Be the first to know when new content like this is available!

Subscribe to our newsletter to get alerts about new posts, local news, and industry insights.

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Since January, a few new adult-use cannabis programs have rolled out, leading to some of the hottest new markets nationwide. Missouri’s first quarter saw combined medical and adult-use sales net over $350 million, while Maryland, a more recent entrant to the adult-use space, saw nearly $85 million in the first month, on track for comparable revenues to Missouri.

As I discussed last fall, Maryland and Missouri both saw cannabis-related proposals on the November ballot, and those states were the only two where proposals were approved. Elsewhere, Arkansas, North Dakota, and South Dakota voters rejected adult-use cannabis expansion proposals. This blog dives into the current program status in Maryland and Missouri and their evolving social equity programs. I’ll also touch upon other upcoming opportunities the industry will see in the near future, notably in tribal communities.

Missouri

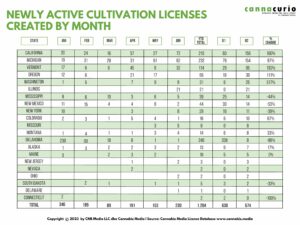

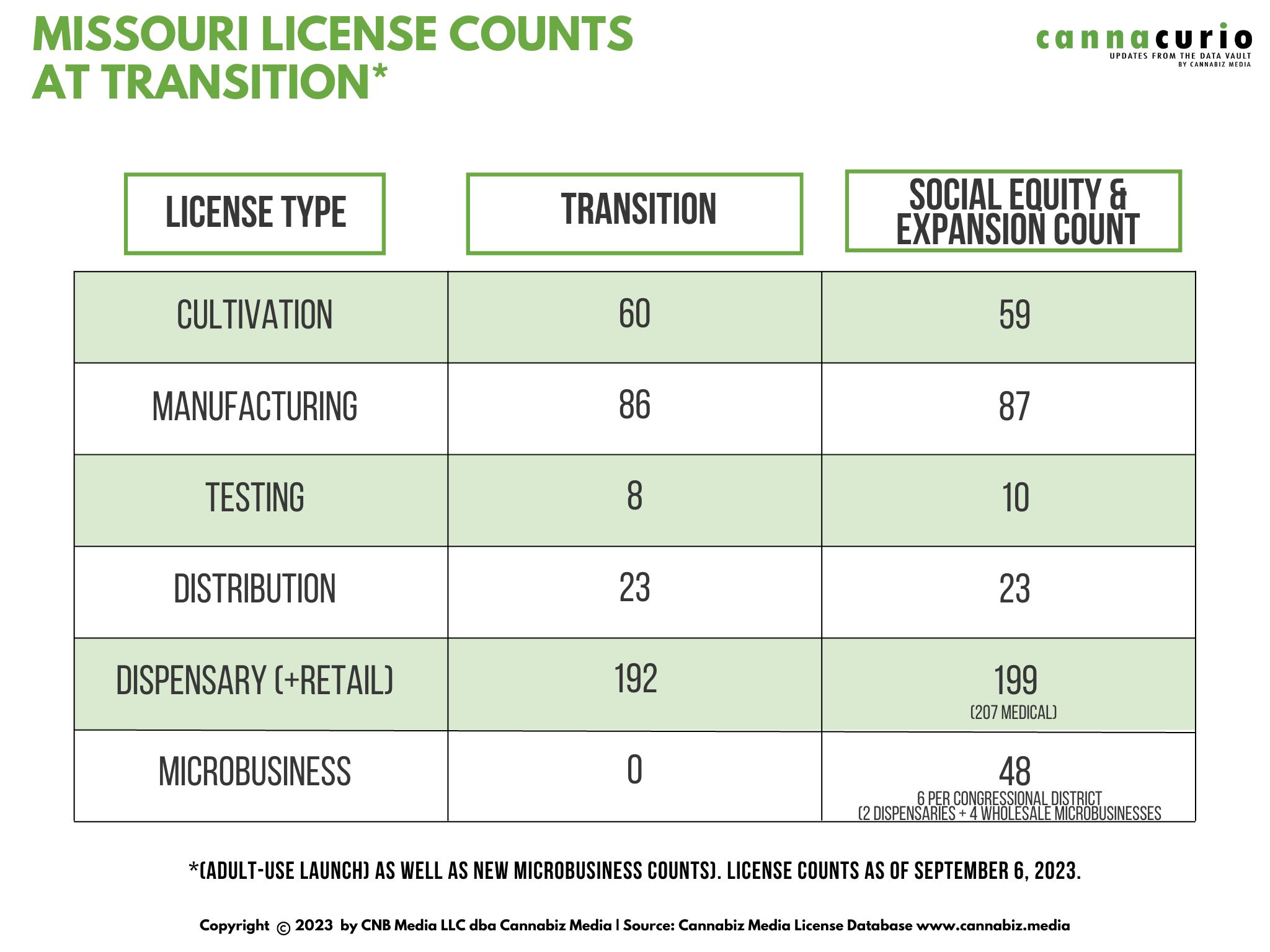

Missouri saw the swiftest cannabis market expansion in recent years, going from voter approval to sales launch in under three months. The voter-approved amendment laid the groundwork and provided clarity to many questions, but also made it harder for legislators to make future tweaks to the program. Regulators spent much of 2022 working on proposed adult-use rules in anticipation of voter approval, and they successfully prepared for an ambitious rollout timeline. The state began accepting license conversion applications only one month after the election, and quickly began clearing licensees to scale up for combined medical and adult-use operations. The table below shows recent changes in license counts; the majority of the state’s licensees have converted, while additional medical cannabis licenses have been granted.

The state’s social equity program kicked off over the summer, after the application window closed. A lottery was held in August to select winners, six in each of the state’s eight congressional districts. The majority of the winners selected in the lottery (32) will be able to operate wholesale microbusinesses, granting them permission to cultivate up to 250 plants, process cannabis, as well as create cannabis products to sell to other microbusinesses. The remaining sixteen licenses will be for microbusiness dispensaries, allowing for limited packaging and sales. It’s important to note: all of these microbusiness licenses are reserved for social equity, and microbusinesses are only permitted to engage with each other, creating a second, smaller, “market within a market” that operates independently of the existing licensed system.

Maryland

