Every year I make a list of predictions & score last year’s predictions.

Here are my predictions for 2024.

- The IPO market remains closed through the first 6 months of the year. But a few mega issuances, especially Stripe & Databricks in the summer or fall, re-open it for others. The Fed cuts rates, which helps.

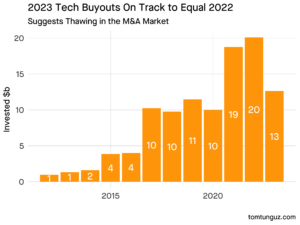

- M&A accelerates throughout the year. The anticipation of a rate change drives fear of target acquisition valuations. In the last two years, M&A has totaled about $49b & it surges to above $60b driven by AI acquisitions. PE becomes an important buyer of companies growing 10-25%, as it did in 2018, driven by lower debt costs.

- AI & data continue to dominate the funding landscape as founders & investors seek novel applications of the technology. A handful of companies achieve record-setting growth rates.

- The share of AI-enabled web searches approaches 50% of all consumer search as consumer behavior patterns evolve, especially on mobile.

- The BTC ETF drives a resurgence in interest in web3 financing. The winter forced many companies to evolve from open-source projects to revenue-generating businesses. We see the first broadly successful tokens with dividends (likely outside the US). This innovation reinvigorates very early-stage IPOs. We also see more ARR-based web3 businesses achieving scale. Record inflows into tokens fuel all-time highs in Bitcoin, Solana, & higher performance L1s who offer better price/performance to market.

- US VC investment falls from $275b in 2022 to $200b in 2023 & sustains at about $200-220b in 2024 as LP interest in venture attenuates after the euphoria in 2020 & 2021. Valuations remain relatively steady except for AI businesses, which command a premium to market of about 10-25%.

- The discussion around AI regulation becomes a critical topic in the US during the election because machine-generated content exacerbates international meddling in US politics. But the overwhelming desire for the US to continue to lead the innovation wave it started creates safe harbors, the same provisions which enabled the web to flourish, are applied to AI.

- Companies & startups in particular begin to report meaningful improvements in productivity from AI, reducing their headcount growth, butn growing revenue just as much as projected. ARR per employee increases 10%, twice the decade long average.

- Data lakes become the dominant data architecture across businessn intelligence & observability workloads as more startups leverage Amazon S3 free replication. Cloudflare R2’s architecture for very large data sets drives a meaningful growth in its usage, predominantly for AI.

Grading last year’s predictions :

- ML propels SaaS into a massive second wave that increases workers’ productivity measurably. SaaS did see a second wave fueled by AI, but the productivity gains remain to be seen. Score : 0.5.

- The hangover from web3’s raucous 2022 extends into 2023. This was true until the very end of the year, as the excitement of the BTC ETF (exchange-traded funds) fueled massive capital inflow into crypto. Score : 1.

- The Fed tames inflation & forward multiples touch 7.0x. Average forward multiple is 7.2x (pretty close!). We can debate whether the Fed has actually tamed inflation or succumbed to election pressure but their intent to cut rates satisfies the prediction. Score : 1.

- Private equity acquires 10% of the 70+ publicly traded software companies by the end of the year. The prediction said 7 PE public take-outs. Score : 1.

| No. | PE Public Take-Private in 2023 | Value, $b |

|---|---|---|

| 1 | Coupa | 8 |

| 2 | New Relic | 6.5 |

| 3 | KnowBe4 | 4.6 |

| 4 | EngageSmart | 4 |

| 5 | DuckCreek | 2.6 |

| 6 | Forge Rock | 2.3 |

| 7 | Sumo Logic | 1.7 |

| 8 | SurveyMonkey | 1.5 |

- The fundraising market thaws, but at materially lower prices than the first half of 2022. The early stage market prices seeds at $10-15m post & Series As at $50-60m post (with about $500k in ARR). Seed valuations increased. Series A valuations fell 10%. Score : 0.5.

| Series | 2022 Post Median, $m | 2023, Post Median, $m |

|---|---|---|

| Seed | 14.6 | 15.0 |

| Series A | 60 | 54 |

Overall, 4.0 / 5.0 - not bad for a tumultuous year!

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.tomtunguz.com/2024-predictions/

- :has

- :is

- :not

- 0x

- 1

- 2018

- 2020

- 2021

- 2022

- 2023

- 2024

- 7

- a

- About

- above

- accelerates

- Achieve

- achieving

- Acquires

- acquisition

- acquisitions

- across

- actually

- After

- AI

- AI regulation

- All

- all-time highs

- also

- Amazon

- an

- anticipation

- applications

- applied

- approaches

- architecture

- ARE

- around

- AS

- At

- average

- Bad

- BE

- because

- become

- becomes

- begin

- behavior

- Better

- Bitcoin

- broadly

- BTC

- BTC ETF

- businesses

- but

- BUYER..

- by

- CAN

- capital

- change

- closed

- CloudFlare

- Companies

- consumer

- consumer behavior

- content

- continue

- copyright

- Costs

- creates

- critical

- crypto

- Cut

- cuts

- data

- data sets

- Databricks

- debate

- Debt

- decade

- desire

- DID

- discussion

- dividends

- dominant

- dominate

- driven

- drives

- during

- Early

- early stage

- Election

- Employee

- enabled

- end

- equity

- especially

- ETF

- Ether (ETH)

- evolve

- Except

- exchange-traded

- Excitement

- extends

- Fall

- Falls

- fear

- Fed

- few

- financing

- First

- flourish

- For

- forced

- Forward

- founders

- Free

- from

- Fuel

- fueled

- funding

- Fundraising

- funds

- Gains

- Growing

- Growth

- Half

- handful

- headcount

- helps

- higher

- Highs

- HTTPS

- i

- important

- improvements

- in

- increased

- Increases

- inflation

- inflows

- Innovation

- Intelligence

- intent

- interest

- International

- into

- investment

- Investors

- IPO

- IPOs

- IT

- ITS

- just

- lakes

- landscape

- large

- Last

- lead

- Leverage

- likely

- List

- Long

- lower

- LP

- M&A

- make

- many

- Market

- Market Prices

- massive

- materially

- meaningful

- Mega

- Mobile

- months

- more

- much

- multiple

- my

- novel

- of

- on

- open source

- or

- Others

- outside

- overwhelming

- P&E

- particular

- patterns

- per

- performance

- plato

- Plato Data Intelligence

- PlatoData

- politics

- Post

- prediction

- Predictions

- predominantly

- Premium

- pressure

- pretty

- Prices

- productivity

- projected

- projects

- public

- publicly

- Rate

- Rates

- record

- reducing

- Regulation

- relatively

- remain

- remains

- replication

- report

- revenue

- SaaS

- Said

- same

- Scale

- score

- Search

- searches

- Second

- see

- seed

- seeds

- Seek

- seen

- Series

- Series A

- Sets

- Share

- Software

- Solana

- Stage

- started

- Startups

- steady

- stripe

- successful

- summer

- Surges

- Target

- Technology

- than

- that

- The

- the Fed

- their

- this

- Through

- throughout

- to

- Tokens

- topic

- touch

- traded

- true

- two

- until

- us

- Usage

- Valuations

- VC

- venture

- very

- was

- Wave

- we

- web

- Web3

- Web3’s

- whether

- which

- WHO

- Winter

- with

- year

- years

- zephyrnet