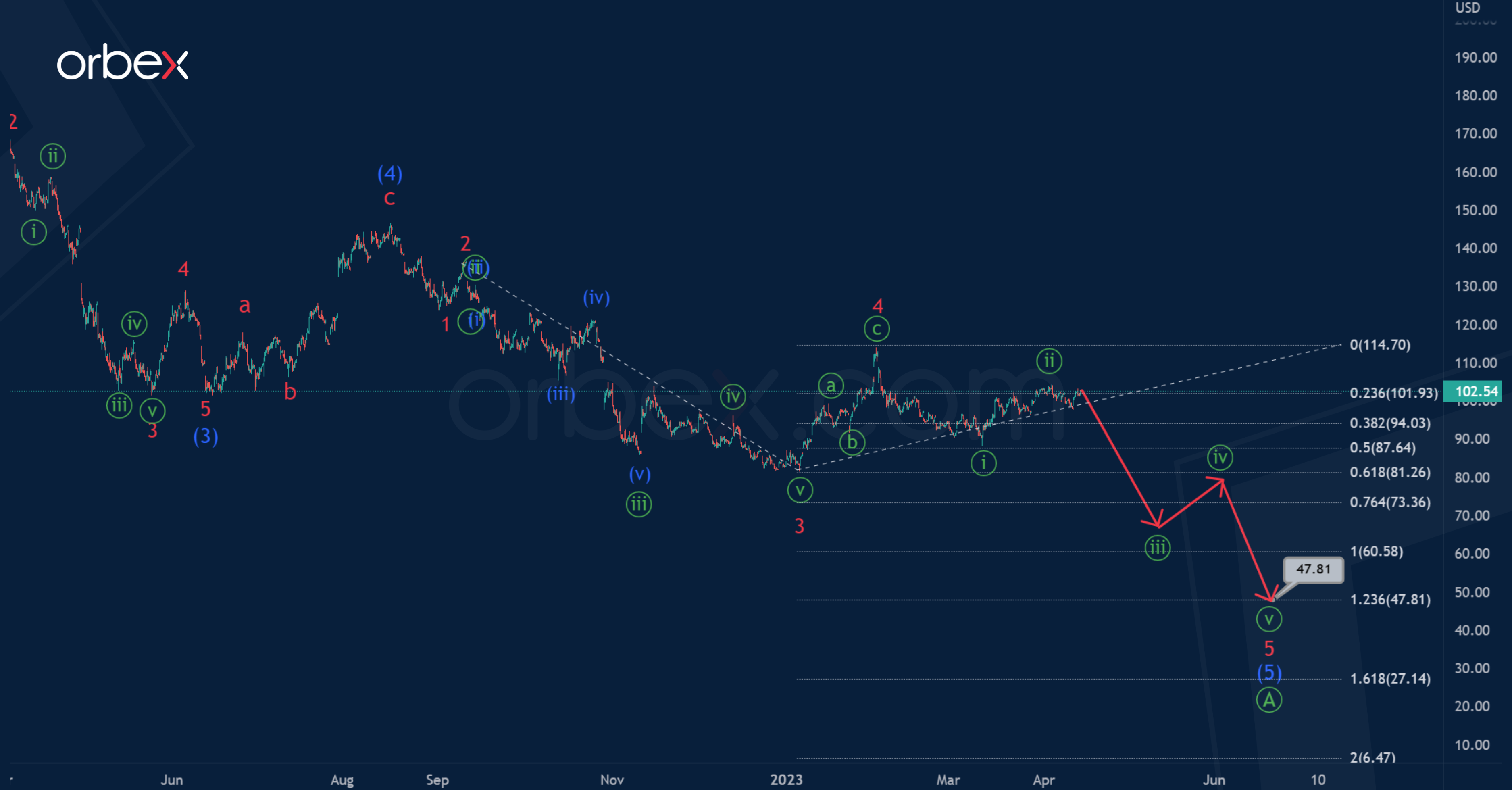

AMZN in the long term suggests the formation of a bearish correction b, it has the form of a zigzag Ⓐ-Ⓑ-Ⓒ of the primary degree.

As a few weeks ago, we see a continuation of the depreciation of stocks in the final intermediate wave 5 of (5) of the leading diagonal Ⓐ near 47.81. At that level, minor wave 5 will be at 123.6% of impulse wave 3.

Wave 5 can take the form of a minute impulse, as shown in the chart.

