Managed detection and response (MDR) company Deepwatch closed a $180 million round of “equity investments and strategic financing” to both push product development and grow partnerships.

The company declined to offer a breakdown of the round pertaining to equity investment and debt/credit.

The financing comes from a handful of investors, including Vista Credit Partners — Vista Equity Partners’ “credit-investing strategy offering flexible, customized debt and structured equity financing,” per its website.

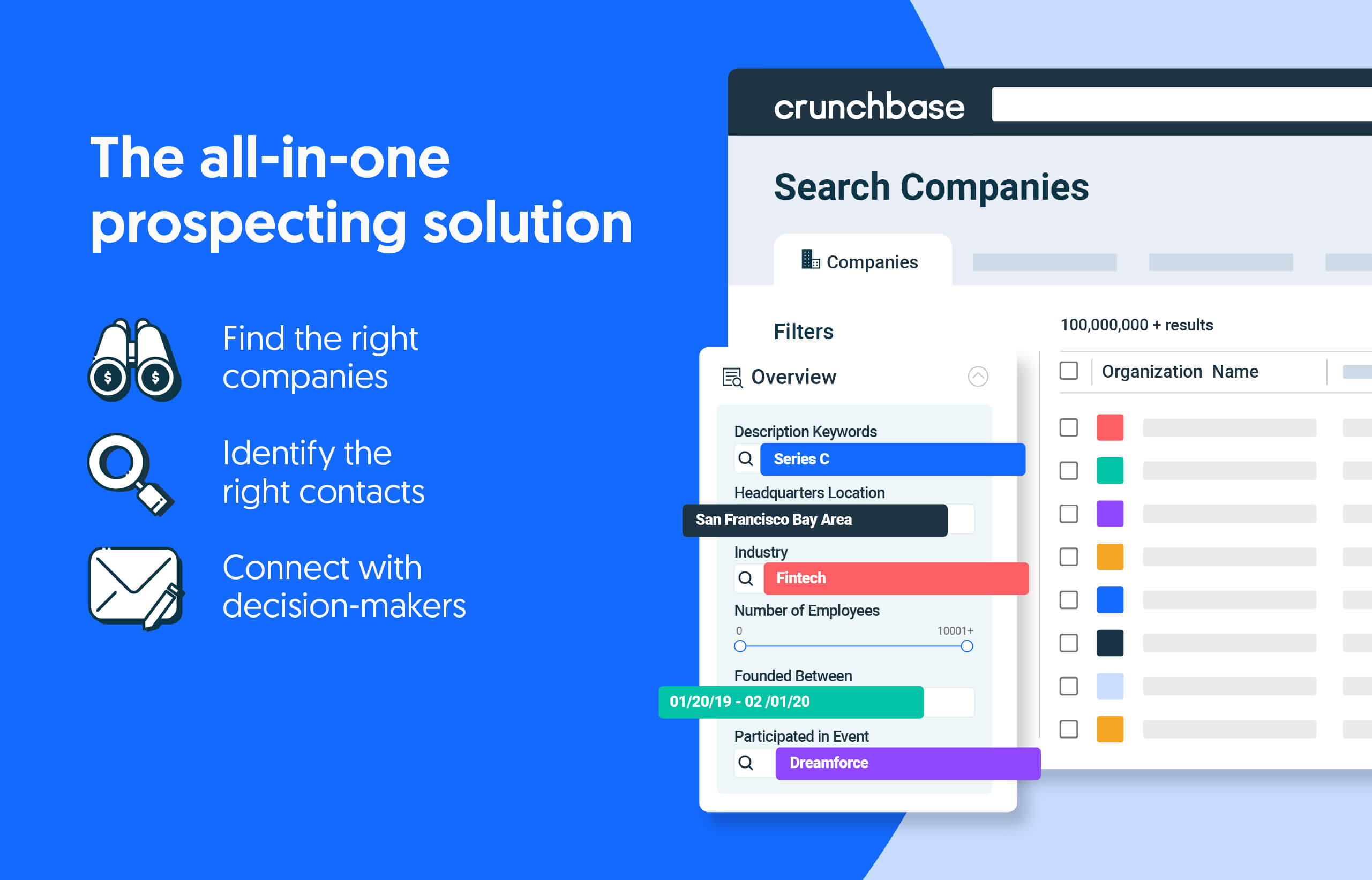

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

Other investors include Springcoast Capital Partners and Splunk Ventures.

