You’ve likely heard of staking cryptocurrency before– the act of earning rewards by locking up tokens on a Proof-of-Stake blockchain for a specified period of time.

If you’ve never staked a token before, you basically just click “stake” on your staking service of choice, and voila, you’re staking. Staking helps secure a blockchain network, and stakers are incentivized with rewards generally in the range of 5% to 12% APY paid in that token’s denomination.

The complexity is mostly abstracted from the act of staking by user-friendly services.

LSTfi, or LST finance, significantly rose in popularity after Ethereum’s Shanghai upgrade (April 2023) enabled staked ETH withdrawals.

Liquid staking tokens are a newer invention, designed out of convenience and necessity to provide stakers some liquidity on their locked-up tokens.

A liquid staking token is a token that represents the staked cryptocurrency– for example, Lido gives stakers stETH for the amount of ETH staked.

Liquid staking tokens, like stETH, allow people to earn yield through staking while maintaining the ability to trade and sell the token.

So, what’s the catch? Is there a catch to liquid staking tokens? Is it a technological evolution or just a temporary loophole?

The following liquid staking token guide explores everything you need to know about the evolution of liquid staking tokens.

A Brief History: What You Need to Know About Liquid Staking Tokens:

When the Ethereum beacon chain launched on December 1, 2020, ETH holders could stake a minimum of 32 ETH and become validators, and automatically earn rewards distributed by the network. In addition to 32 ETH being a substantial sum to lock up, withdrawals were only possible starting in April 2023.

Liquid Staking Derivatives (LSDs) were introduced to make staking more attractive for small and large ETH holders.

Liquid Staking Derivatives (LSDs) are basically tokenized receipts, representing an ownership claim of the staked assets. These receipts can be traded or utilized as loan collateral, providing liquidity for the stakers.

This gave birth to a burgeoning economy of Liquid Staking Derivatives Finance (LSDFi), or Liquid Staking Token Finance (LSTfi)– the terms are used interchangeably

As of writing, there are billions of dollars worth of tokens being staked– $92 billion across the top three PoS networks, Ethereum, Solana, and Cardano.

Twenty-six of those billion dollars is currently in liquid staking (LST) protocols.

It’s the largest category in DeFi, in no small part thanks to market leaders like Lido, who have added a dazzling user-friendly interface to the whole ordeal.

The category is expected to grow even more rapidly due to:

- The continued growth of PoS networks, as well as anticipated rises in their token prices.

- A deeper migration from traditional to liquid staking protocols

Further, decentralized applications like Enzyme, Lybra, Prisma, and Sommelier enable users to stake their LSTs as collateral or for other purposes.

A common use for stETH is providing liquidity on the DeFi classics like Compound, Uniswap, Sushiswap, Balancer, and more– earning an additional 3% to 8% on your stETH, which represents your staked amount of ETH on Lido earning a base 3% or so.

The crypto holder’s constant search for yield is the primary driver of the popularity of liquid staking.

Is liquid staking worth it? On face value, the ability to stake one token for 5% and then stake its receipt for another 5% seems quite valuable– who wouldn’t want to double their yield? One would be inclined to consider– what’s the catch?

Is liquid staking safe? Ask yourself, is anything in DeFi ever safe or not risky? The answer is no, but the system has worked relatively well to its credit– we’ll get into that below.

Is Liquid Staking Safe?

So, how risky is the search for that LSTfi 4.4% average yield?

There are a few threats to become aware of:

- Smart contract exploits: Everything in DeFi hinges on smart contracts. Contract bugs or other exploits can put your funds at risk.

- Slashing due to naughty validators: By using a liquid staking platform, you’re essentially giving its validators carte blanche to behave as they should. If a validator tries to cheat the system, their stake could be slashed– as would some of your rewards.

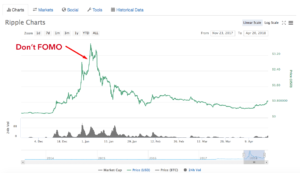

- Price volatility: A liquid staking token is pegged to the price of the base asset, and if that peg breaks, the LST value comes into question.

A few recent real-world examples help demonstrate LSTs in action at a high level.

It’s 2022. Centralized lending company Celsius Network is spiraling out of control. Depositors want their money, and Celsius is caught in a vice– the company covered up significant market losses and was also stuck in illiquid liquid staking positions. Celsius was one of the largest single holders of stETH, with about $426 million of the ETH derivative.

