More real estate agents believe their client shortfall has begun to stabilize, an indication of rising home demand in the new year, according to new results from the latest Inman Intel Index survey.

This report is available exclusively to subscribers of Inman Intel, the data and research arm of Inman offering deep insights and market intelligence on the business of residential real estate and proptech. Subscribe today.

Real estate agents waiting for the levee of pent-up demand to break have been getting increasingly optimistic news.

New data from the Inman Intel Index survey, or Triple-I, reinforces that one of the worst housing cycles in decades might be hitting an inflection point.

TAKE THE JANUARY INMAN INTEL INDEX

Client pipelines are slowly filling back up after being depleted for much of the last two years, according to 586 agent responses to the December Triple-I. What’s more, many real estate professionals expect this slow trickle of new clients to only speed up in the months to come, the survey suggests.

Among this month’s findings:

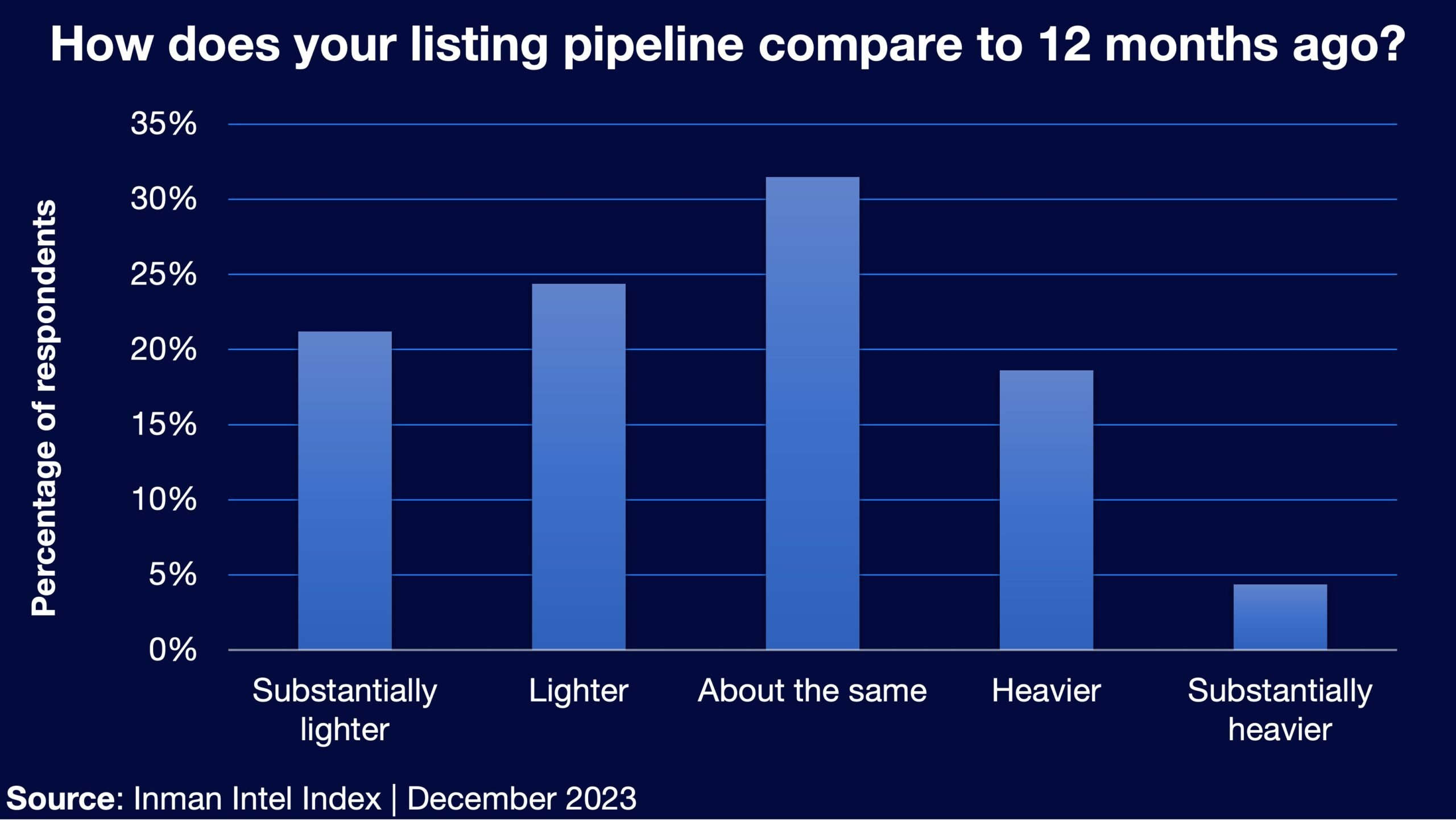

- Almost 1 in 4 agents said they were working with more listing clients in December than at the same time the previous year — up from 1 in 6 agents who said the same in October.

- These gains, however, were mostly moderate: 19 percent of agent respondents described their listing pipelines as “heavier” year over year, while only 4 percent said instead that they were “substantially heavier.”

