Prime brokerages provide a multitude of bundled services to other financial institutions, typically hedge funds to facilitate their operational needs like securities lending/borrowing, cash loans, and risk management. Large hedge funds ($1B+ AUM) can work with as many as ten prime brokers while smaller funds may rely on only one. Typically, the constraint that prevents these funds from utilizing more prime brokers is technology implementation and integration. Clear Street is a tech-enabled prime brokerage that takes an API-first approach to offer a full suite of services that are cloud-native. 70% of the prime brokerage business has been dominated by a handful of institutions and by taking a technology-first approach, Clear Street is able to offer real-time processing and unprecedented data scalability that just isn’t possible in legacy systems used by the incumbents. Presently, the company offers clearing and custodial services, execution, and financing for US equities and options for over 200 funds but plans to expand to cover any asset class, anywhere on the globe.

AlleyWatch caught up with Clear Street Cofounder and CEO Chris Pento to learn more about the business, the company’s strategic plans, latest round of funding, and much, much more…

Who were your investors and how much did you raise?

The second tranche of our Series B capital raise values Clear Street at $2.0B. This $270M funding round follows an initial Series B investment of $165M in May 2022, which was also led by Prysm Capital and valued Clear Street at $1.7B at that time. Additional investors included NextGen Venture Partners, IMC Investments, Walleye Capital, Belvedere, NEAR Foundation, McLaren Strategic Ventures, and Validus Growth Investors.

Tell us about the product or service that Clear Street offers.

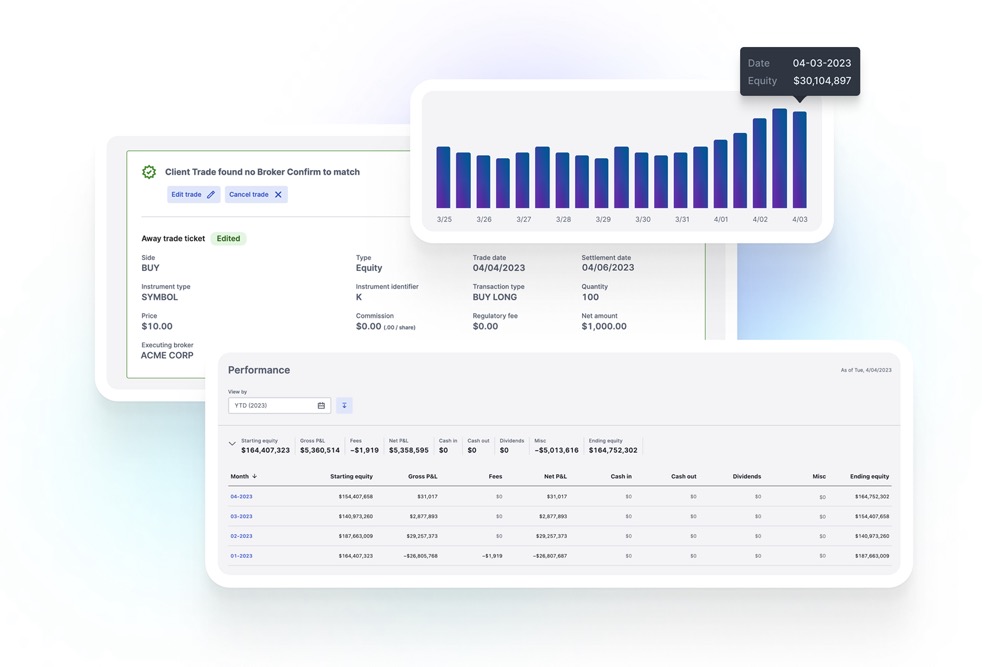

Clear Street is a tech-enabled independent prime broker. We’ve built an internal platform to be API-first, which includes clearing, custody, prime financing and execution, that we are dogfooding to build a multi-asset prime broker business. Today our platform supports U.S. equities and options, but the goal is to be a single source of truth that supports any asset class, any geography, for anyone.

Our tech stack utilizes modern cloud-native infrastructure, including resilient service orchestration, event-driven real-time processing, and scalable data warehousing, which is a sharp contrast to the batch processing offered by mainframes that run many back-office systems. Clear Street’s entire suite of software systems is built upon this consistent and cohesive technology stack, enabling the components to communicate seamlessly.

What inspired the start of Clear Street?

