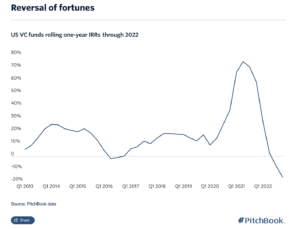

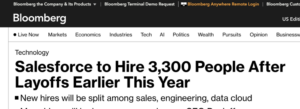

So while the media is full of stories of unicorns doing layoffs and massive cutbacks, the story is a bit different with leading public SaaS companies. Yes many public SaaS companies have done some sort of layoffs the past 12 months, they were often more really reorgs, though, without any net decrease in headcount. And yes, many have gotten tougher on spending for sure. But almost every public SaaS leader has still grown at either pretty good or very good rates the past 12+ months.

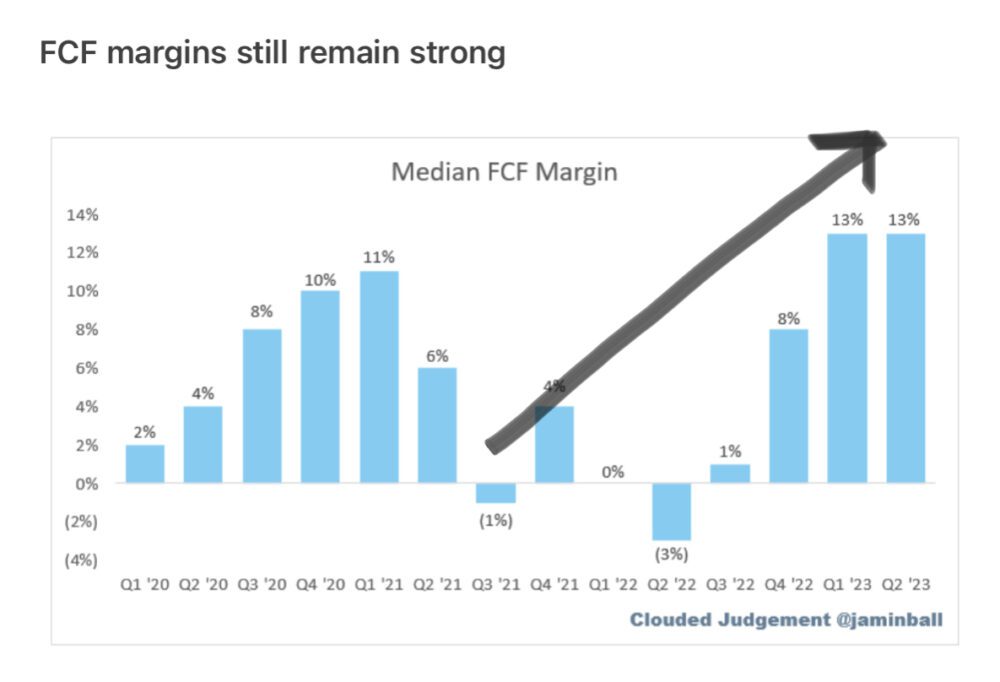

What’s changed the most: the leaders in SaaS have gotten radically more efficient. In many cases, for the first time ever.

Let’s take a look at some examples:

