So a question I get a lot from folks is “How Will 2024 Be?” — mostly from folks who had a tougher 2023.

Now let’s be clear. 2023 wasn’t hard for everyone:

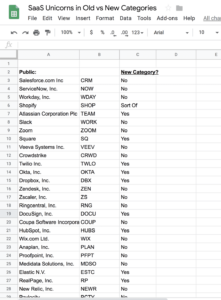

- First, it was mainly hard for folks that sold into “tech”, broadly speaking: Monday sells mainly outside of tech — it crushed 2023. Asana and Atlassian, competitors who sell more to tech? A much tougher year. ZoomInfo saw it’s non-tech customers grow 20%, but overall growth slowed to 9%. That means tech customers shrunk their spend.

- Second, the top public SaaS companies had a great year in their stock prices, even in growth slowed. Shopify was up 128%! HubSpot was up 104%! The average public SaaS company saw it’s stock price up 40%. More on that here.

- Third, AI exploded. OpenAI apparently got to $1.4 Billion in ARR — most of that in just 1 year (!)

So 2023 wasn’t all bad. But for the classic SaaS startup, selling to tech or even “worse”, mostly tech start-ups, had a tough year. Many top sales and marketing apps saw growth plummet to close to 0%.

So for them, will 2024 be any better? Here’s the thing. It basically has to be better — at least a smidge better. The question is how much.

#1. We’re Lapping The Toughest Times.

As both Henry Schuck, CEO of ZoomInfo, and Aaron Levie, CEO of Box pointed out in recent “What’s New” podcasts with us, 2024 almost has to be better because the cuts of 2023 are behind us. The renewal downgrade hits are behind you. And overall public SaaS company data confirms this. Most public SaaS companies hit a low point in new bookings growth around calendar Q2’23. You always get at least a little boost coming off all-time lows.

#2. The Energy to Cut, Cut, Cut Can’t Be Sustained. It Wasn’t in Far Tougher Times, And It Won’t Be in 2024.

So many IT departments and Offices of the CIO spent huge amounts of energy in the “App Layoffs” of late 2022 and 2023. Many simply cut 20% of their apps, period, to conserve costs. But again, that’s mostly behind us. You can’t keep cutting 20% of your apps every year and grow. And more importantly, it took a ton of energy for companies to do this. To manage every nickel of spend on Twilio, to manage every single license of ZoomInfo, etc. You can expend that energy once every 5-7 years, but that can’t be your focus every year, or the majority of years.

#3. Everyone Got a Lot, Lot More Efficient. But That Has Begun to Taper Off, Albeit Slowly and Not Evenly.

