Barbara Corcoran understands real estate arguably better than anyone else. And while most of us know her from Shark Tank, Barbara swims in a league of her own as one of the most successful real estate investors and brokers in New York City. She knows the up-and-coming areas, the overpriced hipster neighborhoods, the streets to stray away from, and which will make you rich when owning real estate. And while Barbara has made a killing, she’s done it in a way foreign to almost any other real estate investor.

If you want to know the “formula” for making a fortune, this is the episode to tune into. In it, Barbara uncovers the exact way she finds the hottest rental markets before anyone else, why she consistently overpays for properties, the reason you should partner on almost EVERY deal you do, and why small-time investors are MUCH more likely to succeed than the big players.

Not only that, but Barbara also shares her past failures and why falling flat on her face was what she needed to see great success. She talks about her infamous word-of-mouth campaign that sold out an eighty-unit apartment complex in hours, the “Corcoran Report” that landed her on the front page of The New York Times, and why you MUST talk to waiters whenever investing in a new area.

Click here to listen on Apple Podcasts.

Listen to the Podcast Here

Read the Transcript Here

David:

This is the BiggerPockets Podcast show 763. What’s going on everyone? It’s David Greene, your host of the BiggerPockets Real Estate podcast. Here today with Rob Abasolo. Not only are we the biggest, the baddest, and the best real estate podcast in the world, we also have another bee Barbara Corcoran.

Barbara:

I try to be honest when I’m not [inaudible 00:00:19] but a lot of people like to be right. They like to be accurate, does it make sense? They ask opinions. They really sharpen their sword and they never get out there.

David:

For those that are listening too and they feel the call in their soul, “I need to be more like Barbara,” but they’re just risk-averse. What advice do you have for those poor, timid souls?

Barbara:

Get out of the game, you’ll never going to do well. I hate to be that coarse, but get out of the game. If you’re afraid of risk, you have no business being in real estate.

David:

Today’s guest is none other than Barbara Corcoran. She is a straight D student, held 20 jobs before the age of 23, is an avid TikTok user. Hosts her own podcast Business Unusual. She’s as resilient as she is brilliant. Please, help me welcome Barbara Corcoran. Barbara, good morning to you.

Barbara:

Thank you, David. Nice to see you, Rob.

Rob:

Nice to see you.

David:

In case you’ve been living under a rock, Barbara is a host of Shark Tank and the Queen of New York City real estate. We are thrilled to have you on today. I know that there’s a lot of information that our listeners are going to love. Barbara, we are going to start with a game, we call this game two truths and a lie, and it should be fun. In this case, I am going to read a statement.

Rob and I are both going to try to guess if it is honest or not, and then you are going to tell us after we guess. Statement number one: Barbara’s landlord once tried to evict her because he thought she was running a prostitution ring. Rob?

Rob:

Okay, that is very specific and I don’t think that that’s a scenario that our producers would’ve just written to be read on this show, so I’m going to go that is true.

Barbara:

True, wow.

David:

I’m going to say that it is exactly what someone would come up trying to not look like they were throwing the wool over their eyes. I think this is a double agent of a question and I’m going to go with lie.

Barbara:

Of course, it was true. I came home one night, eviction notice on my door from being a prostitute. The reason for that, he had a reason to do it. I guess my landlord, John [inaudible 00:02:17] was his name. He saw men in and out of my apartment all day long, but what he didn’t know was that I had started their business in the apartment with my two roommates and I met all my customers there.

They would come in, we’d spend an hour and then I’d go out with them. We come in again, we go out with new guys. He thought I was a prostitute, but what was great was when I confronted him, I went to his office and told him he got it all wrong, I was just a working girl. He gave me an exclusive on his entire building of 14 units. I came out smelling like roses.

David:

I think I missed what the business was. What were you guys doing when you would go out with the gentleman?

Barbara:

We were renting apartments. I started my first brokerage firm and we were renting apartments up and down the streets of the city.

David:

You were going to show apartments to these people. They would just meet you at your place.

Rob:

Now, technically, could he have evicted you for creating an unwarranted business like a commercial business in the apartment? Was that against the lease or anything?

Barbara:

I’m sure it was against the lease, but most importantly if his sentiment was that he’d wanted me out of the building for whatever reason he could have certainly asked me to move out because I had too much traffic.

David:

You turned that into a business opportunity in the sense that you were able to lease his units, right?

Barbara:

Yes, but you have to realize one of his arch competitors was three blocks south on 83rd Street, and I was renting his apartments for 10% more than the building I lived in because I was building part walls and making one bedrooms into one bedrooms and a half. I got more rent for him and he got jealous that’s really why I got his listings.

David:

Next question, Barbara once invested over $100,000 in videotapes for property walkthroughs. Rob?

Rob:

Here’s why I think this is true, I think it’s true because Barbara foresaw that comfy would sell $85 million when other people didn’t see it coming. I imagine that at this time, videotapes for property walkthroughs is probably kind of like a new revolutionary thing. Barbara’s revolutionary, so this is true.

Barbara:

Well, Rob, you’re obviously smarter than David is. What are you going to say?

David:

You threw me off a little bit with that comment there. I’m trying to wrap my head around how these videotapes would be used to generate business. You can’t put them on the internet. There wouldn’t be any reason to mail them, so you’re a smart marketer. I feel like they might have been trying to throw us off by using a marketing tool, but I’m going to go with lie just because I can’t see the benefit of this. Who’s right?

Barbara:

You’re going to get jealous of David once again. It’s true, except the number was wrong. I don’t know how you read that one, but it was $77,000 my first profit I blew on homes on tape. Put all my apartments on tape and asked my salespeople, please give them out to your customers. It’s going to make the shopping easier. Remember, this was before the internet. It was a disaster.

However, I heard that my husband was a Navy captain, had played war games in Korea on this new thing called the internet. When he told me how it worked, I slammed my apartments on there and had two sales with him the week. I was the first firm on the internet with elite time of two years because I just happened to listen to my husband and moved on it quickly.

Rob:

Wow, I would liken this to maybe back in the day in Walmart, you would walk in and they were giving out thousands of AOL CDs and you’re like, “I guess I’ll take it.” This is what you were telling your agents. You’re like, “I’ve got these VHS copies of the third floor walkup here on 8th Street. Give those out to your friends and family, see who wants to buy it. Then, it didn’t actually pan out at that time.

Barbara:

Do you know what’s wrong with that? I had my agent’s name face professional makeup and phone number with every apartment and they refused to give them out because they didn’t want to lose their customer to the next agent. I never thought of that one, that’s why I wasted the $77,000.

