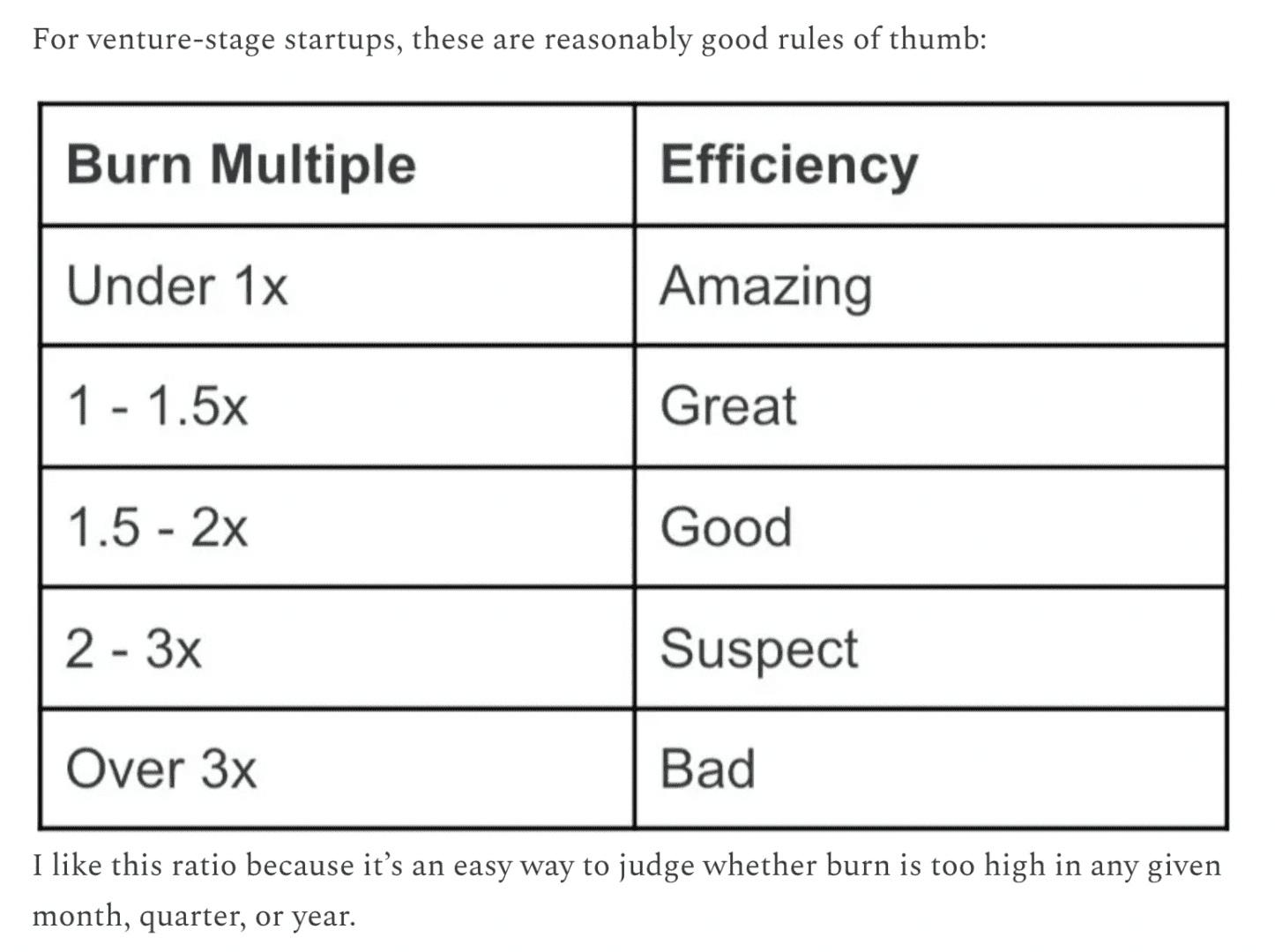

David Sacks’ classic post on Burn Rate Multiple is A+ and a key metric for every venture-backed startup. It simplifies a lot of complexity into one metric.

That if you’re venture-backed, yes, then yes you do have money to spend (and burn) — up to a point. But the best startups burn less each month than they bring in from new bookings and revenue (a Burn Multiple of 1x or less).

And especially these days, having a Burn Multiple of 1x or less will certainly make you more attractive to VCs — if the growth is also there. If.

However, I’ve seen this metric now misused by many venture-backed startups as a magical health meter for a “good enough” burn rate. Why? Well, at a practical level, it assumes the next round is coming.

Many VC-backed founders miss a simple, basic point:

- You can still run out of money even at 1x

- You can still run out of money with a “good” Burn Multiple

- The math on Burn Multiples sort of assumes you have 75%-80% gross margins (see my convo with David Sacks on this below). Much below that, and your Burn Multiple needs to be lower

- The math on Burn Multiples sort of assumes you have 100%+ NRR. Much below that, and your Burn Multiple needs to be lower.

- The Burn Multiple math, most importantly, still assumes you can raise another round

A Burn Multiple of 1x or less is relatively efficient, but it’s still a burn.

If you aren’t 95%+ sure you can raise another round, Zero Cash Date is even more important.

More on Zero Cash Date here:

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.saastr.com/a-low-burn-multiple-is-great-but-it-doesnt-mean-you-wont-run-out-of-money/

- :is

- $UP

- 20

- 30

- a

- also

- and

- Another

- AS

- assumes

- At

- attractive

- basic

- BE

- below

- BEST

- bookings

- bring

- burn

- but

- by

- CAN

- Cash

- certainly

- class

- coming

- complexity

- content

- data

- Date

- David

- Days

- do

- doesn

- each

- efficient

- embedded

- especially

- Even

- Every

- For

- founders

- from

- great

- gross

- Growth

- Have

- having

- Health

- here

- High

- HTTPS

- if

- important

- importantly

- in

- into

- IT

- Key

- less

- Level

- Lot

- Low

- lower

- make

- many

- margins

- math

- mean

- metric

- miss

- money

- Month

- more

- most

- much

- multiple

- my

- needs

- New

- next

- now

- of

- on

- ONE

- or

- out

- plato

- Plato Data Intelligence

- PlatoData

- Point

- Post

- Practical

- raise

- Rate

- relatively

- revenue

- round

- Run

- see

- seen

- sharing

- Simple

- simplifies

- spend

- startup

- Startups

- Still

- sure

- T

- than

- that

- The

- then

- There.

- These

- they

- this

- to

- true

- updated

- VCs

- WELL

- why

- will

- with

- Won

- yes

- you

- Your

- youtube

- zephyrnet

- zero