Fintech Innovation | Dec 5, 2023

Image: VCA, Succeeding with Super Apps, Chart

Image: VCA, Succeeding with Super Apps, ChartSuper Apps Are Redefining Convenience in the Digital Age

A super app is essentially a multi-utility mobile application offering a wide array of services, from financial transactions and e-commerce to social networking and entertainment. Such apps have transformed user experience by integrating various functionalities into a single, user-friendly platform, enabling easy and seamless access to a multitude of services. Visumadvies en -analyse (VCA) published a recent report titled “Succeeding with Super Apps,” highlighting its rapid global growth and key drivers.

Siehe: Zal Elon's X in 2024 een Fintech Super-app worden?

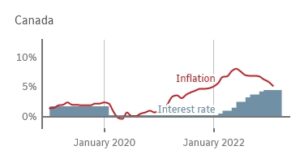

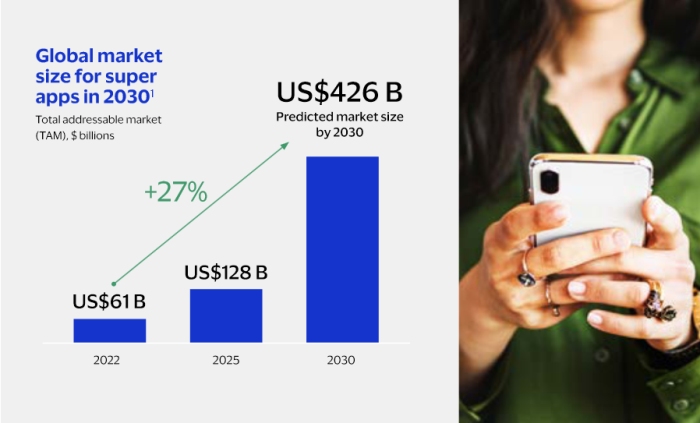

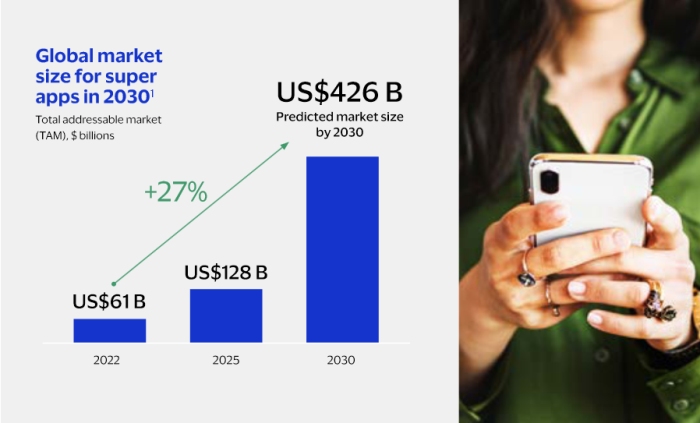

The super app market, valued at over US$60 billion in 2022, is anticipated to grow at a staggering 27% annually, potentially reaching US$426 billion by 2030. This growth is propelled by super apps‘ ability to cater to diverse consumer needs efficiently within a single platform.

Groei drivers

Key factors driving this phenomenal growth include:

- Jongere generaties, familiar and comfortable with digital technologies, show a preference for integrated digitale platforms.

- A digitale transitie from traditional brick-and-mortar services to digital platforms has been observed globally, enhancing the appeal of super apps.

- De convenience of a single app handling multiple services is a welcome change from managing numerous individual applications.

- Companies are increasingly expanding their digital offerings, evolving into super apps.

- The popularity of digital platforms among peer groups and the attraction to popular marketplaces fuel the growth of super apps.

Regionale variaties

The adoption and evolution of super apps show significant regional variations. The table below compares how super apps are being shaped by regional characteristics and how they are evolving to meet diverse consumer nodig heeft.

