November marked one of the most bullish months for the cryptocurrency market in several years as speculation around the approval of the first spot Bitcoin (BTC) exchange-traded fund (ETF) reignited interest in the asset class as a whole.

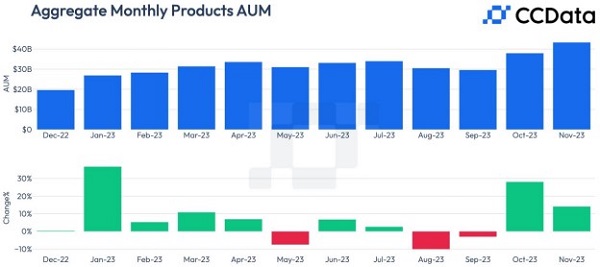

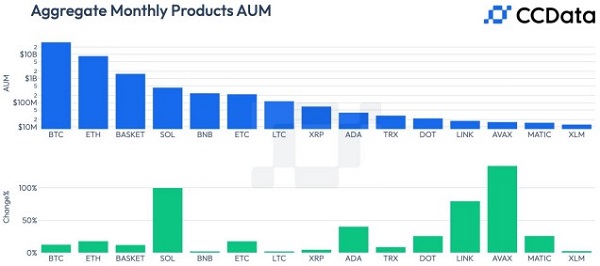

According to the November Digital Asset Management Review report from CCData, the assets under management (AUM) of digital asset investment products grew by 14.1% to $43.3 billion, bringing the cumulative 2023 increase to 120%.

“This recent upswing follows the growing prominence of ETF discussions, with an increasing number of institutions participating in the race for Ether spot ETF, and the rising likelihood of the approval of a Bitcoin spot ETF,” the report said. “The momentum in Bitcoin’s price, which surpassed $38,000 on November 24th, also served as a catalyst for the rise in AUM.”

Aggregate monthly products AuM. Source: CCData

CCData noted that “WisdomTree, BlackRock, Fidelity, Global X, Franklin Templeton, Hashdex, Ark Invest, 21Shares, and Grayscale all engaged with the SEC to either file for ETFs based on Spot Bitcoin and Ether, to discuss prospects and proposals for their ETF applications or to receive delay for their ETF decisions” in November.”

“These events mark a notable surge in the push for regulatory approval of crypto-based ETFs, highlighting the growing interest and mainstream acceptance of cryptocurrency investments among traditional financial institutions,” the report said.

Year-to-date, the AUM for Bitcoin-based products has increased 12.5% to approximately $31.8 billion, “further solidifying their dominance with a substantial annual growth of 140%,” the report said. The AUM for Ether-related products increased by 17.8%, which pushed their valuation to over $8.55 billion, representing an increase of 75.6% since 2022.

“The basket category, also experienced growth, rising by 12.0% reaching $1.57 billion,” the report said. “Products based on Solana recorded an extraordinary monthly surge of nearly 99.9%, propelling their AUM to roughly $424 million.”

Aggregate monthly products AuM. Source: CCData

Products listed in the U.S. grew by 11.5% to hit $32.5 billion in AUM, which solidified its market dominance with a market share of 75.2%. Canada saw a 29.0% increase, now at $3.24 billion, representing 7.50% of the market.

Trading volumes also picked up, increasing by 35.3% to $481 million. “This surge in volume, primarily propelled by companies like Grayscale and ProShares, underscores the profound influence a Bitcoin spot ETF might have on the market,” the report said. “Furthermore, these recorded volume levels, the highest since March 2022, evoke sentiments of a bull market and showcase increased investor confidence in the market.”

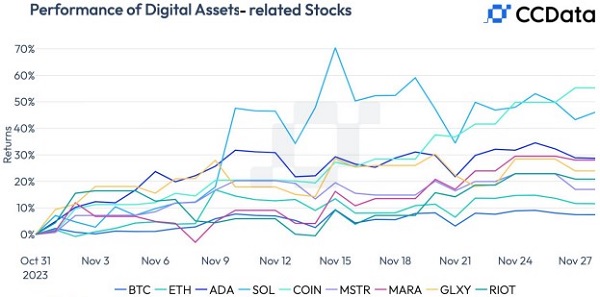

The stocks for digital asset-related companies also experienced notable gains, led by a 55.3% rise in the price of Coinbase (COIN). “Marathon Digital Holdings (MARA) and Galaxy Digital Holdings (GLXY) also delivered significant increases of 28.0% and 24.0%, respectively,” the report said. “This robust performance came amid an overall uptick in the stock market, as evidenced by the S&P 500’s solid 8.50% growth.”

Performance of digital asset-related stocks. Source: CCData

Retail joins the party

It wasn’t just listed products that have seen a rise in activity and volume as Flipside Crypto’s “Crypto Economy Snapshot” report for November shows that there were “multiple breakout moments in terms of DeFi volume and an upswing in NFT trading activity.”

Decentralized exchange (DEX) “transaction volume has swung wildly in recent weeks following a news-heavy month, spanning SEC actions against Binance and Kraken and institutional crypto fund headlines,” the report said. “DEX volume peaked at $4.06b on November 9, around the same time rumors broke of a BlackRock Ether ETF, and the timing of CZ’s ousting from Binance coincided with the second largest DEX volume spike of the month.”

Flipside Crypto analyzed activity across the seven most popular Ethereum Virtual Machine (EVM) compatible networks – including Ethereum, Arbitrum, BSC, Optimism, Avalanche, Polygon, and Base – and found that “There were 57 million daily active users (as measured by externally owned accounts [EOAs]).”

