If Elon Musk has been “asleep at the wheel” as Tesla CEO — which one former bull investor now claims — he certainly needs to wake up fast.

As his worsening problems at both Tesla and Twitter seem to suggest, Musk is facing a waking nightmare. Comments made Thursday meant to reassure the automaker’s increasingly wary investors so far haven’t headed off a continuing stock price plunge. Nor has Musk’s promise to step down as CEO at the social media giant helped restore confidence among former advertisers that have quit Twitter in recent weeks.

And more problems appear to be in the offing. Layoffs and a hiring freeze reportedly now are in the works at Tesla — even as hefty new incentives have been launched to help shore up weakening sales. Then there are the latest reports about crashes involving Tesla vehicles running on the company’s Autopilot and Full Self-Driving technologies — the latter now implicated in a Thanksgiving incident in San Francisco involving eight vehicles traveling on the Bay Bridge.

“Need a new leader”

What seems clear is that investors aren’t giving Musk much leeway, the company’s stock now setting new 52-week lows on a daily basis for the past eight days. It closed at $126.37 on Thursday and then dropped by as much as 3% during early Friday trading before staging a modest recovery. It is down about 61% since Musk first announced a $44 billion plan to acquire Twitter in April, half that decline coming since the controversial acquisition was completed Oct. 28.

Tesla — listed on the Nasdaq as TSLA — has lost two-thirds of its market capitalization, now down below $400 billion, and is barely trading at the same price as when shares were added to the Fortune 500 five years ago.

“At the same time that Tesla is cutting prices and inventory is starting to build globally in face of a likely global recession, Musk is viewed as ‘asleep at the wheel’ from a leadership perspective for Tesla at the time investors need a CEO to navigate this Category 5 storm,” Dan Ives, a longtime Tesla bull and managing director at Wedbush Securities, wrote Friday.

His post joined a growing list of comments of steadfast Tesla and Musk supporters apparently calling for a change in top management at the automaker. “Need a new leader at this time for Tesla, not Ted Striker,” said Ives, referencing the comedy film “Airplane.”

“A very bad feeling”

A notoriously thin-skinned micromanager Musk has, if anything, driven away a number of potential successors at Tesla, those familiar with the company warn. And Musk himself said this week it would take someone “foolish enough” to replace him as CEO at Twitter now that he has promised to step down.

In the meantime, he is dealing with an array of worsening challenges.