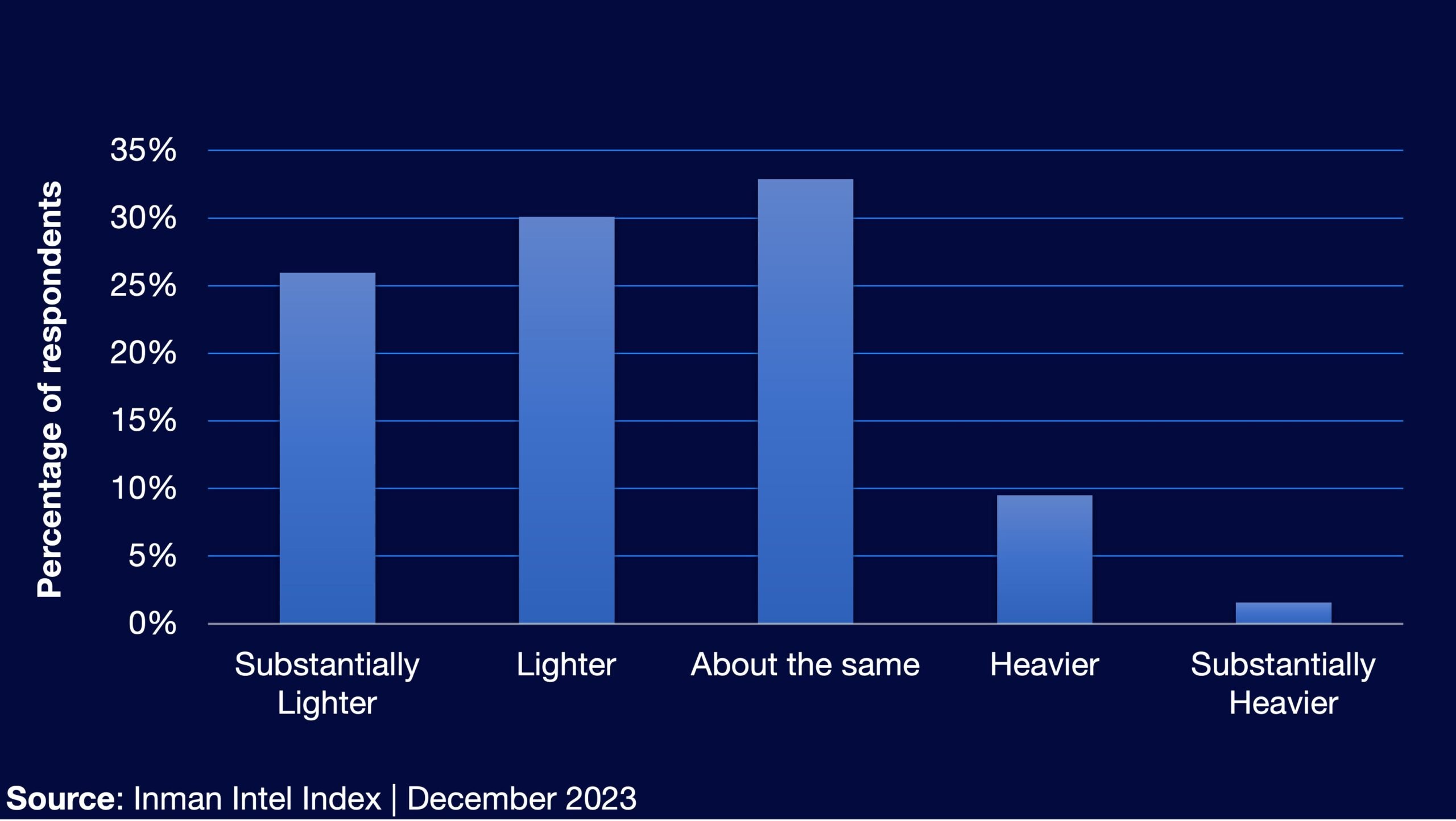

On the other hand, buyer clients remained harder to come by.

- Only 1 in 9 agents told the Triple-I that their buyer pipelines were better off than last year.

- Still, that’s up from 1 in 17 respondents who said the same two months before.

These industry findings are consistent with big-picture transaction data that suggests the housing market may have started to find its footing in the second half of 2023.

Read more below on how real estate professionals are feeling about the current market — and how they’re preparing for the months to come.

A stabilizing market

As a growing number of agents report year-over-year improvement in their listing pipelines, an even greater share now says that their listing clientele have stabilized, even if things aren’t yet improving much.

This is a relatively recent development, the Triple-I suggests.

- For the first time since the Triple-I debuted in September, agents described their listing pipeline as “about the same” as 12 months ago more often than any other response choice.

- Approximately 33 percent of agents chose that option, which climbed from third place to second to first in the preceding 90 days.

These results come on the heels of several data releases that show a year-over-year uptick in sales and inventory at the end of 2023. This period joins 1995 and 2008 as one of the hardest in recent real estate memory.

