(What a difference a year — and subsidies — makes. A year ago, we were celebrating a record month and 25% BEV share. Now … not so much.)

While the overall automotive market had a positive year (+14%), December saw it falling — it was down 4% compared to December ’23 — which was its first drop in 16 months. This was influenced by the German market, which fell a significant 23% in December, no doubt influenced by the economic clouds on the horizon and the chaotic EV subsidies cut in the middle of the month.

Twelve months ago, we were celebrating a record month, which had been influenced by EV subsidies cuts in a number of countries. This time, it is the other way around — Europe’s passenger plugin electric car market had a historic drop in December, with its 294,200 registrations quite far from the 413,500 registrations of a year ago. That is a massive 29% drop YoY, which is the worst drop in over 10 years. This time, both plugin powertrains were hit with falling sales. BEVs were down 25% to 205,922 units, which is — if we exclude the COVID-related drop of April 2020 — the first time BEVs were in the red since December 2016! PHEVs performed even worse, dropping 36% in December, to some 88,000 units, their worst performing month since June 2019, when they also saw sales drop by 36%.

Despite this horrible result in December, the full year performance wasn’t that bad. Plugins progressed by 16% to over three million units, which allowed them to grow slightly faster than the overall market, which in the same period grew by 14%.

These results influenced the market share numbers, with the December plugin vehicle share ending at 28% share, far from the 38% of the previous December. In the BEV field, things were less depressing, as the December 2023 result (20%) wasn’t so far from what happened a year before (25% in December 2022).

Looking at the full year, the 2023 PEV share ended at 24% (16% BEV), which is only a slight improvement over the 2022 results of 23% (14% BEV). Still, growth is growth, right?

And 2022 also had a small jump from the 19% share of 2021 (10% for BEVs alone), so one say that to find another significant rise, one has to go back to 2021, when it jumped from the 11% of 2020 to 19% PEV share.

With 2024 being another year of weak growth, with the German EV market in particular still recovering from the end of subsidies, I think we can only expect a significant rise in market share in 2025. I expect the plugin share will end the year above the 33% mark next year.

For comparison, the Chinese market already ended 2023 at 37%….

Looking at the BEV vs. PHEV breakdown, plugin hybrids’ loss of influence is becoming ever more apparent. While PHEVs ended 2021 and 2020 with the same share of the plugin market (46%), 2022 saw that number reduced significantly, to 39%, and 2023 saw its share reduced even further, to just 33%. Expect the PHEV drop to continue in 2024, to less than 30% share. It could even be the case that we will see a 100% BEV top 20 in 2024! Is that asking too much?

