- AUD/USD is expected to deliver more downside below 0.6850 amid the risk-off market mood.

- A solid case for the continuation of policy tightening by the Fed sent yields on fire.

- Higher Australian Wage Price Index could keep inflationary pressures elevated.

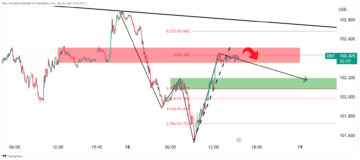

The AUD/USD pair is attempting to build a short-term cushion around 0.6850 in the early Asian session. The Aussie asset is expected to deliver more weakness after surrendering the 0.6850 cushion as the market mood is quite negative ahead of the release of the Federal Open Market Committee (FOMC) minutes.

S&P500 witnessed a massive sell-off on Tuesday as the upbeat preliminary S&P PMI data bolstered the expectations of more rates by the Federal Reserve (Fed) ahead. Upbeat economic activities indicate that the demand for labor could accelerate further, which will result in higher consumer spending. This might propel the United States Consumer Price Index (CPI) ahead. The US Dollar Index (DXY) climbed to near 103.90 amid the risk aversion theme.

A solid case for the continuation of policy tightening by Fed chair Jerome Powell sent yields on fire. The alpha generated on 10-year US Treasury bonds jumped to near 4%.

Preliminary S&P Manufacturing PMI (Feb) climbed to 47.8 from the consensus of 47.3 and the former release of 46.9. The Services PMI soared to 50.5 from the estimates of 47.2 and the prior release of 46.8.

For further guidance, the release of the FOMC minutes will be keenly watched. The FOMC minutes will provide the rationale behind hiking interest rates by 25 basis points (bps) to 4.50-4.75%. Apart from that, cues about the interest rate guidance will be in focus.

On the Australian front, after hawkish Reserve Bank of Australia (RBA) minutes, investors are focusing on the Labor Cost Index (Q4) data. On a quarterly basis, the economic data is seen steady at 1%. The annual data is expected to improve to 3.5% from the former release of 3.1%. Firms are offsetting the demand for labor by providing higher wages, which is going to keep Australian inflationary pressures at elevated levels.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.fxstreet.com/news/aud-usd-sees-more-weakness-below-06850-ahead-of-fomc-minutes-202302212213

- 9

- a

- About

- accelerate

- activities

- After

- ahead

- Alpha

- Amid

- and

- annual

- apart

- around

- asian

- asset

- attempting

- AUD/USD

- aussie

- Australia

- Australian

- aversion

- Bank

- basis

- behind

- below

- build

- case

- Chair

- Climbed

- committee

- Consensus

- consumer

- continuation

- Cost

- could

- CPI

- data

- deliver

- Demand

- Dollar

- downside

- Dxy

- Early

- Economic

- elevated

- estimates

- expectations

- expected

- Fed

- Fed Chair

- Federal

- Federal Open Market Committee

- federal reserve

- Fire

- firms

- Focus

- focusing

- FOMC

- fomc minutes

- Former

- from

- front

- further

- generated

- going

- Hawkish

- higher

- hiking

- HTTPS

- improve

- in

- index

- indicate

- Inflationary

- Inflationary pressures

- interest

- INTEREST RATE

- Investors

- Keep

- labor

- levels

- manufacturing

- Market

- massive

- might

- minutes

- mood

- more

- Near

- negative

- open

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- points

- policy

- price

- Prior

- Propel

- provide

- providing

- Rate

- Rates

- RBA

- release

- Reserve

- reserve bank

- reserve bank of australia

- Reserve Bank of Australia (RBA)

- result

- Risk

- S&P

- sees

- sell-off

- Services

- session

- short-term

- soared

- solid

- Spending

- States

- steady

- The

- the Fed

- theme

- tightening

- to

- treasury

- Tuesday

- United

- United States

- us

- US Treasury

- wage

- wages

- weakness

- which

- will

- witnessed

- yields

- zephyrnet