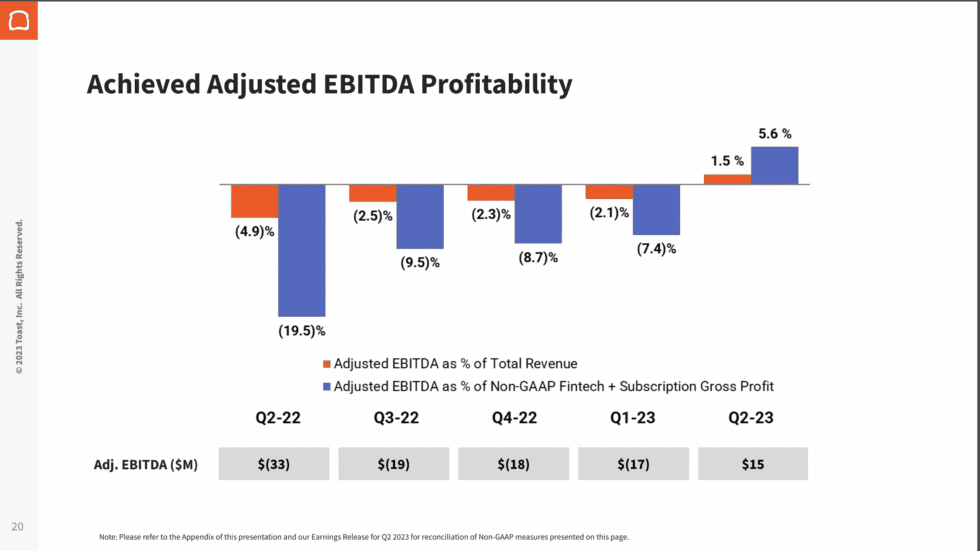

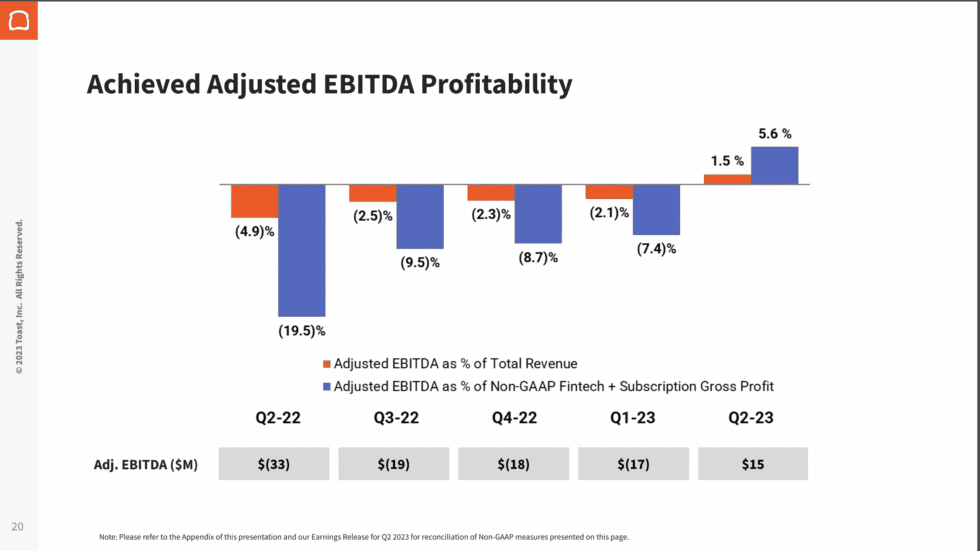

#1. Toast: From -5% EBITA to +6% in Just 12 Months. While Still Growing 43% at $1.1 Billion in ARR!

Toast dominates the restaurant POS space but its model has some inherent challenges in getting to positive operating margins: it sells to SMBs with a sales-driven model (harder), it has high hardware costs that it loses money on, and it has high services costs onboarding these small customers. That’s tough to make the margins work on, and Toast didn’t have to be EBTIDA “profitable” though its IPO. But the markets have changed, and Toast made it happen — all while still growing 43% at $1.1 Billion in ARR. More here.

#2. Monday.com Went From -16% Free Cash Flow to a Stunning +26% in Just 1 Year. Even While Growing 42% at $700,000,000 in ARR!!

Wow, night and day. Monday has always been a break-out leader but has invested heavily in sales and marketing to SMBs. But when it needed to get free cash flow positive, it did fast. Without really sacrificing growth. The key was “simply” keeping headcount flat.

