- China and Hong Kong benchmark stock indices have almost erased last week’s gains.

- NBS Non-Manufacturing PMI sub-components for January are indicating feeble service activities in China.

- A weaker US dollar via a dovish forward monetary policy guidance from the Fed is not enough to act as a bullish catalyst for China and Hong stock markets.

- Technical analysis advocates further potential weakness in the Hang Seng Index in the short to medium term.

This is a follow-up analysis of our prior report, “Hang Seng Index Technical: Countertrend rebound in play but not major bottoming” dated 25 January 2024. Click here for a recap.

Last week’s countertrend rallies triggered by the liquidity infusion from China’s central bank, PBoC’s 50 basis points (bps) cut announcement on the RRR (reserve requirement ratio) for major commercial banks have almost been wiped out at this time of the writing.

Week-to-date as of 31 January, China CSI 300 has declined by -2.8 % with similar losses in Hong Kong’s Hang Seng Indices; Hang Seng Index (-2.6%), Hang Seng TECH Index (-4.7%), and Hang Seng China Enterprises Index (-2.6%).

The resurgence of the bearish tone has been the continuation of lacklustre data from China’s key leading economic indicators. Manufacturing activities have continued to hover in a contractionary mode where the NBS Manufacturing PMI remained below the 50 level for four consecutive months with the latest January’s print just inched up slightly to 49.2 from the December 2023 six-month low of 49.0.

Lack of clear upside momentum in China’s services sector

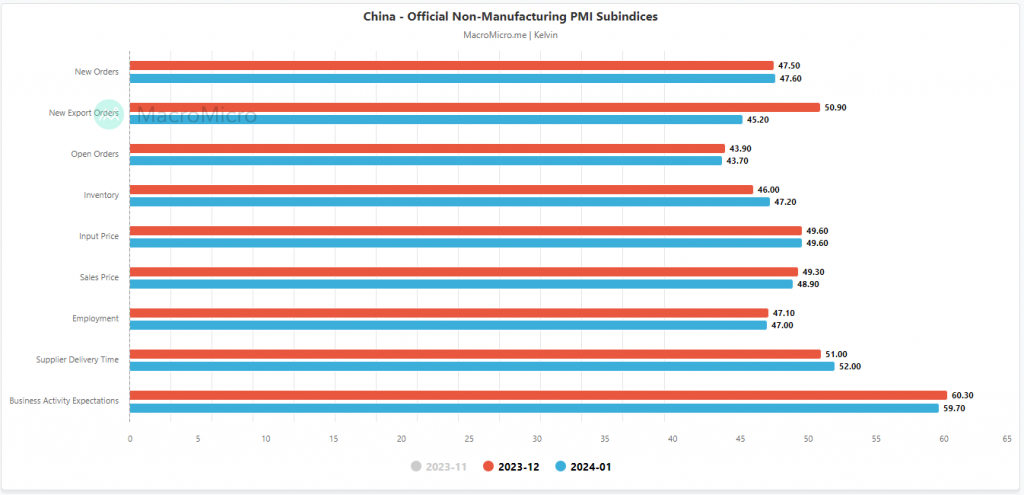

Fig 1: China NBS Non-Manufacturing PMI sub-components as of Jan 2024 (Source: MacroMicro, click to enlarge chart)

Even though the service sector has continued to expand modestly; the NBS Non-Manufacturing PMI for January came in at 50.7 from 50.4 recorded in December 2023 as well as slightly above the consensus of 50.6 but several sub-components have started to contract (see Fig 1).

New export orders have declined in January (45.20 vs 50.90 December), sales prices decreased further (48.9 vs 49.3 December), and business activity expectations (sentiment) eased to a three-month low (59.7 vs 60.3 December).

Overall, it’s a feeble services sector in China where the heightened risk of a deflationary spiral seems to be hard to reverse at least in the mindsets of stock market participants.

A weaker US dollar is likely not enough to act as a bullish catalyst

Fig 2: USD/CNH medium-term trend with CSI 300, HSI, HSCEI & EMXC as of 31 Jan 2024 (Source: TradingView, click to enlarge chart)

Given that the deflationary risk spiral is a structural economic weakness phenomenal, any potential upside cyclical factors such as lower interest rates, and a weaker US dollar may not be enough to trigger a medium-term bullish catalyst for China and the Hong Kong stock market.

Based on the recent broad-based US dollar weakness seen since late October 2023 where the US Fed’s dovish pivot intensified, the offshore yuan (CNH) has reversed from its prior nine-months of bearish trend against the US dollar and rallied by +3.1% but it has not translated to a positive reflexive feedback loop into the CSI 300, Hang Seng Index, and Hang Seng China Enterprises Index in contrast to its previous positive price actions seen during October 2022 to January 2023.

A further conclusion can be observed that other emerging markets stock markets have benefited from a weaker US dollar environment so far as the MSCI Emerging Markets excluding China exchange-traded fund (EMXC) has gained by close to 13% since the end of October 2023.

Therefore, if US Fed Chair Powell issues a dovish forward monetary policy guidance in today’s FOMC, it is likely that the US dollar may kickstart another impulsive down move sequence as US Treasury yields are likely to come under downside pressure.

However, China and Hong Kong stock markets may not be able to reap the fruits of such potential renewed US dollar weakness until the deflationary risk spiral is eradicated.

Watch the 15,900 key short-term resistance on the Hang Seng Index

Fig 3: Hong Kong 33 short-term trend as of 31 Jan 2024 (Source: TradingView, click to enlarge chart)

In the lens of technical analysis, the short and medium-term downtrend phases of the Hong Kong 33 Index (a proxy of the Hang Seng Index futures) are still intact despite last week’s rebound as price actions have continued to oscillate below its 20-day and 50-day moving averages.

