The crypto market is down this week, with the total market capitalization falling by 4.4% to reach its lowest point since June 14 at $1.02 trillion. This movement has increased Bitcoin (BTC) market dominance as regulatory uncertainty hangs over the altcoin markets.

Despite the hype surrounding recently filed Ether (ETH) and BTC exchange-traded funds (ETFs), the United States Securities and Exchange Commission (SEC) continues to delay decisions on the financial instruments.

Here are three reasons why the crypto market is down this week.

ETF delays result in crypto investors choosing the sidelines

Investor expectations of a spot BTC ETF approval had been high, especially with heavyweight endorsements and applications from BlackRock and Fidelity. However, these hopes were dashed as the SEC 계속 지연 its decision, citing concerns over insufficient safeguards against manipulation.

Despite the delays, VanEck 및 아크 투자 have officially applied for spot Ether ETFs. The Sept. 6 filings start the clock for the SEC to make a decision. An estimated deadline for this decision is May 23, 2024.

Although Grayscale was able to win against the SEC in a U.S. appeals court, the Grayscale Bitcoin Trust (GBTC) discount is still hovering at 20% as the SEC weighs appealing the court’s decision. While analysts believe ETFs are bullish in the long term, the market has not sustained such short-term momentum.

관련 : 변동성이 큰 시장에서 암호화폐를 보호하는 방법: 비트코인 OG와 전문가의 의견

Regulatory uncertainty and lawsuits weigh on crypto

Financial difficulties within the Digital Currency Group (DCG), which operates GBTC, have also had a negative impact on investor sentiment. A subsidiary of DCG is grappling with a debt exceeding $1.2 billion to the Gemini exchange.

Additionally, Genesis Global Trading, which declared bankruptcy due to losses stemming from the collapse of Terra and FTX, is now suing DCG, which is run by Barry Silbert. This precarious situation could lead to forced selling of positions in the Grayscale Bitcoin Trust if DCG fails to meet its obligations.

Further compounding the market’s woes is pending regulation. The SEC has leveled a series of 바이낸스에 대한 혐의, the crypto market’s largest exchange, and its CEO, Changpeng Zhao, alleging misleading practices and the operation of an unregistered exchange.

The largest crypto by market cap aside from Bitcoin, Ether also lacks clarity around its legal status. While the Commodity Futures Trading Commission chair believes Ether is a commodity rather than a security, there is currently no clarification from the SEC.

While the crypto market continues to grapple with regulatory uncertainty, the Ripple chief technology officer believes the 조수가 돌고있다 on the U.S. regulatory environment.