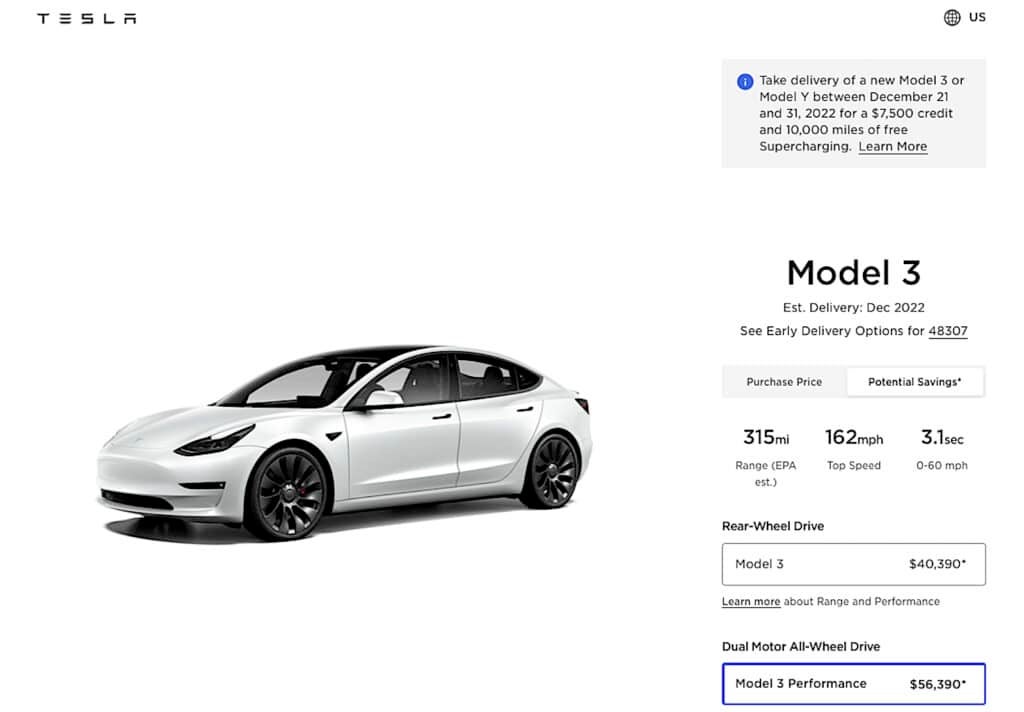

The South African-born executive had promised to deliver “epic” numbers for the fourth quarter of 2022, following solid earnings and sales reports for the July-September period. But the global car market, on the whole, is slowing and Tesla is showing signs of significant weakness. It suspended production for a week in China and doubled end-of-year sales incentives to $7,500 in the U.S. on its two most popular products, the Models 3 and Y.

Musk has warned he has a “very bad feeling” about the economy and website Electrek reported he told employees there will be layoffs coming, along with a job freeze. It’s not clear how extensive these will be and, TheDetroitBureau.com reported, the company still has billboards up in parts of the metro Detroit seeking tooling experts.

“You certainly have my commitment”

Musk last week sold $3.6 billion worth of his Tesla stock, bringing to about $40 billion the amount of his holdings he’s divested this year.

To ease concerns, Musk staged a Twitter Spaces call Thursday during which he said, “You certainly have my commitment I won’t sell stock until, I don’t know, probably two years from now. Definitely not next year under any circumstances and probably not the year thereafter.”

But he has made a number of similar promises that he failed to keep recently. And that’s hurting not only Tesla but Twitter.

Moving to the right

Even before the acquisition was completed, Musk was using the service to openly shift his political stand to the right. He went the next step once he commanded Twitter, attacking Democratic leaders, Liberals, members of the LGBTQ+ community and others on the Left. Declaring himself a “free speech absolutist,” Musk lifted bans on former President Donald Trump and Congresswoman Marjorie Taylor Greene, as well as some notorious anti-vaxxers and anti-Semites. But he also banned critics, including some prominent journalists.

That has led to a flood of defections by advertisers. At last count, about 70% of the largest have fled — as have many high-traffic Twitter users seen as highly valuable to advertisers.

At one point, Musk threatened to “thermonuclear name & shame” those advertisers who bolted, though he didn’t follow through. Still, relationships were soured and there’s no sign that his attempts to cool down controversy and reach out to companies like General Motors and Apple are paying off.

“Advertisers can’t avoid the association”

Where once Musk had a reputation as “the smartest man in the room,” with many powerful figures anxious to be seen in his company. That is far less the case today, analysts warn, especially advertisers hoping to curate a positive image.

“He has made it so that advertisers can’t avoid the association. He created that vulnerability and he continues to double down on it,” Irwin Gotlieb, a former chief executive of ad-buying giant GroupM, told the Wall Street Journal.

As a result, Twitter’s finances continue to weaken, with a deficit reportedly now running about $1 million a day — and Musk facing annual debt payments of around $1 billion.

