- Bitcoin experienced a decline of over 5%, dropping from $44,034 to $41,649.

- In the past 24 hours, liquidations have surpassed $411 million.

A turbulent start to the week as major cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), faced a bearish trend in intraday trading. BTC saw a significant dip of over 5% in the 24 hours, reaching a low of $41,649 before recovering to $42,510, as per CoinMarketCap data.

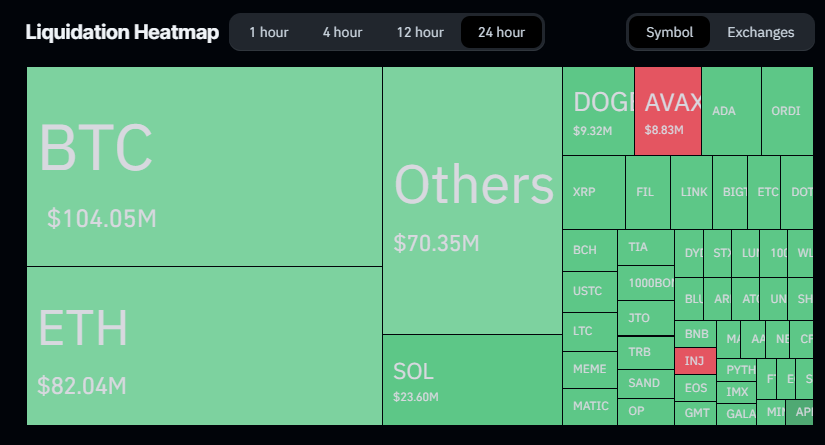

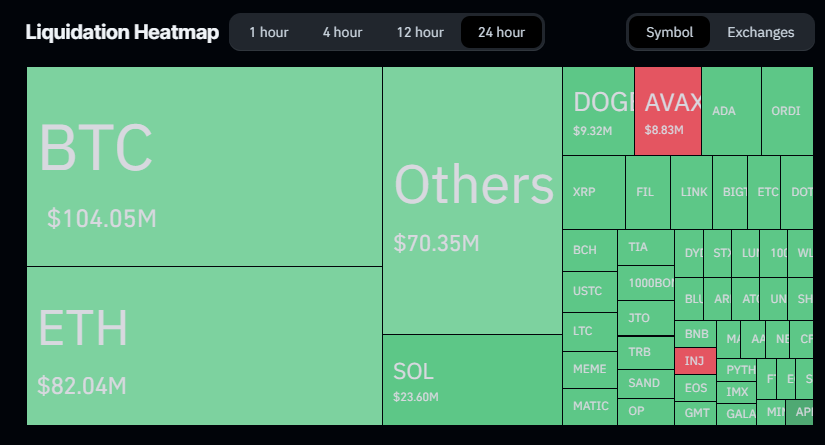

Data from CoinGlass revealed $411 million in liquidations over the past day, with $357 million in long positions across the broader crypto market. The liquidation heatmap displayed that over $104 million BTC and $82 million ETH have been liquidated. Small-cap altcoins also experienced a decline amid the overall market volatility.

Will BTC Regain its Rally?

Despite the downturn, Bitcoin managed to maintain a bullish stance, even breaking the $42,500 resistance. Currently, BTC is trading at $42,182, with a daily trading volume of $24.7 billion, marking a 54% increase in the last 24 hours.

The price of BTC is now in the process of a recovery wave, encountering key resistance around the $42,600 level. If Bitcoin surpasses the $43,000 resistance, it could spark bullish momentum, potentially leading to an ascent towards $43,650. A decisive close above this level might initiate a strong upward movement, targeting the next significant resistance at $43,950, with further potential gains toward $44,500.

However, if Bitcoin fails to breach the $43,000 resistance, there is a possibility for another decline. Immediate support will be formed near the $41,800 level, followed by a $41,350 support zone. A breach below this level could lead to a test of the $40,000 zone, signaling potential downsides for the leading cryptocurrency.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://thenewscrypto.com/bitcoin-price-plunges-over-5-find-out-why/

- :is

- 000

- 24

- 26

- 350

- 36

- 500

- 7

- a

- above

- across

- also

- Altcoins

- Amid

- an

- and

- Another

- around

- AS

- ascent

- At

- BE

- been

- before

- below

- Billion

- Bitcoin

- Bitcoin Price

- breach

- Breaking

- broader

- BTC

- Bullish

- buttons

- by

- Close

- CoinMarketCap

- could

- crypto

- Crypto Market

- cryptocurrencies

- cryptocurrency

- Currently

- daily

- daily trading

- data

- day

- decisive

- Decline

- Dip

- displayed

- downsides

- DOWNTURN

- Dropping

- encountering

- ETH

- ethereum

- ethereum (ETH)

- Even

- experienced

- faced

- fails

- Find

- followed

- For

- formed

- from

- further

- Gains

- Have

- HOURS

- HTTPS

- if

- immediate

- in

- Increase

- initiate

- IT

- ITS

- Key

- key resistance

- Last

- lead

- leading

- Level

- LIQUIDATED

- Liquidation

- liquidations

- Long

- Low

- maintain

- major

- managed

- Market

- market volatility

- marking

- max-width

- might

- million

- Momentum

- movement

- Near

- next

- now

- of

- on

- out

- over

- overall

- past

- per

- PHP

- plato

- Plato Data Intelligence

- PlatoData

- plunges

- positions

- possibility

- potential

- potentially

- price

- process

- rally

- reaching

- recovering

- recovery

- regain

- Resistance

- Revealed

- saw

- Share

- significant

- Source

- Spark

- start

- Status

- strong

- support

- surpassed

- SVG

- targeting

- test

- that

- The

- There.

- this

- to

- toward

- towards

- Trading

- trading volume

- turbulent

- upward

- Volatility

- volume

- Wave

- week

- why

- will

- with

- zephyrnet