Get all the essential market news and expert opinions in one place with our daily newsletter. Receive a comprehensive recap of the day’s top stories directly to your inbox. Sign up here!

(Kitco News) – Little changed in the macro picture for the crypto market on Tuesday as Bitcoin continued to trade above support at $26,000, and as the U.S. Congress entered “crisis mode” ahead of an anticipated government shutdown that will start on Sunday, Oct. 1.

(Kitco News) – Little changed in the macro picture for the crypto market on Tuesday as Bitcoin continued to trade above support at $26,000, and as the U.S. Congress entered “crisis mode” ahead of an anticipated government shutdown that will start on Sunday, Oct. 1.

The impending shutdown had a notable impact on stocks, which traded lower at the open and remained deep in the red throughout the trading day as the realization that the Federal Reserve won’t be cutting interest rates anytime soon finally set in on Wall Street, leading to a broad sell-off in equities.

Treasury yields further complicated matters as the 10-year note hit 4.564%, its highest level since October 2007, prompting traders to adopt a risk-off approach and instead opt for guaranteed yields. At the close of markets, the S&P, Dow, and Nasdaq were all in the red, down 1.47%, 1.14%, and 1.57%, respectively.

Data provided by TradingView shows that Bitcoin’s (BTC) price continues to experience compression, with the top crypto trading in a range between $26,085 and $26,400 on Tuesday.

BTC/USD Chart by TradingView

“October Bitcoin futures prices [were] weaker in early U.S. trading Tuesday,” according to Kitco senior technical analyst Jim Wyckoff, who said otherwise, there’s “Not much new.”

Bitcoin futures 1-day chart. Source: Kitco

“Bears have the overall near-term technical advantage,” Wyckoff said. “That means the path of least resistance for prices is sideways to lower in the near term – until a solid, bullish technical clue emerges to suggest a near-term market bottom is in place.”

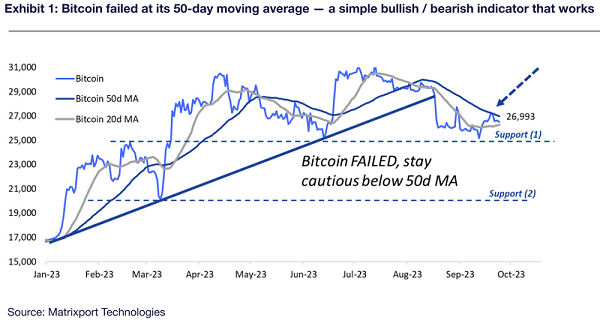

Markus Thielen, head of research at Matrixport, said the current Bitcoin price of $26,197 is “below the 50d MA [moving average], which is bearish.

BTC vs. 50-day MA vs. 20-day MA. Source: Matrixport

“Overall, the market shows a prevailing downtrend, with the outlook staying bearish,” Thielen said. “Although Bitcoin attempted to break its 50d MA, it failed, which could potentially lead to further downside. While October typically exhibits a bullish trend for Bitcoin, we advise caution unless a break over the 50d MA occurs.”

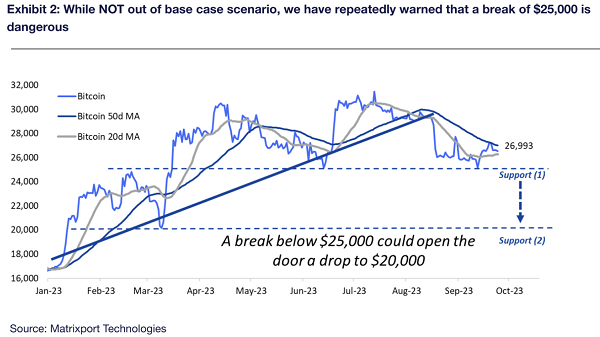

Thielen said that from a technical chart perspective, “Bitcoin’s failure to maintain a level above $27,000 last week necessitates marketing the breaking attempt as unsuccessful. Should Bitcoin trade below $26,000, the market may make another attempt to break lower.”

BTC vs. 50-day MA vs. 20-day MA. Source: Matrixport

Market analyst Rekt Capital warned that “History suggests we could get a revisit of the Macro Higher Low in early 2024.”

BTC/USD 1-week chart. Source: Twitter

Altcoins in the red

Roughly 80% of the tokens in the top 200 traded in the red on Tuesday as the looming government shutdown in the U.S. and high Treasury yields pushed traders to elect for risk-free yields.

