- Options traders have been caught off guard by Bitcoin’s recent surge in March.

- At the time of writing, technicals indicate increased selling pressure in the crypto market.

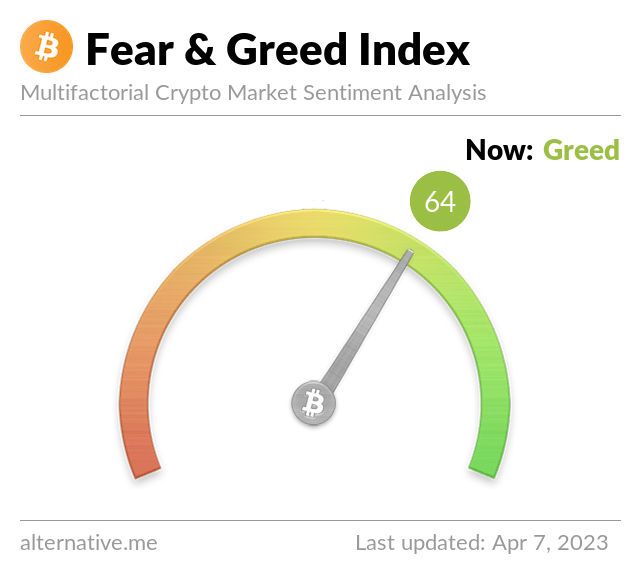

- The Fear and Greed Index shows a high level of greed in the market.

Bitcoin’s value has experienced an astonishing 43% surge between March 10 and March 20, catching options traders off guard. Analysts attribute this spike in value partly to increased demand for commodities, as investors perceive risks in central banks’ emergency funding programs.

As liquidity injection increases, fears of inflationary pressure become more pronounced, with evidence suggesting that investors are hedging their bets accordingly. Only 14% of the $1.12 billion open interest set to expire on April 7 was placed at $28,000 or above.

Bitcoin enthusiasts who were betting big on the cryptocurrency may have missed out on a lucrative opportunity to reap the rewards of increased demand for inflation protection. While Bitcoin bulls may have initially benefited from this surge in demand, some may have squandered their chances by placing excessively large bets on higher prices.

Bears Profit $60M as BTC Trades Between $27-28K

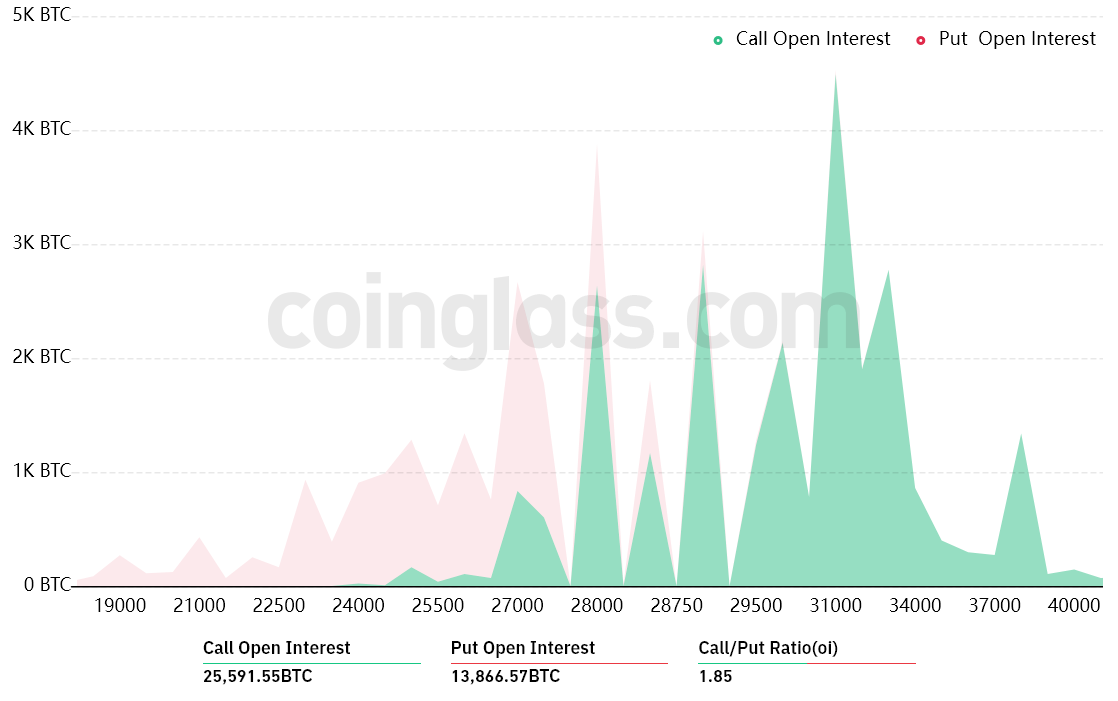

According to reports, the weekly BTC options expiry has a whopping $1.2 billion in open interest. However, it is important to note that this figure may not be entirely accurate, as bullish investors have focused their bets on Bitcoin’s price trading above $29,000.

The 1.85 call-to-put ratio reflects the disparity in open interest between the $720 million call (buy) options and the $390 million put (sell) options. However, the outcome will be much lower since the bulls were overly optimistic.

As of April 7 at 8:00 am UTC, Bitcoin’s price remained at $27,800, resulting in the number of call options available for purchase to decrease significantly to $125 million. This is because the right to buy Bitcoin at $29,000 or $30,000 becomes void if BTC trades below that on the expiry.

