Bitcoin started the week in negative territory and it is offering lower prices but there’s little conviction so let’s have a closer look at today’s latest Bitcoin news.

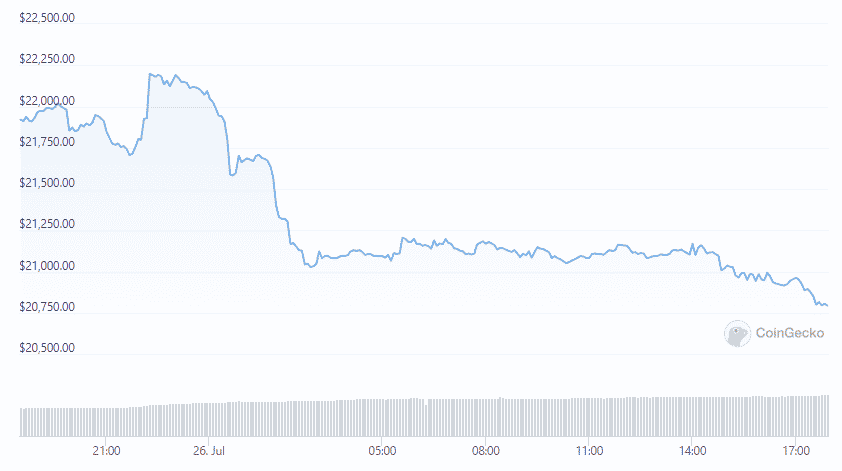

Bitcoin started the week in negative territory and dropped by 4.3% to trade below $22,000 and the price decrease is a retracement after last week’s advance of 14%. the biggest cryptocurrency by market cap is down 54% year to date and BTC dropped five of the past six days on volume which aligns with the 20-period exponential moving average. Over the Sunday trading, the BTC price advanced 0.6% on below-average volume and the move higher came after the recent declines which imply profit taking by the traders at the $23,000 mark.

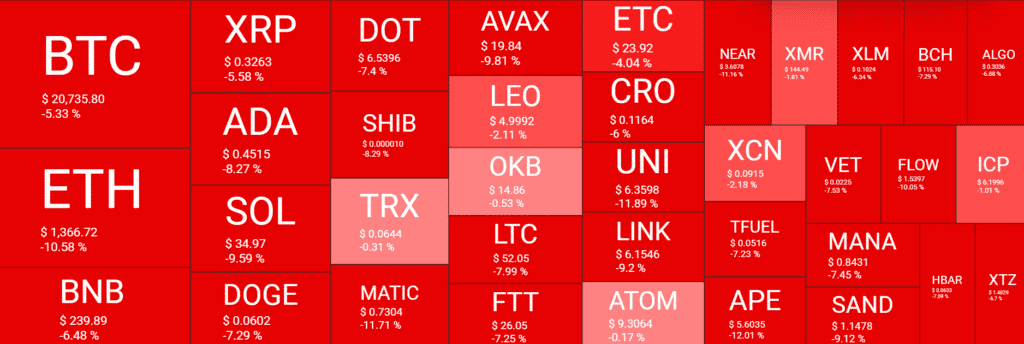

The traditional equity markets and the S&P500 were up by 0.34% and NASDAQ declined by 0.26%. Other altcoins were in decline as well with aVAX failing by 8.4% while XRP dropped by 5.84%. The recent on-chain activity showed an increase in BTC sent to exchanges in the past day and the investors should note that the exchange Netflow total which is an indicator that tracks net deposits on the exchanges and compares the figures to the average of the net deposits in the past week.

The increase in net deposits is often interpreted as the traders sending BTC to exchange from which they can readily exit the BTC positions. We suspect that following last week’s increase of 14%, BTC traders started taking profits and sent bTC to exchanges to be ultimately sold. From a technical standpoint, bitcoin’s price fell into a window between 10-20 day EMAs, and given that the 10-period EMA crossed above the 20-period EMA, some traders might interpret it as a buying window.

ADVERTISEMENT

It should be noted that the daily trading volume for BTC surpassed the average 20-period volume on nine days out of 25. there doesn’t seem to be a lot of conviction among the long or short traders at the moment. Analysts expect that the BTC prices will continue to be range-bound in the short term with the support being set at $20,000. The readers should note that the expectations for support are convicted with the point of contrl value and this metric displays trading activity in a period of time across specific price levels with the point of contrl representing the price level with the highest amount of activity giving the indication of where the amount of agreement on the price exists.

Most investors might be looking forward to Federal Reserve chair Jerome Powell’s comments on the interest rate decision but still, some think that the rate will crush the market sentiment. Make sure to pay attention to Thursday’s GDP growth figures where analysts’ consensus estimates it for an increase of 0.5% with a GDP below 0.5% being interpreted as bearish across the traditional and digital asset markets. The negative figure will suggest that the economy was headed for a recession which could also bring negative growth.

ADVERTISEMENT

- Bitcoin

- Bitcoin News

- Bitcoin Price

- Bitcoin Price Analysis

- bitcoin started

- blockchain

- blockchain compliance

- blockchain conference

- btc negative territory

- btc price

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- DC Forecasts

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- negative territory

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet