Bitcoin (BTC) lastly broke above the $50,500 resistance and Ether (ETH) has risen above the $4,000 mark. This suggests that there’s rising curiosity in cryptocurrencies and several other legacy finance corporations are initiating steps to faucet into this rising demand.

One of the world’s largest unbiased asset managers, Franklin Templeton, has posted fresh job applications for medium to senior-level positions in crypto trading and analysis, in keeping with Linkedin job postings.

Meanwhile, in Japan, monetary conglomerate SBI Holdings is planning to arrange one of many first crypto funds in the country by the top of November. Tomoya Asakura, the director and senior managing govt officer at SBI, mentioned that the launch of a second fund shall be explored relying on the success of the primary one.

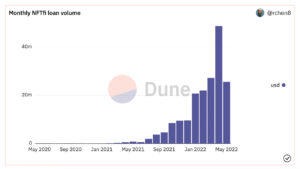

While crypto merchants are cheering the current run-up in a number of altcoins, JPMorgan analysts have warned their clients that the altcoin rally and nonfungible tokens (NFT) are getting frothy.

The analysts mentioned that the altcoins share of the crypto market trading surged from 22% in the beginning of August, to 33%, which is excessive in comparison with historic requirements. They consider the reason being “froth and retail investor ‘mania’ rather than a reflection of a structural uptrend.”

Could Bitcoin maintain above $50,500 and resume its uptrend or will altcoins stay in focus? Let’s research the charts of the top-10 cryptocurrencies to search out out.

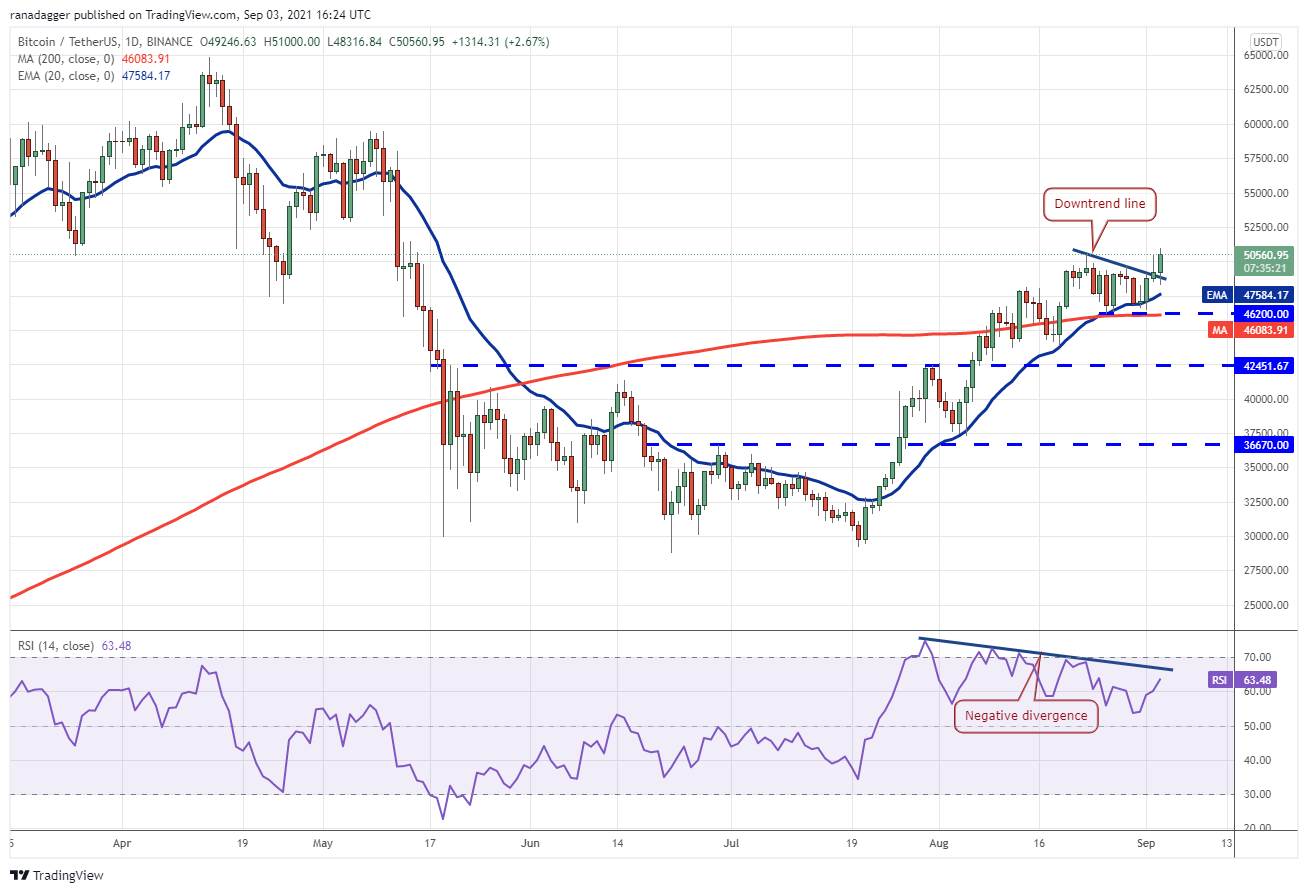

BTC/USDT

The bears efficiently defended the $50,500 resistance on Sep. 2 however they might not pull and maintain the value again under the downtrend line. This might have attracted shopping for from the bulls who’ve pushed Bitcoin above $50,500 at this time.