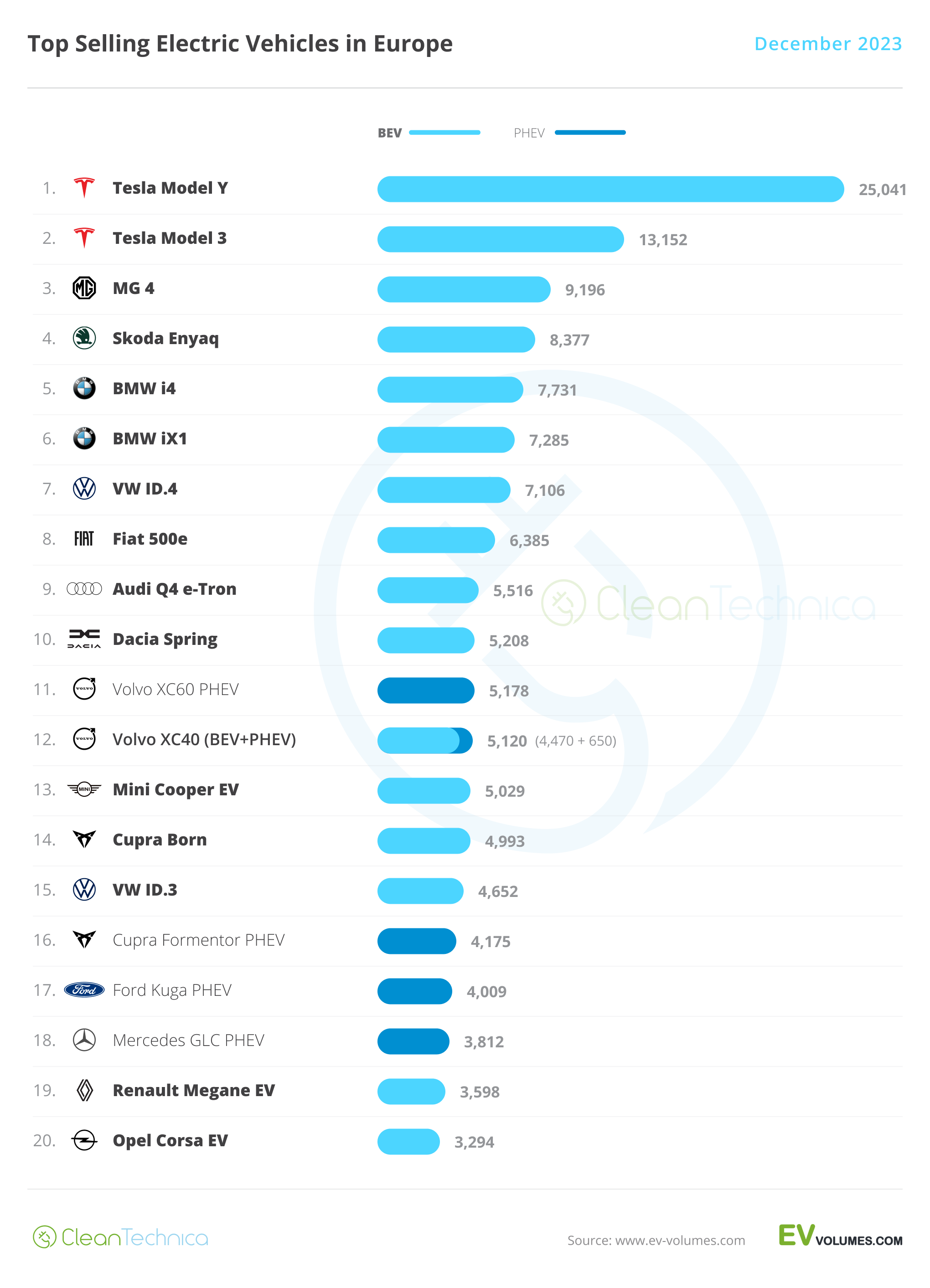

In December, Tesla won #1 and #2, followed by the MG4, the 2023 CleanTechnica Car of the Year award winner in Europe. A prelude of how 2024 will look?

Looking at December’s top 5 models in the electric car market:

#1 Tesla Model Y — The 2022 (and 2023) best selling EV in Europe had a solid 25,041 deliveries, which allowed it to be the best selling model in the overall market in December! On top of this, it was the best selling model in the overall European passenger car in the whole year of 2023! 😮 With this, it has collected a number of firsts: 1st EV to win the overall title, 1st non-European model to win the best seller title, AND 1st SUV to win the #1 status! (Although, saying the Tesla Model Y is an SUV … is kind of a stretch. Crossover? Yes. SUV? Not really….) Can the midsized crossover win the overall best seller title again in 2024? Discuss.

Unlike the Model 3’s focus on France, the crossover’s main markets had a more diverse tone, with the UK being the main market (4,850 sales). Other top markets include France (4,618 sales), Germany (2,721 sales), Denmark (which outsold Germany with 2,937 sales), Norway (1,366 sales), Belgium (1,043 sales), the Netherlands (1,504 sales), and Sweden (1,098 sales).

#2 Tesla Model 3 — Tesla’s sedan had 13,152 deliveries in December. With the recent refresh (and maybe additional price cuts?), expect the sedan’s sales to continue growing — perhaps at a more moderate pace in 2024. It could possibly end the year at around 105,000–110,000 sales. Regarding December, the sedan was focused on France (4,790 deliveries) due to the end of subsidies for made-in-China models. Germany (1,131 units) and … Denmark (1,102 deliveries) were the other big markets for the Model 3 in December. Expect the Model 3 to continue competing for silver throughout 2024, and with no models seemingly able to run at close to 10,000 units/month (maybe the MG4?), expect Tesla’s sedan to continue comfortably in the runner-up spot. On the other hand, there’s a lot to say about the last place on the podium … but more on this later.

#3 MG4 — The star of MG’s lineup ended the month on a high note again, getting 9,196 registrations. That’s the hatchback’s best result ever in Europe, and one wonders when it will earn its first five-digit score. With production fully ramped up, expect the compact EV to build on its current success throughout 2024, thanks to its unbeatable value for money. SAIC is hoping to reach a 9,000 unit/month average with it, a necessary threshold to win next year’s bronze (or silver?) medal. But those 5-digit performances in Europe have one question mark: Will the model have demand for that many in the future? The loss of the French market is not insignificant. … Regarding December deliveries, unsurprisingly, the Chinese EV had its best score in France (4,138 sales) due to the end of subsidies for made-in-China EVs, but Germany (1,775 sales) and the UK (1,390 sales) were also significant markets.

#4 Skoda Enyaq — The Czech EV was the best selling Volkswagen Group model in the table, with 8,377 registrations in December. Interestingly, not only did the Skoda model outsell its Volkswagen counterpart (the ID.4), but the Cupra Born (4,993 sales) also outsold its Volkswagen sibling, the ID.3 (4,652 sales). With the company car market suffering in Germany, due to the end of subsidies, it seems Volkswagen EVs are suffering more from demand issues than their more private buyer-oriented Czech and Spanish siblings. Regarding the December deliveries of the Enyaq, the value-for-money oriented EV had its best scores in Germany (3,185 registrations) and the UK (1,050 registrations), followed by Sweden (931 registrations) and Switzerland (924).

