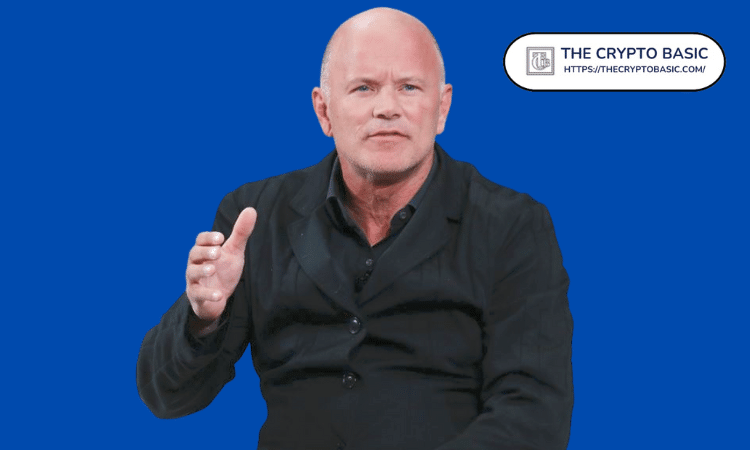

Renowned billionaire investor Mike Novogratz urges people to buy Bitcoin amid the United States’ surging debt and interest payments.

In a recent tweet, the CEO of Galaxy Digital and prominent billionaire investor Mike Novogratz investor and crypto advocate Mike Novogratz issued a resounding call amid concerns over the surging US interest payments reaching new heights.

Specifically, Novogratz exclaimed, “Buy Bitcoin,” in response to market analyst Joe Consorti’s revelation that the United States’ interest payments have skyrocketed to $970 billion. The analyst said the figure marked an alarming increase of $41 billion during the second quarter.

Buy $BTC!!! https://t.co/UyGNaGXzyI

— Mike Novogratz (@novogratz) July 27, 2023

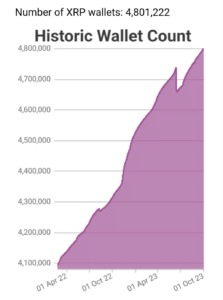

US Interest Payment to Reach $1 Trillion

Consorti’s accompanying graph titled “US Government Annual Interest Expense” further portrayed a stark picture of the US situation. It showed the rise of interest payments from below $400 billion in 2008 to alarming figures projected to be $1 trillion by 2023.

The market analyst highlighted the implications of the mounting interest burden. He argued that as tax receipts continue to fall behind sovereign debt growth, interest payments will increasingly rely on revenue generated from additional debt issuance—a potentially precarious cycle.

Bitcoin as a Hedge

In light of these developments, Mike Novogratz took to Twitter to advocate for Bitcoin. The leading crypto, often called “digital gold,” has gained popularity as a hedge against economic uncertainty and inflation.

Novogratz’s bullish stance on Bitcoin underscores his unwavering belief in its potential to weather economic turbulence. However, Novogratz is not the only financial figure sounding the alarm bells.

Bestselling author and financial expert Robert Kiyosaki recently shared his concerns about the US situation. In a tweet, Kiyosaki questioned the sudden rise in the stock market and attributed it to removing the “Debt Ceiling,” which allows national debt to escalate with the stock market’s gains.

WHY is stock market taking off? Because “Debt Ceiling” removed. Means national debt to rise with stock market. Rich get richer as America gets poorer. Sad. Sticking with real money & real assets: Gold, Silver, Bitcoin.

— Robert Kiyosaki (@theRealKiyosaki) July 14, 2023

He expressed worries that while the rich get richer, the nation, unfortunately, becomes poorer due to increasing debt burdens. Kiyosaki also highlighted his preference for “real money and real assets” to safeguard against financial instability.

He reiterated his trust in time-tested assets like Gold, Silver, and Bitcoin, positioning them as a hedge against the prevailing economic uncertainties.

Follow Us on Twitter and Facebook.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://thecryptobasic.com/2023/07/28/buy-bitcoin-novogratz-exclaims-as-us-interest-payment-projected-to-hit-1-trillion/?utm_source=rss&utm_medium=rss&utm_campaign=buy-bitcoin-novogratz-exclaims-as-us-interest-payment-projected-to-hit-1-trillion

- :has

- :is

- :not

- 11

- 14

- 2008

- 2023

- 27

- a

- About

- Additional

- advice

- advocate

- against

- alarm

- allows

- also

- america

- Amid

- an

- analyst

- and

- annual

- any

- ARE

- argued

- article

- AS

- Assets

- author

- basic

- BE

- because

- becomes

- before

- behind

- belief

- bells

- below

- Billion

- billionaire

- Bitcoin

- burden

- buy

- buy bitcoin

- by

- call

- called

- ceiling

- ceo

- Concerns

- considered

- content

- continue

- crypto

- cycle

- Debt

- decisions

- developments

- digital

- do

- due

- during

- Economic

- economic turbulence

- economic uncertainty

- encouraged

- Ether (ETH)

- expressed

- Fall

- Figure

- Figures

- financial

- financial advice

- For

- from

- further

- gained

- Gains

- Galaxy

- Galaxy Digital

- generated

- get

- Gold

- Government

- graph

- Growth

- Have

- he

- hedge

- heights

- Highlighted

- his

- Hit

- However

- HTTPS

- implications

- in

- include

- Increase

- increasing

- increasingly

- inflation

- Informational

- instability

- interest

- investment

- investor

- Issued

- IT

- ITS

- joe

- Kiyosaki

- leading

- light

- like

- losses

- Making

- marked

- Market

- May..

- means

- mike

- Mike Novogratz

- money

- nation

- National

- New

- Novogratz

- of

- off

- often

- on

- only

- Opinion

- Opinions

- over

- payment

- payments

- People

- personal

- picture

- plato

- Plato Data Intelligence

- PlatoData

- popularity

- portrayed

- positioning

- potential

- potentially

- projected

- prominent

- Quarter

- Questioned

- reach

- reaching

- readers

- real

- real assets

- Real money

- receipts

- recent

- recently

- reflect

- rely

- Removed

- removing

- research

- resounding

- response

- responsible

- revenue

- Rich

- Rise

- ROBERT

- robert kiyosaki

- s

- Said

- Second

- second quarter

- shared

- should

- showed

- Silver

- situation

- sovereign

- stark

- sticking

- stock

- stock market

- sudden

- surging

- taking

- tax

- that

- The

- The Crypto Basic

- Them

- These

- this

- titled

- to

- took

- Trillion

- true

- Trust

- turbulence

- tweet

- uncertainties

- Uncertainty

- underscores

- unfortunately

- United

- unwavering

- urges

- us

- views

- Weather

- which

- while

- will

- with

- zephyrnet