The housing market is stuck. Stubborn homeowners with low rates refuse to move, even as demand starts to pick back up. Homebuilders are driving ahead with more new construction homes, but is it too late to deliver the supply we so desperately needed only a year or two ago? Where is the housing market moving next, and how long will we be stuck in this standoff? Ivy Zelman from Zelman & Associates successfully predicted the last housing crash, so what does she have to say about today’s market?

Ivy is a thought leader in the real estate research space. Her credibility has been showcased repeatedly as her team accurately forecasts numerous housing market moves. Constantly on the phone with institutional buyers and builders, Ivy tends to know what’s happening before even the top forecasters. In this episode, Ivy gives her opinion on today’s housing market, why buyers and sellers are “stuck,” and whether or not the “underbuilding” problem is even an issue as demographic trends start getting dangerous.

She also shares which real estate markets are in the most danger, the concerning catastrophe facing many southern states, and the markets she’s most bullish on that could withstand the test of time. But, more importantly, Ivy shares her thoughts on whether or not real estate is still worth investing in and why it may be time for landlords to diversify into other assets that don’t come with such a considerable risk.

Click here to listen on Apple Podcasts.

Listen to the Podcast Here

Read the Transcript Here

Dave:

What’s up everyone? Welcome to On the Market. I’m your host, Dave Meyer, joined by Jamil Damji today. How you doing man?

Jamil:

How you doing bro?

Dave:

I’m doing great. It is finally summer out. We have an awesome show to do today. I feel like you and I haven’t done a show together in a long time. It’s a good day.

Jamil:

I’m excited about this one, because I’ve spent the last few days really diving into the world of Ivy Zelman. And I’m telling you, I am thoroughly impressed with this lady. She’s so brilliant. I consider you one of the smartest people I know and now I think just… She’s definitely going to be the smartest person I know.

Dave:

Well, thank you for saying that. But this is not even in the same league. It’s an extremely experienced and very intelligent person and has a whole team of researchers. Caitlin actually put together a bio for us to read about Ivy and it’s the length of a full high school essay. But needless to say, Ivy has been working on… Ivy, I should say, is our guest today, Ivy Zelman, who is the CEO of Zelman and Associates. She’s basically just been a thought leader on Wall Street, specifically in the housing industry for a really long time. She works a lot with builders, new construction, institutional investors, and she became really famous. I think, in Wall Street, she was already very well-respected, but she became more of a mainstream name, because she famously in 2006, far before most people did, called the crash the housing market crash in 2008.

So, I feel very lucky that we had Ivy coming on to help us make sense of the very confusing market. Obviously, we have already had this conversation with her. So, I’m curious, Jamil, what were some of the main takeaways you think our audience should pay attention to here?

Jamil:

I think, again, her point of view is that, there’s so many people that are still screaming, “There’s the shortage in inventory. There’s a shortage in inventory.” And you have to really understand what does that mean, and who is compiling this data, and what methodologies are they using to do it. I think that when she makes a very compelling argument that you have to actually look at demand and the percent of change in order to understand, “Do we really have an inventory crisis? Are we short on homes?” And, after hearing her argument, I’m starting to question that thought altogether.

Dave:

Yeah. I love it. I mean, it seems that way, right? Because inventory is so tight. And then, we hear these studies from big companies, Moody’s Analytics, NAR, Freddie Mac, big companies saying that we have a housing shortage. And I’ve honestly, just believed them. But to her point, these companies, they don’t always share their methodology. So you don’t really know how they’re getting there, but you think, “Oh, all these big companies all have said we’re in some shortage.” Whether it’s 1 million, 3 million, 7 million, whatever. You start to believe it, because it’s directionally all the same.

But, Ivy brings up some very contrarian and interesting points about, maybe we’re not, maybe we do have enough housing, maybe we are building an appropriate amount. And that, of course, has huge implications for the housing market and pricing over the next couple of years. So, I totally agree. Very important thing to watch out for and listen up for in this interview. We are going to take a quick break and then we’ll be right back with Ivy Zelman from Zelman and Associates. Ivy Zelman, welcome to On the Market. Thanks so much for being here.

Ivy:

Thanks for having me.

Dave:

Given your extensive experience in the housing sector, I’m curious if you could just start by categorizing this housing market and how you read the current market situation.

Ivy:

For 2023, I think, the first half of the year has been somewhat surprisingly resilient. I’d say, there’s a bit of a divergence between the existing market and the new home market. We’re talking from a transaction perspective. Happy to elaborate, but I’d say this spring selling season was definitely an upside surprise to many in terms of the strength. And we are also seeing stabilization in price sequentially starting to accelerate, and builders are feeling more confident about pushing price even with affordability stretched. I think that the existing home market is very challenged from a lack of supply, which I’m happy to elaborate on, and some thoughts as to why, and challenges that lie ahead.

Dave:

Great. Can we dig into that a little bit? Because, our audience generally is probably more familiar with the existing home market. So could you just help us explain some context about some of the historical differences between the new and existing home markets?

Ivy:

Sure. So, if we think about overall housing, the new home market is a very relatively small percent. It accounts for in the low teens as a percent of the total transactions or total overall sales. And if you think about the existing homes, call it, just for rough math, 85% of the market, the challenges that existing homeowners have today is that many of them are disincentivized to sell, because they’re locked in at rates substantially lower than today’s prevailing rate. A remarkable number of people over 50% or below 3.5%. And roughly, 90% below 5% with rates now roughly back almost at 7%. Freddie Mac came out today, the 30-year fixed was at 6.91, which is the benchmark that we use. I think that the disincentive is real and what we’ve seen is a plummeting and new listings. What we have seen as well is that those homes that are not in pristine condition, that are not in desirable locations are sitting longer, and there’s a lot of pricing expectations that are still elevated, given the surge in pricing that markets enjoy during COVID, post-COVID.

So, there’s more of a reality check in terms of those homes that need to probably adjust. On the other hand, depending on the market where there’s a limited level of availability, you do have transactions, you always have, as the realtors joke, the three Ds, death, divorce and default. And then, you also have, there’s no D for relocations, but we could just call it discretionary, and other D. And we do have discretionary movers who are moving for lifestyle reasons. Those people that are trying to buy, whether they’re relocating or just choosing to move up, they find it very limited in terms of choices. So you see in those cases, it’s always real estate, location, location, location. And you come in and homes are actually seeing those that are on the market, multiple bids. It’s bidding wars again.

I am based in Cleveland, Ohio on the east side of Cleveland. Just had breakfast at the Pancake House with the largest independent broker in the country, one of them. And, they’re in multiple markets across the Midwest and the Southeast. And, pretty much the eastern corridor. And he was telling me a story about a home that I know the street and that the house was listed on Sunday at 7:25 and closed on Tuesday at 9:24.

