token

- tokenomics

- too

- top

- Total

- transaction

- Trustnodes

- Turned

- Uniswap

- USD

- used

- Valuable

- value

- VeloCity

- we

- webp

- week

- whether

- which

- while

- WHO

- will

- with

- without

- Work

- worth

- XEN

- year

- you

- zephyrnet

- zkSync