It’s quite possible the serial entrepreneur, known for his long workdays, really might want to go back to sleep. But with all the problems he has heaped upon himself, he will have to be working even more than ever to find solutions.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.thedetroitbureau.com/2022/12/a-waking-nightmare-musks-tesla-twitter-problems-continue-to-worsen/

- $1 billion

- $3

- 2022

- 28

- a

- About

- accused

- acquire

- acquisition

- added

- advertisers

- All

- among

- amount

- Analysts

- and

- announced

- annual

- appear

- Apple

- April

- around

- Array

- Assembly

- Association

- Attacking

- Attempts

- back

- Bad

- banned

- Bans

- basis

- Bay

- before

- being

- below

- Billion

- BRIDGE

- Bringing

- build

- bull

- buy

- call

- calling

- capitalization

- car

- case

- Category

- ceo

- certainly

- challenges

- change

- chief

- China

- circumstances

- claims

- clear

- closed

- COM

- Comedy

- coming

- comments

- commitment

- community

- Companies

- company

- Company’s

- Completed

- Concerns

- confidence

- Congresswoman

- continue

- continues

- continuing

- controversial

- controversy

- Cool

- created

- Critics

- cutting

- daily

- day

- Days

- dealing

- Debt

- debt payments

- Decline

- DEFICIT

- definitely

- deliver

- democratic

- Director

- Discount

- Donald Trump

- Dont

- double

- doubled

- down

- driven

- dropped

- during

- Early

- Earnings

- economy

- Elon

- Elon Musk

- employees

- Entrepreneur

- especially

- Ether (ETH)

- Even

- EVER

- executive

- experts

- extensive

- Face

- facing

- Failed

- familiar

- FAST

- Figures

- Film

- Finances

- Find

- First

- follow

- following

- Former

- Fortune

- Fourth

- Francisco

- Freeze

- Friday

- from

- full

- General

- General Motors

- giant

- Giga

- Giving

- Global

- global recession

- Globally

- Go

- Growing

- Half

- headed

- help

- helped

- highly

- Hiring

- Holdings

- hoping

- How

- HTTPS

- image

- in

- Incentives

- incident

- Including

- increasingly

- inventory

- investor

- Investors

- IT

- Job

- joined

- journal

- Journalists

- Keep

- Know

- known

- largest

- Last

- latest

- launched

- layoffs

- leader

- leaders

- Leadership

- Led

- Lifted

- likely

- Line

- List

- Listed

- Long

- Lows

- made

- man

- management

- managing

- Managing Director

- many

- Market

- Market Capitalization

- max-width

- meantime

- Media

- Members

- might

- million

- model

- models

- more

- most

- Most Popular

- Motors

- Musk

- name

- Nasdaq

- Navigate

- Need

- needs

- New

- next

- notorious

- number

- numbers

- Oct

- Offing

- ONE

- opening

- Others

- parts

- past

- paying

- payments

- period

- permanently

- perspective

- PLAID

- plan

- plato

- Plato Data Intelligence

- PlatoData

- Plenty

- plunge

- Point

- political

- Popular

- positive

- possible

- Post

- potential

- powerful

- president

- President Donald Trump

- price

- Prices

- probably

- problems

- Production

- Products

- prominent

- promise

- promised

- promises

- Quarter

- reach

- recent

- recently

- recession

- recovery

- Relationships

- replace

- Reported

- Reports

- reputation

- result

- Room

- running

- Said

- sales

- Sales Incentives

- same

- San

- San Francisco

- Securities

- seeking

- seems

- self-driving

- sell

- serial

- service

- setting

- Shares

- shift

- sign

- significant

- Signs

- similar

- since

- sleep

- Slowing

- So

- so Far

- Social

- social media

- sold

- solid

- Solutions

- some

- Someone

- South

- spaces

- Speaks

- speech

- staging

- stand

- Starting

- Step

- Still

- stock

- Storm

- street

- supporters

- suspended

- Take

- Technologies

- Ted

- Tesla

- Thanksgiving

- The

- this week

- this year

- Through

- time

- to

- today

- top

- Trading

- Traveling

- trump

- TSLA

- Twitter Spaces

- two-thirds

- u.s.

- under

- users

- Valuable

- Vehicles

- vulnerability

- Wake

- Wake Up

- Wall Street

- Wall Street Journal

- weakness

- Website

- week

- Weeks

- Wheel

- which

- WHO

- will

- working

- works

- worth

- would

- year

- years

- zephyrnet