#5 BMW i4 — The midsize Bimmer had another record month in December, with 7,731 units registered, allowing BMW’s first top 5 presence in years, since the future classic BMW i3 started to drop from the top positions. After a ride through the desert, following on the career end of the quirky i3, the Bavarian has finally found a replacement to it. Better yet, it is not one replacement, but two, because not only did the i4 end December with a record result and a 5th position, but the crossover iX1 also had a record score (7,285 units) and ended in 6th. So, we could have had two BMWs in the top 5! In 2024, BMW will have plenty of time to milk volumes from its dynamic duo, with both models sure candidates for top 5 positions. Regarding the i4’s December deliveries, the liftback had by far its best score ever in Germany (3,222 registrations). This market alone is responsible for almost half of the model’s deliveries in December. The next best markets were the UK (917 registrations) and France (655 registrations).

Looking at the remaining December best sellers, besides the aforementioned record results, a mention also goes out to the Volvo XC60 PHEV, which scored a surprising 5,178 registrations, a new record for the Swede, which allowed it to be 11th on the table and December’s best selling PHEV.

Still in the PHEV field, another surprising result was the record 4,175 units of Cupra’s Formentor PHEV, with the attractive sporty crossover ending the month in #16. Could this be a good sign for the upcoming Cupra Tavascan?

Another surprise was the Mini Cooper EV. On the last legs of the current generation, it managed to score 5,029 sales, the hot hatch’s best result in two years. Now that’s what I call going out in style….

Outside the top 20, there is stuff to talk about, especially in the full size category. The Audi Q8 e-tron took the category’s monthly title with 3,262 sales, the fat Audi’s best score ever since it was refreshed late last year and gained the “Q8” moniker. This strong result was needed to beat the BMW iX, with the Bavarian rodent shining in December thanks to 3,197 sales, a new year best for the German SUV. Does this mean that the Audi Q8 e-tron will finally have to sweat in order to win the category title in 2024?

The new Hyundai Kona EV continued to ramp up deliveries, with 3,099 registrations, and expect it to ramp up further during 2024.

Finally, a mention goes out to the solid results of the Mercedes EQA (3,201 units) and Polestar 2 (3,153 units), two models that will continue to be on the lookout for a top 20 position next year.

