Carbon credit prices are projected to increase dramatically as more lofty climate goals are made and achieved, according to a report published by Bloomberg with support from Carbon Growth Partners.

The report “Investing in Carbon Markets: Cleared for Take-Off” underlines the importance of carbon credits in reaching net zero emissions. It also highlights the need to invest in the market with growing demand and close the emissions gap.

Closing the Emissions Gap

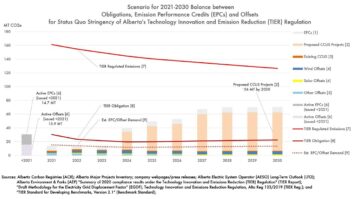

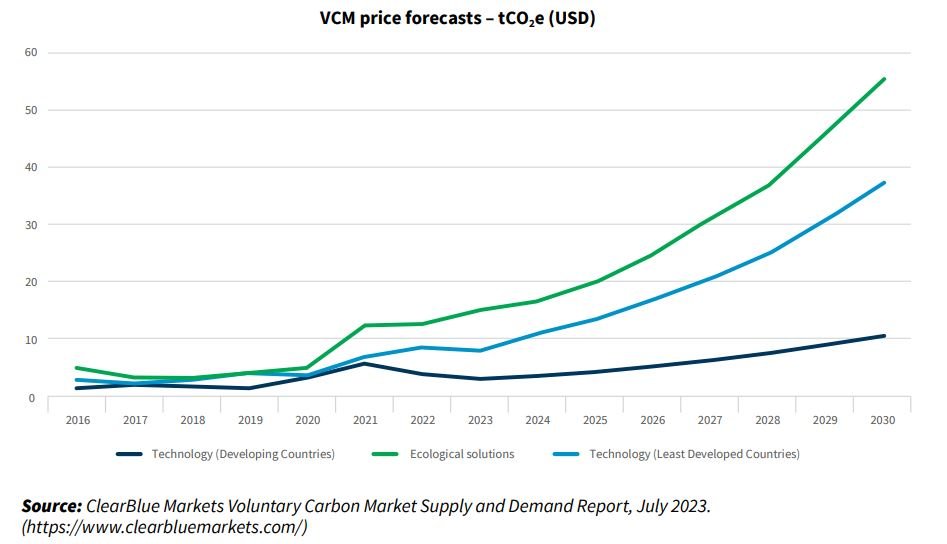

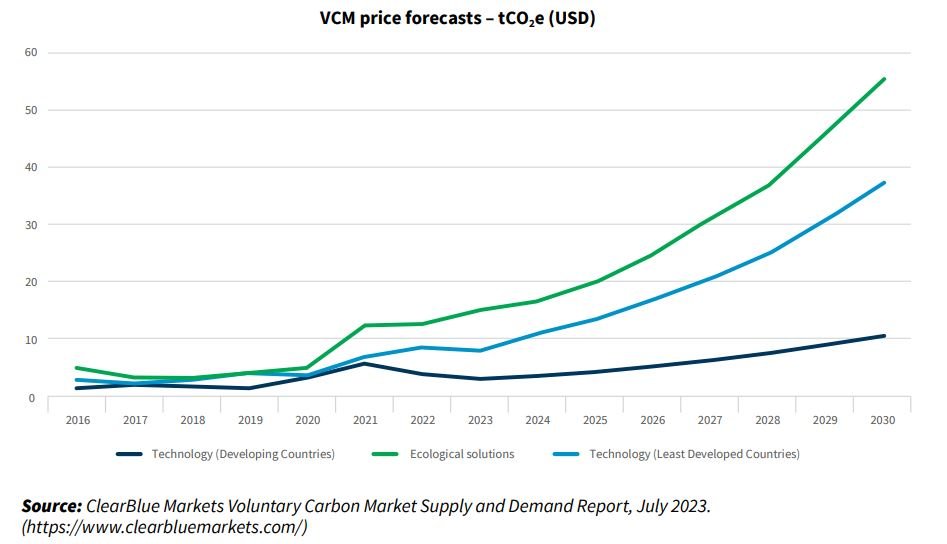

In 2023, the carbon market faced significant challenges. Yet, a surge in corporate demand, alongside stricter carbon credit generation rules, will push the market from oversupply to scarcity. In effect, this will drive carbon prices upward, particularly for nature-based credits, at over $55 per tonne of carbon dioxide in voluntary carbon markets.