Dave:

Whoa.

Ivy:

And there were multiple offers. And this is a suburb in Cleveland in a good school district. And frankly, there’s many stories like that. On the other hand, you can look at a home that’s about probably a 40-minute drive from where this particular home is. And there might be homes on the market that aren’t moving. So, the divergence is really clear on where location and school district being the factors and variables that are most important. I can elaborate interesting things he discussed with me today, but I think Jamil, you had a question, I could tell.

Jamil:

Yeah, what’s interesting is I actually deal in the Ds that you’re talking about, death, divorce. And so, for the market that I’m in, right, which is mainly looking at those properties that need to be repositioned, or updated and refreshed, we’re still seeing some pretty high demand from the investor pool, the investor buyers, but not so much the retail home buyers. So, what have you seen just with respect to what’s happening in the spring market? Is there different types of buyers for different types of classes, and assets, and how has that affected inventory and the market in general?

Ivy:

Well, we actually do a single family rental survey that is really surveying property managers, owners, and operators that might have portfolio as small as a dozen homes or even six to a dozen. And then, there might be a significant institutional investor that might own thousands of homes. And just to give people perspective, roughly, little under 40 million single family rentals exist in this country. And, less than 2% are owned by institutional investors. So it’s really a mom and pop business. And interestingly right now, when you think about the survey that one of the questions we ask is the appetite for new capital into the marketplace, the institutions have pulled back, but retail investors have not. They’re still in the market looking. I think that there was a bit of a slowdown in ’22 as a result of uncertainty, but then that started picking up from the retail investors.

It’s pretty interesting though, because one of the challenges that real estate brokers have today is really providing any type of product offering to those that are interested, whether it be investors or primary buyers. And, part of the challenge is, they actually surveyed many of the mom and pop landlords. And asked them, “Would you be willing to sell?” And a lot of them that responded and, I don’t know, I think it was a pretty significant sample, and I think it was done, I may be mistaken, but through the NAR. And, where the feedback really suggested they want to sell, they made a ton of money. And even though they like their annuity stream from being highly occupied, that capital gain tax keep them from selling, which if there was a way that our legislators would actually recognize that we can actually free up many homes that could be either refurbished, flipped to first time buyers and you can offer it to those that are in minority situations or minority owners.

There’s a lot of things that can be done. But, the fact that the retail investor is still looking to invest is because when you have inflation historically, the best safe haven to be is in residential real estate. And so, there’s still a lot of money out there. People have made a ton. They’re trying to figure out, “Where do I put the money and get the best return?” I mean today, when you look at the returns on single family rental, or assuming they’re doing, let’s just say, rental, U.S. treasuries are pretty much be a better deal, you can argue, after you just look at the value and the returns. So, I think that people don’t really understand returns, because otherwise those retail investors wouldn’t still be looking at real estate, but it’s something they can touch and hold, and there’s clearly been a very strong level performance that they can look to and that’s what they want.

Jamil:

Got it. So do you think that the market is normalized then for the spring or are we still in flux?

Ivy:

I think what I would say is the market’s stuck. We’re stuck in a transaction market that will probably not grow this year, I think will be under pressure. To get any growth at all, you really have to have either rates come down substantially to improve affordability and get people more likely to list their home, and therefore have a catalyst to buy the next home or move up. Again, people in rentals are unfortunately in multifamily are seeing significant rent inflation that’s now decelerating. And I’m sure many of them would like to buy. But affordability, the way we measure it, we’re probably about 20 plus percent above historic trend lines in terms of how stretched we are. So, I think that you have to have a pretty dynamic shift in affordability, and alternatively an offering of affordable housing, which we don’t have to today.

And if you look at investing, we don’t expect home prices to plunge. We don’t expect anything that looks like a GFC. But the question is, do you buy at today’s values, what’s your returns going to look like, and what’s your cost of capital? So, based on that cost of capital, it may not be that that is the best place to be investing today. And depending on the location, if you’re doing a flip, you’re going to spend quite a bit on the building products and labor. And materials are at inflationary peak levels still, with the exception of lumber. Your labor is still at peak levels. It’s highly constrained. That’s not likely to change. So, the investment that you have to make to get that house livable could be substantial that you have to factor into as well, if you’re again a retail investor that’s expecting that they can easily have that unit occupied, it may not be as simple as they think.

And we are starting to see some softening and occupancy in a single family rental market. And there is a lot of build for rent product that is now in certain parts of the country, we refer to as the smile states, the sand states, where a lot of capital chased the opportunity where people were migrating to. So, it very much in my mind is somewhat market dependent. But I do think there’s more competition and there’s a tremendous amount of competition coming in the rental market from completions that we expect are going to be up 20 plus percent and accelerating, because we’re at the largest level of backlog for multifamily that we have been since 1973. So, that could put pressure on rents. And therefore, keeping people more likely to stay multifamily, because it’s more attractive as an alternative.

Dave:

Interesting. So you’re saying that, tenants may stay in multifamily because there’s an oversupply multi-family that will drive down rents and it will become more affordable for tenants to stay in multifamily where they traditionally prefer a single family rental.

Ivy:

Yeah. Or even trade, Dave. Let’s just say that… When it’s go back to a need-based move, your wife is expecting your second child, you’ve been in a two bedroom, it’s not going to work anymore, that won’t likely… Therefore, apples to apples, you really can’t compare the multifamily tenant to what would be likely a single family rental tenant. But in some cases, if they have to, they could stay another year. But let’s say they may trade into a new high-rise that has now opened and is leasing up at better attractive prices. And they might have said, “Well, we were going to buy a buy a house. But, this is a three bedroom we can get.” Or, “This is a larger two bedroom. Why don’t we just live there as it’s a much better deal?” So you’re going to start to see that the pie is fairly finite in terms of households. And the question is, where do they choose to pursue shelter. And what becomes the most attractive with respect to affordability? And again, going back to location and schools.

Dave:

Ivy, you are an expert on builders, and new construction, and their sentiment. And so, I would love the opportunity while you’re here to pick your brain a little bit about that. Given what you said at the top of the show where new construction is taking on a bigger portion of total overall home sales, how would you evaluate builders sentiment right now, particularly when we’re talking about single family construction?

Ivy:

I’d say, cautiously optimistic. They’ve been burned before. And right now, they are seeing continued strength into May. And now, May’s over. Today being the end of May, but I would say the commentary around May, and we’ll do our home building survey for May in the first week of June. But what we’ve heard anecdotally is May has remained strong. [inaudible 00:16:03] reported a public company today and they indicated that May has remained solid in terms of trends. I think that that is really a reflection of today’s what I call consumer’s perception that home prices are not going to go down. So I think the biggest factor when we’re dealing with sentiment is related to fear. And fear starts when rates are surging, buyers pull back, builders had to incentivize whether it was predominantly mortgage rate buy downs and other free option upgrades, discounting actual price cuts.