In 2018, Clear Street set out with the bold mission to replace the outdated infrastructure being used across capital markets. The public U.S. securities industry, which moves trillions of dollars a day, still relies on mainframe technology from the 1980s. These legacy systems are entrenched in manual processes and siloed data, resulting in costly errors and expensive technical debt. For many firms, replacing these antiquated systems would be like removing the engine from a plane in mid-air. It’s time-consuming and difficult to execute with fragmented technology.

In 2018, Clear Street set out with the bold mission to replace the outdated infrastructure being used across capital markets. The public U.S. securities industry, which moves trillions of dollars a day, still relies on mainframe technology from the 1980s. These legacy systems are entrenched in manual processes and siloed data, resulting in costly errors and expensive technical debt. For many firms, replacing these antiquated systems would be like removing the engine from a plane in mid-air. It’s time-consuming and difficult to execute with fragmented technology.

Clear Street is facing the challenge of outdated capital markets infrastructure head-on. We started from scratch and built a completely cloud-native prime brokerage and clearing system designed for a complex, modern global market. Our proprietary technology platform adds significant efficiency to the market, while focusing on maximizing returns and minimizing risk and cost for clients.

Today, we provide clients, from emerging managers to large institutions, with everything they need to clear, custody, and finance U.S. equities and options. In the last year, we launched capital introduction and repo businesses, enhanced our securities lending capabilities, and updated and refined our client-facing position, risk, operations, and reporting portals.

In the future, our single-source platform will serve a variety of investor types, across multiple asset classes, on a global scale. It’s never been more apparent that the forces of volatility, regulatory change, and speed are demanding tools that allow firms to make sense of the markets in real-time.

What market does Clear Street target and how big is it?

Our prime brokerage clients range from emerging managers to large institutions. Over the past year, the number of institutional clients on our platform increased by 500%, our daily transactional volume increased by more than 300%, and our financing balances increased by nearly 150%.

Our prime clearing platform processes 2.5% of the gross notional U.S. equities volume, which is about $10 billion in daily notional trading value of U.S. equities.

What’s your business model?

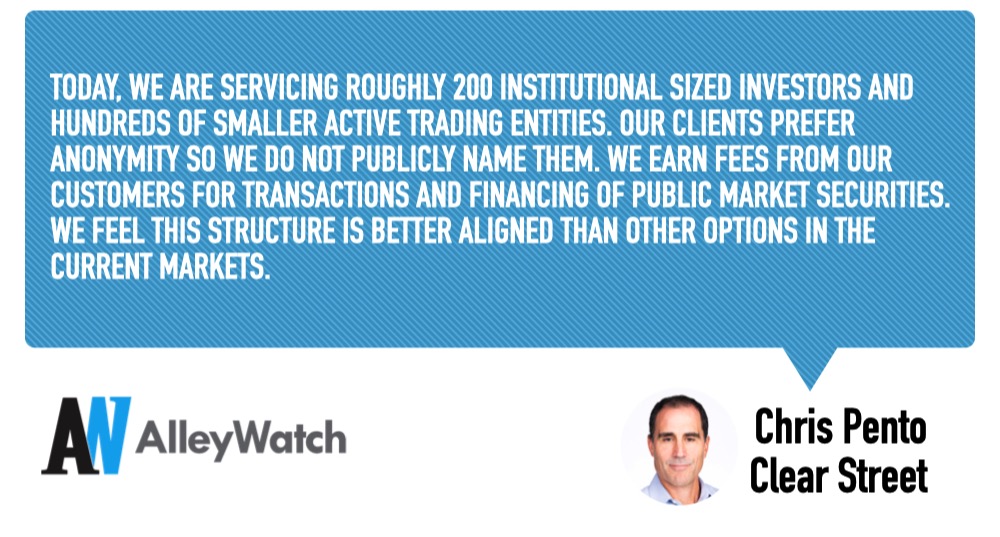

Today, we are servicing roughly 200 institutional-sized investors and hundreds of smaller active trading entities. Our clients prefer anonymity so we do not publicly name them. We earn fees from our customers for transactions and financing of public market securities. We feel this structure is better aligned than other options in the current markets.

What factors about your business led your investors to write the check?

“A significant portion of the financial system’s backbone is made on decades-old legacy technology. With what we believe to be the strongest leadership team in the capital markets industry, Clear Street has rethought and rebuilt the core underlying infrastructure for capital markets to truly modernize an antiquated industry.” – Matt Roberts, Cofounder & Partner at Prysm Capital

Where do you see the company going now over the near term?