If consumers maintain the value above $50,500, the BTC/USDT pair might rally to $60,000. This stage could once more act as a stiff resistance but when bulls can thrust the value above it, the pair might problem the all-time excessive at $64,854.

If bulls drive the relative energy index (RSI) above the downtrend line, it would invalidate the damaging divergence. That together with the upsloping 20-day exponential transferring common ($47,584) point out that the trail of least resistance is to the upside.

This bullish view will invalidate if the value turns down from the present stage and breaks under the 200-day easy transferring common ($46,083). That might pull the value right down to $42,451.67.

ETH/USDT

Ether picked up momentum after breaking above $3,377.89 and hit the $4,000 mark at this time. If bulls maintain the value above this psychological stage, the most important altcoin might problem the all-time excessive at $4,372.72.

The upsloping 20-day EMA ($3,344) and the RSI within the overbought zone recommend that bulls are in management. If consumers push the value above $4,372.72, the ETH/USDT pair might begin its journey towards the vital stage at $5,000.

This is probably not straightforward as bears are prone to produce other plans. They are prone to mount a stiff resistance within the $4,000 to $4,372.72 zone. If the value turns down from this zone and breaks under $3,700, the pair could drop to the 20-day EMA.

A robust rebound off this help will recommend that the sentiment stays bullish. The consumers will then attempt to resume the up-move. Conversely, a break and shut under the 20-day EMA would be the first signal that bulls could also be shedding their grip.

ADA/USDT

Cardano (ADA) broke above the $3 mark on Sep. 2 however the bulls couldn’t maintain the upper ranges as seen from the lengthy wick on the day’s candlestick. Although the value dipped again under $2.97 at this time, the bulls purchased the dip and are once more making an attempt to drive the value above $3.

A breakout and shut above $3.10 will sign the resumption of the uptrend. The ADA/USDT pair might then rally to $3.50. The 20-day EMA ($2.58) favors the bulls however the damaging divergence on the RSI signifies that the bullish momentum could also be weakening.

If bulls fail to drive the value above the overhead resistance, the pair could drop to the 20-day EMA. This is a vital stage for the bulls to defend. A robust rebound off it would recommend that the sentiment stays optimistic.

Conversely, a break under the 20-day EMA could pull the value to the breakout stage at $2.47. A break under this help might begin a deeper correction.

BNB/USDT

Binance Coin (BNB) has been trading between the 20-day EMA ($456) and the overhead resistance at $518.90. The lengthy wick on the Sep. 2 candlestick means that bears are promoting above $500 however the optimistic signal is that bulls should not giving up a lot floor.

The consumers will once more attempt to push and maintain the value above $518.90. If they handle to do this, the BNB/USDT pair might decide up momentum and rally to $600. This psychological stage could act as a resistance but when bulls clear this hurdle, the rally could prolong to $680.

Conversely, if the value turns down from the overhead resistance and dips under the 20-day EMA, the pair could slide to $433. A break under this stage will recommend that bears have overpowered the bulls. The pair could then decline to the 200-day SMA ($375).

XRP/USDT

The bulls pushed XRP above the downtrend line on Sep. 2, invalidating the creating bearish descending triangle sample. The bears tried to tug and maintain the value under the downtrend line at this time however failed.

If bulls maintain the value above the downtrend line, the XRP/USDT pair might rally to $1.35. This stage could act as a resistance and if the value turns down from it, the pair could commerce between $1.05 and $1.35 for just a few days.

The 20-day EMA ($1.15) has turned up and the RSI has risen above 64, indicating that bulls have the higher hand. A breakout and shut above $1.35 might clear the trail for a rally to $1.66. The bears must pull the value under $1.05 to sign a comeback.

SOL/USDT

The bears tried to stall Solana’s (SOL) uptrend at $130 however the bulls had been in no temper to relent. The consumers didn’t enable the value to interrupt under the psychological help at $100.

Buying resumed on Sep. 2 and the bulls have prolonged the SOL/USDT pair to a brand new all-time excessive at this time. Vertical rallies are not often sustainable and so they often lead to sharp declines. The RSI above 88 additionally signifies the pair is overextended within the brief time period.

If the value turns down from the present stage or $150, the primary help is on the 38.2% Fibonacci retracement stage at $115.75.