And in ’22, we saw, call it, a 10 to 20% decline net prices including incentives. That created opportunities for those that were seeking value. It was a catalyst. And there was many people during COVID that wanted to buy during the surge of those seeking distance and space that didn’t get to. So those people on the sidelines come in and start buying. And, “Oh, guess home prices aren’t going to go down.” So now, the fear factor has been eliminated. Now, it goes back to affordability. So, who could afford 7% mortgage rates? How long before we start to see what would arguably would be the pet up demand that is now been unleashed start to fade.

And I would say that, the new home market is really not accelerating, it’s just taking share from what otherwise would’ve been existing home. And so, if you factor in both existing and new, really, the housing market is sluggish when you think about transactions. But the new home market is definitely seeing continued strength at the, I guess, expensive existing homes. And not because there isn’t demand, but because again there’s not product in the right locations at the right price in a plentiful amount.

Jamil:

So, are you guys monitoring this regionally? And, are we seeing different markets having increases in building versus other markets decreasing in building?

Ivy:

Well, the new construction market, we do monitor the nation, we market the top 50 MSAs. We fortunately have several hundred builders that are large private builders that we’ve been surveying for the last 30 years. And, we have every month apples to apples what’s happening with respect to their performance and every metric we track. But I would say that the builders are a bit likely to go where… All the builders will go to the same markets where job growth is the most plentiful, where there is land to purchase, you go into the tri-state area, the New York area, there’s really not any new construction. There’s build on your own lot. There’s really not a lot of new home production, semi-custom builders, Toll Brothers a little bit in Pennsylvania. There’s very little new construction but there are a few smaller privates. You keep going west of the Mississippi and you go east of the Mason Dixon line, you’re going to see more builders where they can buy land. And, in those markets where job growth and also relocation has been the most prevalent, those are the markets that are probably performing the best.

So, investors were less prevalent in the southeast, much more prevalent in the west. And we saw the west really get hit hard in 2022, much more so than the southeast. The southeast remains still a very strong market, and really didn’t… As I mentioned, 10 to 20% that was nationwide for the new home market, really Carolina really didn’t see any pricing pressure. So you can go and look at specific markets and there are no question winners and losers on a relative basis. And I’d say that we continue to see those markets that are really more desirable from climate, from just overall tax status and whether it’s no income state tax, there’s also of course just the overall pricing. If you go into the California MSAs, it’s a hell of a lot more expensive to live there, even though the weather’s great, versus living in, let’s say, the Texas markets where the weather might not be as attractive, but there’s no income tax, and it’s very affordable. So, there are definitely winners and losers relative. But I say, directionally the market remains for the new market all within a stable to improving trend line.

Dave:

Ivy, do you think that we’re starting a new trend or era of the housing market, where new construction is going to take up a higher proportion of home sales going forward? Because as you said, the disincentive to sell your home right now is real. And unless rates drop significantly that disincentive seems like it might continue indefinitely. So I’m curious, if you think this new trend is going to continue.

Ivy:

No, our view has been that land values have not corrected whatsoever. And if anything they’re re-accelerating as builders are back with their foot on the gas to purchase land as they took a break during ’22’s correction. So as land prices are either stable to increasing, it’s very difficult for a builder to build an affordable home at today’s cost structure. So, I think they’re going to have a harder and harder time delivering affordable homes, and therefore affordability matters. Could they still show some modest growth within a framework where the economy is non-recession, job market’s still strong? They could. But from a secular perspective, I do anticipate a slow but steady increase in the new home market gaining share.

But, that doesn’t mean that the new home market isn’t cyclical. So, if we start to think about what we’re seeing in the broader economy with inflation still obviously stubbornly high, and not seeing that improvement that the Fed would like to see, what happens in the future if we start to see the Fed taking more action, having to continue to raise? Or if they pivot to cutting, why are they cutting? Is the situation very grim? Are we in a recession? Because housing really is about confidence in jobs and rates. There’s not really one single variable that matters. But I think that, longer term, under the backdrop of where we are right now as an economy, I think it’s steady slow win for the new home market to continue to gain share in the current environment.

Jamil:

So with this foot on the gas approach that you described, considering you’ve got a contrarian view on home building, do you think we’re currently overbuilding? And what do you see happening in the long run?

Ivy:

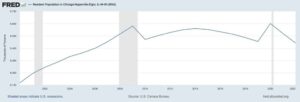

Our view has been not that we’re overbuilding, as much as if we completed all the homes that were started, we would be likely building it for a single family, ahead of what would be a level of normalized supply that you would need for today’s households. The demographics in the United States doesn’t look very good, frankly. I mean, you think about the reduction in immigrants coming into the country, the death rate accelerating even ex-COVID. And then, just overall population growth decelerating, which is really a function of birth rates coming down. So we have a lot of variables that don’t bode well for the demographics. So when you think about the need for shelter, you really look at the rate of change incrementally, how many new households are being formed, therefore that rate of change should mean how many new units of shelter do you need? So, I think when you look at the market in that way, you would say that households are going to consolidate, think about Europe and multi-generational living, and what product is being offered today.

My dad is coming to visit next week and I have a two story with stairs and he needs to stay at a hotel, because he can’t get up the stairs. So, he’ll have to stay at a hotel. And so, what product is out there for our aging population? Mobility rates in the United States have been under pressure well before any impact from rate changes have had on consumers being disincentivized to move. So for example, your cohort from 18 to 24 in a given year, 50% move. But if you get to old dogs like me, we’re in the single digits when we move within a given year, the percent of us that move when you get into my father’s cohort ’82, you’re looking at very few moving, other than moving to a nursing home or passing, God forbid.

My point being is that mobility slowing within an aging population, which is further pressuring transactions and availability. And I think that in itself, when you start to think about what is perceived that, “We’re so under-built. We’re so under-built.” If we offered homes that you can buy at a thousand dollars a month for monthly payment, maybe we could arguably say we’re massively under-built for that product, or something even more affordable, then we’d have, what I call, a decoupling of households.

But you do have a diversion, you’ve got those that are fortunately very well-off, and those that are unfortunately below the poverty line that are multiple families living together. So I think, you really have to dig in to understand, we’re talking about the folks that are listening here, are we talking about the Wall Street folks? Who’s our audience? But the average household income is $70,000 a year. And we’re talking about a lot of people that can’t afford the homes that are being priced in the threes today, and arguably high threes or fours. So, I think we’re under-built for the right affordable product, but not under-built based on the product that we’re offering today.

Dave:

That makes a lot of sense. Basically, if I can paraphrase, it sounds like, you think that we are building sufficiently but not the right kinds of products. So there might be a mismatch between the available supply and the demand for what we’re actually building.

Ivy:

Well, it’s just a question of the number of households that we actually need supply for. During COVID, we’ve continued to see a trend of more investors, second homes, those aren’t households that are primary households that you’d say were under-built. Are we under-built because we need more second homes? Are we under-built because we have more investors that want to own SFR. And therefore they’re going to look for attractive returns. That’s not the same thing as being under-built based on primary households.

Dave:

So, Ivy then, what do you make of the pretty prevalent forecasts out there that we are in the U.S. somewhere between one or 7 million homes under-built, depending on who you listen to. How do you view those analyses?

Ivy:

I don’t like to comment too much on other people’s analyses, especially if I don’t understand their methodology other than very high level. But, if you were to say we look at a point in time, let’s say, 2012 and say we are from here to 2022 for the last 10 years, we under-built to normalize demand. You can make that argument. But, what happens if you started the clock at 2002 and you accounted for all the years we over-built? So, it’s very dependent on where you start the clock and what analysis are you using and what demand number. They never talk about the demand side. They talk about the supply side. What we’ve built. But what goes into the demand analysis, I haven’t read anything from any of those that are forecasting.

So, the demand side is very much predicated as I said on household growth. Household growth is determined by population. What goes into population? Death rate, birth rate, immigration. All are going up until COVID. The birth rate is now improving, but had been decelerating. The rate of growth had been decelerating substantially. Population growth in the decade of the census bureau, or the decennial survey, 2020 was the second-lowest population or the lowest population since the 1930s, and household growth was the second slowest. And that looks even worse if you go out to 2030 now, based on the forecast. And those are hard numbers. You can’t argue with these numbers. The only thing they can change is immigration. So to go back to your question, Dave. Ask your forecasters how they’re measuring demand.

Jamil:

Interesting, because when you think about demand and then you think about just the number of Americans who have second homes, that’s a big number that I don’t think we’re taking into consideration. And, if do you take that into consideration, does that impact the overbuilding or the situation that we’re in right now or not?

Ivy:

Absolutely. I mean, it used to be, but it was several hundred thousand a year were built for homes that were newly built for single family second homes. Or there were starts for second homes. Looking at what that number is today, or wasn’t in the production starts, or custom it’s called. And how much of that is second homes. But, I think that number is accelerated and there is a perception by those second homeowners. There’s two different types of, “I own a second home. I truly want a second home.” Or is it really just an investment? And if the cost of capital increases or, “I’m concerned about the economy.” How quickly do they want to liquidate those homes? And I think that started to happen especially after COVID as people that had maybe been in a hybrid work situation or were completely remote now are being asked to come back.

So I know for example in Boise, talking to a large builder there, they were seeing many people being asked to return to California, that were living in Idaho full-time, that now are being asked to work hybrid and they had to sell their homes. So, some of those second homes, I think the acceleration was related to remote work that may be at an inflection point, whether, “My new employer wants you to be in the office three days a week.” Is that going to change how people live? And is it going to go back eventually to full-time you have to be in the office? I don’t think so personally. But it could. Some employers certainly are saying that.

Dave:

So Ivy, given where we are in the housing market right now where affordability is at a relatively low rate, do you think there is a solution or are we stuck in this low affordability era for the foreseeable future?

Ivy:

I think that we discuss it all the time internally, and amongst ourselves as my colleagues that I’ve been with in many cases 15, 20 years. And I think that, we think that the headwinds are more significant than the tailwinds. So, when you look at that and try to basically evaluate what does that in aggregate mean? I think it means we’re going to be in what could be a fairly benign sluggish environment. And you’re going to have some ebbs and flows, and some markets are going to do well, and some that aren’t. But there’s not going to be some major national change, unless we have something catastrophic happen.

We’re concerned and feel that there’s complacency around climate change, and it’s real. And you can argue that Florida won’t be underwater in my lifetime, but how many storms incrementally every year are we going to see before people start to realize that the flood insurance, property taxes, all of the variables that matter to people are changing now, but it does not changed the demand for homes in Florida, as of yet. And whether it be Governor Abbott in Texas is investing in building walls to try to keep the state from sinking and it being underwater, what has the Governor DeSantis done in Florida? Absolutely nothing. And maybe they can’t.

But those are factors that we think about beyond today. What’s going to matter in a decade from now? What’s going to matter in two decades from now? We’re going to have a hell of a lot of people that are no longer with us, the boomers that are going to pass away, assuming they don’t have any way to keep people living to 130 or something. But there’s bigger picture questions that we want to ask ourselves. People tell me right now, I have a lot of friends, “Well do you think it’s okay I’m going to buy in Florida?” And I’ll say, “I wouldn’t buy in Florida right now personally. I’d go rent in Florida, because I don’t want to be in Cleveland in the winter. But I’m not buying in Florida.” Florida values have surged. It doubled since COVID, in many cases. So, if anything, I’m a seller in Florida. Sell that. Sell it. Hit that bid. It doesn’t make any sense to me.

And yet, people are still migrating there. There’s always migration and relocation, always. But remember, it’s a rate of change that matters. So, if it was where a builder would say 40% of my sales during COVID came from out of state, but now, it’s 25, but that’s great. It’s the rate of change that other analysis does not incorporate and that’s what drives the demand for housing is the rate of change, incremental change. So, that’s a long way to answer it. But, I think we feel like the market is in this, again, stuck zone, because, Dave, your thought about affordability or lack of it. And, the economic backdrop is still positive. And we’re stuck. What happens if that changes? And I’m not an economist. So I’m not going to say what the economy’s going to do. I might have my personal biases. But I think, again, more headwinds than tailwinds. And I’m a seller of real estate right now, where the profits are substantial, and there could be better returns that are less risk-oriented.

Jamil:

That’s an interesting point, right? So, you’re a seller right now. So, that means you’re not a buyer. And, our audience is very much in the world of real estate investing, myself included. And so, what would you advise us? What should an investor do right now? Just given the writing on the wall and the current climate? Should we just park our money? Are there better opportunities elsewhere? Do we buy crypto? I mean, I’m kidding. Never do that. But, what do we do, Ivy?

Ivy:

Well, I’m outside my lane of expertise. I’ll tell you what I’ve done. And then, being a more risk-off person, in general. So, it’s always dependent upon how old you are, you have the kids, you’re going to be able to pay your mortgage. But, assuming you have excess capital and you can arguably put it in something that’s more diversified, but I have more of my money allocated… More of my capital is in treasuries. Whether it ladders, at the short end of the curve, long end of the curve, there’s munis depending on if you have to pay big fees. But, I’m talking outside my lane. I could just tell you real estate. But, I think, why take risk when you can earn at today’s rates that are likely not going to be sustained, maybe not next year, maybe they’ll still be high, but they’re not going to be sustained at these levels for long. So, lock in on the long end of the curve and maybe have some short end exposure. But again, I’m going to stop there. That’s it. That’s completely non-expert thoughts and advice.