Blockchain transaction data shows the following sequence of events:

Celsius transferred $81.6 million in USDC to the automated decentralized lending protocol Aave, allowing it to…

free up $410 million in stETH, which Celsius had pledged as collateral for its Aave loan.

Celsius would continue to pay off its DeFi debts, including another $228 million debt to Maker for $440 million in collateral in WBTC (Wrapped Bitcoin). It would then pay down another $95 million on its loans from Aave and Compound.

What does this teach us about liquid staking tokens? Despite the mess Celsius got itself in, it was forced to untangle itself at least partially and get some liquidity from its various APY-generating engagements, namely using liquid staking tokens.

In other words, Celsius LSTfi endeavors were among the few things that didn’t completely blow up. Celsius lost about $1.7 billion in UST’s collapse and unsecured loans.

In fact, many of LSTfi’s staples are still around today, whereas centralized companies like FTX, BlockFi, Celsius, Voyager, and Hodlnaut are all mired in bankruptcy and prison.

Types of Liquid Staking Tokens

Here’s where things get kind of confusing– everything you’ve read up to this point is enough to know about liquid staking at a functional level. You’re now entering the metaphorical weeds.

Rebase tokens are tokens like Lido’s stETH or Binance’s BETH that automatically adjust their balance based on rewards and deposits.

For example, let’s say you stake 100 ETH on Lido. In return, you get 100 stETH. Assuming an APR of 3.5% on Lido, your stETH tokens would be about 100.067 stETH in a week. That .067 is the reward you got in ETH on Lido, automatically added to your staking balance.

This helps keep the 1:1 parity between the two tokens– if it didn’t exist, you’d be able to trade in 100 stETH for 103.50 ETH at the end of the year, throwing off the balance.

Rebasing typically happens every day, and there’s no visible transaction activity.

Rewards-baring tokens, comparatively, don’t change in quantity. Rather, the exchange rate between the liquid staking token and the staked asset determines the reward.

It’s a bit confusing but no less functional compared to the more popular rebase token architecture,

For example, staking 100 ETH on Stader gives you 98.978 ETHx. In a week, you’ll stll have 98.978 ETHx, but it’ll be worth 100.068 ETH at an example 3.56% APR.

Same same, but different.

Wrapped tokens introduce yet another layer of complexity. The rewards are integrated into the exchange rate and realized through various actions like transfer, minting, or burning.

Popular LSTfi Protocols and dApps

The follow LSTfi protocols, service providers, and dApps are listed alphabetically.

LST Protocols & CEXs:

- Ankr (ANKR) ankrETH

- Binance CEX (BNB) BETH & WBETH

- Coinbase CEX (COIN) cbETH

- Diva Staking (DIVA) divETH & wdiveETH

- Ether.fi eETH

- Frax Finance (FXS) frETH & sfrETH

- Lido (LDO) stETH & wstETH

- Liquid Collective LsETH

- Mantle (MNT) mETH

- Rocket Pool (RPL) rETH

- StakeWise (SWISE) osETH

- Stader (SD) ETHx & MaticX

- Swell (SWELL) swETH

Earning Platforms:

- Asymetrix Protocol (ASX)

- CIAN

- Equilibria (EQB) & Pepin (PNP)

- Flashstake (FLASH)

- Instadapp (INST) iETH

- Pendle (PENDLE)

- Sommelier (SOMM)

- Synthetix (SNX)

- Tapio Finance tapETH

- Tokemak (TOKE)

- Yearn Finance (YFI) yETH

LST-backed Stablecoin:

- Curve Finance (CRV) crvUSD

- Ethena USDe

- Gravita Protocol GRAI

- Liquity V2 (LQTY) LUSD

- Lybra Finance (LBR) eUSD

- Prisma Finance (PRISMA) mkUSD

- Raft (RAFT) R

Is Liquid Staking for You?

Here’s where we enter the realm of opinion– this is neither a recommendation nor financial advice. This section is more of a cautionary warning label, if anything. Still, it should help point you in the directionally-accurate path.

Liquid staking LSTfi is pretty advanced stuff– we’d advise against staking your life savings in ETH for some derivative token from some protocol with anonymous founders that has been around for a few weeks.

