The cryptocurrency is inching slowly upwards after losses yesterday. Its total cap, at $922 billion, has fallen by 5% in a week, and by 32% in a month. It has, however, risen by 1% in 24 hours, along with most major coins. This invites hope for a weekend recovery, which the market is long overdue, even if macroeconomic conditions remain negative. As such, here's our pick of the 5 best cryptocurrency to buy for the recovery.

5 beste kryptovaluta å kjøpe for gjenoppretting

1. Lucky Block (LBLOCK)

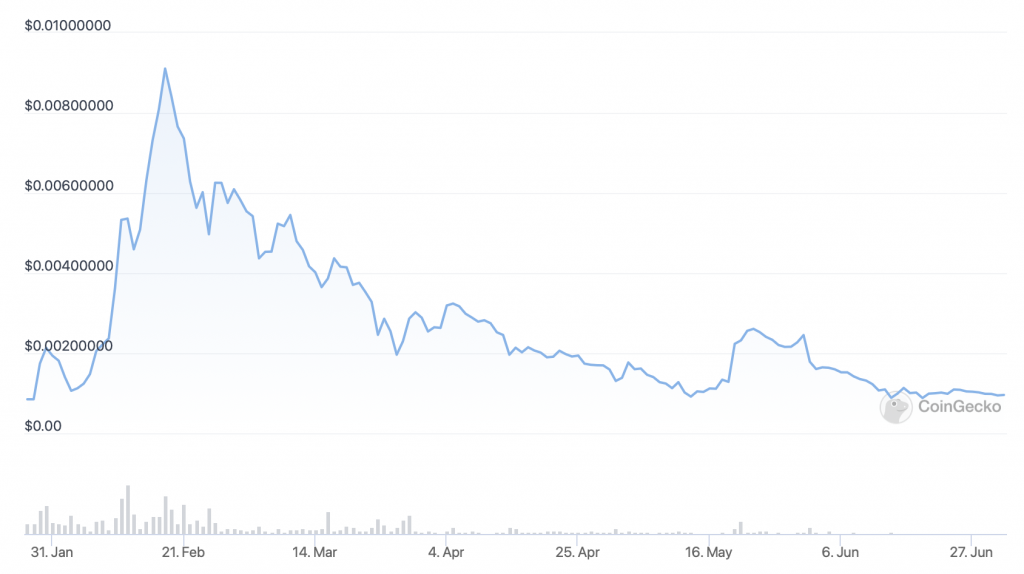

LBLOCK er $0.00095626 for øyeblikket, noe som representerer en brøkdel (0.2%) økning i løpet av de siste 24 timene. Altcoinen har imidlertid gått ned med 12 % den siste uken og med 46 % de siste 30 dagene.

LBLOCK is down by 90% since its all-time high of $0.00974554, set in February. On the other hand, it's up by 120% since launching in late January.

At LBLOCK fortsatt er oppe siden lanseringen er et godt tegn for fremtiden, og nylige Lucky Block-utviklinger tyder på at den kan vokse sterkt når markedsforholdene blir bedre. For det første holder Lucky Block kryptospillplattformen nå vanlige premietrekninger, som garanterer en minimum jackpot på $50,000 XNUMX. På toppen av dette har den bestått revisjonen for sitt kommende ERC-20-token.

V2 token revisjon bestått! ✅

Det betyr at vi nærmer oss noteringer på sentraliserte børser! 🤩

La #CountdownToCEXs begynne! 🥳 @SolidProof_io #crypto #revidere #CEX #oppføringer #blockchain pic.twitter.com/TZJMPdNOdZ

— Lucky Block (@luckyblockcoin) Juni 23, 2022

In other words, an Ethereum-based version of LBOCK is imminent. It had originally launched on Binance Smart Chain, yet a migration to Ethereum will open up significant liquidity for the coin. Likewise, it paves the way for more exchange listings, something which will expand its market substantially. This is why it's one of our 5 best cryptocurrency to buy for the recovery.

2. Bitcoin (BTC)

BTC har steget med 1.5 % de siste 24 timene, og nådde $19,664 18,780. Den hadde falt så lavt som $7 38 i går, noe som understreker muligheten for ytterligere fall. Og den nåværende trenden forblir negativ, etter å ha falt med XNUMX % på en uke og med XNUMX % på en måned.

BTC's indicators are at a very low ebb. Its relative strength index (in purple) is touching 30, indicating that the market is overselling it. Likewise, its 30-day moving average (in red) has fallen to its lowest level relative to its 200-day average (in blue) for a year. This strongly signals an eventual recovery.

Bitcoin remains the market's leader for a reason. It commands rundt 26 milliarder dollar i institusjonelle investeringer, som ser ut til å stige på mellomlang til lang sikt. For eksempel, Jacobi Asset Management har nettopp annonsert the launch of Europe's first-ever spot Bitcoin ETF. It will go live this month on the Euronext Amsterdam exchange, paving the way for more institutional and mainstream investment in bitcoin.