Liquidations and low volume drive the crypto market lower

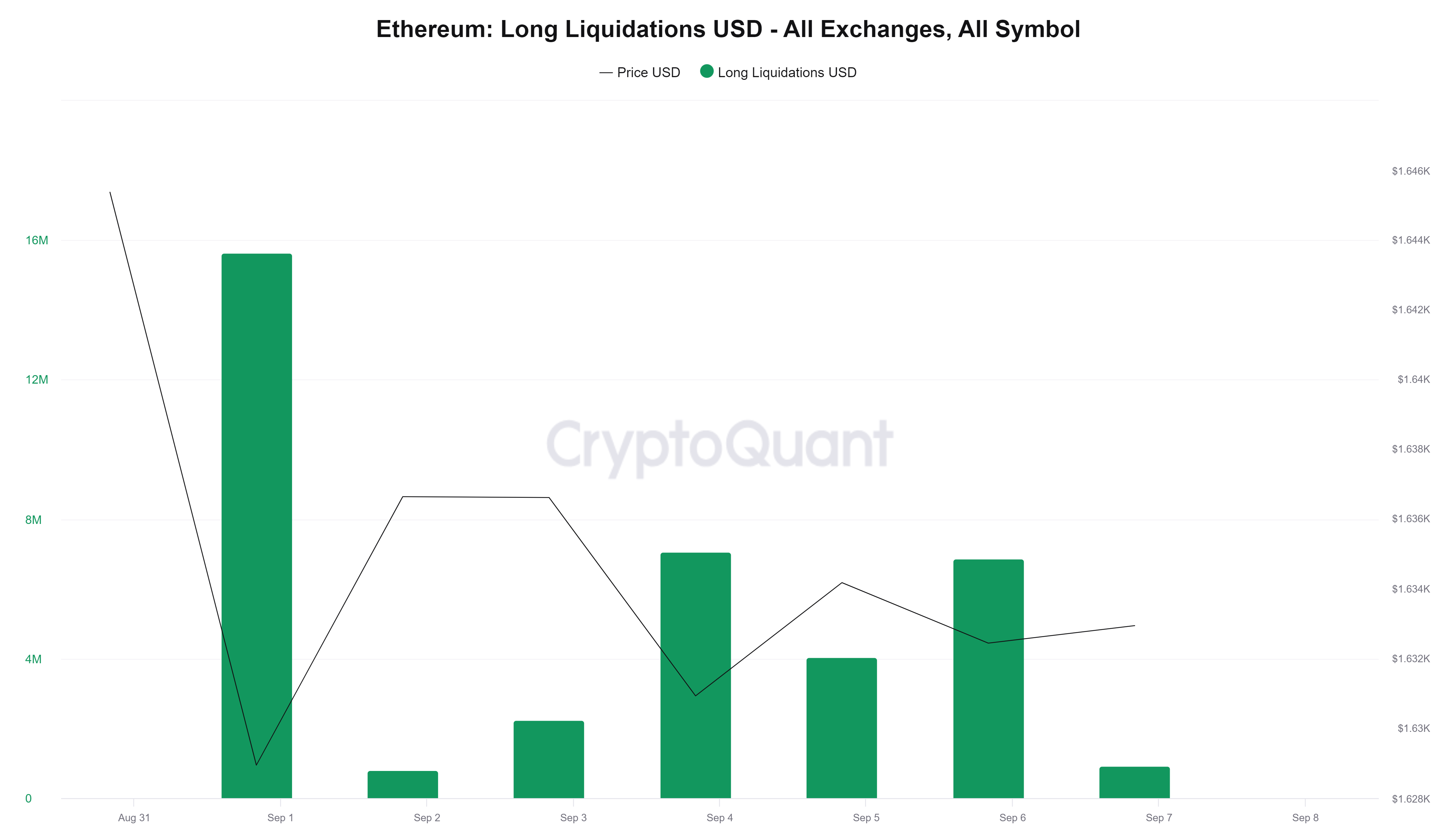

The start of September ignited a wave of 이더리움 leveraged liquidations, with $37 million in liquidations occurring in the first week of this month.

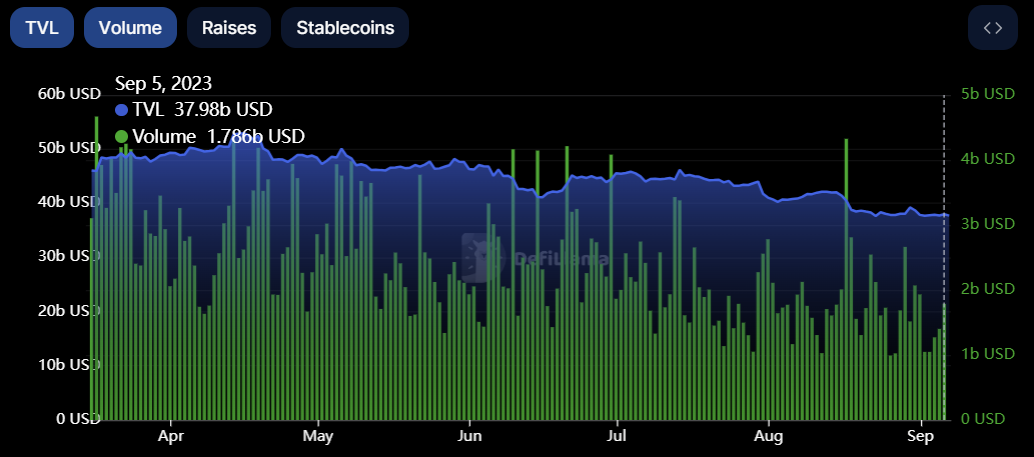

The rush of Ether liquidations comes as the entire crypto market is shedding total value locked (TVL) and volumes continue to decrease. The crypto market TVL reached a 2023 high on April 15 at $53 billion, while the current value is at $37.7 billion, reflecting a loss of over $15 billion.

일부 분석가들은 the renewed strength of the U.S. dollar, which hit a six-month high on Sept. 7, will continue to be a danger to crypto assets.

관련 : BTC 가격이 25.7달러 아래로 떨어지면서 비트코인 입찰가는 XNUMX월 이후 최저치로 떨어졌습니다.

암호화폐 시장이 이러한 다면적인 과제를 헤쳐나가면서 다양한 경제 요인과 규제 개발의 썰물과 흐름이 의심할 여지 없이 앞으로 몇 달 동안 계속해서 궤적을 형성할 것입니다.

이 기사는 일반적인 정보를 제공하기 위한 것이며 법적 또는 투자 조언으로 의도되지 않았으며 받아들여서도 안 됩니다. 여기에 표현된 견해, 생각, 의견은 전적으로 저자의 것이며 반드시 코인텔레그래프의 견해와 의견을 반영하거나 대표하는 것은 아닙니다.

- SEO 기반 콘텐츠 및 PR 배포. 오늘 증폭하십시오.

- PlatoData.Network 수직 생성 Ai. 자신에게 권한을 부여하십시오. 여기에서 액세스하십시오.

- PlatoAiStream. 웹3 인텔리전스. 지식 증폭. 여기에서 액세스하십시오.

- 플라톤ESG. 자동차 / EV, 탄소, 클린테크, 에너지, 환경, 태양광, 폐기물 관리. 여기에서 액세스하십시오.

- PlatoHealth. 생명 공학 및 임상 시험 인텔리전스. 여기에서 액세스하십시오.