For starters, get comfortable with how platforms like Lido operate. Various software wallets like Exodus offer staking services. Even Coinbase allows users to earn rewards by staking their Proof-of-Work assets.

What we’ve outlined here should serve as a mere introduction to the concept of liquid staking, not a strategic blueprint. That being said, there are billions of dollars in liquid staking protocols and quiet fortunes being precariously built– back of the napkin math says roughly $910 million in rewards is being generated by the $26 billion in liquid staking protocols every year.

It’s not a stretch to assume the lion’s share is by whales, institutions, and service providers aggregating tokens– not an even mixture of sub-$10,000 holdings.

It’s a subsector within DeFi worth watching, which is already a fascinating landscape of innovation.

Final Thoughts: Staking Meets Open Market Liquidity

Liquid staking tokens (LSTs) are a response to the need for flexibility and liquidity in staking and have given birth to an entirely new DeFi subsector.

Billions of dollars worth of tokens are being staked and re-utilized in LSTfi, shaping how cryptocurrency users interact with PoS networks like Ethereum and Solana.

Like anything in DeFi, liquid staking comes with its unique set of risks. Smart contract vulnerabilities and market volatility are genuine concerns. Yet, a significant amount of stakers still seek out the potential rewards through one of the many growing LSTfi services.

Staking may seem like a simple click to the average user, but a peek under the hood unveils a complex task aimed at maintaining integral token parity and balancing rewards. The leading horses in the race for back-end LST mechanisms include rebase tokens and wrapped tokens.

For the average cryptocurrency user dipping their toes in the staking water, jumping headfirst into liquid staking might not be the wisest choice. However, understanding the basics (you just did a big part of that with this article!) and familiarizing yourself with popular user-friendly platforms is a sound first step before exploring more complex protocols.

If you decide to wade deeper into the liquid staking pool, make sure you know how deep the waters really are. Remember to never stake more than you can afford to lose.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://coincentral.com/liquid-staking-guide/?utm_source=rss&utm_medium=rss&utm_campaign=liquid-staking-guide

- :has

- :is

- :not

- :where

- $UP

- 000

- 1

- 100

- 2020

- 2022

- 2023

- 32

- 32 ETH

- 50

- 7

- 98

- a

- aave

- ability

- Able

- About

- across

- Act

- Action

- actions

- activity

- added

- addition

- Additional

- adjust

- advanced

- advice

- advise

- After

- against

- AI

- aimed

- All

- allow

- Allowing

- allows

- already

- also

- among

- amount

- an

- and

- Ankr

- Anonymous

- Another

- answer

- Anticipated

- anything

- applications

- apr

- April

- APY

- architecture

- ARE

- around

- AS

- ask

- asset

- Assets

- assume

- ASX

- At

- attractive

- Automated

- automatically

- average

- aware

- back

- Back-end

- Balance

- balancer

- balancing

- Bankruptcy

- base

- based

- Basically

- Basics

- BE

- beacon

- beacon chain

- become

- been

- before

- being

- below

- beth

- between

- Big

- Billion

- billions

- birth

- Bit

- Bitcoin

- blockchain

- blockchain network

- BlockFi

- blow

- blueprint

- bnb

- breaks

- bugs

- burgeoning

- burning

- but

- by

- CAN

- Cardano

- Catch

- Category

- caught

- Cautionary

- Celsius

- Celsius Network

- centralized

- Centralized lending company

- CEX

- CEXs

- chain

- change

- choice

- claim

- classics

- click

- Coin

- coinbase

- Collapse

- Collateral

- Collective

- comes

- comfortable

- Common

- Companies

- company

- comparatively

- compared

- completely

- complex

- complexity

- Compound

- concept

- Concerns

- confusing

- constant

- content

- continue

- continued

- contract

- contracts

- control

- convenience

- could

- covered

- CRV

- crypto

- cryptocurrency

- Currently

- DApps

- data

- day

- Debt

- December

- decentralized

- Decentralized Applications

- decentralized lending

- decide

- deep

- deeper

- DeFi

- demonstrate

- depositors

- deposits

- derivative

- Derivatives

- designed

- Despite

- determines

- DID

- different

- distributed

- does

- dollars

- Dont

- double

- down

- driver

- due

- earn

- Earning

- economy

- enable

- enabled

- end

- endeavors

- engagements

- enhanced

- enough

- Enter

- entering

- entirely

- essentially

- ETH

- Ether (ETH)