| Regio | Omschrijving | Voorbeeld | Details |

|---|---|---|---|

| Aziatisch-Pacifisch | Dominated by mobile usage and favorable demographics, this region sees super apps integrating extensively into daily life. | Started as a messaging app but has evolved into an all-in-one platform, offering services ranging from social media and mobile payments to ride-hailing and bookings. | |

| Central Europe, Middle East, and Africa | Driven by smartphone adoption and a vibrant, dynamic market, super apps are rapidly growing. | careem | Began as a ride-hailing service but has expanded into a super app, providing services like food delivery, payments, and logistics. |

| Europa en VK | A fragmented regulatory landscape and strict data privacy laws have shaped the growth of local super app players. | Revolut | Initially launched as a fintech startup offering banking services, Revolut has expanded its scope significantly, including currency exchange, stock trading, and insurance services. |

| Latijns Amerika | Focuses on financial inclusion and convenience, with super apps evolving from delivery service platforms and marketplaces. | Rappi | Started as a delivery service and has transformed into a super app, offering a wide range of services including grocery delivery, financial services, and travel bookings. |

| Noord Amerika | Presents a challenging environment for super apps due to established players and regulatory hurdles. | PayPal | Primarily known for online payments, PayPal has expanded its services to include features like savings, credit, and shopping tools, moving towards a super app model. |

Uitdagingen en inzichten

Super apps, despite their increasing popularity and utility, face several challenges including:

- Super apps often operate across multiple sectors and, which can bring them under the scrutiny of various regulatory bodies. Regulatory hurdles and compliance with diverse and sometimes conflicting regulations in different jurisdictions can be challenging.

- With super apps collecting vast amounts of personal and financial data, ensuring data privacy and security is paramount. The challenge is to maintain robust data protection measures while offering seamless user experiences.

- In regions where multiple super apps are vying for dominance, there is a risk of market saturation. Super apps have to continually innovate and diversify their offerings to stay competitive and relevant.

Siehe: Interview met Inter CEO: inzicht in het succes van de Super App

- Developing and maintaining a super app that integrates various services smoothly is technically challenging. Ensuring reliability, scalability, and seamless integration of different services requires substantial investment in technology and expertise.

- Balanceren van de complexity of multiple services with a user-friendly interface is crucial. A cluttered or unintuitive app design can deter users, making it essential to focus on a seamless and engaging user experience.

- Super apps need to be culturally and regionally adaptable to succeed in different markets. What works in one region may not necessarily appeal to users in another, requiring localized strategies and customization.

- Finding effective monetization models while keeping the app attractive to users is a delicate balance. Super apps need to devise strategies that generate revenue without compromising user experience or data privacy.

- Users must trust the app with sensitive data and transactions. Building and maintaining this trust, especially in regions with skepticism towards digital services, is a significant challenge.

- Afhankelijkheidsrisico's: The centralization of multiple services in one app creates a dependency risk. If the app faces downtime or security issues, it can disrupt several essential services for users.

- gelijke tred houden met de technologische vooruitgang: The rapid pace of technological advancement means super apps must continually evolve and innovate to stay relevant and meet changing consumer expectations en technologische mogelijkheden.

3 Impacts on the Average Person

- Super apps will streamline daily activities, from shopping and banking to social interactions and entertainment, offering a more integrated lifestyle management system.

Siehe: SEC intensiveert onderzoek naar Wall Street's gebruik van berichtenapps

- With advanced data analytics and AI, super apps will offer highly personalized experiences, recommendations, and services tailored to individual preferences and habits.

- In regions with high niet-gestorte populaties, super apps will provide access to financial services, enhancing financial inclusivity and economic empowerment. To overcome smart phone affordability issues, communities can look at shared devices, subsidized programs and offline functionality.

3 Impacts for Businesses

- Businesses will leverage super apps as new marketing channels, utilizing their broad reach and data analytics for gerichte reclame en klantbetrokkenheid.

- Traditional businesses may need to shift their business models to fit the super app ecosystem, focusing more on digital services and customer experience.

- The convenience and immediacy of super apps will raise customer expectations, pushing businesses to enhance their customer service and support capabilities.

Image courtesy of DALL E

Image courtesy of DALL EExample Customer Journey Touchpoints

- 6:30 AM – Morning Wake-Up: Emily’s day begins with the soft chime of her alarm through her super app. She quickly checks her schedule on the same app, a convenient hub for her daily planner.

- 7:15 AM – Commute Planning: While having breakfast, she opens her super app to book a ride to work. The integrated transport services offer real-time updates on traffic and public transport, making her commute hassle-free.

- 12:30 PM – Lunch Break: During lunch, Emily uses the super app to order food delivery. She browses through multiple cuisines and restaurants available within the app, enjoying the ease of in-app payment.

Siehe: De stem van de klant: feedback gebruiken voor continue verbetering

- 3:00 PM – Midday Errands: She receives a notification from the super app reminding her to pay her utility bills. With a few taps, she completes the transaction smoothly, appreciating the app’s one-stop financial management capability.

- 6:00 PM – Evening Wind Down: After work, Emily plans to catch up with friends. She uses the app’s social feature to coordinate and book a table at a popular restaurant, all within the same platform.

- 9:30 PM – Entertainment and Relaxation: Back home, Emily relaxes by streaming her favorite show through the super app’s entertainment section, a perfect end to her day.

Throughout the day, Emily’s super app seamlessly integrates various aspects of her life, from routine tasks to leisure activities, embodying the essence of convenience and efficiency in her digital-driven lifestyle.

Outlook

These super apps aren’t just aggregating services. We’re quickly heading into a new era where technology is deeply woven into the fabric of our everyday routines.

Siehe: Opkomst van de super-app

As they continue to evolve and adapt to regional needs and technological advancements, super apps stand poised to reshape not only individual lifestyles but also the landscape of global business and commerce. They promise a future of seamless interaction, heightened connectivity, and endless possibilities. Having said that, clearly not everyone will be thrilled with increased device time!

Download het 13 pagina's tellende PDF-rapport -> hier

De Nationale Crowdfunding & Fintech Association (NCFA Canada) is een financieel innovatie-ecosysteem dat onderwijs, marktinformatie, rentmeesterschap van de sector, netwerk- en financieringsmogelijkheden en -diensten biedt aan duizenden leden van de gemeenschap en nauw samenwerkt met de industrie, de overheid, partners en aangesloten bedrijven om een levendige en innovatieve fintech- en financieringsomgeving te creëren. industrie in Canada. NCFA is gedecentraliseerd en gedistribueerd en houdt zich bezig met mondiale belanghebbenden en helpt bij het incuberen van projecten en investeringen in fintech, alternatieve financiering, crowdfunding, peer-to-peer financiering, betalingen, digitale activa en tokens, kunstmatige intelligentie, blockchain, cryptocurrency, regtech en insurtech-sectoren . Aanmelden Canada's Fintech & Funding Community vandaag GRATIS! Of word een bijdragend lid en ontvang speciale voordelen. Ga voor meer informatie naar: www.ncfacanada.org

De Nationale Crowdfunding & Fintech Association (NCFA Canada) is een financieel innovatie-ecosysteem dat onderwijs, marktinformatie, rentmeesterschap van de sector, netwerk- en financieringsmogelijkheden en -diensten biedt aan duizenden leden van de gemeenschap en nauw samenwerkt met de industrie, de overheid, partners en aangesloten bedrijven om een levendige en innovatieve fintech- en financieringsomgeving te creëren. industrie in Canada. NCFA is gedecentraliseerd en gedistribueerd en houdt zich bezig met mondiale belanghebbenden en helpt bij het incuberen van projecten en investeringen in fintech, alternatieve financiering, crowdfunding, peer-to-peer financiering, betalingen, digitale activa en tokens, kunstmatige intelligentie, blockchain, cryptocurrency, regtech en insurtech-sectoren . Aanmelden Canada's Fintech & Funding Community vandaag GRATIS! Of word een bijdragend lid en ontvang speciale voordelen. Ga voor meer informatie naar: www.ncfacanada.org

gerelateerde berichten

- Door SEO aangedreven content en PR-distributie. Word vandaag nog versterkt.

- PlatoData.Network Verticale generatieve AI. Versterk jezelf. Toegang hier.

- PlatoAiStream. Web3-intelligentie. Kennis versterkt. Toegang hier.

- PlatoESG. carbon, CleanTech, Energie, Milieu, Zonne, Afvalbeheer. Toegang hier.

- Plato Gezondheid. Intelligentie op het gebied van biotech en klinische proeven. Toegang hier.

