In a move to bolster its global expansion efforts, Coinbase has enlisted George Osborne, a prominent figure in U.K. politics and finance. Osborne, known for his tenure as the U.K.’s Chancellor of the Exchequer (Treasury) from 2010 to 2016 and his contributions to the country’s economic and financial policies, joins Dr. Mark T. Esper, former U.S. Secretary of Defense, and former Senator Patrick Toomey on the council.

Osborne has historically shown a positive stance toward cryptocurrencies and blockchain technology. Over the years, he has made several statements indicating his belief in their transformative potential.

As reported by Coinbase, the company has made notable strides in global expansion. It has secured operational licenses in various countries, including France, Spain, Singapore, and Bermuda. Coinbase has expanded its reach across 20 African nations, facilitating millions of users’ access to USDC and enabling faster, more cost-effective transactions. Osborne’s extensive experience in government, international finance, and fintech investing is expected to be invaluable in this growth phase.

Coinbase’s Chief Policy Officer, Faryar Shirzad, highlighted Osborne’s diverse business, journalism, and government expertise as key to the company’s future endeavors. “George brings with him a wealth of experience… We look forward to relying on his insights and experiences as we grow Coinbase around the world,” said Shirzad.

Commenting on his appointment, Osborne said,

“There’s a huge amount of exciting innovation in finance right now. Blockchains are transforming financial markets and online transactions. Coinbase is at the frontier of these developments.

I look forward to working with the team there as they build a new future in financial services.”

George Osborne and crypto.

In 2014, Osborne announced that the U.K. government would explore the role of virtual currencies like Bitcoin and how they could help the UK become a leader in the digital economy. By 2015, Osborne expressed his belief in the potential of digital currencies, stating that they could play a significant role in finance. He emphasized his desire for London to be a world leader in FinTech and digital currencies.

Further, Osborne’s venture capital firm, 9Yards Capital, has also invested in crypto. The firm reportedly made significant gains after investing in Internet Computer (ICP.)

Given Coinbase’s recent campaign to “rebuild’ the system, Osborne is an interesting choice. In 2008, Osborne warned of a potential collapse of the fiat system in the United Kingdom,

“We are in danger, if the government is not careful, of having a proper sterling collapse, a run on the pound…

The more you borrow as a government the more you have to sell that debt and the less attractive your currency seems.”

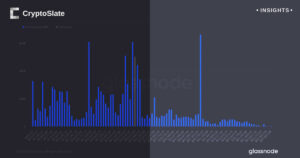

When Osborne made this statement, the U.K.’s national debt was £530 billion; by the time he left office, it had risen to £1.6 trillion. It is estimated to be around £2.7 trillion and approximately 102% of GDP today.

This first-hand experience with spiraling national debt may uniquely position Osborne to understand the benefits of digital currencies such as Bitcoin. Between 2010 and 2016, around £500 billion was printed and added to the U.K. M1 money supply during his time as chancellor.

The U.K. failed to achieve Osborne’s 2015 vision of becoming a digital asset hub. Navigating the ever-increasing regulatory hurdles and limitations to crypto trading in the country will likely be one of Osborne’s most significant challenges in advising Coinbase in the future.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://cryptoslate.com/coinbase-taps-former-uk-treasurer-who-warned-of-run-on-pound-in-2008-for-advisory-council/

- :has

- :is

- :not

- 12

- 20

- 2008

- 2010

- 2014

- 2015

- 2016

- 7

- 8

- a

- access

- Achieve

- across

- added

- advising

- advisory

- African

- After

- also

- amount

- an

- and

- announced

- appointment

- approximately

- ARE

- around

- AS

- asset

- At

- attractive

- bbc

- BE

- become

- becoming

- belief

- benefits

- Bermuda

- between

- Billion

- Bitcoin

- blockchain

- blockchain technology

- blockchains

- bolster

- borrow

- Brings

- build

- business

- by

- Campaign

- capital

- capital firm

- careful

- challenges

- chief

- choice

- CO

- coinbase

- Coinbase’s

- Coindesk

- Collapse

- company

- Company’s

- computer

- contributions

- cost-effective

- could

- Council

- countries

- country

- country’s

- crypto

- crypto trading

- cryptocurrencies

- currencies

- Currency

- DANGER

- Debt

- Defense

- desire

- developments

- digital

- Digital Asset

- digital currencies

- Digital economy

- diverse

- dr

- during

- Economic

- economy

- efforts

- emphasized

- enabling

- endeavors

- estimated

- exciting

- expanded

- expansion

- expected

- experience

- Experiences

- expertise

- explore

- expressed

- extensive

- Extensive Experience

- facilitating

- Failed

- Faryar Shirzad

- faster

- Fiat

- Figure

- finance

- financial

- financial services

- fintech

- Firm

- For

- Former

- Forward

- France

- from

- Frontier

- future

- George

- Global

- global expansion

- Government

- Grow

- Growth

- had

- Have

- having

- he

- help

- Highlighted

- him

- his

- historically

- How

- http

- HTTPS

- Hub

- huge

- ICP

- if

- in

- Including

- indicating

- Innovation

- insights

- interesting

- International

- Internet

- invaluable

- invested

- investing

- IT

- ITS

- Joins

- journalism

- jpg

- Key

- Kingdom

- known

- leader

- left

- less

- like

- likely

- limitations

- London

- Look

- made

- mark

- Markets

- May..

- millions

- money

- money supply

- more

- most

- move

- National

- Nations

- navigating

- New

- notable

- now

- of

- Office

- Officer

- on

- ONE

- online

- over

- patrick

- Patrick Toomey

- phase

- PHP

- plato

- Plato Data Intelligence

- PlatoData

- Play

- policies

- policy

- politics

- position

- positive

- potential

- prominent

- proper

- reach

- recent

- regulatory

- relying

- Reported

- right

- Risen

- Role

- Run

- s

- Said

- secretary

- Secured

- seems

- sell

- Senator

- Services

- several

- shown

- significant

- Singapore

- Spain

- stance

- Statement

- statements

- stating

- sterling

- strides

- such

- supply

- system

- T

- Taps

- team

- Technology

- that

- The

- The Future

- the UK

- the United Kingdom

- the world

- their

- There.

- These

- they

- this

- time

- to

- today

- toomey

- toward

- Trading

- Transactions

- transformative

- transforming

- Treasurer

- treasury

- Trillion

- U.K.

- U.K. government

- u.s.

- Uk

- understand

- uniquely

- United

- United Kingdom

- USDC

- various

- venture

- venture capital

- venture capital firm

- Virtual

- virtual currencies

- warned

- was

- we

- Wealth

- WHO

- will

- with

- working

- world

- would

- years

- you

- Your

- zephyrnet