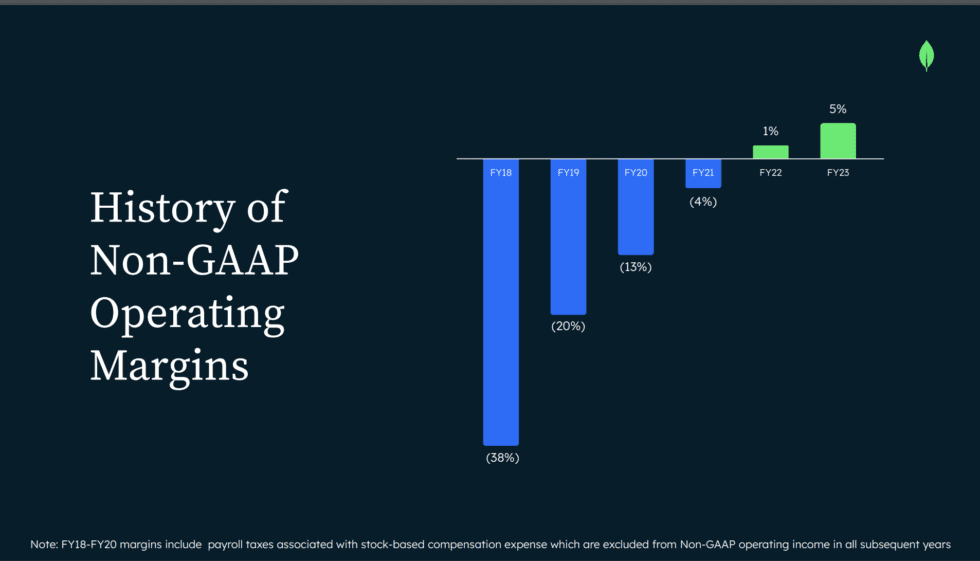

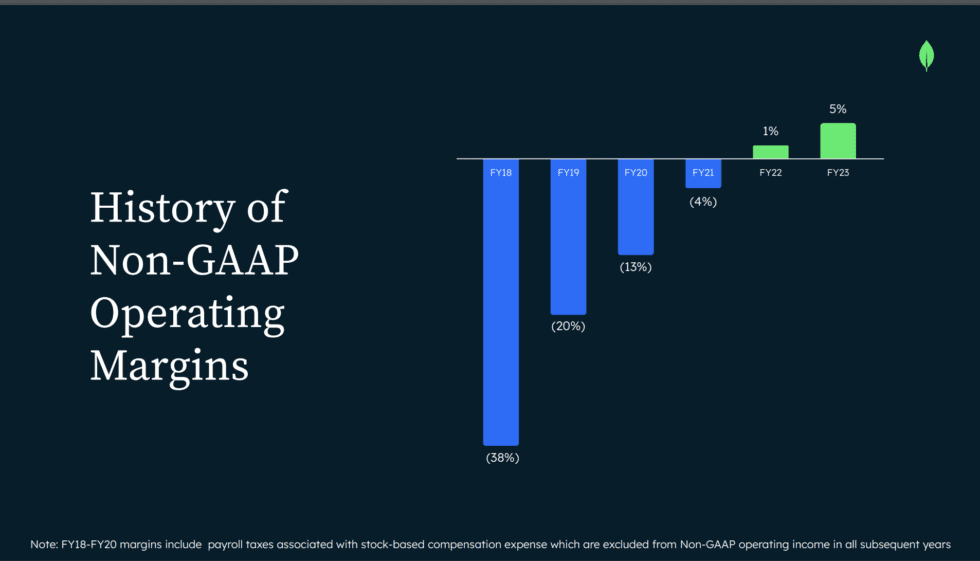

#3. MongoDB: From -4% Operating Margins to +5%. While still growing 29% at $1.5 Billion in ARR.

While this is a more gradual change over 2 years rather than a quick evolution to react to market changes, it’s still impressive to see Mongo’s operating margins evolve over 2 years even with strong top-line growth.