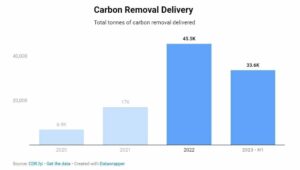

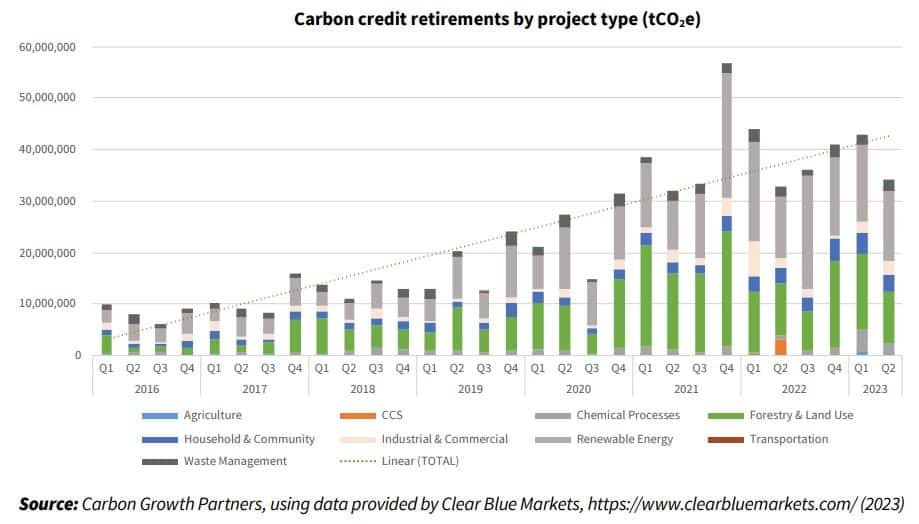

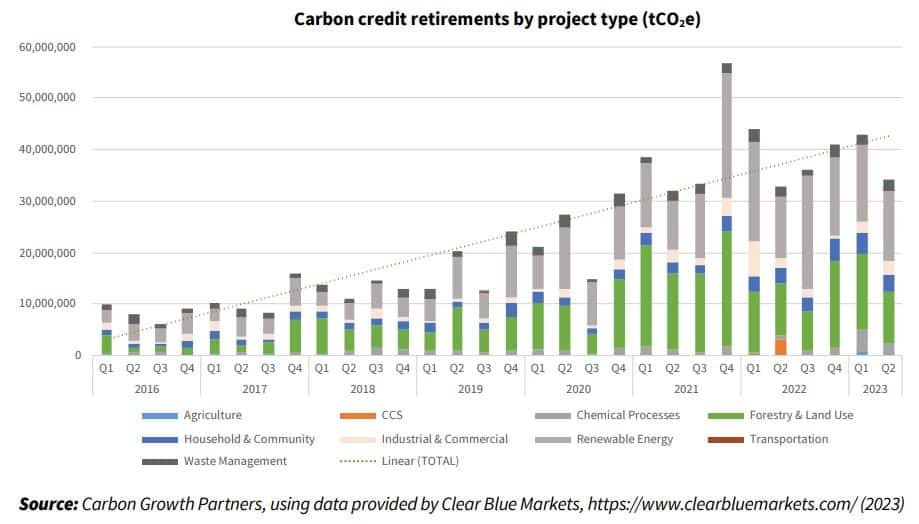

The significance of carbon credits as a pivotal tool in bridging the emissions gap is underscored by a whopping 350% increase in annual retirements since 2016.

The significance of carbon credits as a pivotal tool in bridging the emissions gap is underscored by a whopping 350% increase in annual retirements since 2016.

Carbon Credit Retirements by Project Type (tCO2e)

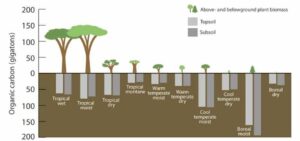

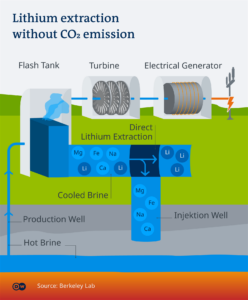

Substantial further growth in offsetting efforts is necessary to meet the target of limiting global warming to 1.5°C. This calls for total emission reductions of 150 billion tonnes of CO2 equivalent by 2030, 45% below 2019 levels.

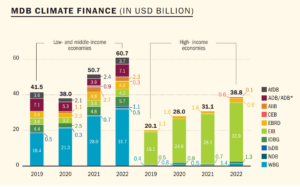

The report also said that the investment needed in renewable energy will be over $44 trillion by 2030.

However, several challenges, including higher borrowing costs, competition for limited capital, and economic slowdowns, may lead to a scaling back or deferral of investments in internal decarbonization by companies. This drives a significant surge in corporate demand for carbon credits as a supplementary strategy throughout the decade.