A robust rebound off this stage will recommend energy and enhance the potential of a break above $150. The subsequent goal on the upside is $166.97. On the opposite, a break under $115.75 might pull the value right down to the 50% retracement stage at $106.29.

DOGE/USDT

Dogecoin (DOGE) broke above the 20-day EMA ($0.28) on Sept. 1 and bulls pushed the value above the downtrend line of the falling wedge sample on Sept. 2. However, the lengthy wick on the day’s candlestick confirmed that bears had been promoting at larger ranges.

The DOGE/USDT pair has bounced off the 20-day EMA and the bulls have pushed the value above the wedge. If consumers maintain the value above $0.31, the pair might rally to $0.35. This stage is prone to act as a powerful resistance.

If the value turns down from $0.35, the pair could once more drop to the 20-day EMA. A robust rebound off it would recommend that the sentiment is optimistic. A breakout and shut above $0.35 might clear the trail for an up-move to $0.45.

On the opposite hand, if the value turns down and breaks under the 20-day EMA, the pair could drop to the help line of the wedge.

DOT/USDT

Polkadot (DOT) has been sustaining above the breakout stage at $28.60 for the previous three days, indicating the beginning of a brand new uptrend. The rising transferring averages and the RSI within the overbought territory point out benefit to consumers.

If bulls drive the value above $33.84, the DOT/USDT pair might begin its northward journey towards $41.40 after which to the sample goal at $46.83.

On the opposite hand, if the value turns down from the present stage, the value could retest the breakout stage at $28.60. If bulls flip this stage into help, it could act as a launchpad for the subsequent leg of the up-move.

A break and shut under the 20-day EMA ($27.12) would be the first signal that the present breakout could have been a bull lure.

Related: How to prepare for the end of the bull run, Part 1: Timing

UNI/USDT

Uniswap’s (UNI) up-move turned down from $31.41 on Sept. 2, suggesting that the bears haven’t thrown within the towel but. The value motion of the previous few days has fashioned a damaging divergence on the RSI, indicating that the bullish momentum could also be weakening.

If the value rebounds off the 20-day EMA ($27.91), the bulls will make another try and push the UNI/USDT pair above the overhead resistance at $31.41. If they succeed, the pair could begin its journey to $37.52 after which to $42.25.

Alternatively, if bears sink the value under the transferring averages, the pair could drop to $25 and stay range-bound for just a few extra days. A break and shut under the $25 to $23.45 help zone will sign that bears are again within the sport.

LINK/USDT

Chainlink (LINK) had been range-bound between $24 and $30 for the previous few days. The bulls pushed the value above the overhead resistance on Sept. 2 however they might not maintain the upper ranges.

The bulls once more purchased the dip at this time and have propelled the value above the overhead resistance. If consumers maintain the value above $30, the LINK/USDT pair might rally to $36 and if that stage is crossed, the up-move could attain $43.50, which is the May 19 intraday excessive.

The 20-day EMA ($26.99) has began to show up and the RSI is within the optimistic territory, indicating that consumers have the higher hand. Contrary to this assumption, if the value turns down and breaks under $30, it would recommend that the range-bound motion could proceed for just a few extra days.

The views and opinions expressed listed below are solely these of the writer and don’t essentially mirror the views of Cointelegraph. Every funding and trading transfer entails threat. You ought to conduct your individual analysis when making a call.

Market information is offered by HitBTC change.

Source: https://btcupload.com/latest-cryptocurrency-news/btc-eth-ada-bnb-xrp-sol-doge-dot-uni-link- 000

- 67

- 84

- ADA

- Altcoin

- Altcoins

- analysis

- applications

- asset

- AUGUST

- bearish

- Bears

- Bitcoin

- bnb

- BNB/USDT

- breakout

- BTC

- BTC/USDT

- Bull Run

- Bullish

- Bulls

- call

- change

- Charts

- Coin

- Cointelegraph

- Commerce

- Common

- Consumers

- Corporations

- Creating

- crypto

- Crypto Market

- crypto trading

- cryptocurrencies

- cryptocurrency

- cryptocurrency market

- curiosity

- Current

- day

- Demand

- Director

- Doge

- DOGE/USDT

- DOT/USDT

- Drop

- efficiency

- EMA

- energy

- ETH

- ETH/USDT

- Ether

- finance

- First

- Focus

- fund

- funding

- funds

- Giving

- HTTPS

- index

- information

- investor

- IT

- Japan

- Job

- keeping

- launch

- lead

- Line

- LINK

- LINK/USDT

- Making

- management

- mark

- Market

- medium

- Merchants

- mirror

- Momentum

- NFT

- Officer

- Opinions

- Other

- planning

- present

- rally

- Requirements

- research

- retail

- Run

- SBI

- SBI Holdings

- Search

- sentiment

- Share

- Shopping

- So

- Sport

- Stage

- stay

- success

- sustainable

- time

- Tokens

- top

- Trading

- UNI

- UNI/USDT

- value

- View

- within

- writer

- XRP/USDT