- Activity by dormant CRV addresses peaked for the first time since July, bringing about a surge in accumulation.

- With increasing volume and more exchange outflows, CRV’s price action could improve.

Curve DAO Token [CRV] may have had an impressive 5.93% hike in the last 30 days, but long-term large investors of the token seemed to think that this is just the start. This sentiment was evident in the behavior of sharks known to hold between 1 million to 10 million CRV tokens.

How much are 1,10,100 CRVs worth today?

Alive to take chances on Curve

According to Santiment, the said cohort added another $9.5 million worth of CRV between 12 and 13 October. The more interesting part is that these sharks are not just the ones who are relatively operational in the market.

🦈 #Curve has seen another big accumulation day from sharks holding 1M-10M $CRV tokens. In just 24 hours, they added 9.5% more to their collective bags, worth $9.5M. A big part of this came from dormant wallets, who are at their most active since July. https://t.co/VzZzmo4e3p pic.twitter.com/DT6E4lrm0H

— Santiment (@santimentfeed) October 13, 2023

Instead, a chunk of the accumulation came from dormant addresses, driving activity by these wallets to their highest point since July. An interpretation of this change looks similar to that of Ethereum [ETH] where a lot of addresses are switching from HODLing to trading.

For Curve, it is likely that these investors are trying to capitalize on rises in the token value. In fact, the period of these sharks’ accumulation drove CRV from $0.42 to $0.44. But could more be in place for Curve in the short term?

One way to look at this is to examine the volume alongside the price trend. At press time, CRV’s volume had increased to 38.15 million. As mentioned earlier, the price action also followed in the same direction.

Usually, rising volume on rising prices tends to bring about a likely price increase, and signals increased interest in a cryptocurrency. If the volume continues to rise and CRV doesn’t fall to profit-taking, it is possible for the token value to rise toward $0.50 in the coming days.

