Join Our Telegram channel to stay up to date on breaking news coverage

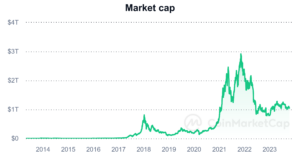

With Ethereum (ETH) having the potential to fall even more if Vitalik Buterin cashes out, analysts suggest investing in Bitcoin Spark (BTCS) alongside other cryptocurrencies like Cardano (ADA) and Solana (SOL) in order to profit.

Vitalik Buterin crypto net worth

Vitalik Buterin, Ethereum’s co-founder, has a crypto net worth estimated at around $465 million. This includes assets in his three verified crypto wallets (0xab, 0xD0, 0xd8) and a multisig contract that holds $399 million worth of ETH.

ETH price prediction

On September 25, Lookonchain reported that Vitalik Buterin deposited 400 ETH, equivalent to around $632,000, on Coinbase. While the intentions are unknown, transferring significant amounts of crypto to centralized exchanges is often indicative of impending sales. As a result, market analysts are predicting further downsides for Ethereum (ETH), with prices potentially falling between $1,300 to $1,500 in the coming weeks due to lack of buying pressure.

Bitcoin Spark: Revolutionizing the crypto landscape

Bitcoin Spark is a cutting-edge blockchain poised to usher in a new era of digital transactions. Drawing inspiration from the pioneering work of Satoshi Nakamoto, this project shares some fundamental traits with Bitcoin, such as a finite supply of 21 million BTCS coins. However, Bitcoin Spark distinguishes itself by offering swift and cost-effective transactions, achieved through a combination of a short block time, an impressive individual block transaction capacity, and a robust network of nodes.

In addition to its speed and affordability, Bitcoin Spark positions itself as a versatile platform for smart contracts and decentralized applications (DApps). Its intricate, multi-layered architecture incorporates a smart contract layer with multiple execution systems, accommodating both high-level and low-level programming languages, all culminating in finality on the main network.

What truly sets Bitcoin Spark apart is its groundbreaking consensus mechanism, the Proof-of-Process (PoP). PoP rewards users in a non-linear fashion for verifying blocks and contributing their processing power to the network. The native Bitcoin Spark application is set to enable Windows, Linux, macOS, iOS, and Android users to participate in validation by offering access to their device’s processing units. The development team has meticulously designed the application to be secure, lightweight, and user-friendly.

Bitcoin Spark will rent out the contributed processing power to organizations or individuals seeking remote computing resources, enabling validators to earn income from what would otherwise be dormant processing capacity. Payments for this decentralized CPU/GPU rental service will be conducted exclusively in BTCS.

Furthermore, Bitcoin Spark will include unobtrusive advertisement slots within its website and application. These advertisements will be community-moderated, and advertisers will be required to make payments using BTCS. This approach not only offers businesses an exciting avenue to connect with their target audience but also channels revenue back to network participants, who receive 50% of the generated income, along with additional incentives for overseeing the advertisements.

Bitcoin Spark is in the sixth phase of its Initial Coin Offering (ICO), selling BTCS at $2.75 and offering an 8% bonus. BTCS will launch at $10, suggesting a 393% profit for investors at the current level. A number of crypto watchers have suggested that Bitcoin Spark (BTCS) is poised for significant price appreciation even after launch due to various factors, including its low supply, groundbreaking technology, and real-world applicability.

For more on Bitcoin Spark:

Join Our Telegram channel to stay up to date on breaking news coverage

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://insidebitcoins.com/news/eth-could-fall-even-more-if-vitalik-cashes-out-invest-in-ada-sol-and-btcs-to-profit

- :has

- :is

- :not

- $UP

- 000

- 25

- 300

- 400

- 500

- 75

- a

- access

- achieved

- ADA

- addition

- Additional

- Advertisement

- advertisers

- After

- All

- along

- alongside

- also

- amounts

- an

- Analysts

- and

- android

- apart

- Application

- applications

- Applications (DApps)

- appreciation

- approach

- architecture

- ARE

- around

- AS

- Assets

- At

- audience

- Avenue

- back

- BE

- between

- Bitcoin

- Block

- Block time

- blockchain

- Blocks

- Bonus

- both

- Breaking

- breaking news

- BTCS

- businesses

- but

- Buterin

- Buying

- by

- Capacity

- Cardano

- Cardano (ADA)

- centralized

- Centralized Exchanges

- channels

- Co-founder

- Coin

- coinbase

- Coins

- combination

- coming

- coming weeks

- computing

- conducted

- Connect

- Consensus

- consensus mechanism

- contract

- contracts

- contributed

- contributing

- cost-effective

- could

- crypto

- crypto wallets

- cryptocurrencies

- culminating

- Current

- cutting-edge

- DApps

- Date

- decentralized

- Decentralized Applications

- deposited

- designed

- Development

- development team

- digital

- digital transactions

- downsides

- drawing

- due

- earn

- enable

- enabling

- Equivalent

- Era

- estimated

- ETH

- ethereum

- ethereum (ETH)

- Ethereum's

- Even

- Exchanges

- exciting

- exclusively

- execution

- factors

- Fall

- Falling

- Fashion

- finality

- For

- For Investors

- from

- fundamental

- further

- generated

- groundbreaking

- Have

- having

- high-level

- his

- holds

- However

- HTTPS

- ICO

- if

- impending

- impressive

- in

- Incentives

- include

- includes

- Including

- Income

- incorporates

- indicative

- individual

- individuals

- initial

- Initial Coin Offering

- Inspiration

- intentions

- intricate

- Invest

- investing

- Investors

- iOS

- ITS

- itself

- Lack

- Languages

- launch

- layer

- Level

- lightweight

- like

- linux

- Low

- macos

- Main

- make

- Market

- mechanism

- meticulously

- million

- million worth

- more

- multi-layered

- multiple

- Multisig

- nakamoto

- native

- net

- network

- New

- news

- nodes

- number

- of

- offering

- Offers

- often

- on

- only

- or

- order

- organizations

- Other

- otherwise

- our

- out

- overseeing

- participants

- participate

- payments

- phase

- Pioneering

- platform

- plato

- Plato Data Intelligence

- PlatoData

- poised

- pop

- positions

- potential

- potentially

- power

- predicting

- pressure

- price

- Prices

- processing

- Processing Power

- Profit

- Programming

- programming languages

- project

- real world

- receive

- remote

- Rent

- Reported

- required

- Resources

- result

- revenue

- Revolutionizing

- Rewards

- robust

- sales

- Satoshi

- Satoshi Nakamoto

- secure

- seeking

- Selling

- September

- service

- set

- Sets

- Shares

- Short

- significant

- sixth

- slots

- smart

- smart contract

- Smart Contracts

- SOL

- Solana

- Solana (SOL)

- some

- Spark

- speed

- stay

- such

- suggest

- supply

- SWIFT

- Systems

- Target

- team

- Technology

- that

- The

- their

- These

- this

- three

- Through

- time

- to

- transaction

- Transactions

- Transferring

- truly

- units

- unknown

- user-friendly

- users

- using

- validation

- validators

- various

- verified

- verifying

- versatile

- vitalik

- vitalik buterin

- Wallets

- Website

- Weeks

- What

- while

- WHO

- will

- windows

- with

- within

- Work

- worth

- would

- wrap

- zephyrnet