Bitcoin’s (BTC) restoration is going through stiff resistance close to $48,500, indicating that bears are energetic at larger ranges.

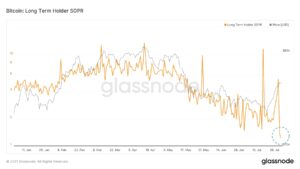

By combining the favored stock-to-flow Bitcoin value mannequin and the illiquid provide knowledge, analyst William Clemente initiatives $39,000 to act as a strong floor on any declines.

On the upside, analysts stay bullish. Bloomberg Intelligence chief analyst Mike McGlone has maintained his goal of $100,000 for Bitcoin. McGlone mentioned that numerous totally different charts underline the bullish potential for Bitcoin.

Along with Bitcoin, Ether (ETH) can be displaying indicators of accumulation. Crypto analytics supplier IntoTheBlock mentioned $1.2 billion worth of Ether was withdrawn inside a 24-hour interval from centralized exchanges on Sept. 16. After the same prevalence in April, Ether had rallied about 60% in 30 days.

Could the highest two cryptocurrencies reside as much as their bullish projections or will crypto markets shock to the draw back? Let’s examine the charts of the highest 10 cryptocurrencies to seek out out.

BTC/USDT

The bulls are trying to maintain Bitcoin above the 20-day exponential transferring common (EMA) ($47,291) whereas bears try to drag the worth beneath it. The 20-day EMA has flattened out and the relative energy index (RSI) is near the midpoint, suggesting a range-bound motion within the brief time period.

If bears sink the worth beneath the transferring averages, the BTC/USDT pair may drop to the vital assist at $42,451.67. A rebound off this stage will point out that bulls are accumulating on dips. That could prolong the consolidation between $42,451.67 and $52,920 for just a few extra days.

On the opposite, if the worth rebounds off the present stage or the 50-day easy transferring common (SMA) ($46,256), the bulls will attempt to push the pair to $50,500 after which to $52,920. The bears are more likely to defend this resistance zone aggressively.

The subsequent main trending transfer is more likely to start after bulls drive the worth above $52,920 or if bears pull the worth beneath $42,451.67.

ETH/USDT

Ether’s (ETH) restoration is going through stiff resistance on the 61.8% Fibonacci retracement stage at $3,637.14, indicating promoting at larger ranges. The bears are trying to sink the worth again beneath the assist at $3,377.89.

If they succeed, the ETH/USDT may drop to the 50-day SMA ($3,238) after which to the vital assist at $3,000. Such a transfer could consequence within the formation of a head and shoulder sample, which is able to full on a break and shut beneath $3,000.

This unfavourable view will invalidate if the worth rebounds off the assist at $3,377.89 or the 50-day SMA and breaks above $3,676.28. The pair may then retest the native excessive at $4,027.88.

The flattish 20-day EMA and the RSI simply above the midpoint don’t point out a transparent benefit both to the bulls or the bears.

ADA/USDT

Cardano (ADA) turned down from the 20-day EMA ($2.52) on Sept. 16, suggesting that bears are promoting on rallies to this resistance. The bears are at the moment trying to drag the worth to the 50-day SMA ($2.25).

The downsloping 20-day EMA and the RSI within the unfavourable zone counsel that bears are in command. If the worth sustains beneath the 50-day SMA, the ADA/USDT pair may drop to the subsequent assist at $1.94.

Such a deep correction will counsel {that a} short-term prime has been made. If bulls need to salvage the uptrend, they should push and maintain the worth above the 20-day EMA. If they do this, the pair may as soon as once more rally to $2.80 after which to $2.97.

BNB/USDT

The bulls did not push Binance Coin (BNB) above the 20-day EMA ($432) previously two days, indicating that purchasing dries up at larger ranges. This could have attracted profit-booking from short-term merchants who purchased at decrease ranges, anticipating a resumption of the up-move.

The 20-day EMA is sloping down and the RSI turned down from the midpoint, suggesting benefit to the sellers. If the worth sustains beneath the 50-day SMA, the BNB/USDT pair may drop to the subsequent main assist at $340.

This unfavourable view will likely be invalidated if the bulls push and maintain the worth above the 20-day EMA. Such a transfer will counsel that the bulls have absorbed the availability. The pair may then rise to the overhead resistance at $518.90.

XRP/USDT

Ripple (XRP) turned down from the 20-day EMA ($1.12) on Sept. 16, indicating that bears are defending this stage aggressively. The downsloping 20-day EMA and the RSI within the unfavourable zone counsel that the trail of least resistance is to the draw back.

If bears maintain the worth beneath the 50-day SMA, the XRP/USDT pair may retest the Sept. 7 intraday low at $0.95. A break and shut beneath this assist will open the doorways for a deeper correction to $0.75.

If the worth rebounds off the present stage or from $0.95, the bulls will once more attempt to push the worth above the 20-day EMA. If they succeed, it should counsel that the correction may very well be over. The pair could then begin its northward march towards $1.35.

SOL/USDT

Solana’s (SOL) bounce off the 20-day EMA ($145) on Sept. 14 fizzled out at $166.50 as bears continued to pounce on aid rallies. The value has slipped beneath the 20-day EMA at the moment, indicating weak point.

