The pattern of an on-chain metric may suggest that Bitcoin could see more downside ahead before a rebound is found.

Bitcoin STH SOPR Hasn’t Hit The Bottom Zone Yet

An analyst in a CryptoQuant Quicktake post explained that the BTC short-term holders are selling at a loss. The relevant indicator here is the “Spent Output Profit Ratio (SOPR),” which tells us whether the Bitcoin holders are selling their coins at a profit or a loss.

When the value of this indicator is greater than 1, it means that the average holder in the market is moving their coins at a profit. On the other hand, values below this threshold imply that loss-taking is the dominant force in the sector.

The SOPR being exactly equal to one naturally suggests that the market is just breaking even on its selling right now as the total amount of realized profits cancel out the losses.

The SOPR can also be defined for just a part of the market. In the context of the current discussion, the short-term holder (STH) group is of interest. These investors have been holding onto their coins since less than 155 days ago.

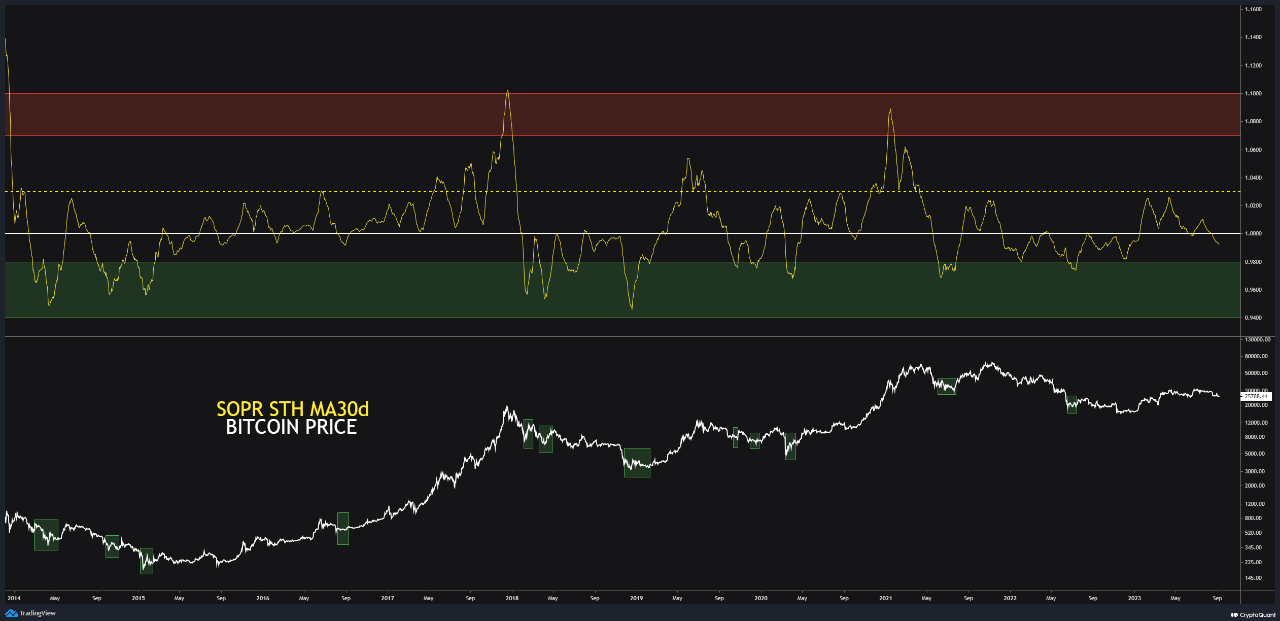

Now, here is a chart that shows the trend in the 30-day moving average (MA) Bitcoin SOPR over the past several years:

As displayed in the above graph, the 30-day MA Bitcoin STH SOPR had been above one for most of the year 2023, but following the recent struggle in the asset’s price, the indicator has dipped below this mark.

Historically, the one indicator level has been a line of support for the cryptocurrency, as it has often found rebounds. For example, Bitcoin found bottoms at this mark during the slumps in both March and June.

With the recent drawdown, though, this support level has been breached, as the STHs are now selling their coins at a loss. Usually, whenever the metric dips below this level, it doesn’t come back above it quickly, as the line begins to act as resistance instead.

The Bitcoin STH SOPR has historically been able to find rebounds in the green box that the quant has highlighted in the chart. The indicator is still a notable distance above this bottoming zone.

If the BTC price will only find its rebound when the indicator dips inside this zone, then more decline could be ahead for the asset so that the STHs are pushed into capitulating at a deeper degree.

BTC Price In The Short Term

Bitcoin has continued its sideways struggle recently as the cryptocurrency has been unable to find a break in either direction. The asset’s price is floating around the $25,700 mark.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.bitcoinnewsminer.com/bitcoin-could-decline-further-before-a-rebound-heres-why-2/

- :has

- :is

- 1

- 2023

- 700

- a

- Able

- above

- Act

- ago

- ahead

- also

- amount

- an

- analyst

- and

- ARE

- around

- AS

- asset

- At

- average

- back

- BE

- been

- before

- being

- below

- Bitcoin

- Bitcoin Holders

- Bitcoin Price

- both

- Bottom

- Box

- Break

- Breaking

- BTC

- btc price

- but

- CAN

- Chart

- Coins

- come

- context

- continued

- could

- cryptocurrency

- cryptoquant

- Current

- Days

- Decline

- deeper

- defined

- Degree

- direction

- discussion

- displayed

- distance

- Doesn’t

- dominant

- downside

- during

- either

- equal

- Even

- exactly

- example

- explained

- Find

- floating

- following

- For

- Force

- found

- further

- graph

- greater

- Green

- Group

- had

- hand

- Have

- here

- High

- Highlighted

- historically

- Hit

- holder

- holders

- holding

- HTTPS

- in

- Indicator

- inside

- instead

- interest

- into

- Investors

- IT

- ITS

- june

- just

- less

- Level

- Line

- loss

- losses

- March

- mark

- Market

- May..

- means

- metric

- more

- most

- moving

- moving average

- NewsBTC

- notable

- now

- of

- often

- on

- On-Chain

- ONE

- only

- or

- Other

- out

- output

- over

- part

- past

- Pattern

- plato

- Plato Data Intelligence

- PlatoData

- price

- price chart

- Profit

- profits

- pushed

- Quant

- quickly

- ratio

- realized

- rebound

- recent

- recently

- relevant

- Resistance

- right

- sector

- see

- Selling

- several

- Short

- short-term

- Shows

- sideways

- since

- So

- SOPR

- Still

- Struggle

- suggest

- Suggests

- support

- support level

- tells

- than

- that

- The

- their

- then

- These

- this

- though?

- threshold

- to

- Total

- TradingView

- Trend

- unable

- us

- usually

- value

- Values

- when

- whenever

- whether

- which

- why

- will

- year

- years

- zephyrnet