ADVERTISEMENT

Charlie Munger despises Bitcoin’s success and along with Warren Buffet, they bashed the entire crypto industry again so let’s read more in today’s BTC news.

The legendary stock market investors Warren Buffet and Charlie Munger talked during Berkshire Hathaway’s annual meeting about crypto and the effects of the new trading era on the global psyche. Buffett expressed his displeasure at the people that treat markets like a casino, claiming that it encouraged a gambling impulse. Buffett also insisted that sound long-term investing is not as easy now as it sounds so he spoke about platforms that allow people to make commission-free trades as they exacerbated what he sees as a latent gambling addiction.

Munger has always been anti-BTC and he even elaborated on the views in the meeting. He said he hates BTC’s success and went on to call the whole “damn development” disgusting and contrary to the interest of civilization. The bulk of Munger’s criticism came from his point of view that crypto is useful to criminals but in 2020, 0.34% of the crypto activity was related to criminal activity.

ADVERTISEMENT

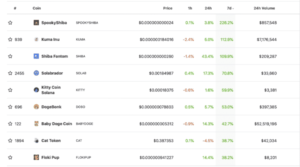

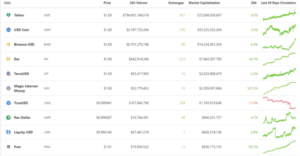

The UN also estimated that between 2% and 5% of the global GDP is connected with illegal activity. The US dollar is also connected to 480% more crime than cryptos are. Munger expressed his displeasure at the fact that billions of dollars were being allocated to someone that invented a new financial product out of thin air and this refers to the fact that anyone can create a new cryptocurrency with relative ease as cryptocurrencies can easily amass giant market caps if they gain traction.

Usually, crypto market caps are based on order book prices and liquidity on exchanges and all of the information is public. Surprisingly enough, in the early 2000s, the financial product called the subprime mortgage-backed security was also created out of thin air and was backed with no-document loans. In October 2008, it was revealed that the bank was the single biggest shareholder in of the main enablers of the proliferation of subprime mortgage derivatives which caused a huge blow to the entire US economy.

As previously reported, Warren Buffett drops his positions on Wells Fargo, along with Berkshire Hathaway, selling 100 million shares. The Oracle of Omaha is still trimming his positions in bank stocks and he is propelling the bull case for gold and bitcoin. Berkshire held about $32 billion in equity in Wells Fargo at one point. According to the reports, the investment conglomerate now owns 3.3% in equity of the lender that is worth about $3.36 billion.

- addiction

- Bank

- Berkshire

- Biggest

- Billion

- Bitcoin

- Bloomberg

- BTC

- call

- Casino

- caused

- Crime

- Criminal

- Criminals

- crypto

- Crypto Industry

- Crypto Market

- Crypto News

- cryptocurrencies

- cryptocurrency

- Derivatives

- Dollar

- dollars

- Early

- economy

- Editorial

- equity

- Exchanges

- financial

- Free

- Gambling

- GDP

- Global

- Gold

- HTTPS

- huge

- Illegal

- industry

- information

- interest

- investing

- investment

- Investors

- IT

- korea

- Liquidity

- Loans

- Market

- Markets

- million

- Mortgage

- new cryptocurrency

- news

- offer

- oracle

- order

- People

- Platforms

- Point of View

- policies

- Premium

- Product

- public

- Reports

- security

- sees

- set

- shareholder

- Shares

- So

- South

- South Korea

- standards

- stock

- stock market

- Stocks

- success

- trades

- Trading

- treat

- UN

- us

- US Dollar

- US economy

- View

- warren

- Warren Buffet

- Warren Buffett

- Website

- Wells Fargo

- worth