- Investors now await Tuesday’s BoJ decision to clarify the bank’s rate outlook.

- The dollar fell amid signs of potential Fed rate cuts next year.

- There has been uncertainty about when the BoJ might phase out its negative interest rate policy.

Monday’s USD/JPY forecast hinted at a bearish trend, fueled by the Bank of Japan’s (BOJ) two-day monetary policy meeting beginning. Traders eagerly anticipated the central bank’s decision, speculating on the potential unwinding of its ultra-loose policy settings.

-Czy chcesz dowiedzieć się więcej? handel opcjami forex? Sprawdź nasz szczegółowy przewodnik-

Moreover, the currency extended weakness from the previous week following signals of potential interest rate cuts next year in the Federal Reserve’s policy meeting. Consequently, the yen gained nearly 2% last week as the dollar fell.

Furthermore, the Japanese currency experienced volatility in recent weeks amid uncertainty about when the BoJ might phase out its negative interest rate policy. Notably, Governor Kazuo Ueda’s comments triggered a significant yen rally earlier this month. However, it was later reversed after news suggested a policy shift might not happen as early as December. Investors now await Tuesday’s BoJ decision to clarify the bank’s rate outlook.

The pair had gained support due to aggressive rate hikes from the Fed and expectations of sustained higher rates in 2022 and 2023. However, recent Fed comments saw the dollar index record a substantial 1.3% decline last week.

Franck Dixmier, a global chief investment officer for fixed income at Allianz Global Investors, commented, “The Fed has officially opened the door to the next cycle of rate cuts.”

Kluczowe wydarzenia USD/JPY dzisiaj

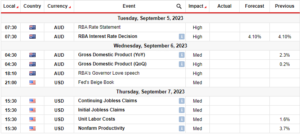

Investors will await the result of the BoJ policy meeting as no high-impact events are scheduled for today.