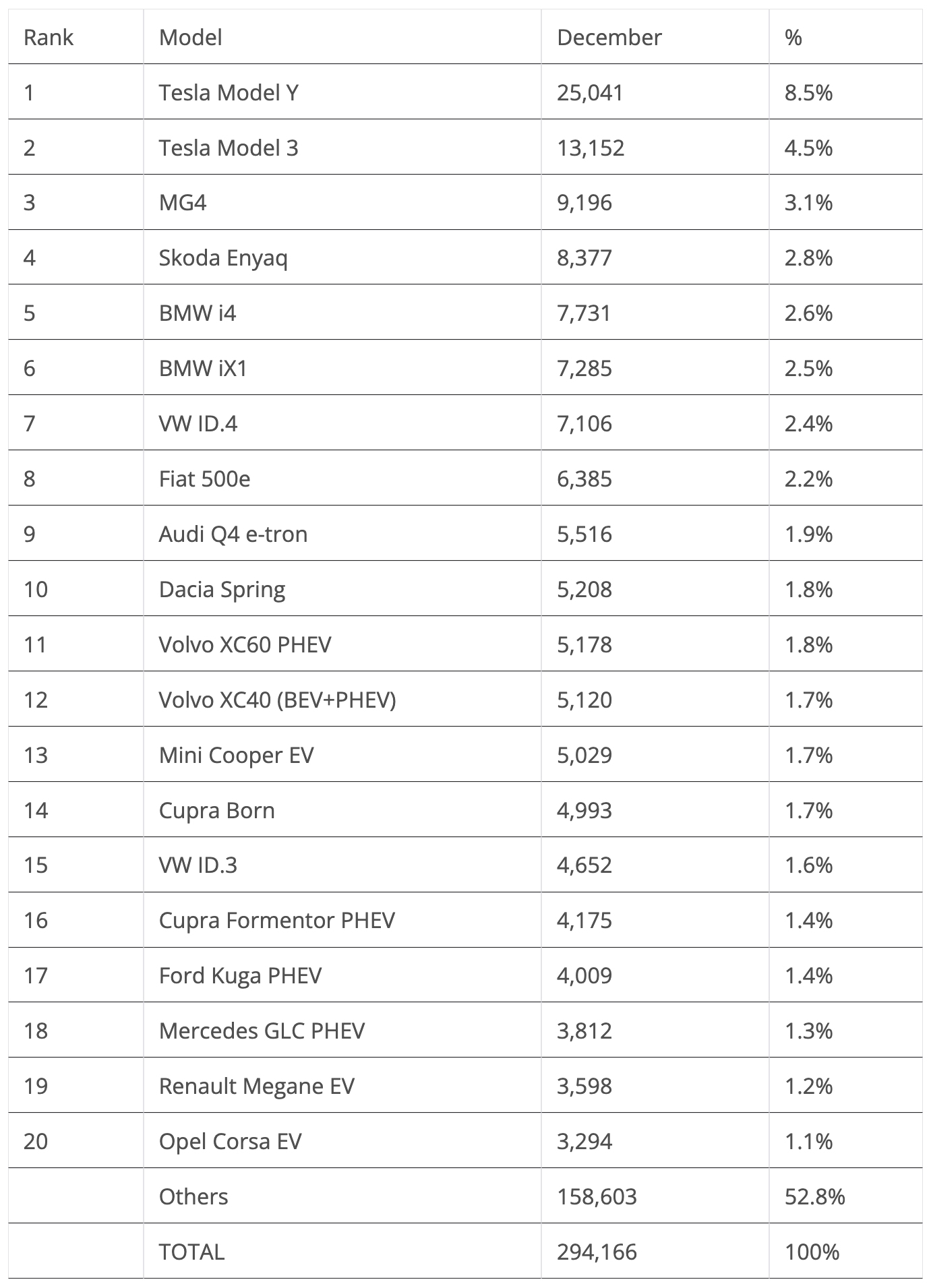

Looking at the 2023 ranking, the Tesla Model Y repeated the 2022 best seller title in 2023, all while its Tesla Model 3 sedan sibling stayed in the runner-up position. So, again, Tesla won 1st and 2nd place in Europe.

Interestingly, this is the Model 3’s 5th podium in a row, after gold in 2019, silver in 2020, gold again in 2021, followed by two silver medals in 2022 and now in 2023.

Expect the Model Y to win this title again in 2024. Although, it will be difficult to beat this year’s score of 255,000 units, which represented an 85% increase over 2022. And the same story regarding the #2 position of the Model 3 — while it should have the 2nd position assured, it will be hard to improve on the 2023 result, which itself was already just 11% above the 2022 score.

The VW ID.4 ended this year just like it ended 2022, in the last place on the podium, which means that the 2023 podium is exactly the same as the 2022 one.

But the German crossover will have a hard time repeating that position in 2024, as it will have to deal with a rising MG4, which is looking for a 100,000-ish result by the end of 2024. And with the current demand issues the Volkswagen model is experiencing, if the Chinese hatchback does indeed reach those heights, the German EV won’t have a chance to defend its podium presence.

But that is not all, even within the Volkswagen Group stable, things will get tougher. The Skoda Enyaq is set to have its best year ever in 2024, possibly reaching some 90,000 sales in the whole year. That could be enough to beat the VW ID.4 as the best selling model of the Group.

And let’s not forget the rising BMWs, with both the i4 and iX1 also looking to get into top positions.

But the dark horses of 2024 lie in the B- and C-segments/subcompact and compact categories. While growth in the top half of the automotive ecosystem is still possible, the biggest opportunities sit on the more competitively priced end of it.

Not only will the new Citroen e-C3 and Renault 5 push B-segment sales up in a significant way, blasting past the current category leader Peugeot e-208, but in the category above, the much awaited Volvo EX30 has enough demand to improve on the 2023 Volvo XC40’s performance. All Volvo needs is to ramp up production fast in order to keep up with demand….

By the end of the first half of the year, we should have a better idea of how things will develop, but until then, let’s go back to the final stage of the 2023 race.

The MG4 profited from a particularly good end of the year to surpass the Audi Q4 e-tron, allowing the Sino-British hatchback to end in 6th.

Also benefitting from strong year-end results were the BMW models, with the i4 jumping two positions, to 12th, while the iX3 was up three spots, to #15. Expect both models to end 2024 in the top half of the table, and this is of particular importance for the midsize model, because while it will be difficult, if not impossible, for it to outpace the Tesla Model 3 in 2024, it is important that the fastback model assumes its role as the strongest alternative to the US sedan — so that the path is easier for its successor, the 2025/2026 Neue Klasse sedan (or whatever it will be called) to beat the Model 3.

Highlighting BMW Group’s good moment, the last change in the table was the Mini Cooper EV replacing the Kia EV6 in #20. Expect the Mini brand to have a strong 2024. Not only will the new Cooper EV land, but so will the small Aceman crossover and slightly larger Countryman. So, three new EVs for the Mini brand in 2024. Not bad…

In the PHEV league, the Ford Kuga PHEV took another category title, without any major effort. However, it should have a harder time retaining the title in 2024, especially from the hands of the new Mercedes GLC PHEV.