Rob:

Had you not done that, do you think that that business strategy would’ve taken off?

Barbara:

Probably not, but what I do know by doing it and failing so miserably I had to save face and come up with a cover, I came up with the internet, and it wasn’t a cover. It was the best thing for me to step in.

Rob:

Very, very cool. Last one, Dave, cue it up.

David:

Last statement, Barbara was asked to speak to Citigroup but then choked on stage.

Barbara:

Easy one, come on guys.

Rob:

I’m going to assume choked like, “I blew it.” Not choked like she eating a piece of steak and you’re like choking. I’m going to go no, impossible.

David:

I think this is choked like Eminem, 8 Mile mama’s spaghetti on the sweater style.

Rob:

Then, I’m going to go not true, I can’t see it. Obviously a very charismatic speaker, so false on this.

David:

I’m going to go much more logically because we already found the lie since this is two truths on the lion, I’m pretty sure this has to be a truth. We probably shouldn’t have named it that, so I’m going to go with truth.

Barbara:

Looks to me, David that you just had a IQ implant somewhere because [inaudible 00:07:21]

David:

Well, I think I still won.

Barbara:

With that deal, it wound up as a good thing because they asked me to sit down. I was mortified. I actually got paranoid and thought everybody had passed on the street had been in the audience that night for a week. Then, I realized I had to get over myself. I was going to have to public speak sometime in my life so I volunteered to teach at NYU at night and I found my star salesperson the first night I was teaching, Carrie Chiang.

She made for me in that year $400,000 when my best agent was making $42,000. For me, I learned the great lesson much more important than speaking. I learned the great lesson, get back up. Get back up, you never know what’s around the corner.

Rob:

Well, this is your opportunity Barbara, if you’d like to redo the speech little redemption, what we’ve blocked off in an hour. You can go ahead and start from the top.

Barbara:

I’m not going to do that to you guys. It wasn’t a very good speech anyway.

David:

Thank you for playing that game with us. It’s always fun to get to learn these little tidbits and personal stories of what someone’s been through.

Barbara:

David, you don’t look like having fun. You don’t look like you’re having fun at all.

David:

I have what’s called resting cop face. They called RCF.

Barbara:

Oh my god.

David:

Don’t let that fool you, Barbara. This is what I look like when I’m-

Barbara:

It’s intimidating.

David:

Yes, as a cop, that wasn’t the worst thing in the world, but I suppose as a podcast host that’s not the same thing. Would you say that most of your successes in real estate investing have been built off of failures?

Barbara:

Yeah, because I don’t know, there’s something about the universe when you fall on your face, it’s like bouncing a ball, the harder you hit, the more you could bounce up. There’s always another flip side to it, always another flip side. I learned that building my business very much so. In terms of investing in real estate outside of my firm where I bought properties and nurtured the properties and tried to increase the rent roles, I don’t think that really holds true that I learned from failure I just became very careful.

I did have a wacky formula for buying real estate and I always did well by repeating the same little dance step again and again. Do you want to know what that is?

David:

Please.

Barbara:

I shortened your question as you know. Number one, I always bought an up and coming areas. I was in Brooklyn long before anybody was buying Brooklyn from Manhattan. I was in there early and I always looked for a 10% partner. I found a local person who knew their neighborhood, loved their neighborhood, wasn’t in the business, I made them the 10% partner, I put in the cash, and they found me the best property, the absolute best property. I hedged my bet right away.

I paid them the 10% and I told them they could overpay for the property, I didn’t care. Almost every property I overpaid for, I overpaid again and again and again. I’ve just repeated that again. I also located the up-and-coming areas by talking to waiters, creative people and said, “Where are you living now?” They were poor. They couldn’t pay their rent. They had five guys living together or four girls living together. I would say, “Where are you living?”

They’d tell me where they were living. I would go at that, we can look at the area and that’s always where I bought my real estate. That’s where the biggest gain is in up-and-coming areas. They’re risky, don’t know what you’re doing and I had a partner who knew what they were doing.

Rob:

You said that you found a 10% partner. Can you explain this construct a little bit? When you say 10% partner, did you say, “Hey, go find me a cool building. If you find me a lead, I’ll give you 10% of the purchase price?” Were they actually equity partners in that property?

Barbara:

They were equity partners and they stayed with me until I sold. I hold onto properties a long time because I say you make a lot of money slowly in real estate, but when I sell, they get their 10% share and it’s substantial. Sometimes I paid off my partners with 10% that represented 50% of what we paid for the building 10 years ago because they really appreciated. Their interest was there. Their heart and soul wasn’t like a broker want to sell me something.

Their interest was I’m going to buy you the best place, the right side of the street away from that problem because they were changing areas, choppy areas. You can always make a lot of mistakes there. I never made a mistake. They always found me the best stuff.

Rob:

That’s really cool. If you’re giving someone 10% stake in the property, were they like property managers? Did you actually empower them to actually run and maintain the property as well? Was that a separate job function?

Barbara:

No, I really didn’t because I knew how to run property. I had the organization set up and that’s not really what turned them on. They didn’t want to collect rent and stuff, but why it worked so well is I had the money, I didn’t have the time. They had the time, they didn’t have the money. We were perfect partners together.

Rob:

Did you ever make any millionaires out of these partners?

Barbara:

Well, I had a different one in every locale I went into. No, probably not millionaires but close to millionaires.

Rob:

Probably pretty close if it’s 50% what you paid for the property. I’ve always said this, sorry, if you can’t afford it’s probably too late for you to buy it. You never really can afford the thing that you want. You should be buying things that scare you a little bit, things that are a little bit more up-and-coming. You said that you would go into these neighborhoods and overpay, why overpay for a property at this time?

Barbara:

There’s something weird that happens when you’re a dealer in properties. The minute I was interested in something, gosh, somebody else was interested. I would just say right away, “I’ll pay 10% more than the next guy.” Close the deal, get your hands on it, take it off the table. It shouldn’t be that way, but for me, maybe I had bad luck it always was that way. I just decided I didn’t care about overpaying.

You go into a new up-and-coming area it appreciates so quickly that 10% is absorbed less than a year later. You’ve already made up that loss and it’s not even a loss, it’s a perceived loss, but you more than make it up so why worry about it? It’s history.

David:

It’s a very narrow perspective when the only way that you look at making money in real estate is from one element, such as you only look at the cash flow. You only look at the price you paid versus what they’re asking for. I’ve broken down to 10 different ways that you make money in real estate. You mentioned one of them is what I call a market appreciation, which is this area will appreciate faster than the market as a whole like you referred to as up-and-coming area.

