Thought Leadership Perspective

“As our CDR expands, there are untold opportunities for innovation by combining datasets from different sectors”

- Kate O’Rourke, Treasury’s First Assistant Secretary for the Consumer Data Right."

Overview of Australia's Consumer Data Right

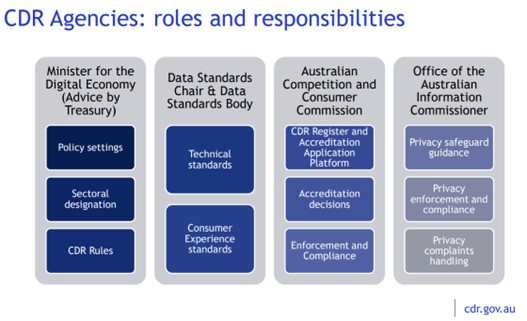

Launched in July 2020 in the banking sector to serve as a testbed, Australia's ambitious economy-wide reform known as the Consumer Data Right (CDR) has expanded since early Q4 2022 to the Energy sector. According to plan a new sector will be assessed and designated every year with Telecommunications being the next sector in line.

The expansion from banking to energy speaks volumes not only about the success of open banking in spite of a low take up according to some sources familiar with the matter but perhaps more importantly it shows the confidence and determination that the authorities have developed in their capability to roll out the multi-year reform. The work around all aspects of open banking might not be finished yet but that is not a roadblock to moving forward, which is a lesson worth keeping in mind, as Canadian committees continue to discuss and agree/challenge their own set of implementation and oversight rules for a made in Canada open banking solution.

Last week, The Australian Financial Review reported that the government has introduced a piece of legislation (“action initiation to CDR”) which is expected to bring significant changes to open banking that should give customers the power to switch banking, energy and telecom providers with only a few clicks of a mouse. Quoting an independent statutory review of the CDR the newspaper added that “screen scraping (common practice globally in countries without banking regulations including in Canada) should be banned in the near future in sectors where the CDR is a viable alternative”.

For our final 2022 open banking thought leadership series article on Canada’s Open Banking Journey, we have reached out to Australia’s CDR Division at the Treasury department to learn more about the vision behind CDR. The team led by Ms Kate O’Rourke works to deliver the Consumer Data Right through strategic policy and rules development, legislation and program management.

We are pleased to share their insightful contributions below, which offers a glimpse into the experience consumers and businesses will enjoy once open banking is fully implemented.

Kate O’Rourke, First Assistant Secretary, Consumer Data Right Division, Australian Treasury

A key foundation of Australia’s growing digital economy, its Consumer Data Right is a game-changing economic reform that will drive competition and innovation across the economy.

Australian consumers can now access the benefits of Open Banking. So far, so good. But in Australia, energy and telecommunications are the next sectors and datasets to be added to its data-sharing program.

The opportunities for innovation in Open Banking are clearly unlimited – faster credit checks, streamlined application processes and even AI-enabled personal finance assistants.

When it expands to the energy sector, Australia’s CDR will help consumers find better deals, encourage new retail products for households and businesses to better manage their energy use and ultimately drive down the cost of energy.

See: Interview with Brenton Charnley, CEO and Founder of Open Finance Advisors, Australia (Ex-TrueLayer ANZ CEO)

Expanding to telecommunications as the third sector, the CDR will help Australian consumers choose products and services that best suit them, while also increasing competition in the sector and driving improved affordability and service offerings. Importantly, when telecommunications data can be combined with a consumer’s banking and energy data, it will provide opportunities for a range of different applications, such as budgeting, cashflow and financial management apps.

Because the CDR is designed to be an economy-wide digital reform, Australia’s Treasury is continuing to identify priority datasets and sectors to ensure the CDR continues to be implemented in a way that maximizes benefits for consumers.

As our CDR expands, there are untold opportunities for innovation by combining datasets from different sectors. When more data is available through the CDR, we’re likely to see rapid growth in time-saving digital solutions for consumers offered by innovative businesses, including our homegrown fintech sector. It will revolutionize the consumer experience across a range of important milestones and decisions in life – like buying your first car, renting an apartment and setting up new energy and internet deals, starting a small business or planning your retirement.

With its whole-of-economy, consumer-led approach, Australia is leading the world in transforming how we all understand and benefit from data.