Looking at the size categories, the Fiat 500e took the city car title, replicating the Italian model’s success in the mainstream city car category. Although, the runner-up Dacia Spring, with different arguments, ended the year just 5,000 units behind it. Expect another interesting race between these two in 2024.

In the size above, the prize again went to the Peugeot e-208, with the attractive hatchback comfortably beating the Mini Cooper EV. Expect lots of new competition in 2024, starting with the new Citroen e-C3 and the upcoming Renault 5 and Fiat Pandina, not forgetting of course the more niche new-generation Mini Cooper EV, Mini Aceman, Lancia Ypsilon, or Alfa Romeo Milano.

In the compact category, the VW ID.4 again won the title, but the Skoda Enyaq ended just 4,000 units behind. 2024 will be an interesting year in this category. The VW ID.4 will try to defend its title from the Skoda Enyaq and MG4, while outsiders the Volvo EX30 and BMW iX1 could also have a shot at leading the pack.

In the categories above, the Teslas Model Y and Model 3 had no real competition among midsizers, but towards the end of the year, we saw the BMW i4 getting ahead of the pack of followers, so the BMW EV could shorten the distance between it and the Tesla best sellers in 2024.

In the full size category, Volkswagen Group racked up 1st and 2nd place — the Audi Q8 e-tron again won the title, with some 27,000 registrations, while the Porsche Taycan ended the year in 2nd, with some 20,000 registrations. In 3rd was the Mercedes EQE with some 18,000 registrations.

Although, it must be said that the BMW iX had a strong end of the year and narrowly lost the podium spot to the Mercedes sedan (they ended separated by just 300 units).

Will the BMW iX be able to go after the big Audi in 2024? And will the new BMW i5 beat the arch rivals Mercedes EQE and Porsche Taycan?