- Bron: https://ncfacanada.org/super-apps-are-redefining-daily-life/

- : heeft

- :is

- :niet

- :waar

- $UP

- 13

- 15%

- 150

- 2018

- 2024

- 2030

- 25

- 30

- 7

- 9

- a

- vermogen

- toegang

- over

- activiteiten

- aanpassen

- Adoptie

- vergevorderd

- vordering

- vooruitgang

- filialen

- Na

- AI

- alarm

- Alles

- alles-in-een

- ook

- alternatief

- alternatieve financiering

- am

- onder

- hoeveelheden

- an

- analytics

- en

- Nog een

- verwachte

- gebruiken

- hoger beroep

- Aanvraag

- toepassingen

- waarderen

- apps

- ZIJN

- reeks

- kunstmatig

- kunstmatige intelligentie

- AS

- aspecten

- Activa

- At

- aantrekkingskracht

- aantrekkelijk

- Beschikbaar

- gemiddelde

- terug

- Balance

- Bankieren

- BE

- worden

- geweest

- wezen

- onder

- Miljard

- Biljetten

- blockchain

- lichamen

- boek

- boekingen

- Breken

- Ontbijt

- brengen

- breed

- Gebouw

- bedrijfsdeskundigen

- ondernemingen

- maar

- by

- cache

- CAN

- Canada

- mogelijkheden

- bekwaamheid

- het worstelen

- tegemoet te komen

- Centralisatie

- ceo

- uitdagen

- uitdagingen

- uitdagend

- verandering

- veranderende

- kenmerken

- tabel

- Controles

- klokkenspel

- duidelijk

- van nabij

- Het verzamelen van

- COM

- comfortabel

- Gemeenschappen

- gemeenschap

- omzetten

- concurrerend

- voltooit

- afbreuk te doen aan

- Tegenstrijdig

- Connectiviteit

- consulting

- consument

- permanent

- voortzetten

- doorlopend

- gemak

- gemakkelijk

- coördineren

- en je merk te creëren

- creëert

- Credits

- Crowdfunding

- cryptogeld

- cultureel

- Valuta

- klant

- Klantbinding

- klantervaring

- Customer Journey

- Klantenservice

- dagelijks

- gegevens

- gegevens Analytics

- data Privacy

- gegevensbescherming

- dag

- gedecentraliseerde

- levering

- Demografie

- Afhankelijkheid

- Design

- Niettegenstaande

- apparaat

- systemen

- bedenken

- anders

- digitaal

- Digitale activa

- digitale platforms

- digitale diensten

- ontwrichten

- verdeeld

- diversen

- Diversificatie

- Overheersing

- beneden

- uitvaltijd

- chauffeurs

- aandrijving

- twee

- gedurende

- dynamisch

- e

- e-commerce

- gemak

- oosten

- En het is heel gemakkelijk

- Economisch

- ecosysteem

- Onderwijs

- effectief

- doeltreffendheid

- efficiënt

- waardoor

- einde

- Eindeloos

- bezig

- engagement

- boeiende

- verhogen

- verbeteren

- genieten van

- zorgen

- Onstpanning

- Milieu

- Tijdperk

- vooral

- essentie

- essentieel

- Essentiële diensten

- in wezen

- gevestigd

- Ether (ETH)

- Europa

- avond

- alledaags

- iedereen

- Evolutie

- ontwikkelen

- evolueerde

- evoluerende

- uitwisseling

- uitgebreid

- ervaring

- Ervaringen

- expertise

- uitgebreid

- stof

- Gezicht

- gezichten

- factoren

- vertrouwd

- gunstig

- Favoriet

- Kenmerk

- Voordelen

- feedback

- weinig

- financiën

- financieel

- financiële data

- financiële inclusie

- financiële innovatie

- financieel management

- financiële diensten

- FinTech

- fintech opstarten

- geschikt

- Focus

- gericht

- eten

- voedsellevering

- Voor

- gefragmenteerd

- vrienden

- oppompen van

- Brandstof

- functionaliteiten

- functionaliteit

- financiering

- financieringsmogelijkheden

- toekomst

- voortbrengen

- krijgen

- Globaal

- Wereldwijd zakendoen

- Wereldwijd

- Overheid

- kruidenierswinkel

- Groep

- Groeiend

- Behandeling

- Benutten

- Hebben

- met

- Titel

- verhoogde

- helpt

- haar

- Hoge

- markeren

- Home

- Hoe

- http

- HTTPS

- Naaf

- Horden

- if

- beeld

- Effecten

- verbetering

- in

- omvatten

- Inclusief

- inclusie

- inclusiviteit

- meer

- meer

- in toenemende mate

- individueel

- -industrie

- informatie

- innoveren

- Innovatie

- innovatieve

- inzichten

- verzekering

- insurtech

- geïntegreerde

- integreert

- Integreren

- integratie

- Intelligentie

- Intensiveert

- wisselwerking

- interacties

- Interface

- Interview

- in

- investering

- problemen

- IT

- HAAR

- jan

- jpg

- rechtsgebieden

- voor slechts

- houden

- sleutel

- bekend

- Landschap

- gelanceerd

- Wetten

- Hefboomwerking

- Life

- Lifestyle

- leefstijlen

- als

- lokaal

- logistiek

- Kijk

- lunch

- onderhouden

- behoud van

- maken

- management

- beheren

- Markt

- Marketing

- marktplaatsen

- Markten

- max-width

- Mei..

- middel

- maatregelen

- Media

- lid

- Leden

- messaging

- Berichten-app

- berichten-apps

- Midden

- Midden-Oosten

- Mobile

- mobiele betalingen

- model

- gelde maken

- meer

- ochtend

- bewegend

- multifunctioneel

- meervoudig

- menigte

- Dan moet je

- nodig

- Noodzaak

- behoeften

- netwerken

- New

- notificatie

- vele

- opgemerkt

- of

- bieden

- het aanbieden van

- aanbod

- offline

- vaak

- on

- EEN

- online.

- online betalingen

- Slechts

- opent

- besturen

- Kansen

- or

- bestellen

- onze

- Overwinnen

- Tempo

- pagina

- partners

- Betaal

- betaling

- betalingen

- PayPal

- Bestandenuitwisseling

- perks

- persoonlijk

- Gepersonaliseerde

- fenomenaal

- phone

- planning

- plannen

- platform

- platforms

- Plato

- Plato gegevensintelligentie

- PlatoData

- spelers

- dan

- pm

- klaar

- Populair

- populariteit

- mogelijkheden

- mogelijk

- voorkeuren

- privacy

- Privacy en Beveiliging

- privacywetten

- sonde

- Programma's

- projecten

- belofte

- voortgestuwd

- bescherming

- zorgen voor

- biedt

- het verstrekken van

- publiek

- gepubliceerde

- voortvarend

- snel

- verhogen

- reeks

- variërend

- snel

- snel

- rappi

- RE

- bereiken

- het bereiken van

- real-time

- ontvangt

- recent

- aanbevelingen

- Redefining

- regio

- regionaal

- regio

- Regtech

- reglement

- regelgevers

- regelgevend landschap

- ontspanning

- relevante

- betrouwbaarheid

- verslag

- vereist

- restaurant

- Restaurants

- inkomsten

- Revolut

- Rijden

- Stijgen

- Risico

- robuust

- routine

- s

- Zei

- dezelfde

- Bespaar geld

- Schaalbaarheid

- rooster

- omvang

- nauwkeurig onderzoek

- naadloos

- naadloos

- SEC

- sectie

- Sectoren

- veiligheid

- ziet

- gevoelig

- service

- Diensten

- verscheidene

- gevormd

- gedeeld

- ze

- verschuiving

- Winkelen

- tonen

- aanzienlijke

- aanzienlijk

- single

- Scepticisme

- slim

- smartphone

- glad

- Social

- social media

- Sociaal netwerken

- Soft /Pastel

- soms

- onthutsend

- stakeholders

- staan

- startup

- blijven

- Rentmeesterschap

- voorraad

- de handel in aandelen

- strategieën

- streaming

- gestroomlijnd

- streng

- wezenlijk

- slagen

- succes

- dergelijk

- Super

- super apps

- Super-app

- ondersteuning

- T

- tafel

- op maat gemaakt

- taps

- taken

- technologisch

- Technologies

- Technologie

- dat

- De

- Het landschap

- hun

- Ze

- Er.

- ze

- dit

- duizenden kosten

- blij

- Door

- getiteld

- naar

- vandaag

- tokens

- tools

- in de richting van

- Handel

- traditioneel

- verkeer

- transactie

- Transacties

- getransformeerd

- vervoeren

- reizen

- Trust

- voor

- niet intuïtief

- updates

- Gebruik

- .

- Gebruiker

- Gebruikerservaring

- gebruiksvriendelijke

- gebruikers

- toepassingen

- utility

- Gebruik makend

- waardevol

- variaties

- divers

- groot

- trillend

- visum

- Bezoek

- Stem

- Gevel

- we

- welkom

- Wat

- welke

- en

- breed

- Grote range

- Wikipedia

- wil

- wind

- Met

- binnen

- zonder

- Mijn werk

- Bedrijven

- geweven

- X

- zephyrnet