Well, if you have a really big chunk on that end, you can afford to buy less equity, which is what I call when you pay less than a property’s worth. You don’t have to win as much on that side if you’re getting a huge win on another side. You’re a great example because so many people in our community would say, “You should never overpay. Just go write another 7,500 offers instead and eventually, you’ll strike gold.” You may end up buying a property that nobody else wants and there’s a reason why that would be.

Barbara:

I share a story I heard as a very young broker that never left me. I was going to listen to Harry Helmsley, of course that name. The biggest commercial owner in New York at the time. I heard him lecture and I raised my hand. I said, “Listen, how do you get a great deal on a property?” He said, “I always overpay.” What? You overpaid?

Rob:

You get a good deal by getting a bad deal?

Barbara:

Right, because it makes up for it in the long run or even in the short run, it makes up for it.

Rob:

I would say, and David, I don’t know if this is true for you too, but on my end of things, when I calculate all of the cash flow that I’ve ever made from real estate, it really pales in comparison to the appreciation I’ve had on the portfolio itself.

David:

Barbara, that’s one of the things about your story that I wanted to ask you is it seems like when you got your start, you’ve talked about the snowball that first property went up in value, created the next, created the next. Now, equity from previous properties is paying for future properties. You never have to put your own money into real estate again theoretically. This is in direct opposition to the cash flow gurus that tell everybody only look at properties for the ROI, the cash flows are going to provide. Nothing else matters.

As someone who’s been very successful with real estate, who has admitted that you’re playing an appreciation game, you’re thinking at it like an entrepreneur, “If I buy this company, how much can I increase the value of the company?” Not just what are the cash flows of this company right now? What can you share about that perspective?

Barbara:

I probably shouldn’t admit this, but I don’t pay attention to it. How I look at it is I look at the property and think, “How much of a mortgage could I slam on this property with the tenants, pay the rent, and I have a little extra to pay the expenses that always come up?” A new roof or what have you. I just see how highly leverage I can get. Then, the minute the property becomes worth more and the rents go up, I go back and slam a new mortgage on it and take the money out.

Remember tax-free, take the money out, I buy another property. I believe in a high leverage, I’m not afraid of that at all. As long as I could pay my expenses, I never leveraged beyond the point where I’m not going to sleep at night that’s how I multiplied my portfolio again and again. Do you know, and this is a true story, I bought a studio apartment in Greenwich Village when I was 29. I scraped together 10%, I think it was $88,000 of thereabouts as my recollection.

I scraped together, I chickened out, and I didn’t close. They kept my deposit. I didn’t sue for it because I just purposely failed the board. It was the board. It took me three years before I could get my hands on another property because Manhattan ran away from me. There was no way I could buy something. When I finally bought a studio, I traded for a one bedroom, then I traded here for a two bedroom and I could always afford it because I appreciate a lot, then a three bedroom.

I can’t say I bought the penthouse I live in today, which is worth so much money from that property. I would’ve never been in the game if I hadn’t gotten in the game. It was such a shame I didn’t get into it three years earlier. I could’ve done so much, not that I regret that because I guess you get cold feet once in a while, but I got cold feet again very often at a closing table I’ll start second guessing myself like, “Well, how good is that area?” I just look at my partner and I think, “What do you think?” They’re such a believer in the neighborhood. I go, “No problem, let’s close.”

David:

It’s so interesting, it sounds like you’re investing in an area not as much in a specific unit.

Barbara:

I don’t care so much about the unit. I care about the area, but realize too I care about the partner. If I’ve got the wrong partner, I’ve got the wrong building. If I got the wrong building, I’ve got the wrong numbers. Another [inaudible 00:17:37] here with you, which illustrates this beautifully, is I bought a townhouse on 10th Street in Greenwich Village and I still own West 10th Street. I bought that building for $120,000, which sounds ridiculous, a five-story, eight unit building.

I remortgaged that building to date probably 9 times, maybe 10, I don’t know if I’m exaggerating. Every time I took a chunk load of hundreds of thousands of dollars out of it and I had a great standard of living. I always took that money out for one purpose to buy myself a more beautiful home or a second home. It’s been a cash cow, I would never sell that business. I said business, it’s really like a business, a separate business. I would never sell that building.

Rob:

This reminded me of a story that I’ve heard, something that I heard on your social channels actually, I think on TikTok. A story about the penthouse that I believe you own now and the origin story of how back in the day you willed it in, you manifested it, “This is going to be my property one day.” Do you think you could share that story for the listeners at home?

Barbara:

Of course, I could. I was in a bad stretch of real estate and I took a job as a messenger because I could work different hours. I had the Corcoran Group at the time, as shocking as I might sound, I probably had about maybe 85 agents, 90 agents working for me, but I couldn’t meet my overhead so I decided I needed another job. I went out and worked as a messenger. They paid very well for messenger that you delivered. I delivered some package to a lady up on 97th and 5th.

I walked into a house, an older lady, and I looked and she had a stunning terrace view of Central Park. I was blown away, I didn’t know people lived like that even though I was in the real estate because I had never seen a place like that. I said to her as she signed for the message, I said, “Do me a favor, ma’am. Call me if you ever decide to sell.” Did I believe myself? Probably not but I thought, “What the heck? I’ll put in my hat.”

What did she say? I think she said something like they’ll take me out in a box or I’ll die at this place something like that. I left, do you know she called me like 14 years later and I bought her apartment for $10 million. How do you like that? I don’t say I manifested it. I don’t think I’m manifest, I had a lot of good luck making money after that and I came out of whatever trough I was in. I was able to quit that job and concentrate on my business again. I couldn’t believe it when she called me, I remembered the view and it was no different when I went back to see it.

Rob:

When she called you, by the way, this is one of the most amazing stories I’ve ever heard, but when she called you, did she happen to remember Barbara Corcoran the messenger, or at this point had your business exploded and maybe she remembers your face and she saw you on billboards? How did she get in contact with you?

Barbara:

When she saw me as a messenger, I wasn’t doing billboard advertising. I didn’t do full pages in the New York Times and the Wall Street Journal. I became prominent in my field after that. I don’t think she even registered my face, but she must have. Then, she saw that I might have the money for that thing because I looked like a big cheese even though most times I didn’t have the money. She called me on the basis of what she was seeing in the public eye.

I’m just the messenger, she remembered me. Funny enough, two days ago I got a handwritten note from her. I can’t even remember her first name. Anyway, she said, “Thank you for answering my call. I’m so happy I called you to sell you my apartment.” I kept it as proof because a lot of people say that can’t possibly happen. I have it.

Rob:

That’s amazing. Well, I’m going to put it out there right now for all of the hundreds of thousands of listeners at home. Barbara, when you want to sell your penthouse, please call me. I’m going to give myself a 14-year clock to be able to afford a penthouse at New York City. Deal?

Barbara:

It’s a deal, but you better shorten your clock to maybe 10 years. I’m not sure I have that much time left.

Rob:

I’ll start putting the feelers out around nine, nine and a half.

Barbara:

Good enough, I won’t answer your call. I’m sure Mike wants my house.

Rob:

That house at the time that you bought it obviously is very expensive $10 million. Was that also in appreciation play? Did you know, “If I buy this, it’s going to be worth more one day? Or was it just more of, “I want this because I wanted it.” I want to realize this goal of owning this home and the financials are the afterthought?

Barbara:

Nothing’s more luscious and having a dream come true. That’s what drove me, I wanted my dream to come true. I dreamt about that place over and over again, that was the driver. I also knew as a real estate person, you buy on Fifth Avenue with the full park view, nobody’s going to build in front of it, what’s going to go wrong with that investment? Nothing, it’s golden. I had no hesitation to get a good investment as well.

David:

You’ve said before, Barbara, that one of your greatest assets as a business leader is your imagination. Coming up with ideas and being willing to test them. What are some of the ideas that have worked for you with real estate investing?

Barbara:

Well, let me tell you, always my imagination, because you know what? The little guy, when you scrap it and trying to come up from the bottom really has the corner on imagination new ideas and getting ideas into the street fast. My big competitors, I noticed they moved slow, they had committees, attorneys, accountants, they have an idea that Monday, it might come out six months later. I had an idea, Monday was on the street by Wednesday.

I very much relied on my imagination. Probably my biggest idea that made the biggest change in my business for the very first time I did it was writing the Corcoran Report. I had 11 sales for the year, it was terrible time. Something wrong with the market, I don’t know what it was. I had a complaining salesperson accusing me of not supporting them not advertising. Well, of course I had no money, I didn’t want to tell them that.

I said, “I have a great idea.” Then, after they left I thought, “Now, what kind of big idea do I have?” I thought of the Corcoran for it. I took the 11 sales average amount and it came out to $58,400 some odd change for an average apartment that I sold, my firm sold. I published a report with one line, the Corcoran Report, sorry, conditions and trends in the greater New York City marketplace is sent to the New York Times every writer wrote that day. Two Sundays later, I was on the front page of the real estate section.

According to Barbara Corcoran, prices have reached all time while using my figure, my figure based on 11 sales. That day was a bellwether change for me in my career because people would call and I could hear my agents on the phone saying, “You’ve heard of us?” Usually, they were on the phone saying, COR, COR, that kind of a thing. We were found. Suddenly, people thought I was smart. Was I smart? No, I was clever.

A lot of people like to be right. They like to be accurate, does it make sense? They ask opinions, they really sharpen their sword and they never get out there. I got the idea, slammed it, whatever it was, and threw it out to the marketplace and only a percentage worked. Believe me, the things that worked for me and my company worked at least five times more than anybody else because I was always out there trying stuff and I ran lean, mean, and fast.

David:

That is such a good point. I can’t let us pass this over. I’ve noticed this as a real estate broker, real estate investor, real estate, everything, people that come into our business from other professions, architects, engineers, anyone that was somewhat analytical.

Barbara:

[inaudible 00:24:48]

David:

Yes, you’re making the same face that we all make when we get those people, they want to make a spreadsheet of the 18 properties that they don’t want to buy and go over all the reasons they don’t want to buy it with you.

Barbara:

Isn’t that true? Yes, the spreadsheet bankers, finance guy, oh my God.

David:

Anyone that has an analytical mind is also trained to not make mistakes. They’ve got this emotional relationship with numbers where they believe making a mistake will lose you money or cause you pain in some way. The way you win at life is to never make a mistake. It is a very difficult gateway that you’ve got to go through to make money in real estate where you learn making mistakes does not lose you money.

Like you just said, throw as much out there as you can, the more things that stick are what are going to make you money. You can do nothing wrong in a day, make zero mistakes and make no money. You can do 20 things in a day, 17 of them were wrong, but your three wins we’re still more than the zero wins that the analytical mind had. I know people that are listening to this are having a hard time gaining traction, they’re having a hard time getting going.

Listen to what Barbara’s saying here, stop thinking that avoiding mistakes is the way that you win in the space with real estate. Any advice on that topic, Barbara?

Barbara:

I would say that I tried, you have some very brilliant people in the game, people well-educated. I always lose my money with Harvard MBAs. I’m sorry, I shouldn’t say that, but I always do. If they’re in the game, I’m like, “I’m not going in there anymore.” You get a left brain type of person, terrible for investing in real estate because they lack one thing in their DNA, they’re risk-aversive. If you are risk-aversive, you can’t win at real estate.

You got to have blind faith a lot of the time. I think, “What am I crazy? I’ll do it anyway because I’ve come this far, I’ll do it anyway.” It’s different. Maybe they run funds and then punch numbers, but they never make a lot of money. I’m telling you, the scrappy first generation immigrant that doesn’t know any better is much more apt to make money than the Harvard educated kid that just came out of schools we’re working for 10 years.

David:

It’s not to say that numbers don’t matter, it’s that being in love with the numbers is the problem, it’s having the vision, it’s seeing the opportunities. That’s such a good point. It made me think about when someone wants to date someone, nobody wants to be courted by a guy who just overanalyzes everything and never makes a mistake. They want a person who’s going to put themselves out there, be passionate about what they’re doing.

Try different things, show the love that they have for someone that matters so much more than the person who’s like, “I made sure we had reservations at every single restaurant at the exact same time. I scanned the menu before we even went, so I knew what I was going to order.” That is what makes anyone fall in love and real estate won’t fall in love with you if that’s the approach you’re taking.

Barbara:

It’s so true what you just said.

Rob:

Barbara, out of curiosity on this, the Barbara Corcoran Report that you mathed out, “The real estate is at an all time low in New York City.” I know that you mathed it out based on yours, but was there actually any truth to that number on a broader scale? Was that pretty close to what was actually happening? Did anybody ever call you and say, “That’s not true. How did you know?” I was kind of curious how that your data actually ended up comparing to the actual data of New York. Did you ever look into that?