More generally, it's bitcoin that continues to attract outside interest. There continue to be nations which turn to BTC during periods of very high inflation (e.g. Kalkun og Argentina), samt de som har gjort det til lovlig betalingsmiddel (El Salvador og Den sentralafrikanske republikk). Denne trenden vil mest sannsynlig fortsette når markedet igjen blir mer positivt.

3. Sandkassen (SAND)

At $1.13, SAND has risen by 15% in a day. It's also up by 12% in a week and by 35% in the past 14 days. That said, it is down by 22% in a month.

Looking at SAND's chart, it had been due a rally. Its RSI has fallen below 30, while its 30-day average had collapsed far below its 200-day. Of course, with conditions remaining challenging, it can't be said how long its current spurt will last.

Det ser ut til at SAND stiger for øyeblikket på grunn av åpningen av broen mellom Sandbox og lag-to-plattformen Polygon. Dette gjør Sandbox-brukere i stand til å overføre LAND ikke-fungible tokens og SAND til (og på) Polygon, noe som senker kostnadene og forbedrer effektiviteten.

🌉 Vi er klare til å distribuere LAND til @ 0xPolygon 🌉

🔸Hver LAND-bro gir en cashback på 10 mSAND!

🔸LAND-multiplikatorer på begge mSAND-innsatsprogrammene er tilbake!

🔸 LAND salg og LAND staking funksjoner (på Polygon) kommer snart!BRO NÅ ➡️ https://t.co/jlcSKxuBWh pic.twitter.com/1tuAAsqEZP

- Sandkassen (@TheSandboxGame) Juni 28, 2022

Ser vi på det større bildet, har Sandbox vært vitne til mye høyprofilert aktivitet på sin spill-/metaverseplattform. Mest bemerkelsesverdig kunngjorde maskinvare lommebokprodusenten Ledger at den hadde valgt Sandbox som sin første virtuelle plassering i metaverset noensinne. Dette er en stor støtte for plattformen, gitt vekten Ledger har innenfor kryptovalutasektoren.

Velkommen LedgerVerse til @TheSandboxGame: Ledger's first step into the metaverse and the first to turn gaming into Web3 education. 🎮

Erobre oppdrag, bekjemp svindlere og vinn Web3-belønninger. 🥇

Mestre kryptosikkerhet.

Lære. Spille. Tjene. Kommer sommeren 2022. pic.twitter.com/56kS9FLZK6

- Ledger (@Ledger) Juni 22, 2022

It's worth remembering that the Sandbox racked up around 350 millioner dollar i salg av virtuell land i 2021, more than any other similar platform. This highlights its potential, and also why we've included it among our 5 best cryptocurrency to buy for the recovery.

4. Ethereum (ETH)

ETH har steget med 2.5 % de siste 24 timene. Til $1,072 6 har den falt med 45 % den siste uken og med XNUMX % den siste måneden.

ETH's indicators are much like BTC's, suggesting a bottom. Its RSI is close to 30, while its 30-day average is far below its 200-day. Of course, the market is going through an unprecedentedly difficult time right now, so it's hard to say whether a rally is imminent.

Likevel har ETH et stort mellom- og langsiktig potensial. Dette er i stor grad fordi Ethereum er i ferd med å skifte til en proof-of-stake konsensusmekanisme. Dette vil gjøre lag-ett blokkjeden mindre energikrevende, mer skalerbar og mer attraktiv for investorer.

Gratulerer til #Ethereum fellesskap på en vellykket sammenslåing på Ropstens testnett.

Det er over $22.78B i verdi satset og klar for den kommende main-net Merge to Proof-of-Stake.

Dette representerer 12.8 millioner $ ETH = 10.78 % av tilbudet.

Direkte diagram: https://t.co/PDQg3lCJCl pic.twitter.com/GiFI3BtSKa

- glassnode (@glassnode) Juni 8, 2022

Due at some point in late summer, the ‘Merge' will massively boost investor confidence in Ethereum. The introduction of staking will increase demand for ETH, and with 10% of ETH's supply already staked on the PoS Beacon Chain, the cryptocurrency could become deflationary. When you add the fact that Ethereum er allerede den største blokkjeden etter total verdi låst inn, it's easy to see why ETH is one of our 5 best cryptocurrency to buy for the recovery.

11/ At the current stake amount, the Ethereum network will be paying out ~600,000 ETH per year, instead of 4,850,000 under the current PoW model, or 88% less in "sell pressure"! At the same time, stakers will still be earning ~4.6% in their staked ETH, a nice return to attract.

- eric.eth (@econoar) Juni 10, 2022

5. Arweave (AR)

AR har økt med 20 % de siste 24 timene, til $10. Den har også steget med 2 % på en uke og med 15 % på fjorten dager, mens den har vært 35 % nede de siste 30 dagene.

AR's chart shows a gradual increase in momentum. Its RSI has gone from under 30 a couple of weeks ago to nearly 50 today. At the same time, its 30-day average is still well below its 200-day, so there's plenty of room left for a bigger recovery.