This funding will support the launch of new products and our expansion into new markets and asset classes. In the last year, we’ve made key hires in Europe and in the Derivatives space. We are also expanding our product offering to support the clearing needs of Market Makers, which we see as a major growth area for Clear Street.

You are seconds away from signing up for the hottest list in Tech!

Sign up today

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Source: https://www.alleywatch.com/2023/04/clear-street-tech-enabled-prime-brokerage-platform-chris-pento/

- :is

- $UP

- 10

- 2018

- 2022

- a

- Able

- About

- across

- active

- Additional

- Adds

- aligned

- and

- Anonymity

- anyone

- anywhere

- apparent

- approach

- ARE

- AREA

- AS

- asset

- asset class

- At

- Backbone

- balances

- BE

- being

- believe

- Better

- Big

- Billion

- bold

- broker

- brokerage

- brokerages

- brokers

- build

- built

- business

- business model

- businesses

- by

- CAN

- capabilities

- capital

- Capital Markets

- Capital raise

- Cash

- challenge

- change

- check

- Chris

- class

- classes

- clear

- Clearing

- clients

- cofounder

- COM

- communicate

- company

- Company’s

- completely

- complex

- components

- consistent

- contrast

- Core

- Cost

- cover

- Current

- custodial

- custodial services

- Custody

- Customers

- daily

- data

- day

- Debt

- demanding

- Derivatives

- designed

- DID

- difficult

- dollars

- earn

- efficiency

- emerging

- enabling

- Engine

- enhanced

- Entire

- entities

- entrenched

- Equities

- Errors

- Ether (ETH)

- Europe

- everything

- execute

- execution

- Expand

- expanding

- expansion

- expensive

- facilitate

- facing

- factors

- Fees

- finance

- financial

- Financial institutions

- financing

- firms

- focusing

- follows

- For

- Forces

- Foundation

- fragmented

- from

- full

- funding

- Funding Round

- funds

- future

- geography

- Global

- global market

- global scale

- globe

- goal

- going

- gross

- Growth

- handful

- hedge

- Hedge Funds

- hires

- hottest

- How

- HTTPS

- Hundreds

- implementation

- in

- included

- includes

- Including

- increased

- independent

- industry

- Infrastructure

- initial

- inspired

- Institutional

- institutional clients

- institutions

- integration

- internal

- Introduction

- investment

- Investments

- investor

- Investors

- IT

- ITS

- jpg

- Key

- large

- Last

- Last Year

- latest

- launch

- launched

- Leadership

- LEARN

- Led

- Legacy

- lending

- like

- List

- Loans

- made

- major

- make

- Makers

- management

- Managers

- manual

- many

- Market

- market makers

- Markets

- max-width

- May..

- McLaren

- minimizing

- Mission

- model

- Modern

- modernize

- more

- moves

- multi-asset

- multiple

- multitude

- name

- Near

- nearly

- Need

- needs

- New

- new products

- Notional

- number

- of

- offer

- offered

- offering

- Offers

- on

- ONE

- operational

- Operations

- Options

- orchestration

- Other

- partner

- partners

- past

- plans

- platform

- plato

- Plato Data Intelligence

- PlatoData

- position

- possible

- prefer

- Prime

- Prime Brokerage

- processes

- processing

- Product

- Products

- proprietary

- provide

- public

- Public Market

- publicly

- raise

- range

- real-time

- refined

- regulatory

- removing

- replace

- Reporting

- resilient

- resulting

- returns

- Risk

- risk management

- roughly

- round

- Run

- s

- Scalability

- scalable

- Scale

- seamlessly

- Second

- seconds

- Securities

- sense

- Series

- Series B

- serve

- service

- Services

- set

- sharp

- significant

- signing

- single

- smaller

- So

- Software

- Source

- Space

- speed

- stack

- start

- started

- Still

- Strategic

- street

- structure

- suite

- support

- Supports

- system

- Systems

- takes

- taking

- Target

- team

- tech

- tech-enabled

- Technical

- Technology

- ten

- that

- The

- The Capital

- The Future

- their

- Them

- These

- time

- time-consuming

- to

- today

- tools

- Trading

- transactional

- Transactions

- trillions

- truth

- types

- typically

- u.s.

- U.S. Securities

- underlying

- unprecedented

- updated

- us

- US Equities

- utilizes

- Utilizing

- value

- valued

- Values

- variety

- venture

- Volatility

- volume

- Warehousing

- What

- which

- while

- will

- with

- Work

- would

- write

- year

- Your

- zephyrnet