Barbara:

No, I didn’t. It was already out, it was printed, I was getting the notoriety. Who knows if it was accurate? Who cares if it was accurate? The main thing was nobody else had a number out there. Nobody was producing numbers. After that, over the next 10, 20 years, people started mimicking my competitors because they realized all the reporters called me. Why? Not that I had better opinions than them or was more experienced, I was certainly less experienced but I had a number to give them.

What do reporters need more than anything else? They don’t need your opinion. They already have an opinion when they call, they want a good sound bite. More importantly, they want numbers to back up their own opinion and I gave it to them. If I had a reporter call me and say, “I’m working on a Russian oil well story and I wonder if you have any rich Russians that I could talk to?” I found them a Russian to talk to, or two or three. They came to me like a source.

I feel like a media joint. “What do you need? Got it. What do you need? Got it.” It’s not important whether your number is right or not, you do the best you can, was that an accurate number? Based on my sales, was it in line with the field? Probably but I didn’t care. I already had the number, it got the notoriety, it was onto the next [inaudible 00:29:13] report? The next [inaudible 00:29:16] report. I just kept churning the things out.

The Richard Gere report, the Madonna report, the Hillary Clinton report, the Guggenheim Museum report. I would grab any number average out, pop it out there. I didn’t have the decency enough to wonder if my numbers were right.

Rob:

I love it. You said you were clever, obviously what was happening here is you’re a genius marketer and that comes into play with something that I heard about, a word of mouth campaign that you had when you were trying to sell out a unit or sell out a building. Could you tell us that story too?

Barbara:

You’re probably referencing the one-day one price sale. By the way, exaggerated, I’m not marketing genius I just take risk. I’m good at that. I swear to God, that’s the baseline of the whole thing. No, I had 88 apartments that an insurance company and developer came to me for, two. Came to every bill, every broker in town, we need to sell these interest rates, we’re 18%. Can you imagine that? That’s why when everybody’s excited about the high interest rates now, I’m like, “What are you talking about?”

Interest rates are 18%, no one was buying anything. They said, “We have to sell these 88 units that we don’t want to auction. We don’t want a public sale because we don’t want to be embarrassed.” I looked at the units, they didn’t have kitchens, they high floors, low floors back, apartments, creepy lobbies, they had everything wrong. I went back and said, “No, there’s no way to sell it. I’d like to tell you differently, no way to sell it. I met with the developer in the insurance company.

Interesting about motivation. The developer, Bernie Mendik, who has since deceased, he said to me, “You’re a smart girl, you’ll figure it out.” I had arise to his occasion. I went home that night and thought of a puppy sale my mother brought me to where all the puppies were given away and there were too many buyers for the puppies, so I did an exact knockoff on that. I went back and I said, “We’re pricing all the units alike, back apartments, high floors, low floors, all alike.”

You give them the mortgage so they don’t have to worry about the mortgage at 2% down from the 18%. We’ll have a one-day sale first come, first serve. I opened that office on the Upper East Side in the morning around, it was due to open at I think eight o’clock, but I was there at 6:30. I had over 150 people in line waiting for those 88 unit apartments. I said go, I gave them the sheets, the addresses. They ran, husbands, wives, single people ran to see the apartments they wanted the best one. It was sold out. I would say with less than two hours I made $1 million.

Who would ever see that thing coming? You know what the key to it was? It wasn’t enough to go around. Even the guy who got the loser, the really disgusting apartment with the same price as everybody else, he was happy because he saw how many people were waiting behind him and couldn’t get anything. That was just a marketing way, a secret sale with no advertising to support it but it worked like a dream.

Rob:

Many units did you say that you sold?

Barbara:

88 Units. And the average sale price, well right now won’t sound like anything, the average sales price I think was $64,000.

Rob:

Wow, that’s 88 units. I’m sure that’s got to be a record in New York for the fastest building ever sold out. If listeners want to hear more about this story, you tell this a little bit more as well on TikTok in your Get Ready With Me video, right?

Barbara:

Yes.

Rob:

Looking at that one, I believe it had over a million views.

Barbara:

Yes, I think it may have. I think it’s because I look so good without makeup.

Rob:

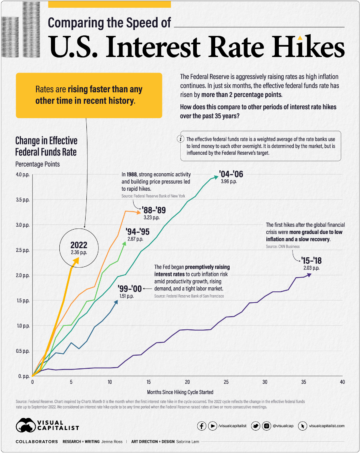

It’s a very fun series. I think your social platform and in all of the stories that you tell really, really are a very fun thing to watch. I find myself on your reels all the time. Something that you mentioned a little bit earlier about the 18% interest rates. I say this all the time, I say that interest rates used to be 16% to 18% back in the ’80s, ’90s. Then, a lot of people say, “Yeah, well the cost of living back then wasn’t all that high, so it’s not the same.”

Well, and that’s what I was going to ask, it’s all relative. When you sort of look at it, having seen your career play out, do you feel that like a 7.50%, 8% interest rate is really detrimental to the success of people in today’s market?

Barbara:

Well, it is in this one regard. It keeps people out of the market because of their expectations. Remember we got until last year, we were accustomed to 3%. I think that’s what the mortgage rate [inaudible 00:33:32] We got accustomed to that. Everything is relative like, “I wish I had gotten it then I missed the boat.” No, it’s not that way at all. It was just as expensive to live in New York, I’m telling you but people still borrowed at all along the way 14, 15, 16, once it got beyond 16, people started pulling back.

Today people are pulling back at what, 5%? Where is it now? I don’t even keep track of it, honestly. It seems so cheap to me. I don’t think that’s true the premise that people are giving you at all. No, I still feel like there’s deals to be done because of the low interest rates. I’m going to labeled it as high. All of my buildings in the last year at a higher rate, I probably should have done it a year early, but it’s still a cheap rate, my god.

Rob:

Well, you did mention, you know, would buy this property and then you would slam a new mortgage on it once the rents went up. That concept I believe you’re talking about is a cash-out refi. Basically, the value of the building would go up and if the rents went up and you could do a cash-out refi, you’d have a little bit of a higher mortgage, as long as you could cover your bills, you would take that money out and reinvest it somewhere else, right?