- ethereum

- Ethereum Beacon chain

- Ethereum's

- Even

- events

- EVER

- Every

- every day

- everything

- evolution

- example

- examples

- exchange

- Exchange rate

- exist

- Exodus

- expected

- exploits

- explores

- Exploring

- Face

- fact

- fascinating

- few

- finance

- financial

- financial advice

- First

- Flash

- Flexibility

- follow

- following

- For

- for yield

- fortunes

- founders

- from

- FTX

- functional

- funds

- FXS

- gave

- generally

- generated

- genuine

- get

- given

- gives

- Giving

- got

- Grow

- Growing

- Growth

- guide

- had

- happens

- Have

- heard

- help

- helps

- here

- High

- hinges

- history

- Hodlnaut

- holders

- Holdings

- hood

- How

- However

- HTTPS

- if

- in

- incentivized

- Inclined

- include

- Including

- Innovation

- institutions

- integral

- integrated

- interact

- Interface

- into

- introduce

- introduced

- Introduction

- Invention

- IT

- ITS

- itself

- just

- Keep

- Kind

- Know

- Label

- landscape

- large

- largest

- launched

- layer

- LDO

- leaders

- leading

- least

- lending

- lending company

- lending protocol

- less

- Level

- LIDO

- Life

- like

- likely

- Liquid

- liquid staking

- Liquidity

- Listed

- loan

- Loans

- loophole

- lose

- losses

- lost

- maintaining

- make

- maker

- many

- Market

- market volatility

- math

- May..

- mechanisms

- Meets

- mere

- might

- migration

- million

- minimum

- minting

- mixture

- money

- more

- mostly

- namely

- necessity

- Need

- Neither

- network

- networks

- never

- New

- newer

- no

- nor

- now

- of

- off

- offer

- on

- ONE

- only

- open

- operate

- or

- Other

- out

- outlined

- ownership

- paid

- parity

- part

- path

- Pay

- Peg

- pegged

- People

- period

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- PNP

- Point

- pool

- Popular

- popularity

- PoS

- positions

- possible

- potential

- pretty

- price

- Prices

- primary

- Prisma

- prison

- Proof-of-Stake

- Proof-of-Work

- protocol

- protocols

- provide

- providers

- providing

- purposes

- put

- quantity

- question

- quite

- Race

- range

- rapidly

- Rate

- rather

- Read

- real world

- realized

- really

- realm

- receipts

- recent

- Recommendation

- relatively

- remember

- representing

- represents

- response

- return

- Reward

- Rewards

- Rises

- Risk

- risks

- Risky

- ROSE

- roughly

- RPL

- safe

- Said

- same

- Savings

- say

- says

- SD

- Search

- Section

- secure

- Seek

- seem

- seems

- sell

- Sequence

- serve

- service

- service providers

- Services

- set

- shanghai

- shaping

- Share

- should

- Shows

- significant

- significantly

- Simple

- single

- small

- smart

- smart contract

- Smart Contracts

- SNX

- So

- Software

- Solana

- some

- Sound

- specified

- stablecoin

- stake

- Staked

- Staked ETH

- stakers

- Staking

- staking pool

- staking services

- starters

- Starting

- Step

- stETH

- Still

- Strategic

- substantial

- sum

- sure

- sushiswap

- system

- Task

- technological

- temporary

- terms

- than

- thanks

- that

- The

- The Basics

- their

- then

- There.

- These

- they

- things

- this

- those

- threats

- three

- Through

- Throwing

- time

- to

- today

- TOKE

- token

- tokenized

- Tokens

- top

- trade

- traded

- traditional

- transaction

- transfer

- transferred

- two

- typically

- under

- understanding

- unique

- Uniswap

- unsecured

- Unveils

- upgrade

- us

- USDC

- use

- used

- User

- user-friendly

- users

- using

- utilized

- Validator

- validators

- value

- various

- visible

- Volatility

- Voyager

- Vulnerabilities

- Wallets

- want

- warning

- was

- watching

- Water

- Waters

- wBTC

- we

- week

- Weeks

- WELL

- were

- whales

- What

- whereas

- which

- while

- WHO

- whole

- with

- Withdrawals

- within

- words

- worked

- worth

- would

- Wrapped

- Wrapped bitcoin

- writing

- year

- yet

- YFI

- Yield

- you

- Your

- yourself

- zephyrnet