# # #

Links you may be interested in:

Mahi Sall is an Ambassador of the National Crowdfunding & Fintech Association of Canada “NCFA”, and an Expert on Fintech-Bank Partnerships. He is based in Berlin, Germany.

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://ncfacanada.org/canadas-open-banking-journey-taking-inspiration-from-australias-consumer-data-right-with-kate-orourke-treasurys-first-assistant-secretary-for-the-cdr/

- 100

- 2018

- 2020

- 2022

- a

- About

- access

- According

- across

- added

- advisors

- affiliates

- All

- alternative

- Ambassador

- ambitious

- and

- Apartment

- Application

- applications

- approach

- apps

- around

- article

- aspects

- assessed

- Assets

- Assistant

- Association

- Australia

- Australian

- Authorities

- available

- Banking

- banking sector

- banned

- based

- become

- behind

- being

- below

- benefit

- benefits

- BEST

- Better

- blockchain

- bring

- budgeting

- business

- businesses

- Buying

- cache

- Canada

- Canadian

- car

- ceo

- CEO and Founder

- Changes

- Checks

- Choose

- clearly

- closely

- combined

- combining

- community

- competition

- confidence

- consumer

- consumer data

- consumer experience

- Consumers

- continue

- continues

- continuing

- contributions

- Cost

- countries

- create

- credit

- Crowdfunding

- cryptocurrency

- Customers

- data

- datasets

- Deals

- decentralized

- decisions

- deliver

- Department

- designed

- determination

- developed

- Development

- different

- digital

- Digital Assets

- Digital economy

- discuss

- distributed

- Division

- down

- drive

- driving

- Early

- Economic

- economy

- ecosystem

- Education

- encourage

- energy

- energy use

- engaged

- enjoy

- ensure

- Ether (ETH)

- Even

- expanded

- expands

- expansion

- expected

- experience

- expert

- familiar

- faster

- few

- final

- finance

- financial

- Find

- fintech

- First

- For Consumers

- Forward

- Foundation

- founder

- from

- fully

- funding

- future

- Germany

- get

- Give

- Glimpse

- Global

- Globally

- good

- Government

- Growing

- Growth

- help

- helps

- households

- How

- HTTPS

- identify

- implementation

- implemented

- important

- improved

- in

- Including

- increasing

- independent

- industry

- information

- Innovation

- innovative

- Inspiration

- Insurtech

- Intelligence

- interested

- Internet

- Interview

- introduced

- investment

- IT

- Jan

- journey

- July

- keeping

- Key

- known

- Leadership

- leading

- LEARN

- Led

- Legislation

- lesson

- Life

- likely

- Line

- Low

- made

- manage

- management

- Market

- Matter

- max-width

- maximizes

- member

- Members

- might

- Milestones

- mind

- more

- moving

- MS

- multi-year

- National

- Near

- networking

- New

- Newsletter

- next

- offered

- Offerings

- Offers

- open

- open banking

- opportunities

- Oversight

- own

- partners

- partnerships

- payments

- peer to peer

- perhaps

- perks

- personal

- Personal Finance

- piece

- plan

- planning

- plato

- Plato Data Intelligence

- PlatoData

- please

- pleased

- policy

- power

- practice

- priority

- processes

- Products

- Program

- projects

- provide

- providers

- provides

- range

- rapid

- reached

- reform

- Regtech

- regulations

- Reported

- retail

- retirement

- review

- revolutionize

- Roll

- rules

- sector

- Sectors

- Series

- serve

- service

- Services

- set

- setting

- Share

- should

- Shows

- sign

- significant

- since

- small

- small business

- So

- so Far

- solution

- Solutions

- some

- Sources

- Speaks

- Spite

- stakeholders

- Starting

- Stewardship

- Strategic

- streamlined

- success

- such

- Suit

- Switch

- Take

- taking

- team

- telecom

- telecommunications

- The

- the world

- their

- Third

- thought

- thought leadership

- thousands

- Through

- to

- today

- Tokens

- transforming

- treasury

- Treasury Department

- Ultimately

- understand

- unlimited

- Untold

- use

- viable

- vibrant

- vision

- volumes

- week

- which

- while

- will

- without

- Work

- works

- world

- worth

- year

- Your

- zephyrnet