Barbara:

I’m talking about a lot of money back out. I’m not saying I had a mortgage of $200,000, I put 250 on it. I would wait five years. For the $200,000 I would then put an $850,000 mortgage on put in my pocket. Listen, refinancing is the way you really get rich in holding real estate that’s what I never like to sell. It’s just a bank that’s going to keep on giving. That’s how I look, I feel like I’m in the banking business, but I have real estate to back it up.

David:

On that topic, you, you’ve mentioned several strategies that are somewhat, what’s the word I’m looking for here? They’re not common, when you hear this overpaying and when you say overpaying, what I’m assuming you mean it’s just paying more than the list price. It doesn’t necessarily mean you overpaid because real estate is worth whatever someone’s willing to pay for it.

Focusing on the location over the actual unit, putting an emphasis on solid fundamentals of an area and an asset class over over-reliance on the analytics of a specific unit and getting, not looking at the numbers with a microscope looking at them with a big picture plan, picking the right partner to invest in. This is very different than the gurus that sell real estate investing courses that say, “I will teach you how to analyze a property and you can just look at every single property individually.”

The question I wanted to ask you is, do you believe this works primarily in markets where you’re likely to see appreciation where money is flowing? Something like New York City, Manhattan, maybe South Florida right now, some of the California markets. Do you think that’s part of where your strategy came from, was the area that you were in and the business that you were involved in?

Barbara:

Not really. I think it would apply anywhere. There’s always primary estate that’s golden that everybody’s clamoring for that you don’t have enough to go around. Then, there’s always the next area, next store. The people say, “I don’t really like it so much, I don’t want to have my kids go to school there.” All the reasons why, those are the areas that are the sweet spot, and that’s everywhere not just New York.

It happened to me because I was in New York doing Brooklyn. I thank God picked Brooklyn versus New Jersey. I don’t know why, I really didn’t know New Jersey, but you could always find an area. It works. I just don’t think it’s about a particular area. There’s always something up and coming. Do you know what is a great way to find out if you’re right in your premise? You travel there at night. I never went into any area of Brooklyn and even found a partner or starting investing, I used to get a car at night, rent a big driver because I didn’t know what I was headed for.

I would cruise the streets. What do you think I would find at night? A lively evening community of creative, generally gay communities, having a ball. The gays always moving first is how I found. Then, after that I would go and I would see the baby carriages and hallways stuffed in collapsible cheap carriage. The yuppies are starting to come in. You see a lot at night when people aren’t at work. You see what’s happening, who’s living there.

I remember I bought one building on the very Upper West Side because I saw old ladies all sitting on the bench with pigeons and they weren’t getting mugged. I thought I would never sit on that bench, but it was safe enough for the old ladies, so I realized something’s changing here. I think you have to just be personally involved and have your mind open. I have even chosen particular blocks based on the trees.

I know it sounds weird, but it’s so darn pretty. I’m thinking everybody’s going to love this block, look at flowering trees. More important to me than the numbers, because when I look at the numbers, I’m just seeing today’s numbers, but I’m projecting what tomorrow’s numbers might be and I’m buying on that basis.

David:

That is such a good point. Not getting wrapped up in, I call it the year one result. When we analyze the property we’re looking at right now in this snapshot of time, what can I expect it to do? You’re not buying it for a year, you’re buying it forever if you’re Barbara and you keep refinancing them. You can’t analyze for what it’s going to be like in 30 years. There’s some intangibles that go into this and you’re sharing a lot of that.

I have one last question, but before I ask it. I know you have a technique involving waiters in restaurants and getting valuable information from them. Can you share that with our audience?

Barbara:

The best, you go to a restaurant there’s always good-looking young waiters. They want to be dancers, they want to be writers, they came to New York. New York is such a wonderful place to draw people in. They all come to New York, but they’re making their rent. They’re working at night. I always make a habit saying, “Where are you living? Where are you living?” Then, I make a mental note. Now, on my phone, I used to have a little pad with me make a mental note.

Then I’m out there within a week looking at it. That’s what I do, it’s a little routine. A lot doesn’t pan out, some areas are too darn early for me. They scare me because I’m like, “I’m so happy I had that big driver with me. That’s not a good area.” Most of them pan out, so I always think you have to tap into youthfulness and people who are short on cash to identify up and coming. I think it’s your best guide.

Rob:

It’s effectively asking locals what the secret spots are. “Hey, where are you at? What’s the cool bar? What’s the cool club in town?” Basically, just following the scent to finding these little pockets that no one really knows about.

Barbara:

Yes, and they’re choosing the right property within that pocket and that’s where the partner comes in.

David:

Last question from me, Barbara. For those that are listening to you and they feel the call in their soul, I need to be more like Barbara, but they’re just risk-averse. They don’t have experience accepting that risk is a part of life. What advice do you have for those poor, timid souls?

Barbara:

Get out of the game, you’ll never going to do well. I hate to be that coarse, but get out of the game. If you’re afraid of risk, you have no business being a real estate. If you want to make money, you have to take a risk, it’s just that way. If you’re measuring what you’re about to go into based on what you could have bought it for last year, your memory is your greatest deficit. We’ll hold you back, if your mind is wired that way, get out of the game.

David:

Well, that is fantastic, Barbara. Thank you very much for sharing that advice.

Rob:

Perhaps the most honest advice and honest answer we’ve ever gotten on the show, by the way. I love it.

Barbara:

Thank you so much. I try to be honest when I’m not bullsh*tting.

David:

As you know from two truths and a lie, there’s often a lie mixed in with truths and sometimes you have to be able to figure it out, but it can still be fun when you do so. Barbara, for people that want to find out more about you, where’s the best place for them to go?

Barbara:

It’s @BarbaraCorcoran on all the social media platforms. If you just have want to have fun just follow me on Instagram at TikTok. I have a blast, but I also give great advice. I try to do both.

David:

Rob, how about you?

Rob:

You can find me @Robuilt on YouTube. You can find me @Robuilt on Instagram. Be sure to follow the raw belt with the newly added blue check mark, which is a beautiful day for me. You no longer have to get asked if I’m going to invest in Forex or anything like that. Make sure it’s the blue check mark. Be sure to also find me on the Apple podcast platform where you can leave the BiggerPockets Podcast, a five star review because this is one of the best episodes we have ever done. David, what about you?

David:

Yes, thank you for that mention about the blue check mark. This is my cup that I keep full of the tears of internet scammers as they are crying themselves to sleep every night, unable to scam people pretending to be us. You can find me at my website, davidgreene24.com or any social media that you like. DavidGreene24. Please do go give me a follow. Barbara, you’re such a pleasure to talk to you. Thank you so much for being here and for calling me out.