Recent price actions have failed to make any clear breakout above its 20-day moving average after a test on it in the past week coupled with no bullish divergence condition being flashed out in the hourly RSI momentum indicator when it hit its oversold zone yesterday, 30 January.

These observations have suggested that short-term downside momentum has resurfaced which may lead to lower price actions of the Index that exposes the next immediate supports at 15,000 and 14,600 (also the key 31 October 2022 swing low area).

On the other hand, a clearance above 15,900 key short-term pivotal resistance negates the bearish tone for another round of countertrend rebound sequence with the next intermediate resistances coming in at 16,220 and 16,525.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.marketpulse.com/indices/a-dovish-fed-guidance-may-not-reverse-the-rout-in-china-and-hong-kong-stock-markets/kwong

- :has

- :is

- :not

- :where

- $UP

- 000

- 1

- 14

- 15 years

- 15%

- 16

- 20

- 2022

- 2023

- 2024

- 220

- 25

- 30

- 300

- 31

- 33

- 420

- 45

- 49

- 50

- 60

- 600

- 7

- 700

- 8

- 9

- 90

- a

- Able

- About

- above

- access

- Act

- actions

- activities

- activity

- addition

- advice

- advocates

- affiliates

- After

- against

- almost

- also

- an

- analyses

- analysis

- and

- Announcement

- Another

- any

- ARE

- AREA

- around

- AS

- At

- author

- authors

- avatar

- average

- award

- Bank

- Banks

- basis

- BE

- bearish

- beat

- been

- being

- below

- Benchmark

- Box

- breakout

- broad-based

- Bullish

- bullish divergence

- business

- but

- buttons

- buy

- by

- came

- CAN

- Catalyst

- central

- Central Bank

- Chair

- Chart

- China

- Chinas

- clear

- clearance

- click

- Close

- COM

- combination

- come

- coming

- commercial

- Commodities

- conclusion

- condition

- conducted

- Connecting

- consecutive

- Consensus

- contact

- content

- continuation

- continued

- contract

- contrast

- coupled

- courses

- CSI

- CSI 300

- Cut

- Cyclical

- data

- December

- decreased

- deflationary

- Despite

- Directors

- Divergence

- Dollar

- Dovish

- down

- downside

- during

- Economic

- economic indicators

- Elliott

- emerging

- emerging markets

- end

- enlarge

- enough

- enterprises

- Environment

- Ether (ETH)

- exchange

- exchange-traded

- excluding

- Expand

- expectations

- experience

- expert

- export

- factors

- Failed

- far

- Fed

- Fed Chair

- Fed Chair Powell

- feedback

- Fig

- financial

- Find

- flow

- FOMC

- For

- foreign

- foreign exchange

- forex

- Forward

- found

- four

- from

- Fruits

- fund

- fundamental

- further

- Futures

- gained

- Gains

- General

- Global

- global markets

- guidance

- hand

- Hang

- Hang Seng

- Hard

- Have

- heightened

- Hit

- Hong

- Hong Kong

- hover

- HTTPS

- if

- immediate

- impulsive

- in

- Inc.

- index

- indicating

- Indicator

- Indicators

- Indices

- information

- infusion

- intensified

- interest

- Interest Rates

- Intermediate

- into

- investment

- issues

- IT

- ITS

- Jan

- January

- just

- Kelvin

- Key

- Kong

- Last

- Late

- latest

- lead

- leading

- least

- Lens

- Level

- levels

- like

- likely

- Liquidity

- losses

- Low

- lower

- Macro

- major

- make

- manufacturing

- Market

- market outlook

- market research

- MarketPulse

- Markets

- max-width

- May..

- medium

- Mode

- Momentum

- Monetary

- Monetary Policy

- months

- more

- move

- moving

- moving average

- moving averages

- MSCI

- necessarily

- news

- next

- no

- numerous

- observations

- observed

- october

- of

- officers

- on

- only

- Opinions

- or

- orders

- Other

- our

- out

- Outlook

- over

- participants

- passionate

- past

- perspectives

- phases

- phenomenal

- photo

- Pivot

- pivotal

- plato

- Plato Data Intelligence

- PlatoData

- Play

- please

- pmi

- points

- policy

- positioning

- positive

- Posts

- potential

- Powell

- pressure

- previous

- price

- Prices

- Prior

- Produced

- providing

- proxy

- purposes

- rallies

- Rates

- ratio

- reap

- rebound

- recap

- recent

- recorded

- remained

- renewed

- report

- requirement

- research

- Reserve

- Resistance

- retail

- Reversal

- reverse

- Risk

- round

- Rout

- rsi

- rss

- sales

- sector

- Securities

- see

- seems

- seen

- sell

- senior

- sentiment

- Sequence

- service

- Services

- several

- sharing

- Short

- short-term

- similar

- since

- Singapore

- site

- So

- so Far

- solution

- Source

- specializing

- started

- Still

- stock

- stock market

- Stock markets

- Strategist

- structural

- subsidiaries

- such

- Supports

- Swing

- tech

- Technical

- Technical Analysis

- ten

- term

- test

- that

- The

- the Fed

- this

- though?

- thousands

- time

- to

- today’s

- TONE

- Traders

- Trading

- TradingView

- Training

- treasury

- Treasury yields

- Trend

- trigger

- triggered

- under

- unique

- until

- Upside

- us

- US Dollar

- us fed

- US Treasury

- US treasury yields

- using

- v1

- via

- Visit

- vs

- Wave

- weaker

- weakness

- week

- WELL

- when

- which

- winning

- with

- wong

- would

- writing

- years

- yesterday

- yields

- you

- Yuan

- zephyrnet

- zone