Daily cryptocurrency market performance. Source: Coin360

Bone ShibaSwap (BONE) led the gainers with an increase of 9.9%, followed by an 8.95% gain for Terra (LUNA) and an 8.5% increase for Kyber Network (KNC). Astar (ASTR) led the losers with a decline of 5.05%, followed by a 4.5% loss for tomiNet (TOMI) and Immutable (IMX).

The overall cryptocurrency market cap now stands at $1.04 trillion, and Bitcoin’s dominance rate is 48.9%.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

#Bitcoin #trades #flat #U.S #Treasury #yields #surge #government #shutdown #looms

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://cryptoinfonet.com/bitcoin-news/bitcoin-trades-flat-as-u-s-treasury-yields-surge-and-government-shutdown-looms/

- :has

- :is

- :not

- ][p

- $UP

- 000

- 1

- 10

- 11

- 12

- 13

- 14

- 15%

- 200

- 2024

- 400

- 700

- 8

- 9

- 95%

- a

- above

- Accept

- According

- accuracy

- adopt

- ADvantage

- advise

- ahead

- All

- an

- analyst

- and

- Another

- Anticipated

- any

- approach

- ARE

- article

- AS

- Astar

- At

- attempt

- attempted

- author

- average

- BE

- bearish

- below

- between

- Bitcoin

- Bitcoin Futures

- Bitcoin Price

- BONE

- Bottom

- Break

- Breaking

- broad

- BTC

- Bullish

- by

- CAN

- cap

- capital

- caution

- changed

- Chart

- Close

- Commodities

- complicated

- comprehensive

- Congress

- continue

- continued

- continues

- could

- crypto

- Crypto Market

- crypto trading

- cryptocurrency

- cryptocurrency market

- Cryptocurrency Market Cap

- CryptoInfonet

- Current

- cutting

- daily

- day

- Decline

- deep

- directly

- do

- Dominance

- dow

- down

- downside

- Early

- effort

- emerges

- ensure

- entered

- Equities

- essential

- Every

- exchange

- exhibits

- experience

- expert

- expressed

- Failed

- Failure

- Federal

- federal reserve

- Finally

- financial

- Financial Instruments

- flat

- followed

- For

- from

- further

- Futures

- Gain

- Gainers

- get

- Government

- guarantee

- guaranteed

- had

- Have

- head

- High

- higher

- highest

- Hit

- However

- HTML

- HTTPS

- immutable

- Impact

- impending

- IMX

- in

- Inc.

- Increase

- information

- Informational

- instead

- instruments

- interest

- Interest Rates

- IT

- ITS

- Jim

- jpg

- Kitco

- KNC

- kyber

- Kyber Network

- Kyber Network (KNC)

- Last

- lead

- leading

- least

- Led

- Level

- LINK

- little

- looming

- Losers

- loss

- losses

- Low

- lower

- Luna

- Macro

- made

- maintain

- make

- Market

- Market Cap

- Market News

- market performance

- Marketing

- Markets

- Matrixport

- Matters

- May..

- means

- Metals

- moving

- moving average

- much

- Nasdaq

- Navigation

- Near

- Neither

- network

- New

- news

- Newsletter

- nor

- notable

- note

- now

- Oct

- october

- of

- on

- ONE

- only

- open

- Opinions

- or

- Other

- otherwise

- our

- Outlook

- over

- overall

- path

- performance

- perspective

- picture

- Place

- plato

- Plato Data Intelligence

- PlatoData

- potentially

- price

- Prices

- provided

- Publication

- purposes

- pushed

- range

- Rate

- Rates

- Reading

- realization

- recap

- receive

- Red

- reflect

- REKT

- rekt capital

- remained

- research

- Reserve

- Resistance

- respectively

- s

- S&P

- Said

- Securities

- sell-off

- senior

- set

- should

- Shows

- shutdown

- side

- sideways

- since

- solicitation

- solid

- Soon

- Source

- stands

- start

- staying

- Stocks

- Stories

- street

- such

- suggest

- Suggests

- sunday

- support

- surge

- Technical

- term

- Terra

- Terra (LUNA)

- that

- The

- this

- those

- throughout

- to

- Tokens

- top

- top stories

- trade

- traded

- Traders

- trades

- Trading

- TradingView

- treasury

- Treasury yields

- Trend

- Trillion

- Tuesday

- typically

- u.s.

- u.s. congress

- U.S. Treasury

- until

- use

- views

- vs

- Wall

- Wall Street

- we

- week

- were

- which

- while

- WHO

- will

- with

- yields

- Your

- zephyrnet