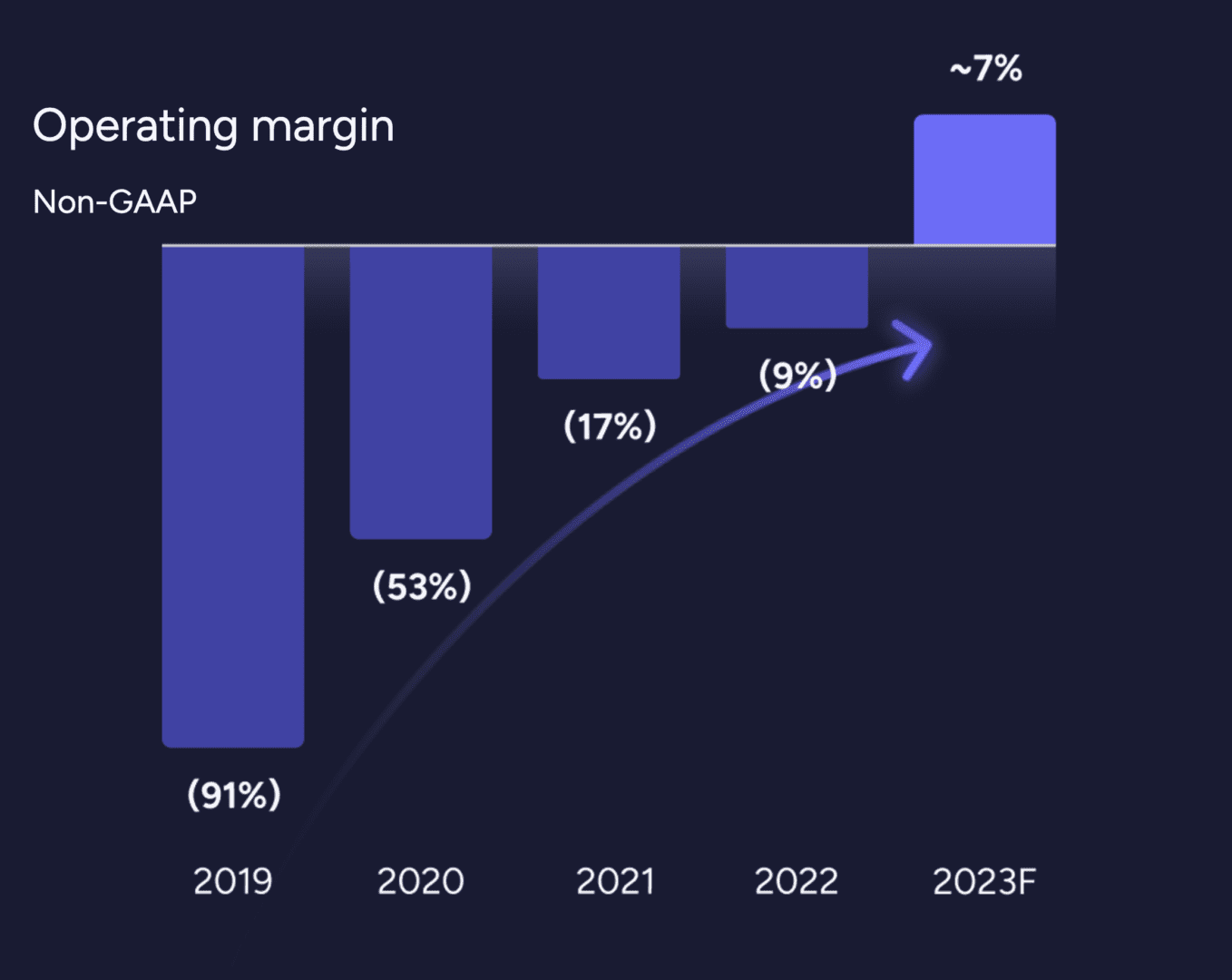

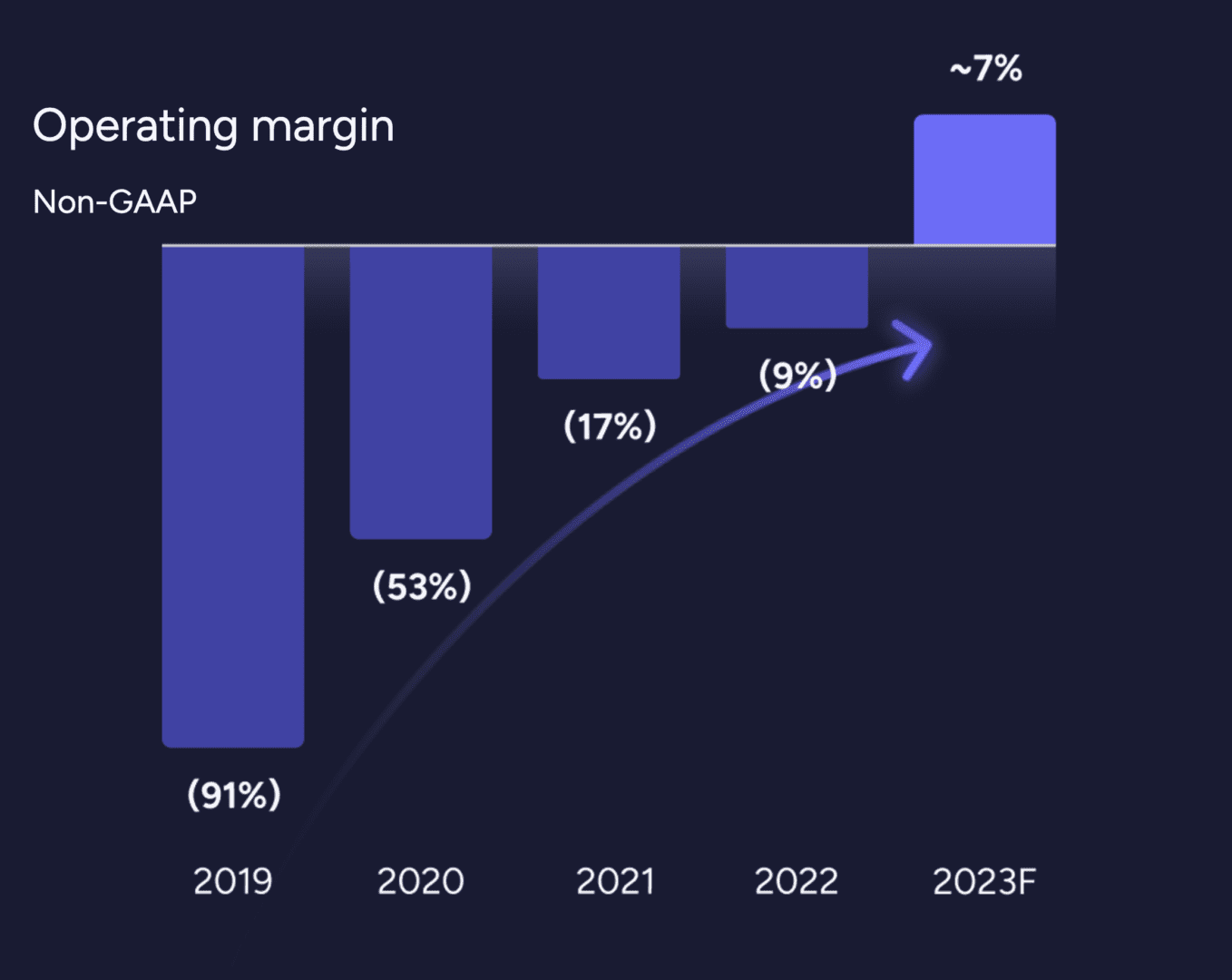

Private and public SaaS and Cloud companies didn’t just get a little more efficient in 2023 — they got stunning more efficient. As just one example, look at how much more efficient Monday got:

And they weren’t the only ones. Unicorns slashed their burn. Everyone from Shopify to Procore to Salesforce to Toast got wildly more efficient. Revenue per employee went way up, and cross $300,000 per employee for public SaaS companies.

Mixing a few related metrics here, but boy, did everyone get a lot, lot, lot, lot more efficient in SaaS pic.twitter.com/aFEYM7hiaJ

— Jason ✨Be Kind✨ Lemkin 🇮🇱 (@jasonlk) August 28, 2023

The thing is, you can only do so much of this. At some point, you reach your Rule of 40 gains, and you have to start hiring and spending again to grow. Even if you hire and spend more slowly than before. Many SaaS and Cloud leaders are there. Monday is hiring again — just at a slower pace than its growing, for example. More on that here:

So that’s likely where we end up in 2024. Spending on many SaaS categories resumes, but more slowly. Because cautious customers have done their cuts, and are resuming hiring and spending. But for now, will do it “in arrears”. More slowly than they grow.

That likely won’t make 2024 seem easy by any stretch. But it does mean there should be more dollars to grab that in 2023.

Go grab ’em.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.saastr.com/3-reasons-2024-has-to-be-better-than-2023/

- :has

- :is

- :not

- :where

- $UP

- 000

- 1

- 2022

- 2023

- 2024

- 28

- 40

- 51

- a

- Aaron

- again

- AI

- All

- almost

- always

- amounts

- and

- any

- apps

- ARE

- around

- AS

- At

- Atlassian

- average

- Bad

- Basically

- BE

- because

- before

- begun

- behind

- Better

- Billion

- bookings

- boost

- both

- Box

- broadly