Dave:

Yeah. I think it’s a good point. I think a lot of people who are into real estate only invest in real estate. They just pick one asset class and go after that. But, to your point, Ivy, the risk adjusted returns on treasuries are pretty good now compared to a lot of different asset classes. And basically, that just means if you can earn 5% on a short-dated treasury right now, with minimal risk, hopefully now that we’ve hopefully averted a debt ceiling disaster, back to minimal risk. Why would you buy a rental property for example that had a 5% cash on cash return or a 4% cash on cash return? Because obviously the rental property has significantly higher risk than the treasury. And there are other ways to earn returns on real estate other than just cashflow, like paying down your mortgage and there’s tax benefits. There’s a lot of other things to think about. But I think it’s a very valid point, Ivy, that for just on a cashflow perspective, for the first time in maybe a decade, attract other attractive options for getting cashflow other than rental property investing.

Ivy:

Two areas that I was bullish on, more incrementally bullish on, are Columbus, Ohio. I don’t live there. But I think it’s affordable. It’s a little south, so the winters aren’t as bad. And, there is a massive chip plant being built there that’s going to bring substantial job growth. And I don’t think that the market’s figured that out yet. So, the values are still compelling. Especially the arbitrage of coming from something a high cost to arguably, not low, low cost, because tax rates in Ohio are still 4%, versus call it, New York 8%. And then, one of my bankers lives in Richmond, Virginia. I worked with at Sally back when I started on the street. And that’s another market that’s affordable and maybe more attractive relative. And, you think about just markets that have yet to be… Really have the sheet mentality where everybody goes there.

And I think, Cleveland needs desperately single family rental. I know when I was moving back here looking, there’s nothing that’s new, and something that’s well-kept, and really not a very good level of landlords. But there’s no land here. And so then, you have to buy up old houses, and you have to refurbish them, and there’s risk associated to that, that means you’re not in the right location again. So, I think, I’d go for the markets where climate risk is low, if you’re a long-term real estate investor, where there’s significant incremental job growth coming. Now, Richmond, Virginia may not have job growth like Columbus. Phoenix is getting a chip plan as well, or they’re building a ship plant. But, I think Phoenix is an area that’s already seen tremendous amount of growth. But, Columbus really the city I wanted to highlight that I’m interested in.

Dave:

Ivy, you famously predicted the 2008 housing crash. Do you have any other predictions you’re shopping around now or that you feel strongly about these days?

Ivy:

No. Not to sound flippant about it, but it was so obvious. Mortgage credit was just go-gos. Free money. You could [inaudible 00:38:04] and get a mortgage. I think fortunately, there is a very strong mortgage framework here in this country today. We’re going to have rising delinquencies in FHA. We do have unfortunately very high end backend ratios for that FHA VA product. There will be challenges if we have a recession. And you will see defaults and foreclosures, but not to the magnitude. So, we don’t have a housing problem in the United States today when it comes to the risks that GFC brought on that we as analysts analyze. There’s a lot of other problems that could arguably say that housing will be a tall midget. But it doesn’t mean necessarily that you should still therefore buy housing incrementally.

It may be that, what you own, you don’t want to sell it, you want diversity. Maybe you own 10 houses, you sell one, and you buy some treasuries, diversify. Take some chips off the table. Don’t sell everything. If you’re in Florida, you might want to sell more there than if you’re in Ohio. But, I do think the thing that we’ll be doing more work on is climate change, because I think that is concerning. And I don’t know enough about it as of yet to make any significant call, but I do have concern based on insurers I’ve spoken with, some climate experts I’ve spoken with, but have a lot more work to do there.

Jamil:

Yeah, that’s interesting, because there’s such a huge influx of people going to the Florida market. And I mean obviously, with respect to climate change, so many things are going on there with weather. And I personally have investors that are unable to get insurance on properties that they’re buying because of that. And so, I think that’s a phenomenal point. And, with respect to Columbus, Ohio, now I’ve got my eyeballs set on it, because as they’ve said before, all roads lead to Ivy. So, I’m going to take some time to look at that market.

Ivy:

Don’t forget about… Thank you for saying that. Very kind. California, the insurers State Farm is no longer going to insure properties in California because of the fire risk that we’re seeing.

Jamil:

Wow.

Dave:

Wow.

Ivy:

And so, I think that it’s not so much that Florida will be underwater. I mean, New York is a risk, they’re talking about. I think it was New Hampshire’s a risk. The New England states are at risk. The southeastern parts of the country are at risk. But it’s not that they’re going to be underwater per se. We know that in Houston that we’ve seen inches of the state sink. I don’t know if everyone saw the high rise tower in San Francisco that six inches has shrunk or sunk. But, I think it’s the insurance, and the cost, and property taxes that would be as an investor, what may be the hitting cost you’re not factoring in when you’re doing your calculations to determine your expected returns that probably become more problematic, as much as the damage you’ll get from expected acceleration in storms.

Dave:

Great. Well, Ivy, thank you so much for joining us. Is there anything else you think our audience should know?

Ivy:

I don’t think I have anything top of mind, but I appreciate the opportunity and I promise I’ll call you if I do.

Dave:

All right. Well in the meantime, if anyone wants to connect with you, where should they do that?

Ivy:

Just our website is zelmanandassociates.com or [email protected] is my direct email. But, we appreciate the opportunity. And, thanks for having us on the show.

Dave:

Absolutely. Thanks again. Jamil, what did you take away from all that?

Jamil:

I mean, a lot.

Dave:

Yeah, I hope so.

Jamil:

She’s just brilliant. And, listening to her analysis, it really gives you an understanding of how deep you can go in the data to determine what’s happening. And, her insights are alarming in some regards. And in some regards, it’s what you would predict. But, I loved her forecast. I love the way that she’s just describing the overall condition of the market right now. Sluggish. But, there’s definitely some concerns. And I think that as investors, especially for the BiggerPockets audience, we should be really checking what Ivy had to say and see how that resonates with your investment strategy. And, of course, don’t buy in Columbus, because I’ll be buying there.

Dave:

Yeah. Watch out. Jamil’s going to outbid you, all of you. But, I’m curious what you made of her comment about not buying right now. And, we got briefly into this idea of risk adjusted returns, and she was talking about buying treasuries, and that real estate’s not attractive. Curious your thoughts.

Jamil:

I mean, look, there’s aspects of what she’s saying that are really right. There’s risk involved. If you’re buying a property right now and your cap rate or cash on cash is 5%, I mean, why?