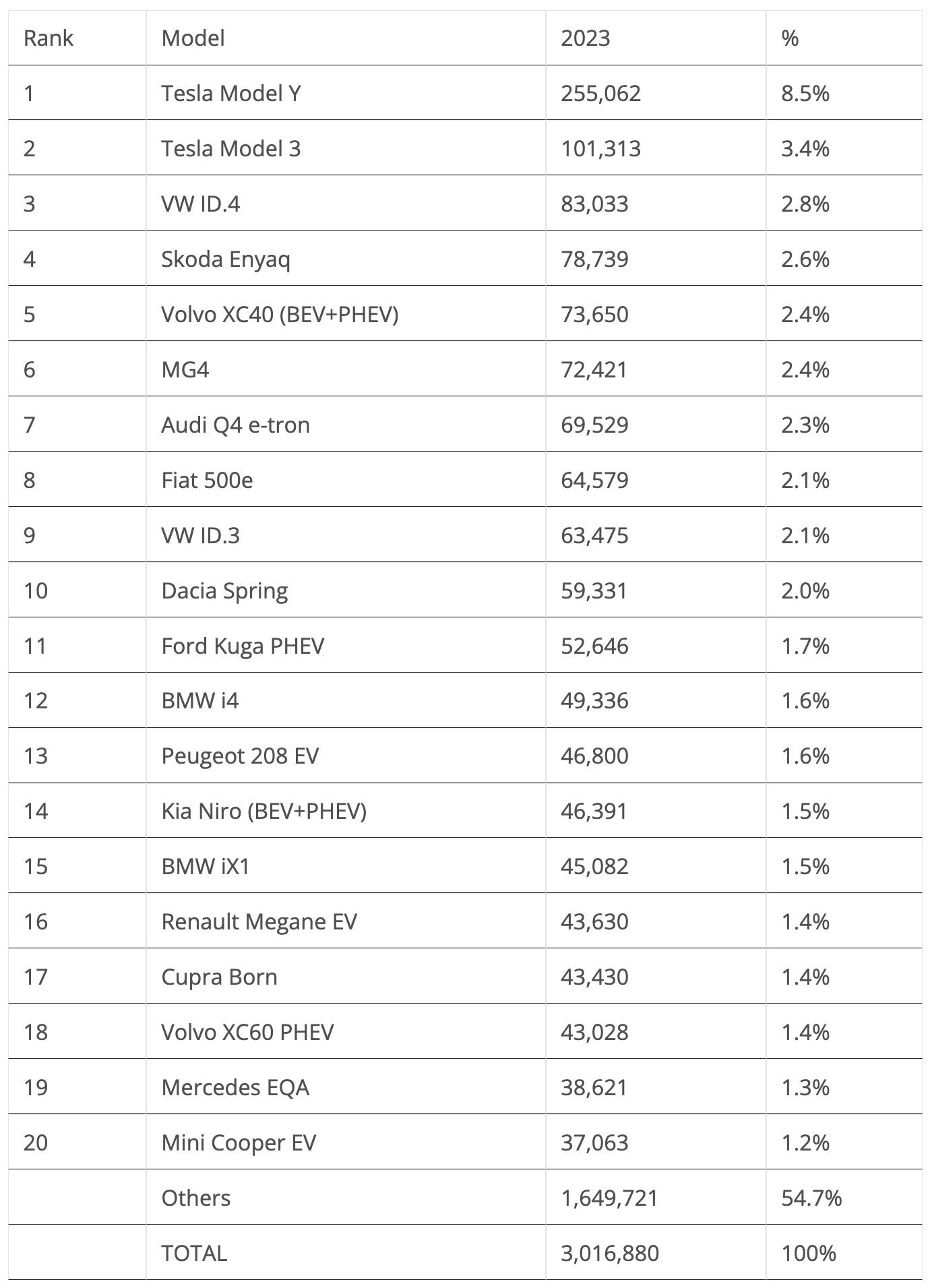

In the passenger vehicle brand ranking, Tesla (12.1%) renewed its best seller title, which is its 3rd in Europe and 2nd in a row. Expect it to remain the main candidate for the 2024 title, even though it should lose some market share on the way.

A rising BMW (8.8%, up 0.3%) again won the runner-up spot, and is also the main candidate for the #2 position in 2024. BMW gained some market share in the process, but not enough to endanger Tesla’s lead.

Volkswagen (8.2% share) also ended in the same position as last year, 3rd. This made the 2023 podium exactly like the one for 2022, thus replicating what happened in the model ranking. Although Volkswagen would like to recover the leadership spot from Tesla’s hands, with no fresh metal in 2024, that will not be possible, so all it can hope is to not lose more market share. Maybe in 2025, with the new ID.2 small EV, Volkswagen can have a go at #1. If the rest of the competition lets them, of course….

Mercedes (7.8%) ended in 4th, just like in 2022, while Audi (5.8%) secured the 5th spot (the same position it had in 2022), ending ahead of #6 Volvo (5.6%).