- burn

- but

- by

- Calendar

- CAN

- categories

- cautious

- ceo

- CIO

- classic

- clear

- Close

- Cloud

- coming

- Companies

- company

- competitors

- content

- Costs

- Cross

- Customers

- Cut

- cuts

- cutting

- data

- departments

- DID

- do

- does

- dollars

- done

- Downgrade

- easy

- efficient

- embedded

- Employee

- end

- energy

- etc

- Even

- evenly

- Every

- everyone

- example

- far

- few

- Focus

- For

- from

- Gains

- get

- got

- grab

- great

- Grow

- Growing

- Growth

- had

- Hard

- Have

- henry

- here

- High

- hire

- Hiring

- Hit

- Hits

- How

- HTTPS

- HubSpot

- huge

- i

- if

- importantly

- in

- into

- IT

- ITS

- just

- just one

- Keep

- Late

- leaders

- least

- License

- likely

- little

- Look

- Lot

- Low

- Lows

- mainly

- Majority

- make

- manage

- many

- Marketing

- max-width

- mean

- means

- Metrics

- Monday

- more

- more efficient

- most

- mostly

- much

- New

- Nickel

- now

- of

- off

- offices

- on

- once

- ONE

- ones

- only

- OpenAI

- or

- out

- outside

- overall

- Pace

- per

- period

- plato

- Plato Data Intelligence

- PlatoData

- Plummet

- Podcasts

- Point

- pretty

- price

- price up

- Prices

- public

- question

- reach

- reasons

- recent

- related

- revenue

- Rule

- SaaS

- sales

- Sales and Marketing

- salesforce

- saw

- seem

- sell

- Selling

- Sells

- Shopify

- should

- simply

- single

- Slowly

- So

- sold

- some

- spend

- Spending

- spent

- start

- start-ups

- startup

- Startups

- stock

- Stunning

- sustained

- tech

- than

- that

- The

- their

- Them

- There.

- they

- thing

- this

- times

- to

- toast

- Ton

- took

- top

- tough

- true

- Twilio

- unicorns

- us

- was

- Way..

- we

- went

- WHO

- will

- with

- year

- years

- you

- Your

- youtube

- zephyrnet