Deepwatch’s MDR helps protect customers from the growing number of cyber threats. MDR platforms help investigate alerts and determine whether there actually is a threat at play. Such platforms use a combination of data analytics, machine learning and human intelligence.

“Our services have never been more vital,” CEO Charlie Thomas said in a release. “Business transformation to cloud and digital, coupled with increasing levels of cyber risk, drives strong demand for advanced protection from Deepwatch.”

Tampa, Florida-based Deepwatch reported 100% sales growth in 2022 while announcing the funding. Founded in 2019, the company has now raised $256 million, per Crunchbase.

Big cyber funding rounds

Deepwatch joins other cyber firms already announcing large rounds this year.

On Tuesday, Alphabet spinout SandboxAQ raised a $500 million round. The startup is looking at how companies and the government can replace current public-key cryptography algorithms with algorithms that are resistant to quantum computer-based attacks.

In January, Santa Clara, California-based Netskope received a $401 million convertible note investment led by Morgan Stanley Tactical Value.

In general, investment in cybersecurity has held relatively steady this year. Through the first six weeks-plus of the new year, cyber startups have received a total of about $1.7 billion, per Crunchbase data. While that number is down from the same period last year — where startups raised more than $4 billion — it actually is ahead of the numbers from 2021 and 2020.

Investors still seem to prioritize cybersecurity as threats continue to grow and more scrutiny is put on how companies are protecting data.

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

The venture market is still recoiling from its highs of 2021, but that hasn’t stopped investors from pouring billions into the next big thing —...

Managing burn rate is a critical aspect of running a startup, especially in a recession or protracted economic downturn. Marc Schröder, managing...

As with most societal problems that technology has a prime role in propagating, innovators believe tech will also play a major part in mitigating the...

The U.S. government has flagged quantum computing as a key technology that is important for national security reasons.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://news.crunchbase.com/cybersecurity/startup-venture-funding-deepwatch/

- 2019

- 2020

- 2021

- 2022

- 7

- a

- About

- acquisitions

- actually

- advanced

- ahead

- algorithms

- all-in-one

- already

- analytics

- and

- Announcing

- aspect

- Attacks

- believe

- Big

- Billion

- billions

- Breakdown

- burn

- capital

- ceo

- Clara

- Close

- closed

- Cloud

- combination

- Companies

- company

- computing

- continue

- coupled

- cover

- credit

- critical

- critical aspect

- CrunchBase

- cryptography

- Current

- Customers

- customized

- cyber

- cyber risk

- Cybersecurity

- daily

- data

- Data Analytics

- Date

- Debt

- Demand

- Detection

- Determine

- Development

- digital

- down

- DOWNTURN

- Economic

- economic downturn

- equity

- equity financing

- especially

- financing

- firms

- First

- flagged

- flexible

- Founded

- fresh

- from

- from 2021

- funding

- funding rounds

- General

- Government

- Grow

- Growing

- Growth

- handful

- Held

- help

- helps

- Highs

- How

- HTTPS

- human

- human intelligence

- important

- in

- include

- Including

- increasing

- innovators

- Intelligence

- investigate

- investment

- Investments

- Investors

- IT

- January

- Joins

- Key

- large

- Last

- Last Year

- leader

- learning

- Led

- levels

- looking

- machine

- machine learning

- major

- managing

- Market

- MDR

- million

- mitigating

- more

- most

- National

- national security

- New

- new year

- next

- number

- numbers

- offer

- offering

- Other

- part

- partnerships

- period

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- Play

- powered

- Prime

- Prioritize

- problems

- Product

- product development

- protect

- protecting

- protection

- Push

- put

- Quantum

- quantum computing

- raised

- raises

- Rate

- reasons

- received

- recent

- Recent Funding

- recession

- relatively

- replace

- Reported

- resistant

- response

- revenue

- Risk

- Role

- round

- rounds

- running

- Said

- sales

- same

- Santa

- security

- Services

- SIX

- societal

- Solutions

- stanley

- startup

- Startups

- stay

- steady

- Still

- stopped

- Strategic

- Strategy

- strong

- structured

- such

- tactical

- tech

- Technology

- The

- thing

- this year

- threat

- threats

- Through

- to

- Total

- Transformation

- Tuesday

- u.s.

- U.S. government

- use

- venture

- vital

- Website

- whether

- while

- will

- year

- Your

- zephyrnet