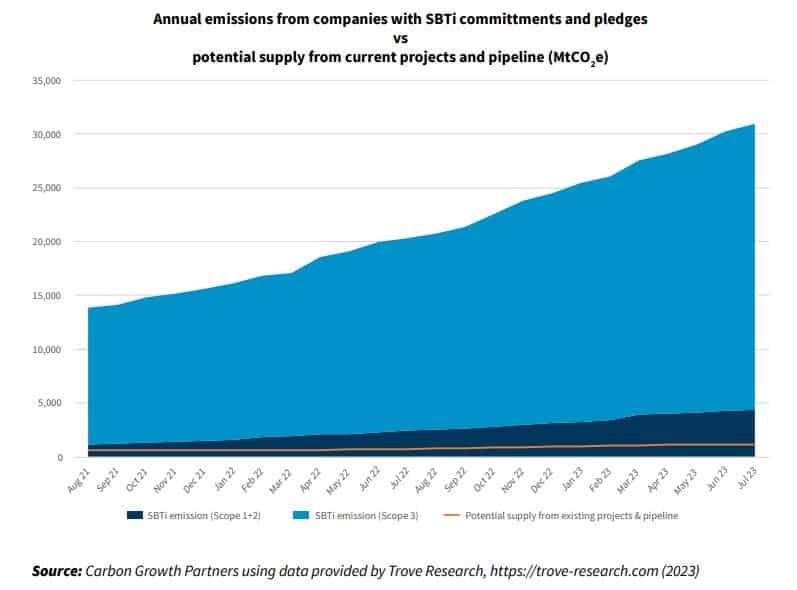

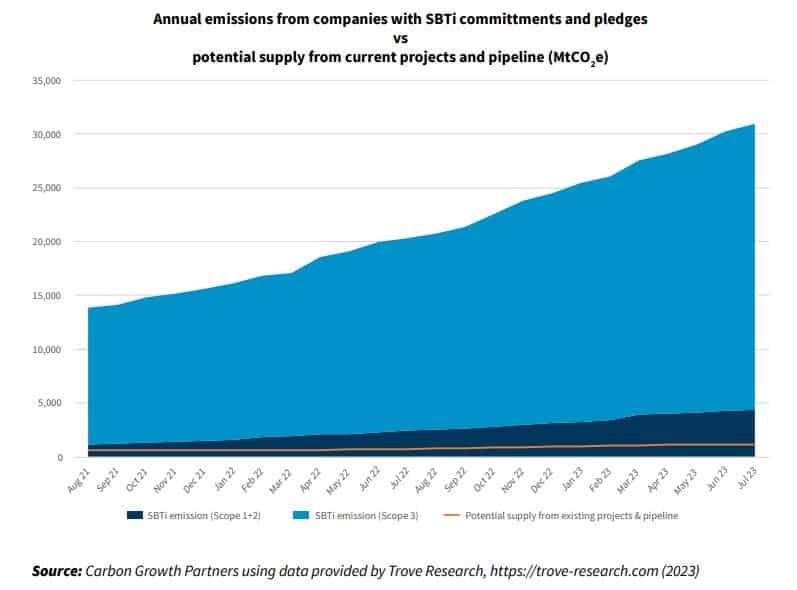

Many corporations are intensifying their emission reduction commitments, with 6,323 entities taking action under the Science-Based Targets Initiative. Together, they’re emitting around 32 billion tonnes of greenhouse gas each year, involving Scope 1, 2, and 3 emissions.

Collectively, these climate pledges suggest a substantial potential demand for carbon credits, even with conservative action scenarios. There’s also a possibility of annual demand for credits reaching 6x the total annual supply from existing and pipeline projects if businesses with an approved SBTi target opt to offset 20% of their emissions.

Moreover, given the sensitivity of carbon pricing, a moderate increase in corporate climate goals and action would push prices up.

New Driver of Demand for Carbon Credits

A burgeoning demand for carbon credits is coming from a new and notable source – investors who recognize the potential of the expanding carbon market.

Though institutional investor involvement has been limited so far, an increasing interest is evident. Many investors are starting to see the opportunity to generate financial returns while supporting climate solutions.

Recognizing the prospective increase in carbon prices due to government and business commitments to carbon emission reduction, major players such as Citi Group and JP Morgan have committed substantial sums to carbon credits.

Citi Group, in particular, emphasizes the enduring nature of the market, claiming that it is “here to stay”. Two months later, JP Morgan revealed its $200 million investment in carbon removal credits to decarbonize operations.