More notable was the fact that November saw a surge in new wallet creation. “Nearly 19 million new users/wallets that executed at least one transaction were created in November,” the report said. “Most EVM networks experienced a burst in new wallet creation the second week of November, in line with rumors of positive regulatory developments within the US’ Bitcoin and Ethereum ETF landscape, although Polygon and Base were the only networks to achieve sustained new user growth throughout the entire month.”

The total value locked (TVL) across the chains grew by more than $8 billion in November, an increase of 13.4%. “One possible reason may be that more crypto users opted to lock their assets in DeFi protocols to earn yield rather than engage in frequent trading, potentially due to market uncertainty or the expectation of future gains,” Flipside Crypto said.

Link:https://www.kitco.com/news/2023-11-30/Bullish-month-for-crypto-tokens-stocks-and-platforms-see-spike-during-November.html?utm_source=pocket_saves

Source: https://www.kitco.com

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.fintechnews.org/bullish-month-for-crypto-tokens-stocks-and-platforms-see-spike-during-november/

- :has

- ][p

- $3

- $UP

- 000

- 11

- 12

- 13

- 14

- 17

- 19

- 2%

- 2022

- 2023

- 21Shares

- 24

- 24th

- 28

- 29

- 35%

- 7

- 75

- 8

- 9

- a

- acceptance

- Accounts

- Achieve

- across

- actions

- active

- activity

- against

- All

- also

- Although

- Amid

- among

- an

- analyzed

- and

- annual

- applications

- approval

- approximately

- arbitrum

- Ark

- ark invest

- around

- articles

- AS

- asset

- asset class

- asset management

- Assets

- At

- Avalanche

- base

- based

- basket

- BE

- Billion

- binance

- Bitcoin

- bitcoin and ethereum

- Bitcoin spot etf

- BlackRock

- breakout

- Bringing

- Broke

- BSC

- bull

- Bull Market

- Bullish

- by

- came

- Canada

- Catalyst

- Category

- chains

- class

- Coin

- coinbase

- Coinbase (COIN)

- coincided

- Companies

- compatible

- confidence

- created

- creation

- crypto

- crypto fund

- crypto users

- crypto-based

- cryptocurrency

- cryptocurrency market

- CZ’s

- daily

- DeFi

- DeFi protocols

- delay

- delivered

- developments

- Dex

- DEX Volume

- digital

- Digital Asset

- Digital Asset Management

- discuss

- discussions

- Dominance

- due

- during

- earn

- economy

- either

- engage

- engaged

- Entire

- ETF

- ETFs

- Ether

- ethereum

- ethereum virtual machine

- Ethereum Virtual Machine (EVM)

- events

- evidenced

- EVM

- exchange

- exchange-traded

- exchange-traded fund (ETF)

- executed

- expectation

- experienced

- externally

- extraordinary

- fact

- fidelity

- File

- financial

- Financial institutions

- First

- flipside

- FLIPSIDE CRYPTO

- following

- follows

- For

- found

- franklin

- frequent

- from

- fund

- future

- Gains

- Galaxy

- Galaxy Digital

- Galaxy Digital Holdings

- Global

- GLXY

- Grayscale

- grew

- Growing

- growing interest

- Growth

- HASHDEX

- Have

- Headlines

- highest

- highlighting

- Hit

- Holdings

- HTML

- HTTPS

- in

- Including

- Increase

- increased

- Increases

- increasing

- influence

- Institutional

- institutions

- interest

- Invest

- investment

- Investments

- investor

- ITS

- Joins

- jpg

- just

- Kitco

- Kraken

- landscape

- largest

- least

- Led

- levels

- like

- likelihood

- Line

- Listed

- locked

- machine

- Mainstream

- management

- Mara

- March

- mark

- marked

- Market

- Market Dominance

- market share

- max-width

- May..

- measured

- might

- million

- Moments

- Momentum

- Month

- monthly

- months

- more

- most

- Most Popular

- nearly

- networks

- New

- NFT

- NFT trading

- notable

- noted

- November

- now

- number

- of

- on

- ONE

- only

- Optimism

- or

- over

- overall

- owned

- participating

- performance

- picked

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- Polygon

- Popular

- positive

- positive regulatory developments

- possible

- potentially

- price

- primarily

- Products

- products increased

- profound

- prominence

- propelled

- propelling

- Proposals

- ProShares

- prospects

- protocols

- Push

- pushed

- Race

- rather

- reaching

- reason

- receive

- recent

- recorded

- regulatory

- regulatory approval

- report

- representing

- respectively

- Rise

- rising

- robust

- roughly

- Rumors

- s

- S&P

- Said

- same

- saw

- SEC

- Second

- see

- seen

- sentiments

- served

- seven

- several

- Share

- showcase

- Shows

- significant

- since

- Solana

- solid

- solidifying

- Source

- spanning

- speculation

- spike

- Spot

- spot etf

- stock

- stock market

- Stocks

- substantial

- surge

- surpassed

- sustained

- templeton

- terms

- than

- that

- The

- their

- There.

- These

- throughout

- time

- timing

- to

- Tokens

- Total

- total value locked

- Trading

- traditional

- transaction

- TVL

- u.s.

- Uncertainty

- under

- underscores

- User

- users

- Valuation

- value

- Virtual

- virtual machine

- volume

- volumes

- Wallet

- was

- week

- Weeks

- were

- which

- whole

- with

- within

- X

- years

- Yield

- zephyrnet