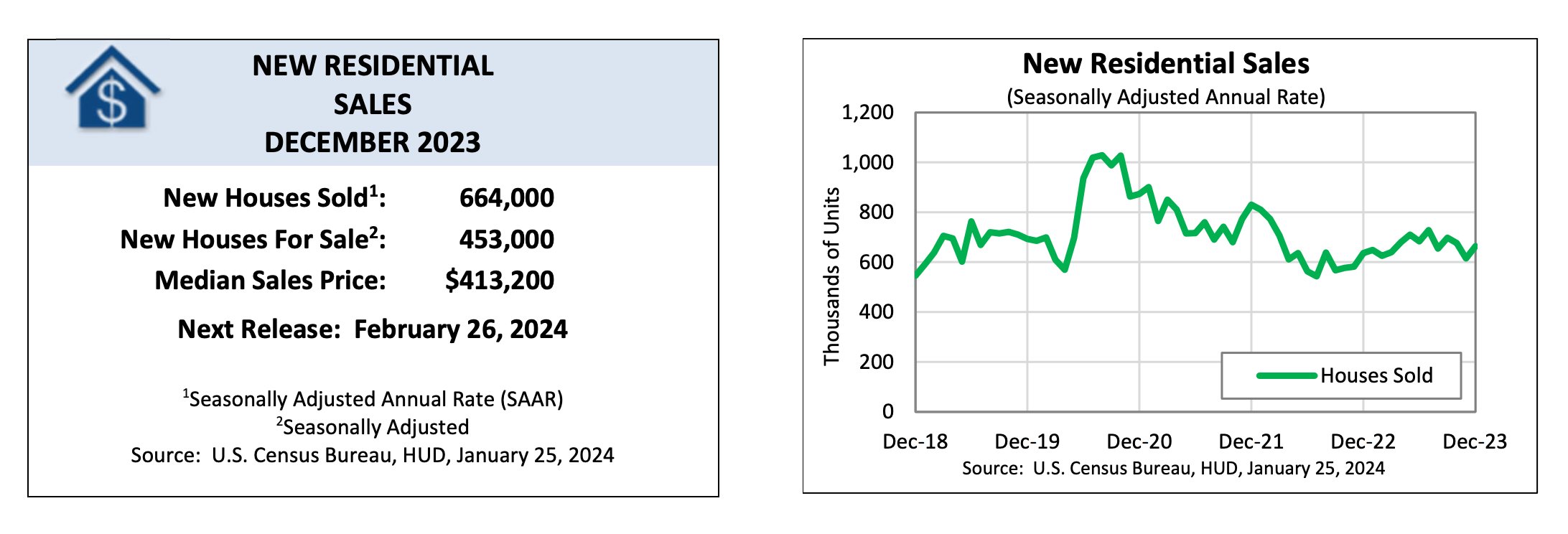

If there was a bright spot, it was a strong year for new-home sales. That’s one area where recent data adds to growing confidence.

- Data published last week by the U.S. Census Bureau and the Department of Housing and Urban Development showed new-home sales in December were up 4.5 percent year over year.

Source: U.S. Census Bureau and the U.S. Department of Housing and Urban Development

As it becomes clearer that the broader market freefall has slowed to a halt, real estate professionals are beginning to eye the prospect of growth once more, the Triple-I finds.

Picking up steam

For a true market turnaround to gain traction, mortgage rates will likely have to continue on their recent downward trajectory.

That’s exactly what an increasingly broad consensus is beginning to expect will happen as the Federal Reserve winds down its inflation-fighting efforts and begins to lower interest rates.

Forward-looking sentiment among agents largely tracks with this improving outlook, the Triple-I finds.

- Forty-seven percent of agents in December’s Triple-I expected a heavier pipeline of buyers 12 months from now.

- If we include the share of agents who expect “about the same” number of buyer clients, 85 percent of agent respondents expect their buyer pipelines to at least remain the same or improve over the coming year.

- Nearly the same share of agents predicted their number of listing clients would either be the same or heavier 12 months from now — up from 63 percent of agents who said this in September.

But ultimately, the recovery will still rely on factors that are difficult to predict — rooted deeply in the attitudes of potential clients.

Hinging on buyers

While more momentum has gathered in the new-home market, industry observers have stressed that the breadth and speed of a potential recovery will rely on factors that are difficult to measure.