Similarly, State Street also announced its pioneering role in offering carbon asset fund administration and depository services. This will help facilitate the integration of carbon-related assets such as voluntary carbon credits into investment portfolios.

Notably, one of the largest asset management companies in the world found out that as an asset class, carbon assets can improve portfolio diversification and efficiency.

Other institutional investors, including Temasek, AXA, CPP Investments, and TPG, have also made significant investments in various carbon-related ventures. The last three companies opted to fund forest protection projects, which generate carbon credits in return.

Their move indicates a growing trend towards using carbon markets for diversified financial returns and climate impact mitigation.

Bloomberg’s latest report, supported by Carbon Growth Partners, highlights the indispensable role of carbon credits in combating climate change, drawing attention to the increasing participation of institutional investors. This dynamic market shift underscores the pivotal role of carbon credits in closing the emissions gap and achieving climate targets.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://carboncredits.com/carbon-credits-are-a-key-player-in-closing-carbon-emissions-gap/

- :has

- :is

- $UP

- 1

- 150

- 2016

- 2019

- 2023

- 2030

- 32

- a

- According

- achieved

- achieving

- Action

- administration

- alongside

- also

- an

- and

- announced

- annual

- approved

- ARE

- around

- AS

- asset

- asset class

- asset management

- Assets

- At

- attention

- AXA

- back

- BE

- been

- below

- Billion

- Bloomberg

- Borrowing

- bridging

- business

- businesses

- by

- Calls

- CAN

- capital

- carbon

- carbon credits

- carbon dioxide

- carbon emissions

- challenges

- change

- Citi

- claiming

- class

- Climate

- Climate change

- Close

- closing

- co2

- combating

- coming

- commitments

- committed

- Companies

- competition

- conservative

- Corporate

- Corporations

- Costs

- credit

- Credits

- data

- decade

- decarbonization

- decarbonize

- Demand

- depository

- diversification

- diversified

- dramatically

- drawing

- drive

- driver

- drives

- due

- dynamic

- each

- Economic

- effect

- efficiency

- efforts

- emission

- Emissions

- emphasizes

- enduring

- energy

- entities

- Equivalent

- Even

- evident

- existing

- faced

- facilitate

- far

- financial

- For

- forecasts

- forest

- found

- from

- fund

- further

- gap

- GAS

- generate

- generation

- given

- Global

- global warming

- Goals

- Government

- greenhouse gas

- Group

- Growing

- Growth

- Have

- help

- higher

- highlights

- http

- HTTPS

- if

- Impact

- importance

- improve

- in

- Including

- Increase

- increasing

- indicates

- Initiative

- Institutional

- institutional investor

- institutional investors

- integration

- intensifying

- interest

- internal

- into

- Invest

- investment

- Investments

- investor

- Investors

- involvement

- involving

- IT

- ITS

- jp morgan

- jpg

- Key

- key player

- largest

- Last

- later

- latest

- lead

- levels

- Limited

- lofty

- made

- major

- management

- many

- Market

- Markets

- max-width

- May..

- Meet

- million

- mitigation

- moderate

- months

- more

- Morgan

- move

- Nature

- necessary

- Need

- needed

- net

- New

- notable

- of

- offering

- offset

- offsetting

- ONE

- Operations

- Opportunity

- or

- out

- over

- participation

- particular

- particularly

- partners

- per

- Pioneering

- pipeline

- pivotal

- plato

- Plato Data Intelligence

- PlatoData

- player

- players

- portfolio

- portfolios

- possibility

- potential

- Prices

- project

- projected

- projects

- prospective

- protection

- published

- Push

- reaching

- recognize

- reduction

- reductions

- removal

- Renewable

- renewable energy

- report

- return

- returns

- Revealed

- Role

- rules

- Said

- scaling

- Scarcity

- scenarios

- scope

- see

- Sensitivity

- Services

- several

- shift

- significance

- significant

- since

- Since 2016

- slowdowns

- So

- so Far

- Solutions

- Source

- Starting

- State

- State Street

- Strategy

- street

- stricter

- substantial

- such

- suggest

- sums

- supply

- support

- Supported

- Supporting

- surge

- taking

- Target

- targets

- Temasek

- that

- The

- the world

- their

- These

- this

- three

- Through

- throughout

- to

- together

- tool

- Total

- towards

- Trend

- Trillion

- two

- type

- under

- underscores

- upward

- using

- various

- Ventures

- voluntary

- vs

- W3

- webp

- which

- while

- WHO

- will

- with

- world

- would

- year

- yet

- zephyrnet

- zero