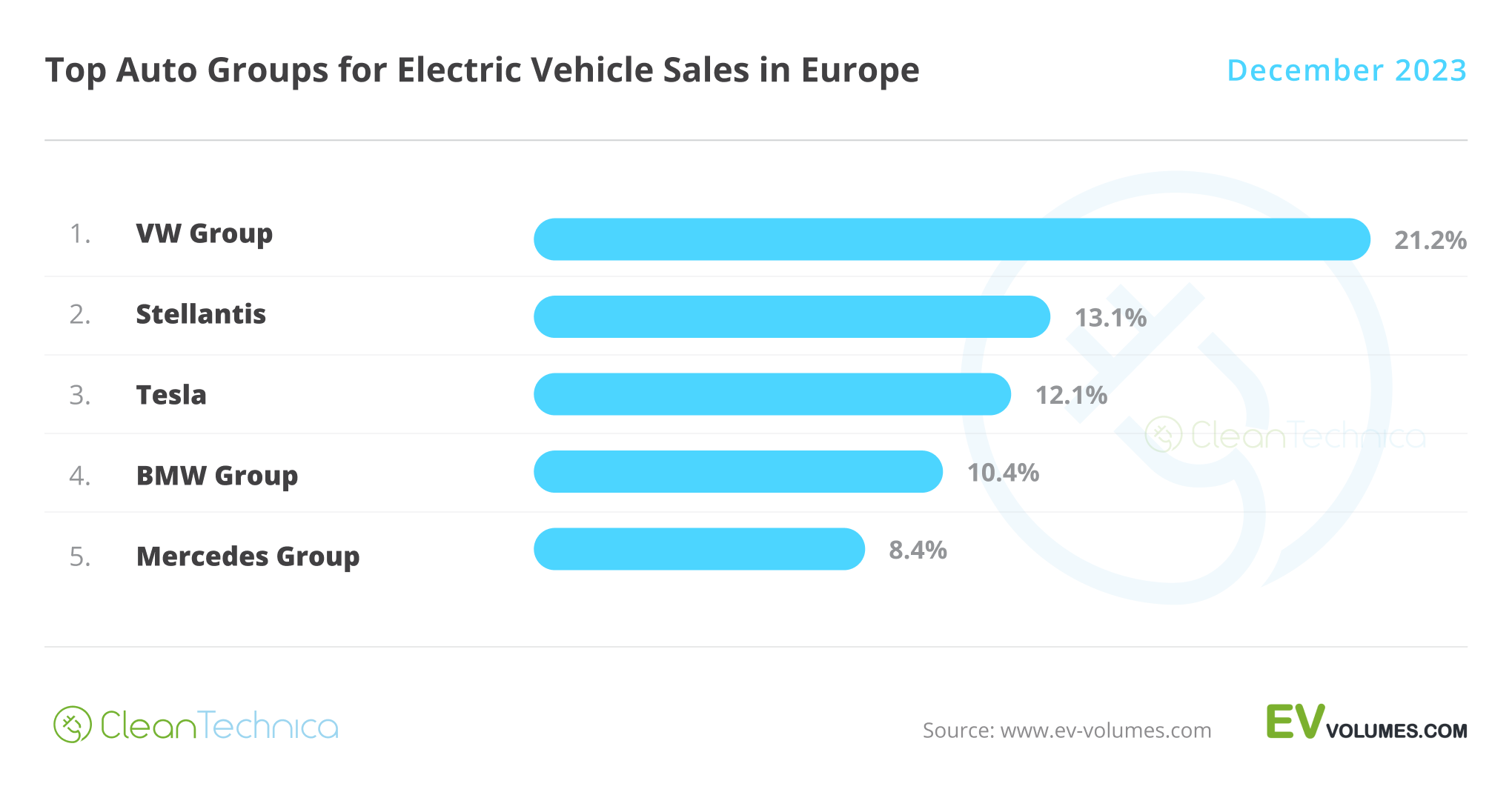

Top Auto Groups/Alliances for Electric Vehicle Sales in Europe — 2023

Finally, looking at the OEM level, #1 Volkswagen Group (21.2%) had no problem winning the electric car market’s top spot again. Stellantis (13.1%, down from 13.7%) repeated its runner-up finish with some degree of comfort, despite a horrible December from the French side of the conglomerate, with no Peugeot featuring in that month’s top 20. Expect Stellantis to recover share in 2024, considering the large number of new/refreshed EVs that will launch in the next few months.

Tesla was 3rd, with 12.1% share, ahead of a rising #4 BMW Group (10.4%, up 0.3%). The USA make won the bronze medal that in 2022 went to the German OEM. Expect a close race between these two in 2024. BMW Group should start as the favorite considering the growth potential of its namesake brand (the i4 & iX1 dynamic duo) and also all the fresh EVs coming from the British brand Mini.

The 5th position changed hands in the last stage of the race, with Hyundai–Kia (8.3%, down from 8.4% in November) losing the spot to Mercedes-Benz (8.4%), allowing the German OEM to end in the same position it had in 2022.

Expect an interesting race for this position in 2024, as Mercedes will have a hard time securing the spot. Hyundai–Kia, Geely–Volvo, and the Renault–Nissan–Mitsubishi Alliance will have fresh metal on the affordable side of the market, allowing them to grow their volumes significantly next year.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

[embedded content]I don't like paywalls. You don't like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we've decided to completely nix paywalls here at CleanTechnica. But...

Thank you!

Advertisement

CleanTechnica uses affiliate links. See our policy here.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://cleantechnica.com/2024/02/03/24-plugin-vehicle-share-in-europe/

- :has

- :is

- :not

- $UP

- 000

- 1

- 10

- 102

- 12

- 12th

- 13

- 15%

- 16

- 178

- 1st

- 2%

- 20

- 200

- 2019

- 2020

- 2021

- 2022

- 2023

- 2024

- 2025

- 2040

- 21

- 27

- 2nd

- 300

- 36

- 3rd

- 4

- 4th

- 5

- 500

- 5th

- 6th

- 7

- 721

- 775

- 8

- 9

- 90

- 937

- a

- Able

- About

- above

- Additional

- Advertise

- Affiliate

- affordable

- After

- again

- ago

- ahead

- All

- Alliance

- allowed

- Allowing

- almost

- alone

- already

- also

- alternative

- Although

- always

- among

- an

- and

- Another

- any

- apparent

- April

- ARE

- arguments

- around

- AS

- asking

- assumes

- assured

- At

- attractive

- audi

- auto

- automotive

- average

- awaited

- award

- back

- Bad

- BE

- beat

- because

- becoming

- been

- before

- behind

- being

- Belgium

- benefitting

- besides

- BEST

- Better

- between

- Big

- Biggest

- Bit

- BMW

- born

- both

- brand

- Breakdown

- British

- build

- but

- by

- call

- called

- CAN

- candidate

- candidates

- car

- Career

- case

- categories

- Category

- Celebrating

- Chance

- change

- changed

- chinese

- Chinese market

- chip

- City

- classic

- cleantech

- Cleantech Talk

- Close

- comfort

- coming

- compact

- Companies

- company

- compared

- comparison

- competing

- competition

- completely

- conglomerate

- considering

- content

- continue

- continued

- cooper

- could

- Counterpart

- countries

- course

- Current

- Cut

- cuts

- Czech

- deal

- December

- decide

- decided

- defend

- Degree

- Deliveries

- Demand

- Denmark

- DESERT

- Despite

- develop

- DID

- difference

- different

- difficult

- discuss

- distance

- diverse

- does

- don

- doubt

- down

- Drop

- Dropping

- due

- duo

- during

- dynamic

- earn

- easier

- Economic

- ecosystem

- effort

- Electric

- electric car

- electric vehicle

- embedded

- end

- ended

- ending

- enough

- especially

- Ether (ETH)