Barbara:

[inaudible 00:42:12] I don’t call you yet, I’m doing it today. Thank you so much, really. Thanks for the platform.

Rob:

I want to say Barbara such a big fan. You are a hero of mine and I think honestly, I held it together pretty good on this podcast considering how dang excited I was to interview you. Thank you so much for joining today.

Barbara:

Let me remind you that you were the winner of the contest, you got two out of three, your partner and only got one out of three.

Rob:

I’m going to be the winner in nine years when I buy the penthouse. That’s really what I’m holding out for.

Barbara:

I’m waiting for you call. Is this you?

David:

It is. This is David Greene for Rob [inaudible 00:42:46] Abasolo, signing out.

Watch the Episode Here

Help Us Out!

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!

In This Episode We Cover:

- Barbara’s investing formula that will make you a FORTUNE (if you take the risk!)

- A terrible first real estate investment and a crucial finding Barbara learned from failing

- Overpaying for properties and why savvy investors don’t worry about the purchase price

- Cash-out refinances and why Barbara is ALWAYS taking money out of her properties

- Almost unbelievable marketing moves that Barbara made to boost her business

- Whether or not buying with today’s “high” mortgage rates is a mistake

- Why taking a night drive could be your key to finding the best real estate markets

- And So Much More!

Links from the Show

Connect with Barbara:

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email .

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://www.biggerpockets.com/blog/real-estate-763

- :has

- :is

- :not

- :where

- $1 million

- $10 million

- $UP

- 000

- 1

- 10

- 11

- 12

- 13

- 14

- 15%

- 2%

- 20

- 20 years

- 23

- 24

- 250

- 30

- 500

- 7

- 8

- 8th

- 9

- a

- Able

- About

- about IT

- Absolute

- accurate

- actually

- added

- addresses

- admit

- admitted

- Advertising

- advice

- afraid

- After

- again

- against

- age

- Agent

- agents

- ago

- ahead

- alike

- All

- along

- already

- also

- always

- am

- amazing

- amount

- an

- Analytical

- analytics

- analyze

- and

- Another

- answer

- any

- anymore

- anyone

- anything

- anywhere

- Apartment

- apartments

- Apple

- Apply

- appreciate

- appreciation

- approach

- APT

- ARE

- AREA

- areas

- around

- AS

- asset

- asset class

- Assets

- At

- attention

- Auction

- audience

- author

- Avenue

- average

- avoiding

- away

- Baby

- back

- Bad

- ball

- Bank

- bankers

- Banking

- bar

- based

- Baseline

- Basically

- basis

- BE

- beautiful

- beautifully

- became

- because

- becomes

- becoming

- been

- before

- behind

- being

- believe

- benefit

- BEST

- Bet

- Better

- Beyond

- Big

- Big Picture

- Biggest

- Bill

- Bills

- Bit

- Block

- blocked

- Blocks

- Blue

- board

- boat

- boost

- border

- borrowed

- both

- Bottom

- bought

- Bounce

- Box

- Brain

- brilliant

- broader

- Broken

- broker

- brokerage

- brokers

- Brooklyn

- brought

- build

- Building

- built

- business

- business strategy

- but

- buy

- buyers

- Buying

- by

- calculate

- california

- call

- called

- calling

- came

- Campaign

- CAN

- Can Get

- car

- care

- Career

- careful

- case

- Cash

- cash flow

- Cause

- CDS

- central

- certainly

- change

- changing

- channels

- cheap

- check

- choosing

- chosen

- Citigroup

- City

- class

- Clock

- Close

- closing

- club

- cold

- collect

- COM

- come

- comes

- coming

- comment

- commercial

- Common

- Communities

- community

- company

- comparing

- comparison

- competitors

- complex

- concentrate

- concept

- conditions

- considering

- construct

- contact

- contest

- Cool

- copies

- Corner

- Cost

- could

- course

- courses

- cover

- crazy

- created

- Creating

- Creative

- crucial

- cruise

- Crying

- Cup

- curiosity

- curious

- customer

- Customers

- dance

- data

- Date

- Dave

- David

- day

- Days

- deal

- dealer

- Deals

- deceased

- decide

- decided

- DEFICIT

- delivered

- deposit

- Developer

- DID

- Die

- different

- difficult

- direct

- disaster

- Display

- dna

- do

- does

- Doesn’t

- doing

- dollars

- done

- Dont

- Door

- double

- down

- draw

- dream

- dreamt

- drive

- driver

- due

- Earlier

- Early

- easier

- East

- effectively

- element

- elite

- eminem

- emphasis

- empower

- end

- Engineers

- enough

- Entire

- Entrepreneur

- episode

- Episodes

- equity

- estate

- Ether (ETH)