Dave:

Yeah.

Jamil:

Of course, you got the other benefits, depreciation, there’s other benefits there that you have, but there’s a tremendous amount of risk associated for those benefits. You got treasuries that are going to return the same amount. And, they’re the safest investment that we have in this country. I mean, for all intents and purposes, there should be some diversification then.

Dave:

Yeah, I totally agree. I think, if you’re an investor who’s just looking for a stabilized asset. You just want to go out, buy a rental property, have it be pretty easy, it’s in good condition, you just collect rent checks every month, a treasury might be a better option for you right now at 5%. That being said, you know this from your business and the deals that I’m investing in right now, there’s still great opportunity if you’re going to do value add, for example. If you’re going to buy something and fix it up or you’re going to flip it, great. Good opportunities there.

If you’re buying in one of these unique markets where demand is surging and there’s huge in migration and there’s limited supply, still good things to do. If you need tax benefits, there’s still good to do. But, I think, when you’re just looking, “Should I go out and buy a plain vanilla rental property?” In a lot of markets, the answer is probably no.

Jamil:

No.

Dave:

Because, you can probably invest your money at 5%, and wait, and see what happens for six months. I’m not personally doing that. I do own a bunch of treasuries. But I’m willing to do more value add stuff. But I’m just saying, if you are the person who’s just looking for that hands off, easy approach, might not want to do it.

Jamil:

I agree. I think she definitely gave us the path, right? There’s opportunities and there’s places where those opportunities exist. And if you are smart about what you’re buying. And again, a contrarian by nature, she’s telling us, “Look at where other people are not. Where’s the sleepers? Where’s that happening?” And again, you can find some of these value add opportunities in markets like that, and hold them then to rent, I mean, you might even do even better there.

Dave:

Yeah. Absolutely. Yeah, there’s some definitely opportunities. I don’t want to dissuade people from thinking about it. Obviously, we both are long on the housing market, so. But I do think just that mindset is really helpful, seeing what other assets are out there, how risky they are compared to real estate. It’s just a good exercise for people to undertake, even if they do wind up buying real estate. It’s just helpful to know what alternatives are out there and why you’re doing it. Before we go though, I did want to ask you about what you said. I don’t know if there were some people you work with, but you said, people in Florida were just straight up unable to get insurance?

Jamil:

Yeah. And it’s interesting, because they’re buying property that had been affected by weather, right? Storms. And so, a lot of these houses right now are coming onto the market or being traded homeowners that figured out their insurance situation and now just want to disposition the property. They’re going into this secondary market of investment real estate where they would find me, or people that I would work with. And, what’s happening right now is, yeah, there’s great deals to be bought. And, all of a sudden, you got a buyer here who was trying to buy a wholesale deal and he can’t close, because he can’t get insurance.

Dave:

Wow. That’s crazy.

Jamil:

And that’s happening, and it’s happening more and more and more. So I think what Ivy had to say is, “Pay attention to climate change. Pay attention to where these insurers are having some trepidation because of risk.” And I would be cautious.

Dave:

Yeah. I’m asking, because I heard a stat that in Florida they’re expecting insurance premiums to go up 40% this year, which is insane.

Jamil:

It is.

Dave:

In one year, 40%. It’s unbelievable.

Jamil:

What does that do to the rental buyer?

Dave:

Right. Yeah. Exactly. Yeah. This makes it really difficult to cashflow in certain types of markets. And, it’s also unpredictable. Rent typically goes up 2, 3% a year, outside of the last few years. Normally, you can count on it keeping up with inflation. But if you start to see insurance or taxes for that matter starting to outpace inflation and outpace your income, that is significant. And, we’re talking a lot about Florida. But she also mentioned California.

I primarily invest in Colorado. We have the same issue with wildfires there. I know people who have had to either delay closing or have missed out on properties because they couldn’t get insurance in wildfire prone areas. So, normally, analyzing deals five years ago, I barely thought about insurance, I’m going to be honest with you. I was just like, “Pencil it in.” But now, I really think you need to call a broker, you need to have a serious conversation. Before you even start bidding on properties, you should probably just really start having conversation with what is available in the areas that you’re considering. So you don’t put in time, effort, and money into a deal that may not be insurable.

Jamil:

They may even have to add an insurance contingency onto these contracts, because it could be as up in the air as financing.

Dave:

Totally. That’s a good point. Yeah. That’s a really good point. Well, hopefully that wasn’t too sad for everyone.

Jamil:

No. But, you know what? It was sobering, Dave.

Dave:

Yeah.

Jamil:

And again, because we’ve talked about possibly having hit the bottom already. Let’s gracefully carry forward guys in a sober manner, so that we don’t have what we’ve seen over and over again with these hyper-inflated markets. I mean, I think some sobriety is warranted.

Dave:

Well said. All right, well thanks again for being here. I always love doing these interviews with you. We appreciate it. If you enjoyed this episode, do us a favor and share it with people. Ivy is obviously an expert and people have very complicated and passionate views about the housing market. And, I think most people who are interested in the real estate space would benefit from learning from Ivy. So, do us a favor and share this episode if you enjoyed it as much as Jamil and I did. Thank you all so much for listening. We’ll see you next time for On The Market. On The Market is created by me, Dave Meyer, and Kalyn Bennett. Produced by Kalyn Bennett, editing by Joel Esparza and Onyx Media. Research by Puja Gendal. Copywriting by Nate Weintraub. And a very special thanks to the entire BiggerPockets team. The content on the show On the Market are opinions only. All listeners should independently verify data points, opinions, and investment strategies.

Watch the Podcast Here

In This Episode We Cover

- The single greatest danger affecting the housing market in 2023

- The new vs. existing home challenge and why homeowners are stuck in place

- Affordable housing and why the “underbuilding problem” isn’t what you think it is

- “Tremendous” competition for rentals and which investors should be concerned

- Underrated housing markets that are seeing strong demand and demographic tailwinds

- 2008 vs. 2023 and whether another housing crash is even feasible in today’s market

- And So Much More!

Links from the Show

Connect with Ivy:

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email [email protected].

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- EVM Finance. Unified Interface for Decentralized Finance. Access Here.

