On-chain data shows the Bitcoin exchange reserve ratio for US versus offshore platforms has continued to decline recently. Here’s what this tells us.

Bitcoin Exchange Reserve Ratio Has Been Falling For A While Now

As explained by an analyst in a CryptoQuant post, the BTC reserve of the US-based exchanges is going down. The “exchange reserve” is an indicator that measures the total amount of Bitcoin that’s currently sitting in the wallets of a centralized exchange or a group of such platforms.

The metric of interest here is not actually the exchange reserve, but the “exchange reserve ratio.” As this indicator’s name implies, it tells us about the ratio between the exchange reserves of two given sets of platforms. In the context of the current discussion, the two sets of exchanges are the American and foreign platforms.

When the value of this ratio increases, it means the number of coins sitting on the US-based platforms is going up relative to the supply on the offshore exchanges. This naturally means that the American platforms are receiving a higher amount of deposits (or just lower withdrawals) than the foreign ones.

On the other hand, the metric’s value going down suggests the global platforms are seeing higher growth in their reserves than the US-based exchanges at the moment.

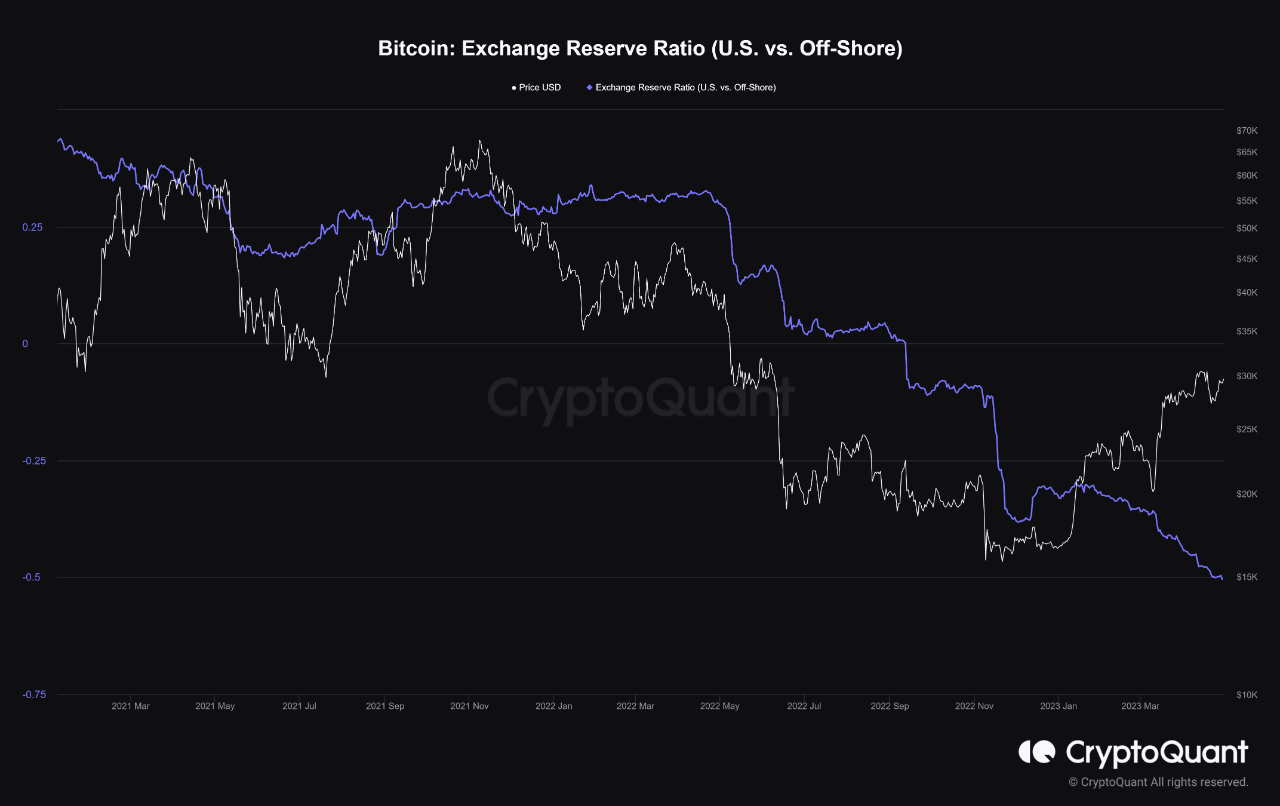

Now, here is a chart that shows the trend in the Bitcoin exchange reserve ratio for the US vs offshore platforms over the last couple of years:

The value of the metric seems to have been going down in recent days | Source: CryptoQuant

As you can see in the above graph, the Bitcoin exchange reserve ratio for these two sets of platforms has been falling off since the first half of 2022. This implies that the supply on the US-based exchanges has been constantly declining compared to that on the foreign platforms.

The decline has been especially sharp during major crashes where some major platforms have gone bankrupt and FUD has spread around the market, leading to investors withdrawing their coins from centralized exchanges.

Though, while these crashes may have caused temporary accelerations in the drawdown, the total exchange supply of Bitcoin has been in a state of decline for a long while now. The decline has also been a market-wide phenomenon, meaning that all exchanges are seeing a shrinkage in their supply.

However, considering that the exchange reserve ratio has continued to go down, it means that the decline has been especially sharp for the US-based platforms. This would imply that investors have been fleeing American exchanges at a faster rate during this period.

“Because of regulatory demands, American investors may no longer have as much faith in exchanges and would rather shift their coins to offshore exchanges or their wallets,” the quant explains. “If American policymakers put pressure on this industry, they risk falling behind the rest of the globe.”

BTC Price

At the time of writing, Bitcoin is trading around $28,500, up 4% in the last week.

BTC has plummeted in the last 24 hours | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Source: https://bitcoinist.com/bitcoin-investors-leaving-american-exchanges-data/

- :has

- :is

- :not

- :where

- $UP

- 2022

- 24

- 500

- a

- About

- above

- actually

- All

- also

- American

- amount

- an

- analyst

- and

- ARE

- around

- AS

- At

- bankrupt

- been

- behind

- between

- Bitcoin

- bitcoin investors

- Bitcoin Price

- blockchain

- BTC

- but

- by

- CAN

- caused

- centralized

- centralized exchange

- Centralized Exchanges

- Chart

- Charts

- Coins

- COM

- compared

- considering

- constantly

- context

- continued

- Couple

- cryptoquant

- Current

- Currently

- data

- Days

- Decline

- Declining

- demands

- deposits

- discussion

- down

- during

- especially

- exchange

- Exchange Reserves

- Exchanges

- explained

- Explains

- faith

- Falling

- faster

- First

- For

- foreign

- from

- FUD

- given

- Global

- globe

- Go

- going

- graph

- Group

- Growth

- Half

- hand

- Have

- here

- higher

- HOURS

- HTTPS

- image

- in

- Increases

- Indicator

- industry

- interest

- Investors

- IT

- just

- Last

- leading

- leaving

- Long

- longer

- major

- Market

- May..

- meaning

- means

- measures

- metric

- moment

- much

- name

- no

- now

- number

- of

- off

- on

- or

- Other

- over

- period

- phenomenon

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- policymakers

- pressure

- price

- price chart

- put

- Quant

- Rate

- rather

- ratio

- receiving

- recent

- recently

- regulatory

- Reserve

- reserves

- REST

- Risk

- says

- see

- seeing

- seems

- Sets

- sharp

- shift

- Shows

- since

- Sitting

- some

- Source

- spread

- State

- such

- Suggests

- supply

- tells

- temporary

- than

- that

- The

- their

- These

- they

- this

- time

- to

- Total

- Trading

- TradingView

- Trend

- two

- Unsplash

- us

- value

- Versus

- vs

- Wallets

- week

- What

- while

- Withdrawals

- would

- writing

- years

- you

- zephyrnet