- Even

- evening

- eventually

- EVER

- Every

- everyone

- everything

- exactly

- example

- Except

- excited

- Exclusive

- expect

- expectations

- expenses

- expensive

- experience

- experienced

- Explain

- extra

- eye

- Eyes

- Face

- Failed

- failing

- Failure

- faith

- Fall

- Falling

- false

- family

- fan

- fantastic

- far

- FAST

- faster

- fastest

- favor

- feel

- Feet

- field

- Figure

- Finally

- finance

- financials

- Find

- finding

- Firm

- First

- First Generation

- first time

- flat

- Flip

- Floor

- floors

- florida

- flow

- Flowing

- Flows

- follow

- following

- For

- foreign

- forever

- forex

- formula

- Fortune

- found

- four

- friends

- from

- front

- full

- fun

- function

- Fundamentals

- funds

- funny

- future

- Gain

- gaining

- game

- Games

- gateway

- generally

- generate

- generation

- genius

- get

- getting

- Girl

- girls

- Give

- given

- Giving

- Go

- goal

- God

- going

- Gold

- Golden

- good

- grab

- great

- greater

- greatest

- Group

- Guest

- guggenheim

- guide

- Guy

- had

- Half

- hand

- Hands

- happen

- happened

- Happening

- happens

- happy

- Hard

- harvard

- hat

- Have

- having

- he

- head

- headed

- hear

- heard

- Heart

- Hedged

- Held

- help

- her

- here

- Hero

- Hidden

- High

- higher

- highly

- his

- history

- Hit

- hold

- holding

- holds

- Home

- Homes

- Honestly

- host

- hosts

- hottest

- hour

- HOURS

- House

- How

- How To

- HTTPS

- huge

- Hundreds

- i

- I’LL

- idea

- ideas

- identify

- if

- illustrates

- imagination

- imagine

- important

- impossible

- in

- Increase

- Individually

- infamous

- information

- instead

- instructions

- insurance

- interest

- INTEREST RATE

- Interest Rates

- interested

- interesting

- Internet

- Interview

- intimidating

- into

- Invest

- invested

- investing

- investment

- investor

- Investors

- involved

- IT

- itself

- iTunes

- Jersey

- Job

- Jobs

- John

- joining

- joint

- journal

- jpg

- just

- Keep

- Key

- Kid

- kids

- Kind

- Know

- korea

- Lack

- landlord

- Last

- Last Year

- Late

- later

- lead

- leader

- League

- LEARN

- learned

- learning

- least

- Leave

- leaving

- Lecture

- left

- less

- lesson

- Leverage

- LG

- Life

- like

- likely

- Line

- Lion

- List

- Listening

- Listings

- little

- live

- living

- load

- local

- located

- location

- Long

- long time

- longer

- Look

- look like

- looked

- looking

- lose

- loss

- Lot

- love

- loved

- Low

- luck

- made

- Main

- maintain

- make

- make money

- MAKES

- makeup

- Making

- Managers

- many

- many people

- mark

- Market

- Marketing

- marketplace

- Markets

- Matter

- Matters

- May..

- mean

- measuring

- Media

- Meet

- Memory

- Men

- mental

- mentioned

- Menu

- message

- Messenger

- Microscope

- might

- million

- millionaires

- mind

- minute

- mistake

- mistakes

- mixed

- Monday

- money

- months

- more

- morning

- Mortgage

- most

- mother

- Motivation

- mouth

- move

- moves

- moving

- much

- multiplied

- Museum

- must

- name

- Named

- necessarily

- Need

- needed

- never

- New

- New Jersey

- New York

- new york city

- New York Times

- next

- night

- no

- nothing

- Notice..

- now

- number

- numbers

- NYU

- occasion

- of

- off

- Offers

- Office

- often

- Oil

- Old

- on

- once

- ONE

- ONE Price

- only

- open

- opened

- Opinion

- Opinions

- opportunities

- Opportunity

- opposition

- or

- order

- organization

- Origin

- Other

- our

- out

- outside

- over

- own

- owner

- package

- pad

- page

- paid

- Pain

- PAN

- Park

- part

- particular

- partner

- partners

- pass

- passed

- passionate

- past

- Pay

- paying

- People

- perceived

- percentage

- perfect

- person

- personal

- Personally

- perspective

- phone

- picked

- picture

- piece

- Place

- plan

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- Play

- played

- player

- players

- playing

- please

- pleasure

- pockets

- podcast

- Podcasts

- Point

- poor

- pop

- portfolio

- possibly

- pretty

- previous

- price

- Prices

- pricing

- primarily

- primary

- probably

- Problem

- Producers

- professional

- Profit

- prominent

- proof

- properties

- property

- protected

- provide

- public

- published

- pulling

- punch

- purchase

- purpose

- put

- Putting

- question

- quickly

- raised

- Rate

- Rates

- rating

- Raw

- reach

- reached

- Read

- ready

- real

- real estate

- realize

- realized

- really

- reason

- reasons

- record

- referred

- ReFi

- regard

- registered

- regret

- reinvest

- relationship

- remember

- Rent

- repeat

- repeated

- report

- reporter

- represent

- represented

- resilient

- restaurant

- Restaurants

- result

- review

- revolutionary

- Rich

- Richard

- Ring

- Risk

- Risky

- rob

- Rock

- ROI

- roles

- roof

- round

- Run

- running

- russian

- Russian oil

- Russians

- safe

- Said

- sale

- sales

- Salespeople

- Salesperson

- same

- Save

- savvy

- say

- saying

- Scale

- Scam

- Scammers

- scenario

- School

- Schools

- Second

- seconds

- Secret

- Section

- see

- seeing

- seems

- seen

- sell

- sense

- sentiment

- separate

- Series

- serve

- set

- several

- Share

- Shares

- sharing

- Shark

- she

- Shopping

- Short

- shortened

- should

- show

- side

- signed

- signing

- since

- single

- Sitting

- SIX

- Six months

- sleep

- slow

- Slowly

- smart

- smarter

- Snapshot

- So

- Social

- social channels

- social media

- social media platforms

- social platform

- sold

- solid

- some

- Someone

- something

- somewhat

- somewhere

- Soul

- Sound

- Source

- South

- Space

- speak

- Speaker

- speaking

- specific

- speech

- spend

- Sponsors

- Spot

- Spreadsheet

- Stage

- stake

- standard

- Star

- start

- started

- Starting

- Statement

- stayed

- Step

- Stick

- Still

- Stop

- store

- Stories

- Story

- straight

- strategies

- Strategy

- Stray

- street

- strike

- Student

- studio

- Stunning

- style

- substantial

- success

- successful

- such

- sue

- support

- Supporting

- sweet

- swims

- table

- tactics

- Take

- takes

- taking

- Talk

- talking

- Talks

- tank

- Tap

- Teaching

- tell

- terms

- test

- than

- thanks

- that

- The

- The Area

- The Lion

- The New York Times

- The Wall Street Journal

- the world

- their

- Them

- themselves

- then

- There.

- These

- they

- thing

- things

- think

- Thinking

- Third

- this

- those

- though?

- thought

- thousands

- three

- thrilled

- Through

- Throwing

- tiktok

- time

- times

- to

- today

- today’s

- together

- too

- took

- tool

- top

- topic

- track

- traction

- traded

- traffic

- trained

- Transcript

- travel

- Trees

- Trends

- tried

- true

- truth

- Turned

- two

- type

- unable

- under

- understands

- unit

- units

- Universe

- until

- unusual

- us

- used

- User

- using

- usually

- Valuable

- Valuable Information

- value

- Versus

- very

- Video

- View

- views

- Village

- vision

- wait

- Waiting

- walked

- Wall

- Wall Street

- Wall Street Journal

- Walmart

- want

- wanted

- wants

- war

- was

- Watch

- Way..

- ways

- we

- Website

- Wednesday

- week

- welcome

- WELL

- were

- West

- What

- What is

- when

- whenever

- whether

- which

- while

- WHO

- whole

- why

- Wild

- will

- willing

- win

- winner

- Wins

- with

- within

- without

- Won

- wonderful

- Word

- Work

- worked

- working

- works

- world

- worry

- Worst

- worth

- would

- WoW

- wrap

- Wrapped

- write

- writer

- writing

- written

- Wrong

- year

- years

- yet

- york

- you

- young

- Your

- yourself

- youtube

- zephyrnet

- zero