- Quantum Media Group. IR/PR Amplified. Access Here.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.biggerpockets.com/blog/on-the-market-113

- :has

- :is

- :not

- :where

- $UP

- 000

- 1

- 10

- 15%

- 16

- 2%

- 20

- 20 years

- 2006

- 2008

- 2012

- 2020

- 2022

- 2023

- 2030

- 24

- 25

- 30

- 40

- 50

- 7

- 9

- 91

- a

- Able

- About

- about IT

- above

- absolutely

- accelerate

- accelerated

- accelerating

- acceleration

- Accounts

- accurately

- across

- Action

- actual

- actually

- add

- Adjusted

- advice

- advise

- affecting

- affordable

- affordable housing

- After

- again

- Aging

- ago

- ahead

- AIR

- All

- already

- also

- alternative

- alternatives

- altogether

- always

- am

- Americans

- amongst

- amount

- an

- analysis

- Analysts

- analytics

- analyze

- analyzing

- and

- Another

- answer

- anticipate

- any

- anymore

- anyone

- anything

- appetite

- Apple

- appreciate

- approach

- appropriate

- arbitrage

- ARE

- are we in a recession

- AREA

- areas

- arguably

- argue

- argument

- around

- AS

- aspects

- asset

- asset class

- Assets

- associated

- At

- attention

- attract

- attractive

- audience

- author

- availability

- available

- average

- away

- back

- backdrop

- Backend

- Bad

- bankers

- based

- Basically

- basis

- BE

- became

- because

- become

- becomes

- becoming

- been

- before

- being

- believe

- believed

- below

- Benchmark

- benefit

- benefits

- BEST

- Better

- between

- Beyond

- biases

- bid

- Big

- bigger

- Biggest

- Bit

- border

- both

- Bottom

- bought

- Brain

- Break

- Breakfast

- briefly

- brilliant

- bring

- Brings

- broader

- broker

- brokers

- brothers

- brought

- build

- builder

- builders

- Building

- built

- Bullish

- Bunch

- Bureau

- burned

- business

- but

- buy

- buy crypto

- BUYER..

- buyers

- Buying

- by

- california

- call

- called

- came

- CAN

- Can Get

- cap

- capital

- capital gain tax

- carry

- cases

- Cash

- Catalyst

- catastrophic

- categorizing

- cautious

- cautiously

- ceiling

- Census

- Census Bureau

- ceo

- certain

- certainly

- challenge

- challenged

- challenges

- change

- changed

- Changes

- changing

- check

- checking

- Checks

- child

- chip

- Chips

- choices

- Choose

- choosing

- City

- class

- classes

- clear

- clearly

- cleveland

- Climate

- Climate change

- Clock

- Close

- closed

- closing

- Cohort

- colleagues

- collect

- Colorado

- COM

- come

- comes

- coming

- comment

- Commentary

- Companies

- company

- compare

- compared

- compelling

- competition

- Completed

- completely

- complicated

- Concern

- concerned

- concerning

- Concerns

- condition

- confidence

- confident

- confusing

- Connect

- Consider

- considerable

- consideration

- considering

- consolidate

- constantly

- construction

- Consumers

- content

- context

- continue

- continued

- contracts

- Conversation

- copywriting

- corrected

- Cost

- could

- country

- Couple

- course

- Covid

- Crash

- crazy

- created

- Credibility

- credit

- crisis

- crypto

- curious

- Current

- Currently

- curve

- custom

- cuts

- cutting

- Cyclical

- Dad

- damage

- DANGER

- data

- data points

- Dave

- day

- Days

- deal

- dealing

- Deals

- Death

- Debt

- decade

- decades

- Decline

- deep

- Default

- defaults

- definitely

- delay

- deliver

- delivering

- Demand

- demographic

- Demographics

- dependent

- Depending

- described

- desperately

- Determine

- determined

- DID

- differences

- different

- difficult

- DIG

- digits

- direct

- disaster

- discretionary

- discuss

- discussed

- Display

- dissuade

- distance

- district

- Divergence

- diversification

- diversified

- diversify

- Diversion

- Diversity

- do

- does

- Doesn’t

- Dogs

- doing

- dollars

- done

- Dont

- doubled

- down

- downs

- dozen

- drive

- drives

- driving

- Drop

- during

- dynamic

- earn

- easily

- East

- eastern

- easy

- ebbs

- Economic

- Economist

- economy

- economy’s

- editing

- effort

- either

- Elaborate

- elevated

- eliminated

- else

- elsewhere

- employers

- end

- England

- enjoy

- enough

- Entire

- Environment

- episode

- Era

- especially

- ESSAY

- estate

- Ether (ETH)

- Europe

- evaluate

- Even

- eventually

- Every

- everyone

- everything

- exactly

- example

- exception

- excess

- excited

- Exercise

- exist

- existing

- expect

- expectations

- expected

- expecting

- expensive

- experience

- experienced

- expert

- expertise

- experts

- Explain

- Exposure

- extensive

- Extensive Experience

- extremely

- facing

- fact

- factor

- factors

- fade

- fairly

- familiar

- families

- family

- famous

- famously

- far

- farm

- favor

- fear

- feasible

- Fed

- feedback

- feel

- Fees

- few

- Figure

- figured

- Finally

- financing

- Find

- Fire

- First

- first time

- five

- Fix

- fixed

- Flip

- flood

- florida

- Flows

- FLUX

- Foot

- For

- Forecast

- forecasts

- foreseeable

- formed

- Fortunately

- Forward

- Framework

- Francisco

- Free

- friends

- from

- full

- function

- further

- future

- Gain

- gaining

- GAS

- General

- generally

- get

- getting

- GFC

- Give

- given

- gives

- Go

- God

- Goes

- going

- good

- Governor

- great

- greatest

- grim

- Grow

- Growth

- Guest

- had

- Half

- hand

- Hands

- happen

- Happening

- happens

- happy

- Hard

- Have

- having

- he

- headwinds

- hear

- heard

- hearing

- help

- helpful

- her

- here

- Hidden

- High

- higher

- Highlight

- highly

- historic

- historical

- historically

- Hit

- hitting

- hold

- Home

- Homes

- Honestly

- hope

- Hopefully

- host

- hotel

- House

- household

- households

- houses

- housing

- housing market

- houston

- How

- HTTPS

- huge

- hundred

- Hybrid

- Hybrid Work

- i

- I’LL

- idea

- if

- Immigrants

- immigration

- Impact

- implications

- important

- impressed

- improve

- improvement

- improving

- in

- Incentives

- incentivize

- inches

- included

- Including

- Income

- income tax

- incorporate

- Increase

- Increases

- increasing

- independent

- independently

- indicated

- industry

- inflation

- Inflationary

- Inflection Point

- influx

- INSANE

- insights

- Institutional

- institutional investor

- institutional investors

- institutions

- insurance

- insurers

- Intelligent

- interested

- interesting

- internally

- Interview

- Interviews

- into

- inventory

- Invest

- investing

- investment

- Investment strategy

- investor

- Investors

- involved

- issue

- IT

- itself

- Job

- Jobs

- joined

- joining

- joining us

- jpg

- june

- just

- Keep

- keeping

- kids

- Kind

- Know

- labor

- Lack

- lady

- Land

- Lane

- large

- larger

- largest

- Last

- Late

- lead

- leader

- League

- learning

- leasing

- legislators

- Length

- less

- Level

- levels

- LG

- lifestyle

- lifetime

- like

- likely

- Limited

- Line

- lines

- liquidate

- List

- Listed

- Listening

- Listings

- little

- live

- Lives

- living

- location

- locations

- locked

- Long

- long time

- long-term

- longer

- Look

- look like

- looking

- LOOKS

- Losers

- Lot

- love

- loved

- Low

- low rates

- lower

- lowest

- mac

- made

- Main

- mainly

- Mainstream

- major

- make

- MAKES

- man

- Managers

- manner

- many

- many people

- Market

- market crash

- marketplace

- Markets

- Mason

- massive

- massively

- materials

- math

- Matter

- Matters

- May..