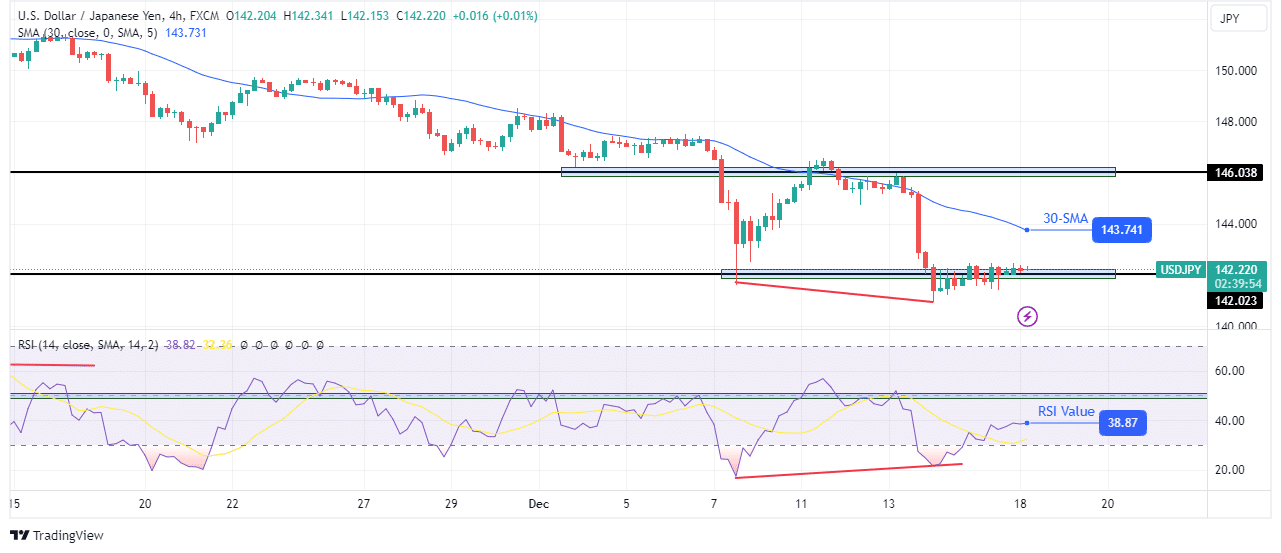

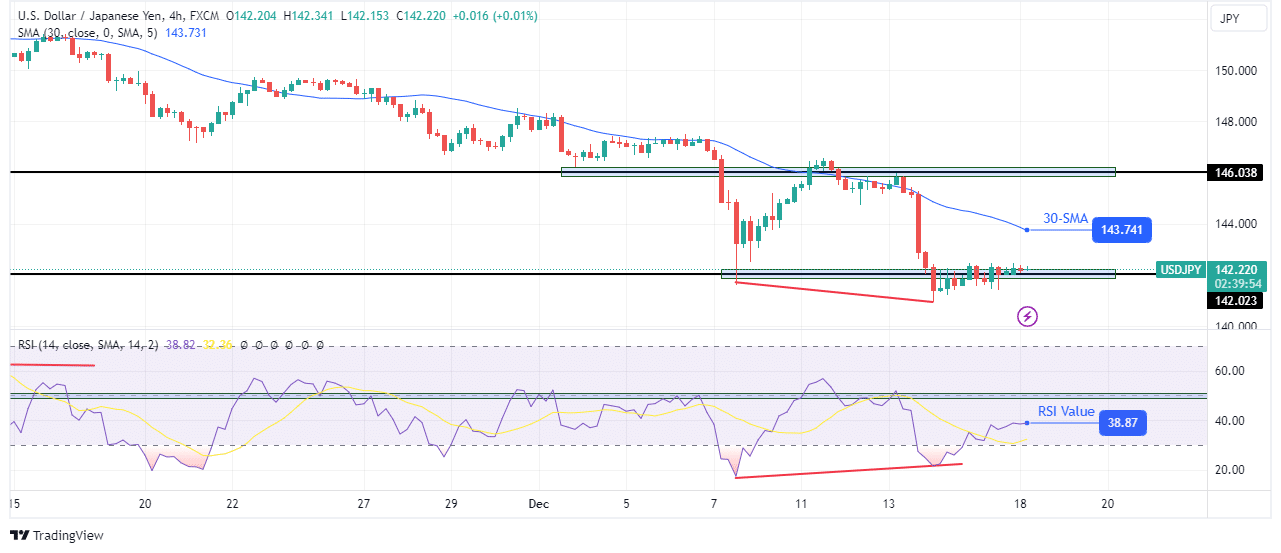

USD/JPY technical forecast: 142.02 support holds firm, decline takes a breather

On the technical side, the USD/JPY’s decline has paused near the 142.02 key support level. However, the bearish bias remains strong as the price sits far below the 30-SMA, and the RSI is below the 50 mark. The recent decline started at the 146.03 key level, where the price respected the 30-SMA resistance.

-Czy chcesz dowiedzieć się więcej? narzędzia forex? Sprawdź nasz szczegółowy przewodnik-

However, bears show some vulnerability as the RSI has made a bullish divergence. Therefore, it shows bearish momentum has weakened, and this might allow bulls to trigger a pullback or reversal. The downtrend might continue without a pullback if bears regain strength. However, in case of a pullback, the price will likely pause at the 30-SMA before the downtrend continues.

Chcesz teraz handlować na rynku Forex? Zainwestuj w eToro!

67% rachunków inwestorów detalicznych traci pieniądze podczas handlu kontraktami CFD z tym dostawcą. Zastanów się, czy możesz sobie pozwolić na wysokie ryzyko utraty pieniędzy.

- Dystrybucja treści i PR oparta na SEO. Uzyskaj wzmocnienie już dziś.

- PlatoData.Network Pionowe generatywne AI. Wzmocnij się. Dostęp tutaj.

- PlatoAiStream. Inteligencja Web3. Wiedza wzmocniona. Dostęp tutaj.

- PlatonESG. Węgiel Czysta technologia, Energia, Środowisko, Słoneczny, Gospodarowanie odpadami. Dostęp tutaj.