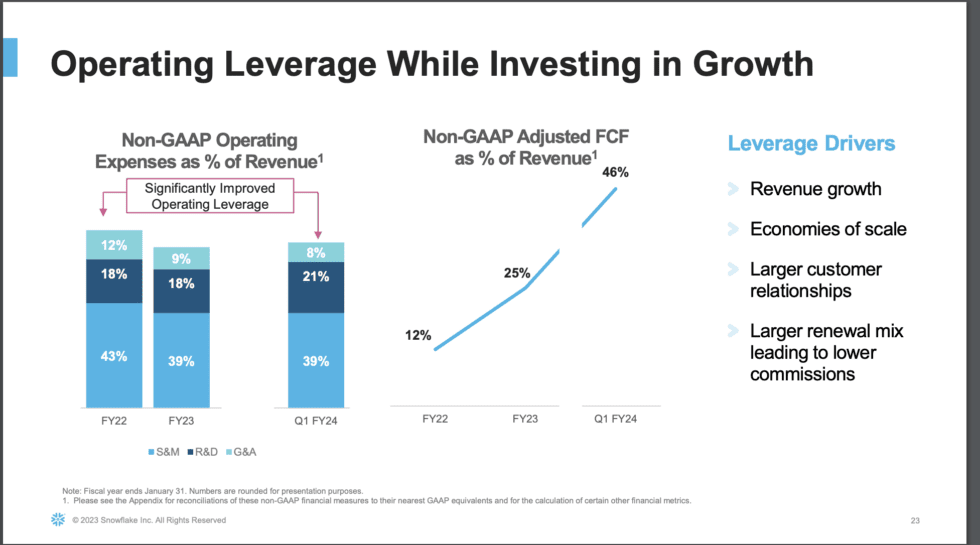

#4. Snowflake Has Gotten Radically More Efficient As It’s Cruised Past $2 Billion in ARR.

Not only has its free-cash flow doubled in just one year from 12% to 25%, but it’s predicting epic free cash flow in 2024 of 46%. Wow. Everyone is basically doing more with not much more headcount. That’s the theme.