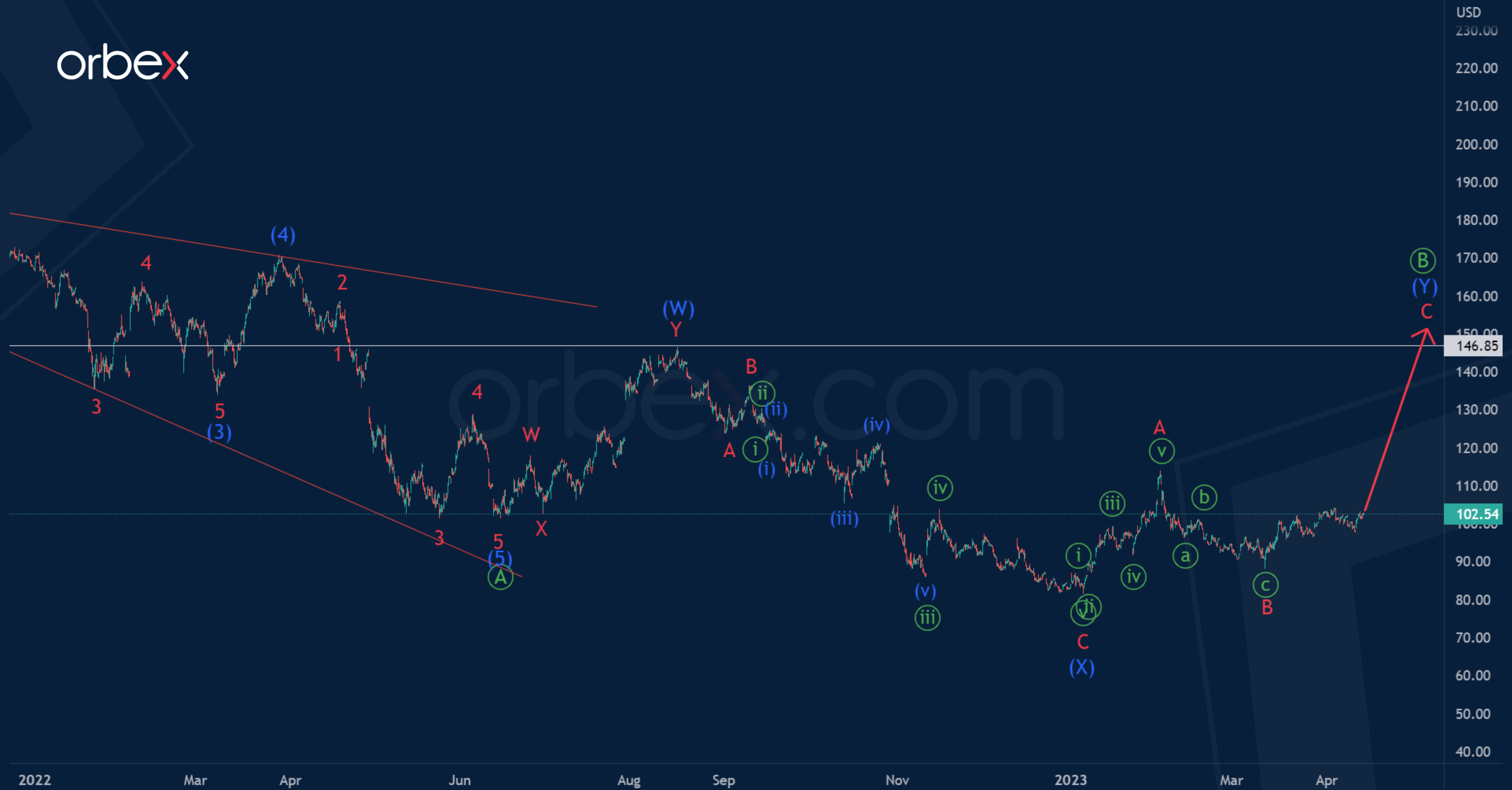

An alternative scenario shows a situation in which the leading diagonal Ⓐ can be fully completed, and the price moves in a horizontal correction Ⓑ.

There is a high probability that the correction wave Ⓑ will take the form of an intermediate double three (W)-(X)-(Y), where the second intervening wave (X) has come to an end.

In the next coming trading days, an upward movement is expected in the final zigzag wave (Y), more precisely in the minor wave C to the maximum of 146.85, where the wave (W) was completed.

Test your strategy on how the AMZN will fare with Orbex

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Source: https://www.orbex.com/blog/en/2023/04/amzn-minute-impulse-likely-to-complete-bearish-trend

- :is

- 2012

- a

- active

- alternative

- analysis

- analyst

- and

- articles

- AS

- At

- author

- avatar

- BE

- bearish

- Blog

- CAN

- Chart

- come

- coming

- complete

- Completed

- continuation

- daily

- Days

- Degree

- description

- double

- Elliott

- Ether (ETH)

- exclusively

- expected

- few

- final

- financial

- Focus

- form

- formation

- fully

- High

- Horizontal

- How

- HTTPS

- image

- in

- Intermediate

- intervening

- IT

- leading

- Level

- likely

- live

- Long

- Main

- Markets

- max-width

- maximum

- minor

- minute

- more

- movement

- moves

- Near

- next

- of

- on

- plato

- Plato Data Intelligence

- PlatoData

- practice

- precisely

- price

- primary

- probability

- research

- scenario

- seasoned

- Second

- Shares

- shown

- Shows

- since

- situation

- skill

- specializing

- Stocks

- Strategy

- Studying

- Suggests

- Take

- Technical

- Technical Analysis

- that

- The

- three

- to

- trader

- Trading

- Trend

- types

- upward

- URL

- various

- W

- Wave

- Weeks

- which

- WHO

- will

- with

- X

- years

- Your

- zephyrnet