- 차트프라임. ChartPrime으로 트레이딩 게임을 향상시키십시오. 여기에서 액세스하십시오.

- BlockOffsets. 환경 오프셋 소유권 현대화. 여기에서 액세스하십시오.

- 출처: https://cointelegraph.com/news/why-is-the-crypto-market-down-this-week

- :있다

- :이다

- :아니

- 14

- 15%

- 2023

- 2024

- 23

- 7

- a

- 조언

- 반대

- 혼자

- 또한

- 알트코인

- 알트코인 시장

- an

- 애널리스트

- 및

- 항소

- 어플리케이션

- 적용된

- 승인

- Apr

- 있군요

- 약

- 기사

- AS

- 자산

- At

- 파산

- 배리 실베르트

- BE

- 된

- 믿으세요

- 생각

- 억원

- 비트코인

- 비트 코인 트러스트

- BlackRock

- BTC

- BTC ETF

- btc price

- by

- 캡

- 자본화

- 대표 이사

- 의장

- 과제

- Changpeng

- 조창핀

- 주요한

- 최고 기술 책임자 (CTO)

- 선택

- 선명도

- 시계

- 코인 텔레그래프

- 축소

- 제공

- 오는

- 위원회

- 상품

- 우려 사항

- 계속

- 계속

- 수

- 법정

- 암호화는

- 암호 투자자

- 암호화 시장

- 암호 시가 총액

- 암호 자산

- 암호 화폐

- cryptocurrency market

- 환율

- Current

- 현재

- 위험

- DCG

- 빚

- 결정

- 결정

- 감소

- 지연

- 지연

- 개발

- 어려움

- 디지털

- 디지털 통화

- 디지털 통화 그룹

- 할인

- do

- 달러

- 권세

- 아래 (down)

- 드라이브

- 두

- 간결한

- 추천

- 전체의

- 환경

- 특히

- 예상

- ETF

- ETF의

- 에테르

- 교환

- 교환위원회

- 거래소

- 기대

- 전문가

- 표현

- 요인

- 실패

- 전도

- 충실도

- 제출

- 서류

- 금융

- 금융 상품

- 먼저,

- 흐름

- 럭셔리

- 에

- FTX

- 자금

- 선물

- 선물 거래

- GBTC

- 쌍둥이 자리

- 쌍둥이 교환

- 일반

- 창세기

- 창세기 글로벌

- 창세기 글로벌 트레이딩

- 글로벌

- 그레이 스케일

- 그레이 스케일 비트 코인 트러스트

- 그레이 스케일 비트 코인 트러스트 (GBTC)

- 그룹

- 했다

- 있다

- 헤비급 선수

- 여기에서 지금 확인해 보세요.

- 높은

- 히트

- 희망

- 그러나

- HTTPS

- 과대 광고

- if

- 영향

- in

- 증가

- 정보

- 악기

- 예정된

- 투자

- 투자자

- 투자 심리

- 법률

- 그

- 유월

- 가장 큰

- 가장 큰 암호

- 소송

- 리드

- 이용약관

- 청산

- 고정

- 긴

- 오프

- 사상자 수

- 낮은

- 가장 낮은

- 확인

- 시장 조작

- Mar

- 시장

- 시총

- 시가 총액

- 시장 지배력

- 시장

- XNUMX월..

- 소개

- 백만

- 오도 된

- 기세

- 달

- 개월

- 움직임

- 운동

- 다각적 인

- 필연적으로

- 부정

- 아니

- 지금

- 의무

- 발생하는

- of

- 장교

- 공무상

- on

- 운영

- 조작

- 의견

- or

- 위에

- 대기

- 플라톤

- 플라톤 데이터 인텔리전스

- 플라토데이터

- 포인트 적립

- 위치

- 사례

- 가격

- 가격 하락

- 보호

- 목적

- 차라리

- 도달

- 도달

- 이유

- 최근에

- 반영

- 반영

- 규제

- 규정하는

- 갱신

- 대표

- 결과

- 달리기

- 돌진

- s

- 보호

- SEC

- 증권

- 증권 거래위원회

- 판매

- 감정

- 일곱

- XNUMX월

- 연속

- 셰이프

- 단기간의

- 영상을

- 이후

- 사태

- 출처

- Spot

- 스타트

- 미국

- Status

- 아직도

- 보조적인

- 이러한

- 주변

- 지탱 된

- 촬영

- Technology

- 기간

- 지구

- 보다

- XNUMXD덴탈의

- 그곳에.

- Bowman의

- 이

- 이번 주

- 세

- 을 통하여

- 에

- 금액

- 잠긴 총 가치

- 트레이딩

- 사선

- 일조

- 믿어

- TVL

- 우리

- 미국 달러

- 불확실성

- 아래에

- 의심 할 여지없이

- 미국

- United States

- 미등록의

- 가치

- 여러

- 보기

- 휘발성의

- 음량

- 볼륨

- 였다

- 웨이브

- 주

- 달다

- 무게를다는

- 했다

- 어느

- 동안

- why

- 의지

- 승리

- 과

- 이내

- 너의

- 제퍼 넷

- 조