Banks and API Ecosystem Strategies

CCG | Kate Drew | May 11, 2023

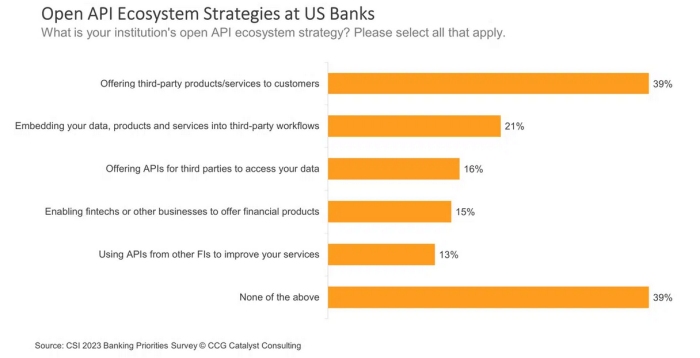

According to CSI’s 2023 Banking Priorities Survey, the number one strategy banks are pursuing when it comes to their open API ecosystems is offering third-party products/services to customers.

Three key take-aways:

1. Banks Prioritize Third-Party Offerings: According to the CSI's 2023 Banking Priorities Survey, banks are increasingly focusing on offering third-party products/services through their open API ecosystems. This best-of-breed approach enables them to provide solutions tailored to specific functions or use cases, rather than solely relying on a single vendor. This strategy helps banks to differentiate themselves in a highly competitive market.

See: McKinsey: Reshaping Retail Banks for the Digital Battlefield

2. Potential Missed Opportunities: Despite the push towards third-party offerings, banks may be neglecting other important aspects of API strategy. Data shows that only 21% of banks are embedding their data, products, and services into third-party workflows, and only 16% are offering APIs for third parties to access their data. As open banking regulations are likely to increase, banks might be missing out on important opportunities by not broadening their API strategies.

3. Importance of a Holistic Strategy: It's crucial for banks to develop a comprehensive and long-term strategy when approaching API ecosystems. While it's positive that 66% of US banking leaders are including an interoperability layer or API gateway in their modernization strategy, forethought and planning are key. Without a well-thought-out strategy, there's a risk of building solutions that may not fully utilize the potential of API ecosystems, leading to missed opportunities and potential inefficiencies.

Continue to the full article --> here

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://ncfacanada.org/banks-and-api-ecosystem-strategies/

- :is

- :not

- 11

- 2018

- 2023

- 28

- a

- access

- According

- affiliates

- AI/ML

- alternative

- alternative finance

- an

- and

- api

- APIs

- approach

- approaching

- ARE

- article

- AS

- aspects

- Assets

- Banking

- Banks

- Battlefield

- BE

- become

- blockchain

- Building

- by

- cache

- Canada

- capital

- cases

- Category

- CGI

- closely

- comes

- community

- competition

- competitive

- comprehensive

- create

- Crowdfunding

- crucial

- cryptocurrency

- CSI

- Customers

- Dark

- data

- decentralized

- Despite

- develop

- differentiate

- digital

- Digital Assets

- distributed

- ecosystem

- Ecosystems

- Education

- embedding

- enables

- engaged

- entry

- Ether (ETH)

- finance

- financial

- financial innovation

- fintech

- focusing

- For

- forethought

- from

- full

- fully

- functions

- funding

- funding opportunities

- gateway

- get

- Global

- Government

- helps

- highly

- holistic

- HTML

- http

- HTTPS

- human

- importance

- important

- in

- Including

- Increase

- increasingly

- industry

- information

- Innovation

- innovative

- Insurtech

- Intelligence

- Interoperability

- into

- investment

- IT

- Jan

- jpg

- Key

- layer

- leaders

- leading

- light

- likely

- long-term

- Market

- max-width

- May..

- McKinsey

- member

- Members

- might

- missing

- modernization

- more

- NEO

- networking

- number

- of

- offering

- Offerings

- on

- ONE

- only

- open

- open banking

- opportunities

- or

- Other

- out

- parties

- partners

- payments

- peer to peer

- perks

- planning

- plato

- Plato Data Intelligence

- PlatoData

- please

- positive

- potential

- Prioritize

- productivity

- Products

- projects

- provide

- provides

- Push

- rather

- Regtech

- regulations

- retail

- Risk

- s

- Sectors

- Services

- Shows

- single

- Solutions

- specific

- stakeholders

- Stewardship

- strategies

- Strategy

- Survey

- TAG

- tailored

- than

- that

- The

- their

- Them

- themselves

- There.

- Third

- third parties

- third-party

- this

- thousands

- Through

- Title

- to

- today

- Tokens

- towards

- us

- use

- utilize

- vendor

- vibrant

- Visit

- when

- while

- with

- without

- workflows

- works

- Yahoo

- zephyrnet