It seems that AR is rallying right now due to the launch of Arweave's very own domain registry system. Basically, its Arweave's own version of the Ethereum Name Service, enabling users to purchase ArNS-based domain names using AR. This has caused demand for AR to rise as users move to claim their own domains.

I dag lanserer vi vårt pilotprogram for Arweave Name System (ArNS) – en Smartweave-basert katalog med vennlige underdomener aktivert av https://t.co/ljKQFJO6vN porter på @arweaveteam permaweb!

🧵 1/3 pic.twitter.com/62tQDABgyz

— 🐘🔗ario.arweave.dev (@ar_io_network) Juni 29, 2022

Looking at AR's fundamentals, it's encouraging to note that Arweave — a decentralised data storage network — har vært vitne til økende transaksjoner det siste året. From 1.75 million daily transactions August 2021, its traffic increased to 48.8 million daily transactions by May of this year. This figure has since declined, as a result of the market downturn, but it's likely to continue witnessing growth once the economic picture improves.

Kapitalen din er i faresonen.

Les mer:

- "

- 000

- 10

- 2021

- 2022

- 28

- a

- aktivitet

- Afrikansk

- allerede

- Altcoin

- blant

- beløp

- amsterdam

- annonsert

- AR

- rundt

- eiendel

- Kapitalforvaltning

- revisjon

- August

- gjennomsnittlig

- I utgangspunktet

- bbc

- fyrkjede

- bli

- under

- BEST

- mellom

- større

- Biggest

- Milliarder

- binance

- Bitcoin

- Bitcoin ETF

- Blokker

- blockchain

- øke

- BRO

- BTC

- kjøpe

- kjøp bitcoin

- hovedstad

- forårsaket

- sentral

- sentralisert

- kjede

- utfordrende

- valgt ut

- hevder

- nærmere

- CNBC

- Coin

- Mynter

- kommer

- samfunnet

- forhold

- selvtillit

- Konsensus

- fortsette

- fortsetter

- Kostnader

- kunne

- Par

- krypto

- cryptocurrency

- Gjeldende

- daglig

- dato

- datalagring

- dag

- Dager

- deflasjons

- Etterspørsel

- utplassere

- dev

- utviklingen

- vanskelig

- Vise

- domene

- domener

- ned

- droppet

- under

- hver enkelt

- tjene

- tjene

- økonomisk

- Kunnskap

- effektivitet

- muliggjør

- muliggjør

- oppmuntrende

- energi

- ERC-20

- ETF

- ETH

- ethereum

- ethereum (ETH)

- ethereum nettverk

- Europa

- eksempel

- utveksling

- Expand

- Egenskaper

- Figur

- Først

- brøk

- fra

- Fundamentals

- videre

- framtid

- Games

- gaming

- generelt

- få

- glass node

- skal

- god

- tilskudd

- flott

- Grow

- Vekst

- garantere

- maskinvare

- Maskinvare lommebok

- å ha

- her.

- Høy

- striper

- holder

- håp

- Hvordan

- Men

- HTTPS

- forbedre

- inkludert

- Øke

- økt

- indeks

- inflasjon

- institusjonell

- interesse

- investering

- investor

- Investorer

- IT

- Januar

- Juli

- lansere

- lansert

- lansere

- leder

- Ledger

- Lovlig

- Nivå

- Sannsynlig

- Likviditet

- oppføringer

- leve

- plassering

- låst

- Lang

- langsiktig

- tap

- laget

- Mainstream

- større

- gjøre

- ledelse

- leder

- Produsent

- marked

- midler

- mekanisme

- Flett

- metaverse

- millioner

- minimum

- modell

- Momentum

- Måned

- mer

- mest

- flytte

- flytting

- navn

- Nasjoner

- negativ

- nettverk

- ikke-fungible

- ikke-fungible symboler

- åpen

- åpning

- Annen

- egen

- perioder

- bilde

- pilot

- plattform

- Spille

- Plenty

- Point

- polygon

- PoS

- positiv

- mulighet

- potensiell

- PoW

- press

- pris

- premie

- prosess

- program

- programmer

- Proof-of-stav

- offentlig

- Kjøp

- oppdrag

- rally

- RE

- nylig

- utvinning

- regelmessig

- forbli

- gjenværende

- forblir

- representerer

- representerer

- retur

- Reuters

- Belønninger

- stiger

- Risiko

- Sa

- salg

- samme

- SAND

- sandkasse

- skalerbar

- svindlere

- sektor

- sikkerhet

- selger

- tjeneste

- sett

- undertegne

- signifikant

- lignende

- siden

- Smart

- So

- noen

- noe

- Spot

- stake

- staking

- Still

- lagring

- styrke

- vellykket

- sommer

- levere

- system

- De

- Gjennom

- tid

- i dag

- token

- tokens

- topp

- trafikk

- Transaksjoner

- overføre

- etter

- under 30

- kommende

- oppover

- Brukere

- verdi

- versjon

- virtuelle

- synlighet

- W3

- lommebok

- Web3

- uke

- helg

- om

- mens

- vinne

- innenfor

- ord

- verdt

- år