The flattening 20-day EMA and the RSI simply above the midpoint counsel that bulls have misplaced their grip. If bears maintain the worth beneath the 20-day EMA, the SOL/USDT pair may decline to the 61.8% Fibonacci retracement stage at $123.42.

This is a vital assist to be careful for as a result of if it cracks, the pair may plunge to psychological assist at $100.

Conversely, if the worth turns up from the present stage or rebounds off $123.42, the bulls will attempt to resume the uptrend. The up-move may face stiff resistance close to $170 after which at $200.

DOT/USDT

Polkadot (DOT) turned down from the resistance line on Sept. 15 and dropped near the 20-day EMA ($32.04) on Sept.. This is a vital stage for the bulls to defend as a result of a break beneath it may pull the worth all the way down to the 50-day SMA ($26.36).

Although the transferring averages are sloping up, the unfavourable divergence on the RSI warns that the bullish momentum may very well be slowing down. A break and shut beneath the 50-day SMA may counsel the beginning of a deeper correction.

Contrary to this assumption, if the worth rebounds off the 20-day EMA, the bulls will once more attempt to propel the DOT/USDT pair above the resistance line. If they handle to try this, the pair may decide up momentum and rally to $41.40 after which retest the all-time excessive at $49.78.

Related: Next stop $85K for Bitcoin as analysts predict ‘explosive’ Q4 for BTC price action

DOGE/USDT

Although Dogecoin (DOGE) has been trading beneath the transferring averages for the previous few days, the bears haven’t been in a position to sink the worth to the speedy assist at $0.21. This suggests an absence of sellers at decrease ranges.

The bulls tried to push the worth above the transferring averages at the moment however the bears are in no temper to relent. The downsloping 20-day EMA ($0.26) and the RSI beneath 42 point out that sellers have the higher hand.

If bears sink the worth beneath $0.21, the DOGE/USDT pair may prolong the decline to $0.15. Alternatively, if bulls drive the worth above the transferring averages, the pair may rise to the downtrend line.

A break and shut above this resistance would be the first signal that the correction could also be over. The pair may then begin its journey towards the overhead resistance at $0.45.

UNI/USDT

Uniswap (UNI) surged above the transferring averages on Sept. 15 however the bulls couldn’t push the worth above the downtrend line, which can have attracted profit-booking by the short-term bulls and shorting by the aggressive bears.

The flat 20-day EMA ($25.72) and the RSI slightly below 50 point out a marginal benefit to the bears. If the worth sustains beneath $25, the bears will attempt to pull the UNI/USDT pair to $23.50 after which to $21. If this assist cracks, it should point out the beginning of a deeper correction.

On the opposite, if the worth rebounds off the present stage or $23.50, the bulls will once more attempt to drive the worth above the downtrend line. If they succeed, the pair may transfer as much as the overhead resistance at $31.41.

LUNA/USDT

Terra protocol’s LUNA token rose to $39.77 on Sept. 16 however couldn’t maintain the upper ranges as seen from the lengthy wick on the day’s candlestick. This means that merchants could also be closing their lengthy positions on rallies.

The bears will now attempt to seize the chance and sink the worth beneath the 20-day exponential transferring common ($33.97). If they handle to try this, the LUNA/USDT pair may decline to the 50-day SMA ($26.26).

Alternatively, if the worth once more rebounds off the 20-day EMA, the pair may rise to $40 and stay range-bound between these two ranges for just a few extra days. A breakout and shut above $40 may open the doorways for a retest of the all-time excessive at $45.01.

The views and opinions expressed listed below are solely these of the writer and don’t essentially mirror the views of Cointelegraph. Every funding and trading transfer entails danger. You ought to conduct your individual analysis when making a choice.

Market knowledge is supplied by HitBTC change.

Source: https://btcupload.com/latest-cryptocurrency-news/btc-eth-ada-bnb-xrp-sol-dot-doge-uni-luna- 000

- 67

- 7

- 77

- ADA

- All

- analysis

- analyst

- analytics

- April

- availability

- Bears

- Billion

- binance

- Binance Coin

- Bitcoin

- Bloomberg

- bnb

- BNB/USDT

- breakout

- BTC

- btc price

- BTC/USDT

- Bullish

- Bulls

- change

- Charts

- chief

- Coin

- Cointelegraph

- Common

- consolidation

- crypto

- Crypto Markets

- cryptocurrencies

- cryptocurrency

- cryptocurrency market

- day

- DID

- Doge

- DOGE/USDT

- Dogecoin

- DOT/USDT

- Drop

- dropped

- efficiency

- EMA

- energy

- ETH

- ETH/USDT

- Ether

- Exchanges

- Face

- First

- full

- funding

- head

- HTTPS

- index

- Intelligence

- intotheblock

- IT

- knowledge

- Line

- Making

- March

- Market

- Markets

- Merchants

- mike mcglone

- mirror

- Momentum

- Near

- open

- Opinions

- present

- price

- rally

- Seize

- Sellers

- Shorting

- Slowing

- Stage

- start

- stay

- time

- token

- Trading

- trending

- UNI

- UNI/USDT

- value

- View

- WHO

- within

- worth

- writer

- xrp

- XRP/USDT