Ali Wolf, chief economist at housing data company Zonda, focuses on the new home space but characterized the start to 2024 as “better than expected” during a state-of-the-market presentation at Inman Connect.

Wolf went on to literally sound a note of caution, though.

“We asked builders to describe the market in three words,” Wolf said, adding, “and the number one most commonly cited word was ‘cautious.’ So while they are seeing that foot traffic, there still is just that sense of, ‘OK, how deep is this demand pool of buyers?’”

Methodology notes: This month’s Inman Intel Index survey was conducted Dec. 21-31, 2023. The entire Inman reader community was invited to participate, and Intel received a total of 808 responses. Respondents for this survey were directed to the SurveyMonkey platform, where they self-identified their profiles within the residential real estate market. Respondents were limited to one response per device, but there was no limitation to IP addresses. Once a profile (residential real estate agent, mortgage broker/banker, corporate executive/investor/proptech, or other) was selected, respondents answered a unique set of questions for that specific profile. Because the survey did not request demographic information for age, gender or geography, there was no data weighting. This survey will be conducted monthly, with both recurring and unique questions for each profile type.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.inman.com/2024/01/31/client-pipelines-tick-back-up-as-agents-eye-2024-gains-triple-i/

- :has

- :is

- :not

- :where

- $UP

- 1

- 10

- 12

- 12 months

- 17

- 1995

- 2008

- 2023

- 2024

- 32

- 90

- a

- About

- According

- adding

- addresses

- Adds

- After

- age

- Agent

- agents

- ago

- among

- an

- and

- any

- ARE

- AREA

- ARM

- AS

- At

- available

- back

- BE

- because

- becomes

- been

- before

- Beginning

- begins

- begun

- being

- believe

- below

- Better

- both

- breadth

- Break

- Bright

- broad

- broader

- builders

- Bureau

- business

- but

- BUYER..

