An analysis of the DRAM and flash market confirms prices in both commodities are rising sharply and could continue to do so for the remainder of 2024. This means that prices of memory modules and SSDs could be on the rise, too.

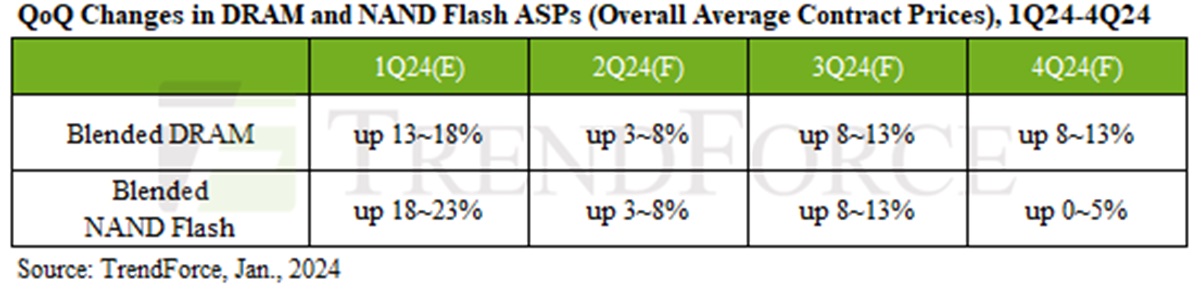

TrendForce began noticing the increases in the spot market for DRAM and flash at the end of last year. Prices had fallen for two straight years since the end of 2021. Now, the company is predicting price increases in the contract market for DRAM of between 13 to 18 percent in the first quarter alone as well price hikes for NAND flash of between 18 to 23 percent.

The new report is a much more concrete leading indicator that prices in both DRAM and SSDs are on the rise. Think of the spot market (mentioned in the older TrendForce report) as a “grocery store” of electronic components: memory-module makers will put in large orders for DRAM to make modules out of. If they’re off by a bit, they’ll buy or sell the remainder on the spot market.

It’s these large bulk orders, however, where a module maker or an SSD maker will indicate what they believe to be the “true” price of the commodity. These are the contract prices, where the majority of the DRAM and flash are sold. And buyers are locking in higher prices.

TrendForce believes that the NAND flash buyers will finish up restocking their own inventories by the first quarter, so that flash contract prices will drop from a sharp jump of between an estimated 18 to 23 percent in the first quarter to more modest price increases throughout the year. TrendForce measures quarter-over-quarter price changes, so a 3 to 8 percent increase in the second quarter represents that price increase from the quarter before.) Naturally, these are forecasts.

TrendForce

DRAM prices are expected to show smaller, but steadier gains over the entire year. In part, that’s because the increased percentage of DDR5 memory will push up the overall average price, TrendForce said.

As has been the case for decades, however, there’s a wrinkle: greed. In many ways, memory and flash operate in the same way as oil cartels. If everyone cuts manufacturing, volume stays low and prices remain high. But memory manufacturing capacity still remains below 100 percent utilization, TrendForce noted. If memory makers get too aggressive in increasing production, then supply will once again outpace demand — and prices will fall. That’s not anticipated to happen…but it could.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.pcworld.com/article/2214654/flash-dram-prices-are-definitely-rising-analyst-says.html

- :has

- :is

- :not

- :where

- $UP

- 100

- 13

- 2021

- 2024

- 23

- 8

- a

- again

- aggressive

- alone

- an

- analysis

- analyst

- and

- Anticipated

- ARE

- AS

- At

- average

- BE

- because

- been

- before

- began

- believe

- believes

- below

- between

- Bit

- both

- but

- buy

- buyers

- by

- Capacity

- case

- Changes

- Commodities

- commodity

- company

- components

- concrete

- continue

- contract

- could

- cuts

- decades

- definitely

- Demand

- do

- Drop

- Electronic

- end

- Entire

- estimated

- everyone

- expected

- Fall

- Fallen

- finish

- First

- Flash

- For

- forecasts

- from

- Gains

- get

- Greed

- had

- High

- higher

- Hikes

- However

- HTML

- HTTPS

- if

- in

- Increase

- increased

- Increases

- increasing

- indicate

- Indicator

- IT

- jpg

- jump

- large

- Last

- Last Year

- leading

- Low

- Majority

- make

- maker

- Makers

- manufacturing

- many

- Market

- means

- measures

- Memory

- mentioned

- modest

- module

- Modules

- more

- much

- noted

- now

- of

- off

- Oil

- older

- on

- On The Spot

- once

- operate

- or

- orders

- out

- over

- overall

- own

- part

- percent

- percentage

- plato

- Plato Data Intelligence

- PlatoData

- predicting

- price

- Price Increase

- Prices

- Production

- Push

- put

- Q1

- Quarter

- remain

- remainder

- remains

- report

- represents

- Rise

- rising

- Said

- same

- says

- Second

- second quarter

- sell

- sharp

- show

- since

- smaller

- So

- sold

- Spot

- spot market

- Still

- straight

- supply

- that

- The

- their

- then

- These

- they

- think

- this

- throughout

- to

- too

- two

- volume

- Way..

- ways

- WELL

- What

- will

- year

- years

- zephyrnet