- Venture capitalists are still haunted by the upheaval that descended on the crypto industry last year.

- In comparison to 2022, investments have moved from NFTs, metaverse, Web 3.0 projects to blockchain and cryptocurrency-focused infrastructure projects in 2023.

The upheaval that descended on the crypto industry last year still haunts venture capitalists (VCs).

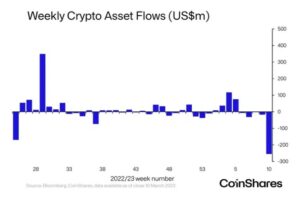

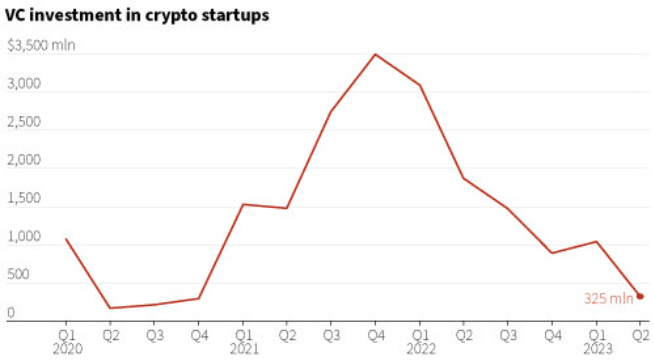

Citing the data firm PitchBook, Reuters reported that VC crypto investments totaled just under $2.3 billion in the second quarter of 2023. This is the lowest quarterly investment for over three years. In total, VC investment declined to $5 billion in the first half of 2023.

A total of 814 deals took place in the first half of this year. On the other hand, the first half of 2022 saw the finalization of 1,862 deals.

Investments in crypto startups have dropped for the fifth straight quarter.

What led to this decline?

It was in 2022 that major crypto firms like Terraform Labs, FTX, Three Arrows Capital, etc. collapsed. These events led to a significant confidence deficit among VCs about the crypto sector.

In addition, the regulatory agencies in the United States are also going after the crypto sector. Since there are still not clear rules and regulations around crypto in the U.S., regulators are pursuing regulation by enforcement.

The White House made a statement regarding the risks related to cryptocurrency in January 2023. It expressed the administration’s desire to employ regulators to contain such risks.

The Federal Reserve, the Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of the Currency (OCC) issued a joint statement in February 2023, warning banking institutions of the liquidity risks posed by stablecoins.

In March 2023, we witnessed the collapse of the Silvergate Bank, the Silicon Valley Bank, and the Signature Bank. All of these institutions were closely tied to the crypto sector.

Cameron Peake, partner at Restive Ventures, said,

“The biggest change from the height of the market is more time to do deeper diligence… There’s not necessarily anything new that is happening, except that funds are actually doing diligence now. Deals are no longer closing in mere days.”

Will Bitcoin price rally lead to increased investments?

Tal Elyashiv, founder and managing partner of SPiCE VC, said,

“The lofty exuberant valuation days are gone.”

PitchBook, however, noted that VC investments in crypto are correlated with the digital asset’s prices.

Source: Reuters/PitchBook

Bitcoin [BTC], which fell 65% last year, rose more than 90% in the first half of 2023. BTC is now up about 55% year-to-date. It was trading at $25,708 at press time. BTC’s price hit its peak in 2021, rising to $69,000.

Source: Reuters/PitchBook

If Bitcoin can successfully rally back to its previous heights, we might see increased VC interest in the sector.

NFTs, Metaverse, Web 3.0 no longer ideal investments

There is another significant change taking place in regard to which crypto sectors VCs are investing in.

2022 saw them investing in non-fungible tokens [NFTs], metaverse, Web 3.0. On the other hand, firms focused on core blockchain or cryptocurrency technology have caught the attention of investors this year.

In 2023, VCs invested $325 million in infrastructure firms such as crypto exchanges, wallets etc. VCs invested $220 million and $274.6 million in blockchain and Web3 companies respectively in 2023.