- Platon Zdrowie. Inteligencja w zakresie biotechnologii i badań klinicznych. Dostęp tutaj.

- Źródło: https://www.forexcrunch.com/blog/2023/12/18/usd-jpy-forecast-traders-on-edge-as-bojs-policy-shift/

- :ma

- :Jest

- :nie

- :Gdzie

- 1

- 2%

- 2022

- 2023

- 50

- a

- O nas

- Konta

- Po

- agresywny

- Allianz

- dopuszczać

- Wśród

- i

- Przewiduje

- SĄ

- AS

- At

- oczekiwać

- Bank

- niedźwiedzi

- Niedźwiedzi Momentum

- Niedźwiedzie

- być

- zanim

- Początek

- poniżej

- stronniczość

- boj

- Spotkanie polityczne BoJ

- Uparty

- bierna dywergencja

- Byki

- by

- CAN

- walizka

- centralny

- CFD

- ZOBACZ

- szef

- skomentował

- komentarze

- w konsekwencji

- Rozważać

- kontynuować

- ciągły

- Waluta

- obniżki

- cykl

- grudzień

- decyzja

- upadek

- szczegółowe

- Rozbieżność

- Dolar

- Indeks dolara

- Drzwi

- z powodu

- z zapałem

- Wcześniej

- Wcześnie

- krawędź

- wydarzenia

- oczekiwania

- doświadczony

- dużym

- daleko

- nakarmiony

- Federalny

- Rezerwa Federalna

- Firma

- ustalony

- o stałym dochodzie

- następujący

- W razie zamówieenia projektu

- Prognoza

- forex

- od

- podsycane

- zdobyte

- Globalne

- Gubernator

- miał

- zdarzyć

- Wysoki

- wyższy

- Piesze wędrówki

- napomknął

- posiada

- Jednak

- HTTPS

- if

- in

- Dochód

- wskaźnik

- odsetki

- OPROCENTOWANIE

- zainteresowany

- Inwestuj

- inwestycja

- inwestor

- Inwestorzy

- IT

- JEGO

- Japonii

- Japonki

- Klawisz

- Nazwisko

- później

- UCZYĆ SIĘ

- poziom

- Prawdopodobnie

- stracić

- utraty

- zrobiony

- znak

- Maksymalna szerokość

- Spotkanie

- może

- pęd

- Monetarny

- Polityka pieniężna

- pieniądze

- Miesiąc

- jeszcze

- Blisko

- prawie

- ujemny

- aktualności

- Następny

- Nie

- szczególnie

- już dziś

- of

- Oficer

- Oficjalnie

- on

- otwierany

- Opcje

- or

- ludzkiej,

- na zewnątrz

- Outlook

- đôi

- pauza

- Wstrzymany

- faza

- plato

- Analiza danych Platona

- PlatoDane

- polityka

- potencjał

- poprzedni

- Cena

- dostawca

- Zatrzymaj się

- rajd

- Kurs

- podwyżki stóp

- ceny

- niedawny

- rekord

- wracać

- szczątki

- zarezerwowany

- Odporność

- szanowany

- dalsze

- detaliczny

- Odwrócenie

- Ryzyko

- rsi

- s

- zobaczył

- zaplanowane

- w panelu ustawień

- przesunięcie

- powinien

- pokazać

- Targi

- bok

- Sygnały

- znaczący

- znaki

- siada

- kilka

- rozpoczęty

- jest determinacja.

- silny

- znaczny

- wsparcie

- poziom wsparcia

- podtrzymany

- Brać

- trwa

- Techniczny

- Połączenia

- Fed

- w związku z tym

- to

- do

- już dziś

- handel

- Handlowcy

- Handel

- Trend

- wyzwalać

- rozsierdzony

- Niepewność

- USD / JPY

- Zmienność

- wrażliwość

- była

- osłabienie

- tydzień

- tygodni

- jeśli chodzi o komunikację i motywację

- czy

- będzie

- w

- bez

- rok

- Jen

- ty

- Twój

- zefirnet