Based on the current price action, the net result favored the bears by $60 million, as there were 1,200 calls versus 3,500 put between $27,000 and $28,000. This meant that traders who placed bearish bets made a profit of $60 million, as Bitcoin’s price remained within this range on the expiry.

Technicals Show Increasing Selling Pressure in Crypto Market

According to Santiment, a blockchain analytics platform, traders have made trades at a loss twice the rate of return for the first time in five weeks.

This trend change indicates that traders who were once enthusiastic buyers of the rally are now abandoning it. This is supported by information provided by other crypto data aggregators as well.

CryptoQuant, another cryptocurrency data aggregator, revealed that selling pressure was dominant across the derivatives market, evident from BTC’s taker buy/sell ratio, contributing to many more long traders getting liquidated.

Over $7.8 million in long positions and $3.25 million in shorts were liquidated in the last 24 hours. The increased liquidations in the market may have contributed to a 0.54% drop in Bitcoin‘s price, causing it to remain below the $28,000 level in time for the Bitcoin Options Expiry.

“Be fearful when others are greedy, and greedy when others are fearful.” - Warren Buffett

The Fear and Greed Index currently stands at 64, indicating a high level of greed in the market. It is a measure of traders’ emotions and sentiments, where higher values indicate more greed and lower values indicate more fear.

On the Flipside

- As Warren Buffett’s quote suggests, the high level of greed reflected in the Fear and Greed Index could also be a warning sign for investors.

- The dominance of selling pressure in the derivatives market could indicate a lack of confidence in the current rally.

Why You Should Care

The Bitcoin options market plays a crucial role in determining the sentiment of traders and investors and provides insights into future price movements. The recent expiration of BTC options and the resulting profits and losses for traders can impact the overall market sentiment and potentially influence the direction of Bitcoin’s price in the short term.

To learn more about the potential impact of BRC-20 on Bitcoin’s future, read here:

Bitcoin Ordinals Record New Highs Amid BRC-20 Hype

For the latest discovery related to Bitcoin’s origin, check out this article:

Bitcoin’s Ultimate Easter Egg: Hidden White Paper in MacOS

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://dailycoin.com/btc-options-expiry-bulls-concentrated-bets-above-29k/

- :is

- $3

- 000

- 1

- 10

- 7

- 8

- a

- About

- above

- accordingly

- accurate

- across

- Action

- Aggregators

- Amid

- Analysts

- analytics

- and

- April

- ARE

- article

- AS

- At

- available

- BE

- bearish

- Bears

- because

- become

- becomes

- below

- Bets

- Betting

- between

- Big

- Billion

- Bitcoin

- bitcoin bulls

- bitcoin options

- blockchain

- BLOCKCHAIN ANALYTICS

- BTC

- Bullish

- Bulls

- buy

- buy bitcoin

- buyers

- by

- call

- Calls

- CAN

- caught

- causing

- central

- chances

- change

- Chart

- check

- COM

- Commodities

- Concentrated

- confidence

- contributed

- contributing

- could

- crucial

- crypto

- crypto data

- Crypto Market

- cryptocurrency

- Current

- Currently

- data

- decrease

- Demand

- Derivatives

- determining

- direction

- discovery

- Dominance

- dominant

- emergency

- emotions

- enthusiastic

- enthusiasts

- entirely

- Ether (ETH)

- evidence

- excessively

- experienced

- expiry

- external

- fear

- Fear & Greed

- Fear & Greed Index

- fear and greed index

- fears

- Figure

- First

- first time

- focused

- follow

- For

- For Investors

- from

- funding

- future

- Future Price

- getting

- Greed

- Greedy

- Guard

- Have

- hedging

- here

- Hidden

- High

- higher

- Highs

- HOURS

- However

- HTTPS

- Impact

- important

- in

- increased

- Increases

- increasing

- index

- indicate

- indicates

- indicating

- inflation

- Inflationary

- influence

- information

- initially

- insights

- interest

- internal

- Investors

- IT

- Lack

- large

- Last

- latest

- LEARN

- Level

- LIQUIDATED

- liquidations

- Liquidity

- Liquidity Injection

- Long

- loss

- losses

- lucrative

- made

- many

- March

- Market

- market sentiment

- max-width

- measure

- million

- more

- movements

- net

- New

- number

- of

- on

- open

- open interest

- Opportunity

- Optimistic

- Options

- Origin

- Other

- Others

- Outcome

- overall

- Paper

- placing

- platform

- plato

- Plato Data Intelligence

- PlatoData

- positions

- potential

- potentially

- presented

- pressure

- price

- PRICE ACTION

- Prices

- Profit

- profits

- Programs

- protection

- provided

- provides

- purchase

- put

- rally

- range

- Rate

- ratio

- Read

- recent

- record

- reflected

- reflects

- related

- remain

- remained

- Reports

- result

- resulting

- return

- Rewards

- risks

- Role

- sell

- Selling

- sentiment

- set

- Short

- shorts

- should

- show

- Shows

- sign

- significantly

- since

- some

- spike

- stands

- Suggests

- Supported

- surge

- that

- The

- The Weekly

- their

- time

- to

- Traders

- trades

- Trading

- Trend

- Twice

- ultimate

- UTC

- value

- Values

- Versus

- warning

- warren

- weekly

- Weeks

- WELL

- while

- white

- white paper

- WHO

- will

- with

- within

- writing

- zephyrnet