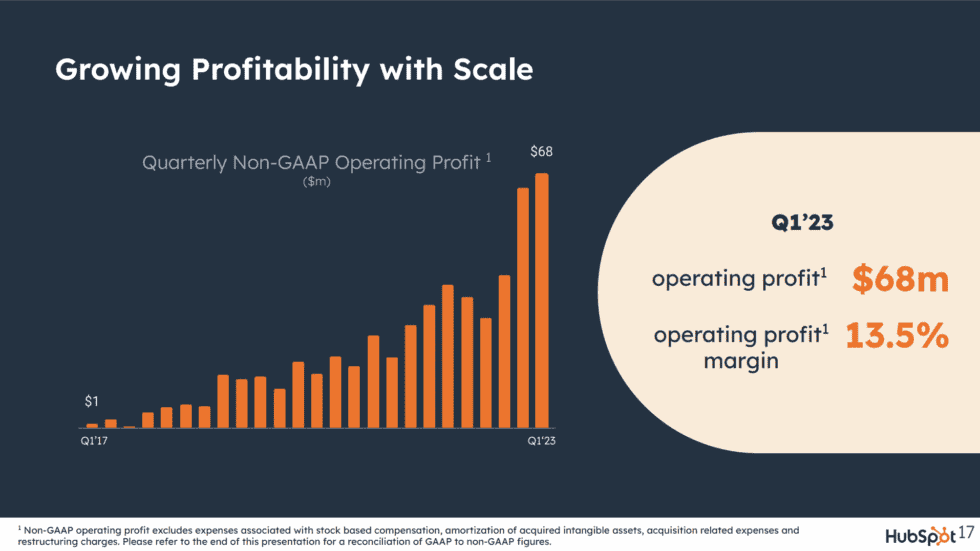

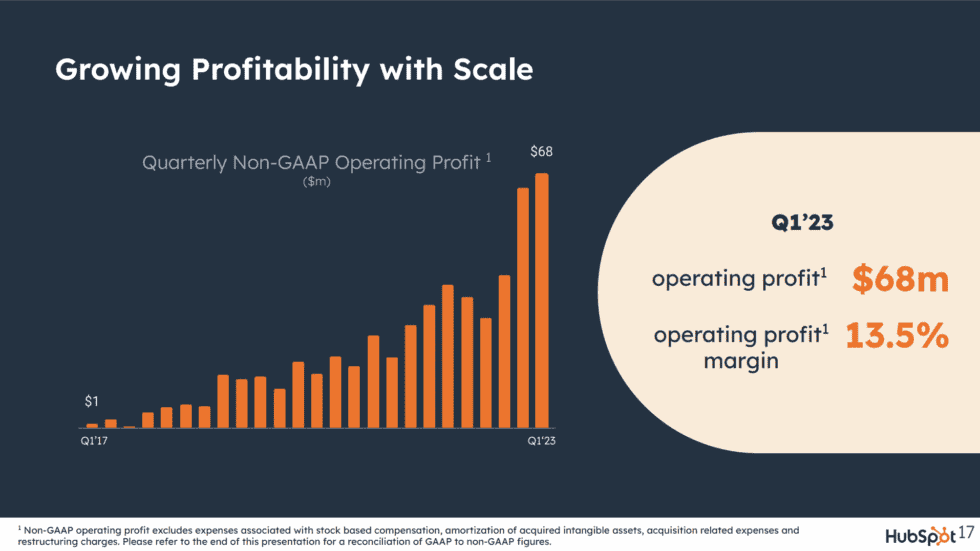

#5. HubSpot Too Has Gotten Radically More Efficient. Even While Still Growing 30% at $2 Billion in ARR!

HubSpot’s operating margins have scaled into the double-digits the past two quarters for the first time. HubSpot has managed to continue impressive growth (30% at $2B ARR) while still getting radically more efficient than 12 months ago. They did it. You can, too. Basically, we all have to now.

Almost everyone at scale in SaaS has continued to grow AND gotten radically more efficient. That’s the big take-away. Yes, it can be done.

Now that we’ve proven you really can have it all at scale — strong growth, even past $1B in ARR, and efficient growth — will the era of inefficient growth be forever behind us in SaaS? That’s the big question.

Or will a potentially stronger market in coming quarters lead the markets to once again care mainly about growth, and ignore the bottom line to a large extent? We’ll see.

My sense is now that so many SaaS leaders have proven that yes, you can have it all — growth and efficiency — that it will be tough to go back. And that will put continued pressure on headcount and sales & marketing efficiency.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.saastr.com/almost-everyones-gotten-radically-more-efficient-in-saas/

- :has

- :is

- :not

- 000

- 1

- 12

- 12 months

- 2019

- 2024

- 40

- a

- About

- again

- ago

- All

- always

- and

- any

- AS

- At

- back

- Basically

- BE

- been

- behind

- Big

- Billion

- Bit

- Bottom

- but

- Campaign

- CAN

- care

- cases

- Cash

- cash flow

- challenges

- change

- changed

- Changes

- Chapter

- COM

- coming

- Companies

- continue

- continued

- converting

- Costs

- Customers

- day

- decrease

- DID

- different

- doing

- dominates

- done

- doubled

- efficiency

- efficient

- either

- embed

- EPIC

- Era

- Ether (ETH)

- Even

- EVER

- Every

- everyone

- evolution

- evolve

- examples

- extent

- FAST

- First

- first time

- flat

- flow

- For

- forever

- Free

- from

- full

- get

- getting

- Go

- good

- gradual

- Grow

- Growing

- grown

- Growth

- happen

- harder

- Hardware

- Have

- headcount

- heavily

- High

- HTTPS

- HubSpot

- impressive

- impressive growth

- in

- inefficient

- inherent

- into

- invested

- IPO

- IT

- ITS

- just

- just one

- keeping

- Key

- large

- layoffs

- lead

- leader

- leaders

- leading

- Line

- Look

- Loses

- made

- mainly

- make

- managed

- many

- margins

- Market

- Marketing

- Markets

- massive

- max-width

- Media

- model

- Monday

- money

- MongoDB

- months

- more

- more efficient

- most

- much

- needed

- net

- night

- now

- of

- often

- on

- Onboarding

- once

- ONE

- only

- operating

- or

- over

- past

- plato

- Plato Data Intelligence

- PlatoData

- PoS

- positive

- potentially

- predicting

- pressure

- pretty

- proven

- public

- put

- question

- Quick

- radically

- Rates

- rather

- React

- really

- restaurant

- s

- SaaS

- sacrificing

- sales

- Sales & Marketing

- Sales and Marketing

- Scale

- see

- Sells

- sense

- Services

- site

- small

- SMBs

- So

- some

- Space

- Spending

- Still

- Stories

- Story

- strong

- stronger

- Stunning

- subscribers

- sure

- Take

- than

- that

- The

- theme

- These

- they

- this

- though?

- time

- Title

- to

- toast

- too

- tough

- two

- unicorns

- us

- very

- visitors

- was

- we

- went

- were

- when

- while

- will

- with

- without

- Work

- WoW

- year

- years

- yes

- you

- zephyrnet