- Bitcoin whales acquire 30,000 BTC worth $1 billion in the past week, driven by increasing Bitcoin spot ETF applications.

- Institutional activity in BTC on the rise, with an uptick in large BTC transactions above $100,000.

- BTC’s recent surge brings it above $35,000, gaining 15% in the past week.

On-chain data indicates Bitcoin whales have been aggressively accumulating in recent days, purchasing over 30,000 BTC worth about $1 billion over the last week.

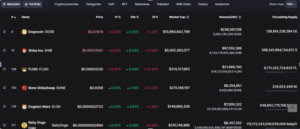

According to crypto analyst Ali, the rush of Bitcoin spot ETF applications appears to be fueling increased appetite for Bitcoin among whales and institutions. Blockchain analytics platform IntoTheBlock also shows institutional activity rising for the top cryptocurrency.

The number of large BTC transactions worth over $100,000 has reached new highs in 2023. These spiked in late June following BlackRock’s ETF application and have now exceeded that level as BTC hits fresh yearly highs above $35,000.

After briefly topping $35,000 for the first time since May 2022, Bitcoin has gained approximately 15% over the past week. It recently settled around $34481 at press time.

Bitcoin movement shows signs of a bull run

So far in 2023, BTC has risen over 66%, potentially signaling the early stage of a new bull market. Short-term momentum is accelerating, yet the BTC market value to realized value ratio indicates the bull run likely has room to continue.

The recent $35,000 high marks the next resistance level for BTC. A break above could open the door to $38,000–39,000. But even if a correction occurs, analysts say support appears strong at around $30,000.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://thenewscrypto.com/bitcoin-whales-aggressively-accumulating-data-shows/

- :has

- :is

- $1 billion

- 000

- 15%

- 2022

- 2023

- 26

- 30

- 31

- 32

- 36

- a

- About

- above

- accelerating

- acquire

- activity

- aggressively

- also

- among

- an

- analyst

- Analysts

- analytics

- and

- appears

- appetite

- Application

- applications

- approximately

- around

- AS

- At

- BE

- been

- Billion

- Bitcoin

- Bitcoin spot etf

- bitcoin whales

- blockchain

- BLOCKCHAIN ANALYTICS

- border

- Break

- briefly

- Brings

- BTC

- btc transactions

- bull

- Bull Market

- Bull Run

- but

- buttons

- by

- content

- continue

- could

- crypto

- crypto analyst

- cryptocurrency

- Cryptocurrency Industry

- data

- Days

- Door

- driven

- Early

- early stage

- editor

- entered

- ETF

- Even

- exceeded

- far

- First

- first time

- following

- For

- fresh

- gained

- gaining

- Have

- High

- Highs

- Hits

- HTTPS

- if

- in

- increased

- increasing

- indicates

- industry

- Institutional

- institutions

- intotheblock

- IT

- journalist

- june

- large

- Last

- Late

- Level

- likely

- love

- Market

- market value

- max-width

- May..

- Momentum

- movement

- New

- next

- now

- number

- of

- on

- open

- out

- over

- passion

- past

- PHP

- platform

- plato

- Plato Data Intelligence

- PlatoData

- potentially

- press

- purchasing

- ratio

- reached

- realized

- recent

- recently

- Resistance

- Rise

- Risen

- rising

- Room

- Run

- rush

- say

- Settled

- Share

- short-term

- Shows

- Signs

- since

- Spot

- spot etf

- Stage

- strong

- support

- surge

- SVG

- that

- The

- These

- time

- to

- top

- Transactions

- value

- week

- whales

- WHO

- with

- worth

- writer

- writing

- yearly

- yet

- zephyrnet