Payments Research | Jan 31, 2024

Deciphering Canada's Payment Landscape from the the 2022 Bank of Canada Survey

The 2022 Methods-of-Payment Survey by the Bank of Canada shines light on evolving payment preferences in Canada, spanning over a decade looking at data from 2009 to 2022. The research shows a shift from traditional cash handling to an increasingly digital-centric payment culture through the backdrop of new payment methods like digital currencies and the unprecedented impact of the COVID-19 pandemic.

See: Feds Promise Open Banking Laws in 2024 and to Broaden Access to Payments Canada

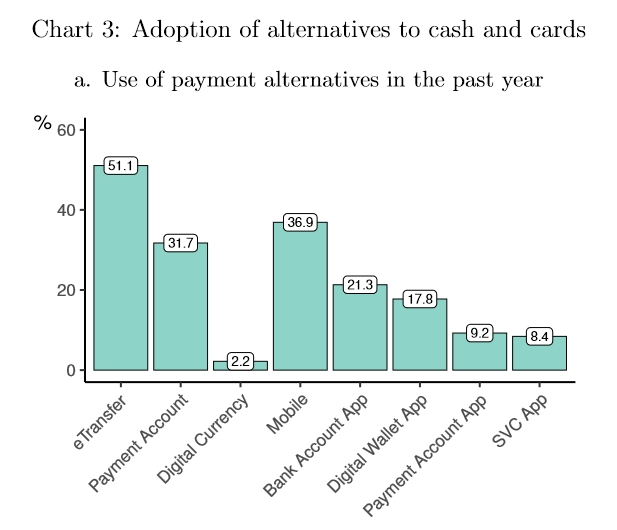

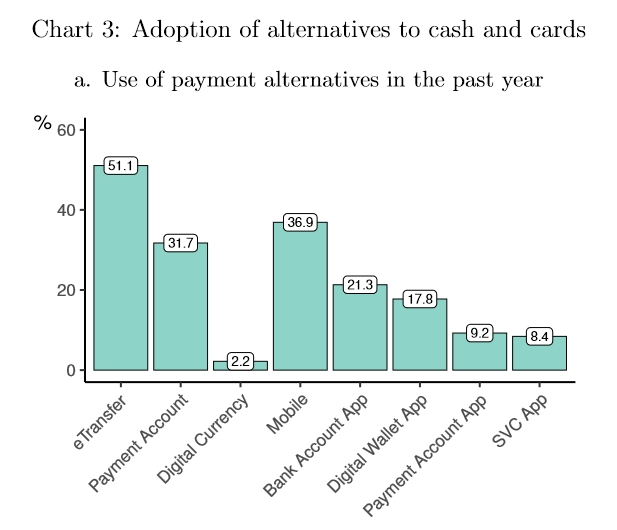

Image: Bank of Canada Payments Landscape 2022 Survey, Chart 3

Image: Bank of Canada Payments Landscape 2022 Survey, Chart 3Takeaways

- Canadians held an average of $130 in cash in 2022, mirroring 2021 figures, despite significant inflation, indicating cash's resilience.

- Online transactions surged, with nearly 15% of purchases made online in recent years, a big increase from less than 5% in 2013 and 2017.

- Credit cards were still the predominant payment method in 2022, constituting 48% of all transactions and 59% of total transaction value. This includes contactless payments which represent over 66.7% of credit card transactions in 2022, highlighting the adoption of convenient payment technologies.

- The COVID-19 pandemic catalyzed a significant behavioural shift to online shopping, with the volume share of online shopping rising from 3% in 2017 to 12% in 2020.

- Interac e-Transfer saw widespread adoption, used by 51% of Canadians, overshadowing digital currencies like Bitcoin, which had a much lower usage rate.

- ATM cash withdrawals fdeclined by about half by 2017 (from 2009).

- Nearly all small and medium-sized businesses in Canada accepted cash in 2022, with a substantial increase in debit and credit card acceptance since 2018.