Maryland voters approved a broader ballot question, generally legalizing cannabis but leaving the details to the state legislature. Legislators passed a package containing rules and licensing provisions in early April, giving the state only a few months to prepare for a July 1 launch date. In a process similar to Missouri, existing medical cannabis licensees were given the opportunity to apply for conversions, and at sales launch, no new licenses had yet been awarded. Two social equity licensing rounds will be permitted, with the first occurring this fall. A series of microbusinesses will fill in the map further, creating a tier of smaller craft producers. After May 2024, a second round of licensing will occur, with details to be ironed out at a later date. The second licensing phase will include on-site consumption licenses.

The table below highlights the increased license counts after social equity expansion. The license cap will nearly double for cultivation and dispensaries, and more than double for manufacturers.

Tribal

Missouri and Maryland aren’t the only regions seeing program rollouts this year - tribal cannabis sales have been recently on the rise nationwide. Many tribes have had discussions about launching medical or adult-use cannabis programs, with varying implementation success. Some tribes have waited for their neighboring states for a signal, opting to delay implementation until their neighbors legalize or conclude rule-making. Recent conversations in North Carolina indicate the Eastern Band of Cherokee Indians could be the first tribe in the region to launch adult-use sales. This wouldn’t be a national first—Nevada tribes have had dispensaries for years, including the country’s first and long-running tribal cannabis consumption lounge, while state cannabis regulators prepare for the launch of nearly 40 additional licensed lounges.

On the east coast, tribes in New York have had a head start while the state fumbles its retail license rollout—with multiple upstate tribes operating over two dozen retailers, a combination of tribal operations and private licensees. TILT Holdings made news recently as it cut ties with numerous social equity partners, including a Long Island tribe with a standing partnership to develop a vertically-integrated operation and multiple retail stores. According to Green Market Report, TILT sold their stake to PowerFund Partners.

One major opportunity area for tribes will be the Upper Midwest. Minnesota’s legislature finally legalized cannabis after numerous attempts, but regulators have a long pathway to license issuance and launch—possibly up to 18 months. So far, two tribes, the White Earth and Red Lake Nations, have begun sales to adults aged 21 and up. According to Minnesota Public Radio, the state’s eleven tribes are considering establishing a tribal cannabis compact, similar to the one in effect in Nevada. In the meantime, Minnesotans looking to purchase cannabis without a medical card may continue to turn to tribal businesses, and the primary cannabis business opportunity will be on reservations. It remains to be seen if a tribe will launch a similar partnership with an MSO, as TILT Holdings attempted.

Summary

Overall, the remaining months of 2023 will see some new opportunities for hopeful cultivation, manufacturing, and dispensary applicants, most notably in Missouri and Maryland. Many of these businesses will be licensed and could be on track to open in Q2 2024. Additional licensing opportunities will remain in both markets well into 2024, as well as in Minnesota, where tribes may continue to develop programs in the coming months.

To keep track of the recreational market and changes in the United States (and international markets), subscribe to the Cannabis Market Intelligence Platform.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.cannabiz.media/blog/emerging-adult-use-markets-update-september-2023

- :has

- :where

- $UP

- 1

- 2022

- 2023

- 2024

- 250

- 32

- 36

- 40

- 7

- a

- Able

- About

- accepting

- According

- Additional

- adults

- After

- aged

- alerts

- All

- Allowing

- also

- ambitious

- an

- and

- anticipation

- applicants

- Application

- applications

- Apply

- approval

- approved

- April

- ARE

- AREA

- arkansas

- AS

- At

- attempted

- Attempts

- AUGUST

- awarded

- ballot

- BAND

- BE

- been

- began

- begun

- below

- Blog

- both

- broader

- business

- businesses

- but

- cannabis

- cannabis business

- cannabis products

- Cannabiz Media

- cap

- card

- Carolina

- Changes

- clarity

- Clearing

- closed

- Coast

- combination

- combined

- coming

- Communities

- compact

- comparable

- conclude

- Congressional

- considering

- consumption

- content

- continue

- conversations

- Conversion

- conversions

- converted

- could

- country’s

- craft

- create

- Creating

- Cultivate

- cultivation

- Current

- Cut

- Dakota

- Date

- delay

- details

- develop

- discussed

- discussions

- dispensaries

- double

- dozen

- each

- Early

- earth

- East

- east coast

- effect

- Election

- eleven

- elsewhere

- emerging

- engage

- equity

- establishing

- evolving

- existing

- expansion

- Fall

- far

- few

- fill

- Finally

- First

- For

- Forbes

- form

- from

- further

- future

- generally

- get

- given

- Giving

- going

- granted

- granting

- groundwork

- had

- harder

- Have

- head

- Held

- highlights

- Holdings

- hopeful

- hottest

- HTTPS

- i

- I’LL

- if

- implementation

- important

- in

- include

- Including

- increased

- independently

- indicate

- industry

- Industry Insights

- insights

- Intelligence

- International

- into

- island

- issuance

- IT

- ITS

- January

- jpg

- July

- Keep

- Know

- lake

- later

- launch

- launching

- leading

- leaving

- legalize

- legalized

- legislators

- Legislature

- License

- Licensed

- licensees

- licenses

- Licensing

- like

- local

- Long

- looking

- lottery

- made

- major

- Majority

- make

- Manufacturers

- manufacturing

- many

- map

- Market

- Markets

- Maryland

- May..

- meantime

- Media

- medical

- medical cannabis

- midwest

- minnesota

- Month

- months

- more

- most

- much

- multiple

- National

- Nations

- Nationwide

- Near

- nearly

- neighboring

- neighbors

- NEVADA

- New

- New York

- news

- Newsletter

- no

- North

- north carolina

- North Dakota

- notably

- note

- November

- numerous

- occur

- occurring

- of

- off

- on

- ONE

- only

- open

- operate

- operates

- operating

- operation

- Operations

- opportunities

- Opportunity

- or

- Other

- our

- out

- over

- package

- packaging

- partners

- Partnership

- passed

- pathway

- permission

- phase

- PHP

- plants

- platform

- plato

- Plato Data Intelligence

- PlatoData

- Posts

- Prepare

- prepared

- primary

- private

- process

- Producers

- Products

- Program

- Programs

- Proposals

- proposed

- provided

- public

- purchase

- Q2

- Quarter

- question

- Questions

- quickly

- recent

- recently

- Recreational

- Red

- region

- regions

- Regulators

- remain

- remaining

- remains

- reserved

- retail

- retailers

- revenues

- Rise

- Rolled

- rollout

- round

- rounds

- rules

- sales

- saw

- Scale

- Second

- see

- seeing

- seen

- selected

- sell

- September

- Series

- Shows

- Signal

- similar

- SIX

- smaller

- So

- so Far

- Social

- sold

- some

- something

- South

- Space

- spent

- stake

- start

- State

- States

- Status

- stores

- submission

- subscribe

- success

- Successfully

- summer

- system

- table

- than

- that

- The

- The State

- their

- Them

- These

- they

- this

- this year

- those

- three

- tier

- Ties

- timeline

- to

- touch

- track

- Tribal

- Tribe

- tribes

- TURN

- two

- under

- United

- United States

- until

- upcoming

- Update

- upon

- Voter

- voters

- was

- WELL

- went

- were

- when

- while

- white

- wholesale

- will

- window

- winners

- with

- within

- without

- working

- Wrong

- year

- years

- yet

- york

- Your

- zephyrnet