Source: Santiment

No chance for sellers yet

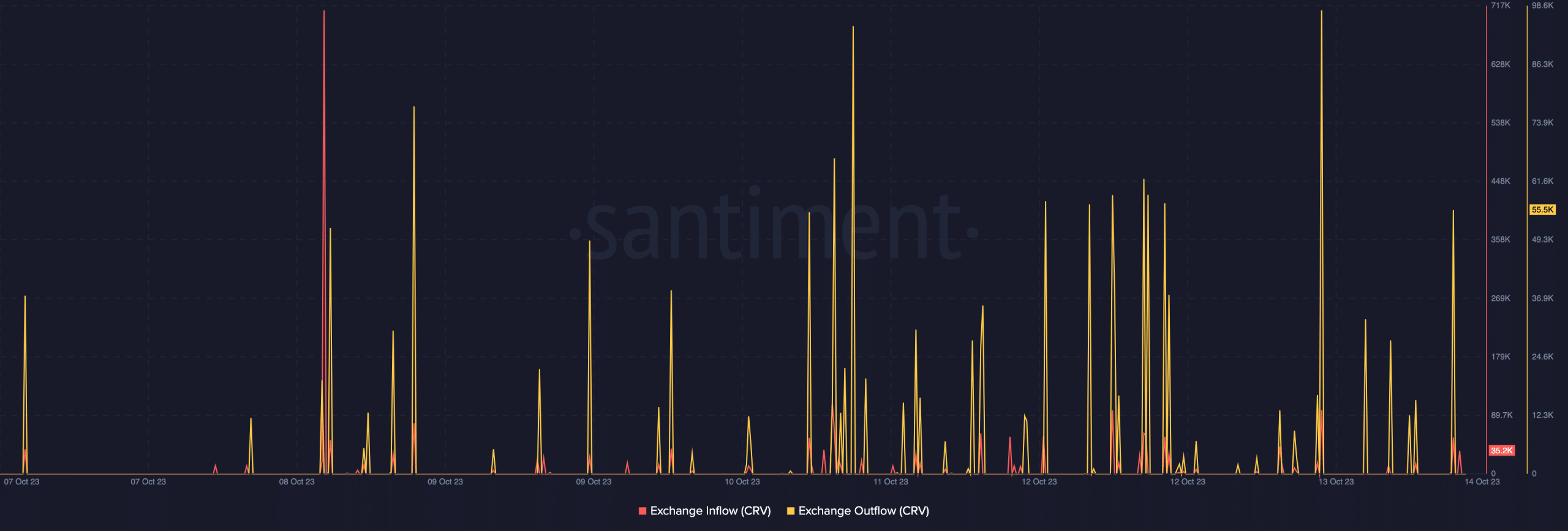

Another way to assess if these sharks are making the right call is by looking at the activity on exchanges. According to Santiment, CRV’s exchange inflow was 35,200 at press time. This metric is the number of tokens sent from non-exchange wallets into exchange addresses.

On the other hand, the exchange outflow was higher at 55,500. The opposite of the inflow, the exchange outflow is the number of tokens sent out of exchanges. It is also noteworthy to mention that only one throughout the last week has the inflow outpace the outflow.

Is your portfolio green? Check the Curve DAO Token Profit Calculator

Source: Santiment

So, a much larger outflow means there is a very tiny chance for CRV to expect selling pressure. That is if there is any significant one. This means that a large part of the market is bullish on the CRV price action.

Provided the exchange inflow doesn’t outweigh the outflow, Curve’s price has a high chance of resisting a downside.

Source: https://ambcrypto.com/curve-sharks-leave-the-sidelines-bets-big-on-crv/

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://bitcoinethereumnews.com/tech/curve-sharks-leave-the-sidelines-bets-big-on-crv/?utm_source=rss&utm_medium=rss&utm_campaign=curve-sharks-leave-the-sidelines-bets-big-on-crv

- :has

- :is

- :not

- :where

- $10 million

- 1

- 10

- 100

- 12

- 13

- 15%

- 200

- 24

- 30

- 35%

- 50

- 500

- 9

- a

- About

- According

- accumulation

- Action

- active

- activity

- added

- addresses

- also

- an

- and

- Another

- any

- ARE

- AS

- assess

- At

- auto

- bags

- BE

- Bets

- between

- Big

- blockchain

- bring

- Bringing

- but

- by

- call

- came

- capitalize

- Chance

- chances

- change

- check

- Cohort

- Collective

- coming

- continues

- could

- CRV

- CRV Price

- cryptocurrency

- curve

- Curve DAO

- DAO

- day

- Days

- Doesn’t

- downside

- driving

- Earlier

- ETH

- Ether (ETH)

- evident

- examine

- exchange

- Exchanges

- expect

- external

- fact

- Fall

- First

- first time

- fluid

- followed

- For

- from

- Green

- had

- hand

- Have

- High

- higher

- highest

- Hike

- HODLING

- hold

- holding

- HOURS

- HTTPS

- if

- impressive

- improve

- in

- Increase

- increased

- increasing

- interest

- interesting

- interpretation

- into

- Investors

- IT

- July

- just

- known

- large

- larger

- Last

- Leave

- likely

- long-term

- Look

- looking

- LOOKS

- Lot

- Making

- Market

- max-width

- May..

- means

- mention

- mentioned

- metric

- million

- million worth

- more

- most

- much

- noteworthy

- number

- october

- of

- on

- ONE

- ones

- only

- operational

- opposite

- Other

- out

- outflows

- part

- period

- Place

- plato

- Plato Data Intelligence

- PlatoData

- Point

- portfolio

- possible

- press

- pressure

- price

- PRICE ACTION

- Price Increase

- Prices

- Profit

- relatively

- right

- Rise

- Rises

- rising

- Said

- same

- Santiment

- seemed

- seen

- Sellers

- Selling

- sent

- sentiment

- Sharks

- Short

- signals

- significant

- similar

- since

- start

- surge

- Take

- tends

- term

- that

- The

- their

- There.

- These

- they

- think

- this

- throughout

- time

- to

- token

- Token Value

- Tokens

- toward

- Trading

- Trend

- true

- trying

- value

- very

- volume

- Wallets

- was

- Way..

- week

- WHO

- worth

- Your

- zephyrnet