- buyers

- by

- caution

- Census

- Census Bureau

- characterized

- chief

- choice

- chose

- Chris

- cited

- clearer

- client

- clientele

- clients

- Climbed

- COM

- come

- coming

- commonly

- community

- company

- conducted

- confidence

- Consensus

- consistent

- continue

- Corporate

- Current

- cycles

- data

- Days

- debuted

- dec

- decades

- December

- deep

- deeply

- Demand

- demographic

- Department

- describe

- described

- Development

- device

- DID

- difficult

- directed

- down

- downward

- during

- each

- Economist

- efforts

- either

- end

- Entire

- estate

- Even

- exactly

- exclusively

- expect

- expected

- eye

- factors

- Federal

- federal reserve

- feeling

- filling

- Find

- findings

- finds

- First

- first time

- focuses

- Foot

- For

- from

- Gain

- Gains

- gathered

- Gender

- geography

- getting

- greater

- Growing

- Growth

- Half

- hand

- happen

- harder

- Have

- hitting

- Home

- housing

- housing market

- How

- However

- HTTPS

- if

- improvement

- improving

- in

- include

- increasingly

- index

- indication

- industry

- Inflection

- Inflection Point

- information

- insights

- instead

- Intel

- Intelligence

- interest

- Interest Rates

- inventory

- invited

- IP

- IP addresses

- IT

- ITS

- January

- Joins

- jpg

- just

- largely

- Last

- Last Year

- latest

- least

- likely

- limitation

- Limited

- listing

- lower

- many

- Market

- max-width

- May..

- measure

- Memory

- might

- moderate

- Momentum

- monthly

- months

- more

- Mortgage

- most

- mostly

- much

- New

- new year

- news

- no

- note

- Notes

- now

- number

- observers

- october

- of

- off

- offering

- often

- on

- once

- ONE

- only

- Optimistic

- Option

- or

- Other

- Outlook

- over

- participate

- per

- percent

- period

- pipeline

- Place

- platform

- plato

- Plato Data Intelligence

- PlatoData

- Point

- pool

- potential

- potential clients

- potential recovery

- preceding

- predict

- predicted

- preparing

- presentation

- previous

- professionals

- Profile

- Profiles

- PropTech

- prospect

- published

- Questions

- Rates

- Reader

- real

- real estate

- real estate market

- received

- recent

- recovery

- recurring

- reinforces

- relatively

- Releases

- rely

- remained

- report

- request

- research

- Reserve

- residential

- respondents

- response

- responses

- Results

- rising

- rooted

- s

- Said

- sales

- same

- says

- Second

- seeing

- selected

- sense

- sentiment

- September

- set

- several

- Share

- shortfall

- show

- showed

- since

- slow

- Slowly

- So

- Sound

- Space

- specific

- speed

- Spot

- stabilize

- start

- started

- Still

- strong

- subscribers

- Suggests

- Survey

- SurveyMonkey

- than

- that

- The

- their

- There.

- they

- things

- Third

- this

- though?

- three

- tick

- time

- to

- told

- Total

- tracks

- traction

- traffic

- trajectory

- transaction

- true

- two

- type

- u.s.

- Ultimately

- unique

- urban

- Waiting

- was

- we

- week

- went

- were

- What

- which

- while

- WHO

- will

- winds

- with

- within

- Wolf

- Word

- words

- working

- Worst

- would

- year

- years

- yet

- zephyrnet

- zonda