USDC issuer Circle says in a letter to US Senators that it doesn’t finance illegal actors.

Circle, the issuer of the USDC stablecoin, has sent a letter to U.S. Senators Sherrod Brown (D-OH) and Elizabeth Warren (N-MA) refuting claims that the company financed Hamas and other illicit actors.

Tron founder Justin Sun was explicitly named in the letter.

“Circle does not “bank” Justin Sun,” wrote Chief Strategy Officer and Head of Global Policy for Circle, Dante Disparte, adding that “Neither Mr. Sun nor any entity owned or controlled by Mr. Sun, including the TRON Foundation or Huobi Global, currently have accounts with Circle.”

Sun has been under the microscope lately.

Bittrace, a blockchain analytics firm, alleged on Nov. 28 that the majority of activity - some $17B worth - on Tron is linked with illicit purposes. That figure includes illegal forex, commodity transactions, and cryptocurrency transactions, among other activities.

“Circle does not facilitate, directly or indirectly, or finance Hamas (or any other illicit actors), ” Disparte said.

The response comes after the Campaign For Accountability, a non-profit ethics watchdog group based in Washington D.C., claimed the crypto company was financing and facilitating illicit actors with access to digital dollars.

Disparte added that “Circle has always been an active partner of regulators and law enforcement in the United States, Israel, and other jurisdictions to help ensure that our stablecoin, USDC, does not fund illicit activity of any kind.”

The U.S. Congress has placed heightened pressure on the crypto industry after a report in the Wall Street Journal alleged that Palestinian terrorist groups held up to $93 million in digital assets.

However, according to Disparte, public blockchain data show that of the $93 million in digital assets wallets identified by the Israeli government, only $160 was transferred in USDC among those wallets, and none of that was acquired from Circle.

It’s also important to note that neither Sun nor his entities have been officially sanctioned by U.S authorities.

Sun’s Outsized Crypto Footprint

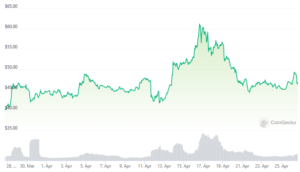

Observers have pointed out that projects linked to Sun constitute a considerable portion of the cryptocurrency market.

Roughly $47B worth of USDT lives on Tron, and an additional $9B (20%) of the $47B of assets locked across DeFi is also connected to Sun’s platforms.

JustLend, for example, recently surpassed Aave as the largest Web3 lending market, with a TVL of $6.08 billion, according to DefiLlama.

“The fallout of a Justin implosion is very underestimated,” pseudonymous DeFi researcher Rho Rider wrote on Twitter.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://thedefiant.io/circle-says-it-does-not-bank-justin-sun

- :has

- :is

- :not

- $UP

- 08

- 28

- 31

- 7

- a

- aave

- Absolute

- access

- According

- accountability

- Accounts

- acquired

- across

- active

- activities

- activity

- actors

- added

- adding

- Additional

- After

- alleged

- Alpha

- also

- always

- among

- an

- analytics

- and

- any

- AS

- Assets

- Authorities

- based

- become

- been

- Billion

- Block

- blockchain

- BLOCKCHAIN ANALYTICS

- blockchain data

- brown

- by

- Campaign

- chief

- Circle

- claimed

- claims

- comes

- commodity

- community

- company

- Congress

- connected

- considerable

- constitute

- controlled

- crypto

- crypto company

- Crypto Industry

- cryptocurrency

- cryptocurrency market

- Currently

- D.C.

- daily

- data

- DeFi

- digital

- Digital Assets

- directly

- disabled

- does

- Doesn’t

- dollars

- dump

- enforcement

- ensure

- entities

- entity

- ethics

- example

- explicitly

- facilitate

- facilitating

- fallout

- Figure

- finance

- financed

- financing

- Firm

- For

- forex

- Foundation

- founder

- from

- fund

- Global

- Government

- Group

- Group’s

- hamas

- Have

- head

- heightened

- Held

- help

- Hidden

- his

- hover

- HTTPS

- Huobi

- Huobi Global

- identified

- Illegal

- illicit

- illicit activity

- implosion

- important

- in

- includes

- Including

- indirectly

- industry

- Israel

- Israeli

- Issuer

- IT

- join

- journal

- jpg

- jurisdictions

- Justin

- Justin Sun

- Kind

- largest

- Law

- law enforcement

- lending

- letter

- LG

- linked

- Lives

- locked

- Majority

- Market

- member

- Microscope

- million

- mr

- Named

- Neither

- non-profit

- None

- nor

- note

- nov

- of

- Officer

- Officially

- on

- only

- or

- Other

- our

- out

- owned

- partner

- placed

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- podcast

- policy

- Premium

- pressure

- projects

- public

- public blockchain

- purposes

- recap

- Regulators

- relative

- report

- researcher

- response

- s

- Said

- Sanctioned

- says

- SENATORS

- sent

- Sherrod Brown

- show

- some

- stablecoin

- States

- Strategy

- street

- Sun

- terrorist

- that

- The

- The Defiant

- The Wall Street Journal

- those

- to

- Transactions

- Transcript

- transferred

- TRON

- TRON Foundation

- TVL

- u.s.

- u.s. congress

- under

- United

- United States

- us

- US senators

- USDC

- USDT

- very

- visible

- Wall

- Wall Street

- Wall Street Journal

- Wallets

- was

- washington

- Washington D.C.

- watchdog

- Web3

- with

- worth

- wrote

- zephyrnet