Alyse Killeen, founder of Bitcoin-focused venture firm Stillmark, remarked,

“We’re seeing less appetite for risk and more appetite for sustaining technology.”

Source: https://ambcrypto.com/crypto-venture-capitalists-unable-to-shake-off-2022-memories/

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://bitcoinethereumnews.com/crypto/crypto-venture-capitalists-unable-to-shake-off-2022-memories/?utm_source=rss&utm_medium=rss&utm_campaign=crypto-venture-capitalists-unable-to-shake-off-2022-memories

- :is

- :not

- $UP

- 000

- 1

- 2021

- 2022

- 2023

- 361

- a

- About

- actually

- addition

- After

- agencies

- All

- also

- among

- and

- Another

- anything

- appetite

- ARE

- around

- AS

- At

- attention

- auto

- back

- Bank

- Banking

- Biggest

- Billion

- Bitcoin

- Bitcoin Price

- Bitcoin price rally

- blockchain

- blockchain and web3

- BTC

- by

- CAN

- capital

- capitalists

- caught

- change

- clear

- closely

- closing

- Collapse

- collapsed

- Companies

- comparison

- Comptroller

- Comptroller of the Currency

- confidence

- contain

- Core

- CORPORATION

- correlated

- crypto

- Crypto Exchanges

- crypto firms

- Crypto Industry

- crypto investments

- crypto sector

- crypto startups

- cryptocurrency

- cryptocurrency technology

- Currency

- data

- Days

- Deals

- Decline

- deeper

- DEFICIT

- deposit

- DEPOSIT INSURANCE

- desire

- digital

- diligence

- do

- doing

- dropped

- enforcement

- etc

- events

- Except

- Exchanges

- expressed

- fdic

- February

- Federal

- Federal Deposit Insurance Corporation

- federal reserve

- fifth

- Firm

- firms

- First

- fluid

- focused

- For

- founder

- from

- FTX

- funds

- going

- gone

- Half

- hand

- Happening

- Have

- height

- heights

- Hit

- House

- However

- HTTPS

- ideal

- in

- increased

- industry

- Infrastructure

- institutions

- insurance

- interest

- invested

- investing

- investment

- Investments

- Investors

- Issued

- IT

- ITS

- January

- joint

- just

- Labs

- Last

- Last Year

- lead

- Led

- less

- like

- Liquidity

- lofty

- longer

- lowest

- made

- major

- managing

- managing partner

- March

- Market

- max-width

- Memories

- mere

- Metaverse

- might

- million

- more

- moved

- necessarily

- New

- NFTs

- no

- non-fungible

- non-fungible tokens

- noted

- now

- OCC

- of

- off

- Office

- Office of the Comptroller of the Currency

- on

- or

- Other

- over

- partner

- Peak

- Pitchbook

- Place

- plato

- Plato Data Intelligence

- PlatoData

- posed

- press

- previous

- price

- price rally

- Prices

- projects

- Quarter

- rally

- regard

- regarding

- Regulation

- regulation by enforcement

- regulations

- Regulators

- regulatory

- related

- remarked

- Reported

- Reserve

- respectively

- Reuters

- rising

- Risk

- risks

- ROSE

- rules

- s

- Said

- saw

- Second

- second quarter

- sector

- Sectors

- see

- seeing

- significant

- Silicon

- Silicon Valley

- silicon valley bank

- Silvergate

- SILVERGATE BANK

- since

- spice

- Stablecoins

- Startups

- Statement

- States

- Still

- Stillmark

- straight

- Successfully

- such

- taking

- Technology

- Terraform

- Terraform Labs

- than

- that

- The

- Them

- There.

- These

- this

- this year

- three

- Three Arrows

- Three Arrows Capital

- Tied

- time

- to

- Tokens

- took

- Total

- Trading

- true

- u.s.

- unable

- under

- United

- United States

- upheaval

- Valley

- Valuation

- VC

- VCs

- venture

- Ventures

- Wallets

- warning

- was

- we

- web

- Web 3

- Web 3.0

- Web3

- web3 companies

- were

- which

- white

- White House

- with

- witnessed

- year

- years

- zephyrnet