- mean

- means

- meantime

- measure

- measuring

- Media

- mentioned

- methodologies

- Methodology

- metric

- Meyer

- might

- migrating

- migration

- million

- mind

- Mindset

- minimal

- minority

- missed

- Mississippi

- mobility

- modest

- mom

- money

- Monitor

- monitoring

- Month

- monthly

- months

- Moody’s Analytics

- more

- Mortgage

- most

- move

- Movers

- moving

- much

- multi-family

- multiple

- my

- name

- nation

- National

- Nationwide

- Nature

- necessarily

- Need

- Needless

- needs

- net

- never

- New

- New Construction

- New Market

- New York

- newly

- next

- next week

- no

- normally

- nothing

- now

- number

- numbers

- numerous

- Nursing

- obvious

- occupancy

- of

- off

- offer

- offered

- offering

- Offers

- Office

- Ohio

- Okay

- Old

- on

- ONE

- only

- Onyx

- opened

- operators

- Opinion

- Opinions

- opportunities

- Opportunity

- Optimistic

- Option

- Options

- or

- order

- Other

- otherwise

- our

- ourselves

- out

- outside

- over

- overall

- own

- owned

- owners

- pancake

- Park

- part

- particular

- particularly

- partner

- parts

- pass

- Passing

- passionate

- path

- Pay

- paying

- payment

- Peak

- Pennsylvania

- People

- people’s

- perceived

- percent

- perception

- performance

- performing

- person

- personal

- Personally

- perspective

- pet

- phenomenal

- phoenix

- phone

- pick

- picture

- Pivot

- Place

- Places

- Plain

- plan

- plato

- Plato Data Intelligence

- PlatoData

- player

- plunge

- plus

- podcast

- Podcasts

- Point

- Point of View

- points

- pool

- pop

- population

- portfolio

- positive

- possibly

- Poverty

- predict

- predicted

- Predictions

- Predictor

- predominantly

- prefer

- pressure

- pretty

- prevalent

- price

- Prices

- pricing

- primarily

- primary

- private

- probably

- Problem

- problems

- Produced

- Product

- Production

- Products

- profits

- promise

- properties

- property

- proportion

- protected

- providing

- public

- puja

- purchase

- purposes

- pursue

- Pushing

- put

- question

- Questions

- Quick

- quickly

- raise

- Rate

- Rates

- Read

- real

- real estate

- Reality

- realize

- really

- reasons

- recession

- recognize

- reduction

- reflection

- regards

- related

- relative

- relatively

- remained

- remains

- remarkable

- remember

- remote

- remote work

- Rent

- rentals

- REPEATEDLY

- Reported

- represent

- research

- researchers

- residential

- resilient

- resonates

- respect

- result

- retail

- Retail Investors

- return

- returns

- right

- Rise

- rising

- Risk

- risks

- Risky

- roads

- roughly

- round

- Run

- s

- safe

- Safe Haven

- safest

- Said

- sales

- same

- San

- San Francisco

- SAND

- saw

- say

- saying

- School

- Schools

- screaming

- Season

- Second

- secondary

- Secondary Market

- sector

- see

- seeing

- seeking

- seems

- seen

- sell

- Sellers

- Selling

- sense

- sentiment

- serious

- set

- several

- Share

- Shares

- she

- sheet

- Shelter

- shift

- Shopping

- Short

- shortage

- should

- show

- showcased

- side

- significant

- significantly

- Simple

- since

- single

- Sitting

- situation

- situations

- SIX

- Six months

- slow

- Slowdown

- Slowing

- sluggish

- small

- smaller

- smart

- smartest

- So

- sober

- sobering

- solid

- solution

- some

- something

- somewhat

- somewhere

- Sound

- South

- Southern

- Space

- special

- specific

- specifically

- spend

- spent

- spoken

- Sponsors

- spring

- stable

- start

- started

- Starting

- starts

- State

- State Farm

- States

- Status

- stay

- steady

- Still

- Stop

- Stories

- storms

- Story

- straight

- strategies

- Strategy

- stream

- street

- strength

- strong

- strongly

- structure

- studies

- substantial

- substantially

- such

- sudden

- summer

- supply

- surge

- Surged

- surprise

- Survey

- surveyed

- sustained

- table

- Take

- Takeaways

- taking

- Talk

- talking

- tax

- Tax Status

- Taxes

- team

- Teens

- tell

- tenant

- term

- terms

- test

- texas

- than

- thank

- thanks

- that

- The

- the Fed

- The Future

- The State

- The West

- the world

- their

- Them

- then

- There.

- therefore

- These

- they

- thing

- things

- think

- Thinking

- this

- this year

- thoroughly

- those

- though?

- thought

- thousands

- three

- Through

- time

- to

- today

- today’s

- together

- Ton

- too

- took

- top

- Total

- TOTALLY

- touch

- Tower

- track

- trade

- traded

- traditionally

- transaction

- Transactions

- Transcript

- Treasuries

- treasury

- tremendous

- Trend

- Trends

- truly

- try

- Tuesday

- two

- type

- types

- typically

- u.s.

- U.S. Treasuries

- unable

- Uncertainty

- under

- understand

- understanding

- undertake

- underwater

- unfortunately

- unique

- unit

- United

- United States

- units

- unleashed

- unpredictable

- until

- updated

- upgrades

- upon

- Upside

- us

- use

- used

- using

- value

- Values

- verify

- Versus

- very

- Video

- View

- views

- virginia

- Visit

- vs

- wait

- Wall

- Wall Street

- want

- wanted

- wants

- was

- Watch

- Way..

- ways

- we

- Weather

- Website

- week

- welcome

- WELL

- were

- West

- What

- What is

- whatever

- when

- whether

- which

- while

- WHO

- whole

- wholesale

- why

- wife

- will

- willing

- win

- wind

- winners

- Winter

- with

- within

- Work

- worked

- working

- works

- world

- worse

- would

- writing

- written

- year

- years

- yet

- york

- you

- Your

- yourself

- youtube

- zephyrnet