Over the past week, Bitcoin price reached new multi-month highs largely due to the euphoria of the potential approval of a spot exchange-traded fund (ETF). While the recent momentum appears to have waned in the past few days, there are signs that the premier cryptocurrency may not be done just yet.

Crypto analytics platform IntoTheBlock has offered an insight into the present action and future trajectory of Bitcoin, highlighting major levels investors might want to keep an eye on.

This Could Happen If Bitcoin Price Closes Above $35,000

In a post on the X (formerly Twitter) platform, IntoTheBlock shared the next Bitcoin price levels to watch out for. The on-chain data tracker stated that investors can identify where the price of BTC may be heading based on the recent buying activity recorded on-chain.

Bitcoin Levels to Watch – Based on buying activity recorded on-chain, we can identify price levels where BTC may be heading next

🔼The recent high of $35,000 is the next resistance point for Bitcoin, where previously 664,000 holders bought 340k BTC

🔼If this level is surpassed,… pic.twitter.com/63oBOngxBQ— IntoTheBlock (@intotheblock) October 27, 2023

According to IntoTheBlock’s analysis, the recent multi-month high of $35,000 is the next major resistance level for Bitcoin. On Wednesday, October 25, Bitcoin touched – albeit failed to close above – the $35,000 mark for the first time since mid-2022

Furthermore, the on-chain analytics platform highlighted that more than 664,000 addresses bought about 340,000 BTC at the $35,000 level. If Bitcoin’s price manages to breach and stay above this mark, investors could see the market leader travel to around $39,000, where the next major resistance lies.

On the flip side, if the current momentum continues to cool off and there is further downward movement, the BTC price could go as low as the $30,000 mark. According to IntoTheBlock, there seems to be concentrated buying activity just above the psychological price level, with nearly 1.5 million addresses purchasing 553,000 BTC around this point.

After a memorable week dominated by the anticipation of a Bitcoin spot ETF, the Bitcoin price has been relatively quiet in the past few days. As of this writing, the premier cryptocurrency trades at $34,121, reflecting no significant price change in the past 24 hours.

BTC’s Institutional Interest Continues To Rise

Surging institutional interest is believed to be one of the major factors contributing to the recent positive Bitcoin price. As Bitcoinist reported earlier, BTC’s price ascent is deeply rooted in burgeoning institutional demand.

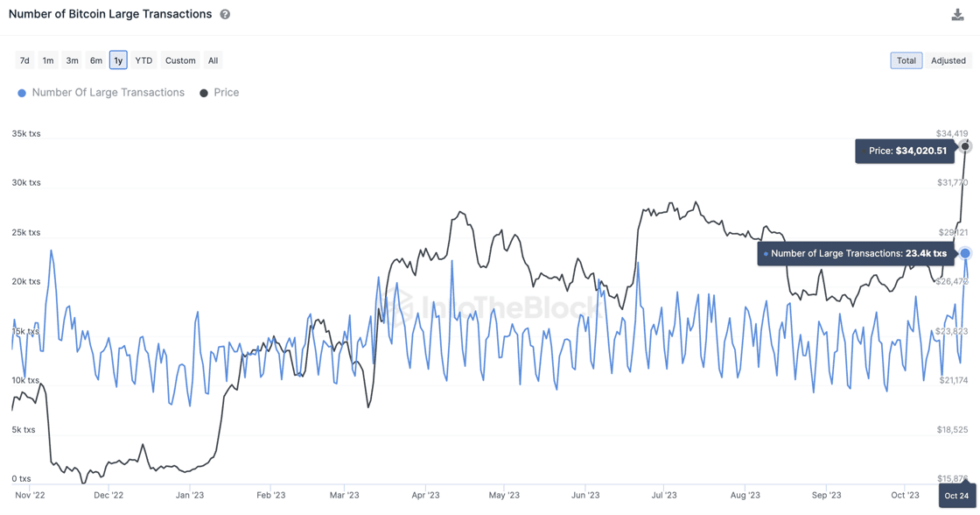

In a separate report, IntoTheBlock has highlighted the rise of institutional interest in Bitcoin. According to data from the on-chain analytics platform, the number of BTC transactions over $100,000 surpassed 23,400 on Tuesday, October 24, marking a new high in 2023.

Number of Bitcoin Large Transactions | Source: IntoTheBlock/X

IntoTheBlock specifically pointed to the recent spot exchange-traded fund as the force behind the rising institutional interest in Bitcoin. The last time this metric witnessed a significant spike was in June 2023 when BlackRock filed for a BTC spot ETF.

Bitcoin price trades around $34,000 on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://bitcoinist.com/bitcoin-price-to-39000-heres-key-level-to-watch/

- :has

- :is

- :not

- :where

- 000

- 1

- 121

- 15%

- 2023

- 23

- 24

- 25

- 27

- 400

- 500

- 515

- a

- About

- above

- According

- Action

- activity

- addresses

- an

- analysis

- analytics

- and

- appears

- approval

- ARE

- around

- AS

- At

- based

- BE

- been

- behind

- believed

- Bitcoin

- Bitcoin Price

- Bitcoinist

- Bitcoinist.com

- BlackRock

- blockchain

- bought

- breach

- BTC

- btc price

- btc transactions

- BTCUSDT

- Buying

- by

- CAN

- change

- Chart

- Close

- Closes

- COM

- Concentrated

- continues

- contributing

- Cool

- could

- cryptocurrency

- Current

- daily

- data

- Days

- Demand

- done

- downward

- due

- Earlier

- ETF

- exchange-traded

- exchange-traded fund (ETF)

- eye

- factors

- Failed

- few

- filed

- First

- first time

- Flip

- For

- Force

- formerly

- from

- fund

- future

- Go

- happen

- Have

- Heading

- High

- Highlighted

- highlighting

- Highs

- holders

- HOURS

- HTTPS

- identify

- if

- image

- in

- insight

- Institutional

- Institutional Interest

- interest

- into

- intotheblock

- Investors

- june

- just

- Keep

- Key

- large

- largely

- Last

- leader

- Level

- levels

- lies

- Low

- major

- manages

- mark

- Market

- Market Leader

- marking

- max-width

- May..

- memorable

- metric

- might

- million

- Momentum

- more

- nearly

- New

- next

- no

- number

- october

- of

- off

- offered

- on

- On-Chain

- on-chain data

- ONE

- out

- over

- past

- platform

- plato

- Plato Data Intelligence

- PlatoData

- Point

- positive

- Post

- potential

- premier

- present

- previously

- price

- psychological

- purchasing

- reached

- recent

- recorded

- reflecting

- relatively

- Reported

- Resistance

- Rise

- rising

- rooted

- see

- seems

- shared

- side

- significant

- Signs

- since

- Source

- specifically

- spike

- Spot

- spot etf

- stated

- stay

- surpassed

- than

- that

- The

- There.

- this

- time

- timeframe

- to

- touched

- trades

- TradingView

- trajectory

- Transactions

- travel

- true

- Tuesday

- want

- was

- Watch

- we

- Wednesday

- week

- when

- while

- with

- witnessed

- writing

- X

- yet

- zephyrnet