- Polygon’s MATIC token has shown signs of significant buyer accumulation in the past two weeks.

- The current stability near the lower range suggests a potential reversal of the previous bearish trend.

- Crypto analysts advise caution in interpreting breakouts.

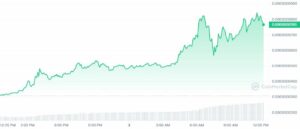

Over the past two weeks, Polygon’s native MATIC token has shown intriguing signals of significant buyer accumulation despite ranging prices. For seasoned crypto investors, such early signs often foreshadow major volatility swings.

MATIC has traded sideways in a relatively narrow band since its unexpected 21% single-day drop seen earlier this month. However according to classic market principles, subtle volume and support metrics surrounding such consolidation offer insights into where the asset may head next.

On MATIC’s daily price chart, the recent volume profile reveals declining spikes even as the price carved out a floor following last month’s flash crash. That divergence between lagging volume and sideways drift suggests existing holders are absorbing available liquidity rather than panicking into continued selling.

Current Polygon range shows readiness to reverse

Indeed, the stability formed near the current range lows hints at readiness to reverse the preceding bearish impulse. From recent price action alone, MATIC appears poised to break out of its contraction into a new expansive move.

However, crypto analysts caution that not all breakouts behave equally. The exact circumstances surrounding the next definitive chart close above or below MATIC’s expected resistance marker will indicate the probable scale and sustainability of breakout momentum.

A high-volume thrust past resistance signals confidence and backs follow-through, while more muted action on decreased activity generally fizzles out. But analysts also watch for springboard launches after prolonged declines grind to low-volume bottoms as weaker hands fully capitulate.

Therefore, MATIC traders face the nuanced task of determining whether bargain-hunting whales quietly grabbed up tokens during this period of indecision. If so, thin liquidity from tapped-out sellers means any uptick in buying interest could spark a violent recovery.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://thenewscrypto.com/early-signs-of-accumulation-hint-at-polygon-reversal/

- :has

- :not

- :where

- $UP

- 26

- 31

- 36

- 360

- 67

- a

- above

- According

- accumulation

- Action

- activity

- advise

- After

- All

- alone

- also

- Analysts

- and

- any

- appears

- ARE

- AS

- asset

- At

- available

- backs

- BAND

- bearish

- below

- between

- border

- Break

- break out

- breakout

- breakouts

- but

- buttons

- BUYER..

- Buying

- carved

- caution

- Chart

- circumstances

- classic

- Close

- confidence

- consolidation

- content

- continued

- contraction

- could

- Crash

- crypto

- Crypto investors

- cryptocurrency

- Cryptocurrency Industry

- Current

- daily

- Declines

- Declining

- decreased

- definitive

- Despite

- determining

- Divergence

- Drop

- during

- Earlier

- Early

- editor

- entered

- equally

- Even

- existing

- expansive

- expected

- Face

- Flash

- Floor

- following

- For

- formed

- from

- fully

- generally

- Hands

- head

- High

- hints

- holders

- However

- HTTPS

- if

- in

- indicate

- industry

- insights

- interest

- into

- intriguing

- Investors

- ITS

- journalist

- jpg

- lagging

- Last

- launches

- Liquidity

- love

- lower

- Lows

- major

- marker

- Market

- Matic

- max-width

- May..

- means

- Metrics

- Momentum

- Month

- more

- move

- native

- Near

- New

- next

- of

- offer

- often

- on

- or

- out

- passion

- past

- period

- PHP

- plato

- Plato Data Intelligence

- PlatoData

- poised

- Polygon

- potential

- previous

- price

- PRICE ACTION

- price chart

- Prices

- principles

- Profile

- quietly

- range

- ranging

- rather

- Readiness

- recent

- recovery

- relatively

- Resistance

- Reveals

- Reversal

- reverse

- Scale

- seasoned

- seen

- Sellers

- Selling

- Share

- shown

- Shows

- sideways

- signals

- significant

- Signs

- since

- So

- Spark

- spikes

- Stability

- such

- Suggests

- support

- Surrounding

- Sustainability

- SVG

- Swings

- Task

- than

- that

- The

- this

- thrust

- to

- token

- Tokens

- traded

- Traders

- Trend

- two

- Unexpected

- Volatility

- volume

- Watch

- Weeks

- whales

- whether

- while

- WHO

- will

- writer

- writing

- zephyrnet