- Europe

- European

- Europes

- EV

- Even

- EVER

- evs

- exactly

- Exclusive

- expect

- experiencing

- Falling

- far

- FAST

- faster

- Favorite

- Featuring

- felt

- few

- fewer

- Fiat

- field

- final

- Finally

- Find

- finish

- First

- first time

- Focus

- focused

- followed

- followers

- following

- For

- Ford

- found

- France

- French

- fresh

- from

- full

- fully

- further

- future

- gained

- generation

- German

- Germany

- get

- getting

- Go

- Goes

- going

- Gold

- good

- grew

- Group

- Group’s

- Grow

- Growing

- Growth

- growth potential

- Guest

- had

- Half

- hand

- Hands

- happened

- Hard

- harder

- Have

- heights

- help

- here

- High

- historic

- Hit

- hope

- hoping

- horizon

- HOT

- How

- However

- HTTPS

- Hyundai

- i

- i3

- ID

- idea

- if

- implemented

- importance

- important

- impossible

- improve

- improvement

- in

- include

- Increase

- indeed

- influence

- influenced

- interesting

- into

- issues

- IT

- Italian

- ITS

- itself

- jump

- jumped

- june

- just

- Keep

- Kia

- Kind

- Land

- large

- larger

- Last

- Last Year

- Late

- later

- launch

- lead

- leader

- Leadership

- leading

- League

- legs

- less

- Lets

- lie

- like

- likes

- Limited

- lineup

- links

- Look

- looking

- lose

- losing

- loss

- lost

- Lot

- lots

- made

- Main

- Mainstream

- major

- make

- MAKES

- managed

- many

- mark

- Market

- market share

- Markets

- massive

- max-width

- maybe

- mean

- means

- Medals

- Media

- mention

- metal

- Middle

- MILANO

- Milk

- million

- model

- models

- moderate

- moment

- Month

- monthly

- months

- more

- most

- much

- must

- necessary

- Need

- needed

- needs

- Netherlands

- New

- new year

- news

- next

- niche

- no

- Norway

- note

- November

- now

- number

- numbers

- of

- on

- ONE

- only

- opportunities

- or

- order

- Other

- our

- out

- over

- overall

- Pace

- Pack

- particular

- particularly

- past

- path

- People

- performance

- performances

- performed

- performing

- perhaps

- period

- Place

- plato

- Plato Data Intelligence

- PlatoData

- player

- Plenty

- plugin

- plugins

- podcast

- podium

- policy

- Porsche

- position

- positions

- positive

- possible

- possibly

- potential

- presence

- previous

- price

- private

- prize

- Problem

- process

- Production

- profited

- progressed

- publish

- Push

- put

- question

- quite

- Race

- Ramp

- Ranking

- reach

- reaching

- Read

- Reader

- real

- recent

- record

- Recover

- recovering

- Red

- Reduced

- regarding

- remain

- remaining

- Renault

- renewed

- repeated

- replacement

- represented

- responsible

- REST

- result

- Results

- retaining

- Ride

- right

- Rise

- rising

- rivals

- Role

- ROW

- Run

- Said

- sales

- same

- saw

- say

- saying

- score

- scored

- scores

- Secured

- securing

- see

- seems

- Sellers

- Selling

- set

- Share

- shining

- shot

- should

- side

- sign

- significant

- significantly

- Silver

- since

- sit

- Size

- slight

- slightly

- small

- So

- so Far

- solid

- some

- Spanish

- Spot

- spots

- spring

- stable

- Stage

- Star

- start

- started

- Starting

- stayed

- Still

- Stories

- Story

- strong

- strongest

- stuff

- success

- suffering

- suggest

- support

- sure

- surpass

- surprise

- surprising

- SWEAT

- Sweden

- switzerland

- T

- table

- Talk

- team

- Tesla

- Teslas

- than

- thanks

- that

- The

- The Future

- the Netherlands

- the UK

- their

- Them

- then

- theory

- There.

- These

- they

- things

- think

- this

- this year

- those

- though?

- three

- threshold

- Through

- throughout

- Thus

- time

- tip

- Title

- to

- TONE

- too

- took

- top

- top 5

- tough

- towards

- try

- tv

- two

- Uk

- units

- until

- upcoming

- Updates

- us

- USA

- uses

- Ve

- vehicle

- Video

- volkswagen

- Volkswagen Group

- volumes

- volvo

- vs

- vw

- want

- was

- Way..

- we

- went

- were

- What

- whatever

- when

- which

- while

- WHO

- whole

- will

- win

- winner

- winning

- with

- within

- without

- Won

- worse

- Worst

- would

- write

- Wrong

- year

- years

- yes

- yet

- you

- Your

- youtube

- zephyrnet