- The survey highlights a multifaceted payment landscape in Canada, accommodating various methods including cash, cards, mobile payments, and digital currencies.

Closing Outlook

While digital and contactless payments are on the rise, the enduring role of cash underscores the need for a multi-pronged approach to payment options to ensure inclusivity and accessibility in Canada's financial services, catering to all segments of the population.

See: JPMorgan’s New Programmable Payments in Blockchain

As the country progresses further into the digital age, continuous monitoring and adaptable strategies will be essential for financial institutions and policymakers. This approach will ensure alignment with evolving consumer trends and technological advancements.

Download the 48 page PDF report --> here

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://ncfacanada.org/canadas-payment-landscape-2009-2022-boc/

- :is

- 15%

- 150

- 2009

- 2013

- 2017

- 2018

- 2021

- 2022

- 2024

- 300

- 31

- 33

- 500

- 66

- a

- About

- acceptance

- accepted

- access

- accessibility

- Adoption

- advancements

- affiliates

- age

- alignment

- All

- alternative

- alternative finance

- alternatives

- an

- and

- approach

- ARE

- artificial

- artificial intelligence

- Assets

- At

- average

- backdrop

- Bank

- bank of canada

- Banking

- BE

- become

- behavioural

- Big

- Bitcoin

- blockchain

- BoC

- broaden

- businesses

- by

- cache

- Canada

- Canadians

- card

- Cards

- Cash

- cash withdrawals

- catering

- Chart

- closely

- community

- consumer

- Contactless

- contactless payments

- continuous

- Convenient

- country

- COVID-19

- COVID-19 pandemic

- create

- credit

- credit card

- Crowdfunding

- cryptocurrency

- currencies

- Cusp

- data

- Debit

- decade

- decentralized

- Despite

- digital

- digital age

- Digital Assets

- digital currencies

- distributed

- ecosystem

- Education

- enduring

- engaged

- ensure

- essential

- Ether (ETH)

- evolving

- Feds

- Figures

- finance

- financial

- financial innovation

- Financial institutions

- financial services

- fintech

- For

- from

- funding

- funding opportunities

- further

- get

- Global

- Global Payments

- Government

- had

- Half

- Handling

- Held

- helps

- High

- highlighting

- highlights

- http

- HTTPS

- image

- Impact

- in

- includes

- Including

- Inclusivity

- Increase

- indicating

- industry

- inflation

- information

- Innovation

- innovative

- institutions

- Insurtech

- Intelligence

- into

- investment

- Investopedia

- Jan

- jpg

- landscape

- Laws

- less

- light

- like

- looking

- lower

- made

- Market

- max-width

- McKinsey

- member

- Members

- method

- methods

- mirroring

- Mobile

- mobile payments

- monitoring

- more

- much

- nearly

- Need

- networking

- New

- of

- on

- online

- online shopping

- open

- open banking

- opportunities

- Options

- or

- over

- page

- pandemic

- partners

- past

- payment

- payment method

- payment methods

- payments

- peer to peer

- perks

- plato

- Plato Data Intelligence

- PlatoData

- please

- policymakers

- population

- preferences

- programmable

- projects

- promise

- provides

- purchases

- Rate

- recent

- Regtech

- report

- represent

- research

- resilience

- Rise

- rising

- Role

- s

- saw

- Sectors

- segments

- Services

- Share

- shift

- shines

- Shopping

- Shows

- significant

- since

- small

- spanning

- stakeholders

- Stewardship

- Still

- strategies

- Survey

- technological

- than

- that

- The

- this

- thousands

- Through

- to

- today

- Tokens

- Total

- traditional

- transaction

- Transactions

- Trends

- underscores

- unprecedented

- Usage

- use

- used

- value

- various

- vibrant

- Visit

- volume

- were

- which

- widespread

- will

- with

- Withdrawals

- works

- year

- years

- zephyrnet